Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Magic Card finance is much broader than simple supply and demand. Because the cards have utility in a competitive setting, you have playability and metagame factors. Because the cards have associations to fantasy concepts people get excited about, there is an emotional aspect. And because there are exchanges going on constantly, there is a Game Theory / Psychological aspect.

Many finance articles focus heavily on the supply and demand portion. I reference this portion of the pastime frequently as well. For example, my lack of desire to pre-order Return to Ravnica cards because of price inflation due to hype and perceived short supply is a fundamental economics concept that is easy to understand.

But basic economic theory isn’t sufficient to explain all players’ behaviors, and this is due to other factors involved in the hobby. The historical data is blaring – presale prices nearly always drop upon a set’s release. Yet emotions run wild and players want to brew up the next competitive deck right away so they throw rational economic sense out the window and make their purchases.

This week I want to return to the behaviors of Magic players that are driven not by economic gain, but by emotional and psychological factors. And while not directly applicable to speculating on cards, perhaps it will open the window a bit further into what causes us to do the irrational from time to time.

It’s All Relative – Price Association

The first concept I want to introduce perhaps explains why people preorder cards at ridiculous prices. We are all convinced that there will be a card or two in Return to Ravnica that will shoot up in price post release. And we all hope we will be capable of identifying said treasure.

But the reality is in order to be successful in this endeavor, emotions and past associations need to be kept in check. It is easy into fall into the trap of saying a card like Abrupt Decay is destined for greatness because it’s bigger brothers Maelstrom Pulse and Vindicate are valuable removal spells in Eternal formats.

Because of selective memory, these examples are causing an inflated preorder price on Abrupt Decay.

Here’s my take: people compare Abrupt Decay to Maelstrom Pulse and they identify how Pulse was a $20 card in Standard despite not being Mythic. What they neglect to remember is that Jund had completely warped the Standard format, and so the removal spell was in especially high demand. But the format distortion was not caused by Maelstrom Pulse, but by a partner in crime… Bloodbraid Elf.

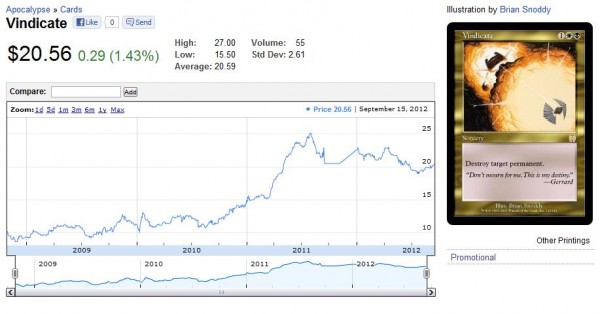

Next, people will compare the card to Vindicate, identifying how that card is now worth over $20 thanks to Legacy. What they neglect to notice, however, is that the card was worth half that for years (chart from blacklotusproject.com), not to mention the fact that Apocalypse didn’t sell on the same order of magnitude as Return to Ravnica will. Additionally, Abrupt Decay is a Rare in the Mythic Rare era.

Players like to preorder cards they can associate with other cards because it makes them feel capable of predicting future prices based on these comparisons. But often times people are led astray because of these comparisons.

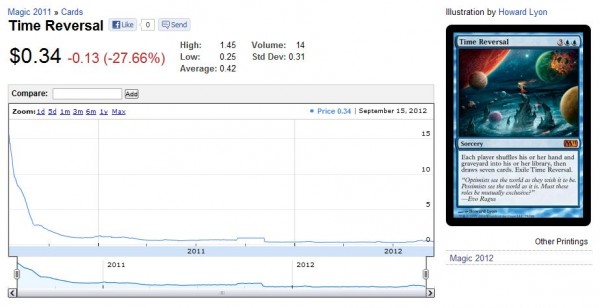

Another example is with Time Reversal, which sold for $29.99 upon initial spoiling simply due to the association with [card Timetwister]Power 9[/card]. It’s the same reason nearly every new Planeswalker is way overpriced during preorder season – emotional responses of buyers due to a potential subconscious association with Jace, the Mind Sculptor.

But the fact that we are capable of making this association hinders us more than it helps us. It gives us a false feeling that we can predict what’s next, when in reality there are a plethora of other factors involved with price predictions. It is very easy to fall into the trap of making a prediction based on selective memory.

The best way to avoid this pitfall: don’t preorder cards.

(Disclaimer: the only card I’ve preordered from Return to Ravnica is a set of Angel of Serenity. I collect angels and since the card is a Mythic Rare, I don’t anticipate I’ll be opening one in draft any time soon.)

The Cost of Ownership

The other concept I want to mention comes from Behavioral Economics again, and I picked this idea up from Dan Ariely’s Predictably Irrational: The cost of ownership.

