Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

At the moment, Liliana of the Veil is the most expensive Standard card on MTGO. Defying the predictions of an impending price drop, Liliana has continued to reach new highs in the face of Fall rotation. As speculators, trying to make sense of why this card has continued to rise in price could reveal future opportunities.

The Value Perspective

Investing from a value perspective is the strategy perfected by Warren Buffet, who became the most successful speculator of all time. The basic tenet is to identify what the market is valuing incorrectly, place a bet accordingly, and then wait for the market to realize its mistake. Usually investing for value involves buying the shares of out-of-favor companies, but it can also mean identifying structural changes that the market has not yet fully understood.

Buffet purchased a large stake in Coca-Cola in 1988. From a value perspective the shares of Coca-Cola weren’t that cheap at the time with a Price to Earnings ratio of 15. It wasn’t a battered-down company which the market had abandoned, but Buffet went ahead and bought a big chunk of the company anyway. The stake represented a third of Berkshire-Hathaway’s portfolio at the time, a significant bet to say the least.

Buying Coca-Cola stock in 1988 turned out to be a very good move as the company continued to see strong global growth. Although not cheap from a value perspective, Buffet had identified a strong growth company that the market wasn’t valuing correctly.

A Market Shift

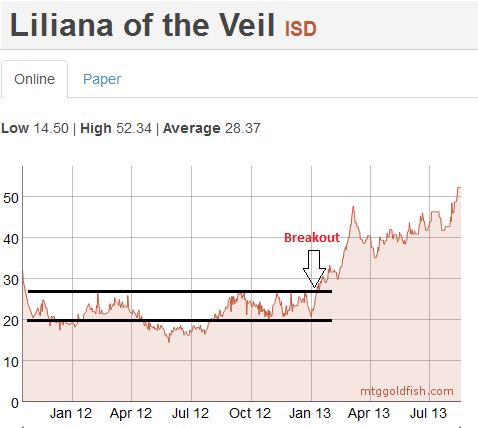

The MTGO price of Liliana of the Veil saw a long congestive period between Innistrad's (ISD) release right through to January of 2013. It did have a period of price weakness in the Summer of 2012 where it dipped as low as 15 tix, but for the most part it stayed in the 18-25 ticket range.