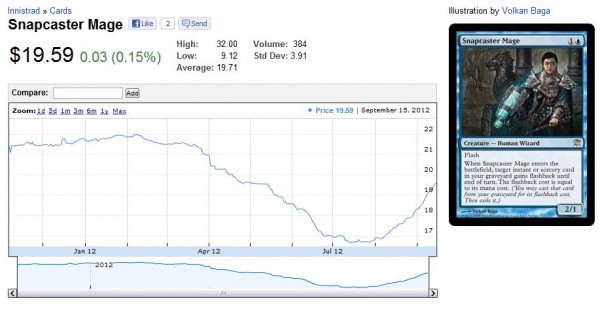

I’ll begin with an example – have you ever attempted to trade with someone only to find they were valuing their Snapcaster Mage at retail? They proceed to explain how it’s always in high demand and easy to move, and therefore they deserve a premium on the card.

In reality, the card is readily available on MOTL for $18-$20 despite retailing for $24.99. You know this, and you also know that many players trade the card at $20 since everyone knows a twenty dollar bill will immediately get you a dozen sellers on MOTL willing to sell you their copy (chart from blacklotusproject.com).

Why does this discrepancy exist? Often times, the owner of a card or other item will value it higher than the party interested in acquiring the same item. The owner subconsciously will factor in many additional pieces of data that you aren’t privy to. The owner may consider what they gave up for the Snapcaster Mage, the fact that the Snapcaster Mage is part of a playset, or that the card recently won them a tournament. Whatever the influential factors are, they aren’t economics-driven and they often aren’t rational.

A Snapcaster Mage is a Snapcaster Mage, and almost everyone knows what they are worth. The information is public and widespread due to the popularity of the card, yet sometimes we fall short of an agreement on the card’s value. This concept can apply to many situations involving any card, really.

How can we beat this shortcoming everyone possesses, including ourselves, if we’re not consciously doing it?

My advice is that you try to position a trade with someone in a way that makes your trade partner feel like they already own your cards before the trade is complete. The best way I’ve come up with to do this is by encouraging your trade partner to pull the cards they want out of your binder and place them aside during a trade. By doing this, they already subconsciously feel like they “own” the cards and that the trade is going to be more likely. Because of the perceived ownership, they just may be willing to value your cards a tiny bit higher.

There’s even ample data to support this concept all over eBay. Many times I’ve acquired a card at a discount because the starting bid was placed just below average completed auction prices. People see the higher starting bid and although it may be slightly below average ended auctions, they compare the price with auctions for the same card starting at $0.99 and they bid on those instead.

Once they bid, they subconsciously (or even consciously) begin to feel like they already own the cards. They anticipate winning the auction, and winning is a great feeling in and of itself. Then when they are suddenly outbid they are willing to pay more for the cards because they feel like they lost something they already possessed. And that feeling of loss is quite powerful. The end result – the buyer ends up with an economically suboptimal outcome due to irrational emotions.

Examples are endless on eBay, but I’ll use two recent Snapcaster Mage auctions to illustrate my point.

This auction recently ended at $90 for a set of Mages, and the starting bid was $0.99:

This auction started at $70.00 and ended up selling with one bid:

Granted there are other factors involved when predicting ended auction prices on eBay – a seller’s feedback rating, card conditions, auction ending time, etc. But I’ve found that auctions for popular cards that start right below average completed auction values sell for less than auctions starting at $0.99. I am a believer that this is due to the emotional “cost of ownership”

Conclusion and Quick Facts

Nobel Prizes have been won for some of the economic concepts we learn in high school and college, but it’s interesting how experts in the field of psychology and behavioral sciences are recently finding shortcomings in some of these basic economic concepts. Supply and Demand and the Invisible Hand are not the only factors dictating price because human beings are occasionally emotional, irrational creatures.

~

Now I want to try something a little different. I’m always observing price trends on cards I’m interested in buying/selling. I want to try closing my article with three recent observations, which I find noteworthy. While unrelated to the article’s content, such tidbits of information may be both interesting and useful to you in your trading.

Let me know if you like this feature and I’ll continue to close out my articles with more of such observations on a weekly basis.

- As of 9/16 at 8am, Star City Games is once again sold out of Woodland Cemetery at $11.99, which is very close to average eBay pricing. I expect retail prices to increase again soon.

- Star City Games and Channel Fireball have a few copies of foil Little Girl in stock for $19 - $20 depending on condition. This price is about the same as eBay completed listings and it’s less than other retail sites such as Troll and Toad ($25) and Strike Zone ($25.75).

- Star City Games increased their preorder pricing on Angel of Serenity from $8 to $10 shortly after my email blast on the card. The cheapest Buy it Now price on eBay for a single copy of the card is $8.

-Sigmund Ausfresser

@sigfig8

I checked some of the recent auctions I won for staple cards (via a sniper) and I confirm your observation. 19/27 (=70%) of the auctions I won, had a starting price close to my maximum bid! All others started at 0.99.

Once I start using eBay again for selling, I will sure be selling my staples starting at 0.99 from now on 🙂

By the way, I love the tidbits! Make it 5 iso 3 😉

Thanks for confirming my observations! 70% is fairly significant for any observation when psychology is involved. I myself fall into the trap of listing cards at higher starting auction prices. Maybe I should start taking my own advice for selling!

Glad you like the tidbits 🙂

The way I remember it Apocalypse was rather more popular than surrounding sets because of the enemy colors theme. It quite likely wasn’t printed more than Return to Ravnica, but I wouldn’t be surprised if more was opened than from Planeshift. Whenever I get a collection from that time there are many more apocalypse cards than any other set.

Speaking of Apocalypse btw, Spiritmonger was all the rage back then I must have moved through at least 10 of them. You’d be hesitant to trade your Monger for a Vindicate and would probably ask for some throws. When did you last see a Monger in play? Actually surprised SCG still asks $5 for them.

I have to admit I got excited about preorders once. That failed on far too many levels. I got Kozileks at $20 each. He dropped hard, nobody wanted them and I eventually traded them in at €5 each. These days he’s back up to $20 retail. So basically I got in too high and sold too low. Whenever I think about preordering anything I remind myself of Kozilek.

I stayed out of Time Reversal, but with the whole horror themed Innistrad block coming I did decide to get an extra set for speculation just in case there was a big graveyard theme going on. Didn’t work out, but at least I was only in a couple of bucks rather than $30 each.

Gosh, Spiritmonger seems so underwhelming nowadays. Power creep is most pronounced with creatures and this is a prime example. Troll Ascetic is another example – uber-powerful creature back in its hey-day and now virtually bulk. SCG is delusional with their $5 price tag, but I’m guessing some selective price memory drives people to paying that price!

Preorders are so difficult, I almost always avoid them regardless of the hype they receive. It’s often the cards that don’t see any hype that end up increasing significantly.

Side note, the October releases should tend to show a significantly higher demand for chase rares due to one thing: States is being held the week after release this year.

I need to go back to double check some things, but last year there was a two-week lead time between release and States, and prices as a seller were fantastic (snap-sales of Stromkirk @ $10-13, Liliana going for $70 with ease, etc). Post-States? Things fell down. Maybe this is endemic to the system as a whole with a generic release cycle, but States likes to exacerbate the issue.

What I wonder is what the further reduced lead time will do to this effect, and how many more people are just buying boxes / cases this time in order to “ensure” availability. We already see a “shortage” from distributors, even high volume types, and shops are raising prices left and right two weeks out.

Interesting observation…how can we best stay on top of the hot cards during this short period of time? Or are you suggesting we buy more aggressively leading up to States?

This is a comment on your article about RtR spoiler coverage but there is no option to comment there so i do it here :

Rakdos will never make Falkenrath aristocrate cost 0; you still have to pay the colored manacost !

Just like with so many other cards with the same ability…

Thanks for the comment, but that was Jason’s post so we’ll have to relay the message to him. We’ll try to sign our posts from now on so you know who to feedback to 🙂

Great article this week! There was a time where pre-ordering on ebay made sense but sellers have wisened to some mistakes that they used to make. Many sellers who crack cases used to list Buy-it-now auctions right after a card was spoiled but before market demand had established a price. This led to me getting some good deals back in the Kamigawa days on Kokusho and Cranial Extraction from sellers who underestimated their initial value. Now, most sellers list a pre-order card without BIN prices and just let hype take over or they wait for SCG to establish initial pricing.

This is a great point! And many sellers are actively monitoring the market as well. I’ve been watching one seller on eBay vary his pricing on Angel of Serenity. He started just under 6$, increased it to $8, dropped it to $7, and now it’s up close to $11. All over the place reflecting every meme someone puts out there on the card.

I picked up 2 playsets of Angel of Serenity on ebay after your email blast. They have since jumped from $7 on SCG to $12! Thanks for the tip. I also think Patrick Chapin’s article helped tipped everyone else off to the value. Either way, it’s already been a great pick up for me, and the set hasn’t even been spoiled yet. Do you think I should try to trade them off/sell them shortly after release to capitalize on the hype? Or is the card strong enough that the value will have solid staying power? My only concern is that RTR will be opened for a long time, which could potentially deflate the price. Thoughts? Great article, btw. 🙂

I usually stay away from preordering cards, for the same reasons you describe. However, having those reasons articulated is always nice. 🙂

Tyler, sweet pickup! I was very nervous sending out my first email blast and it is very rewarding to see pros like Chapin have the same opinion on the Angel’s power as I have. In regards to your question, I definitely think trading/selling early on is the way to go. As more product is open, supply will only increase. The only way the price continues to rise is if the demand outpaces the supply, and this I think is a risky call. Since I’m risk averse, I’d take profits right away rather than risk them and hope for much more.

Thanks for commenting!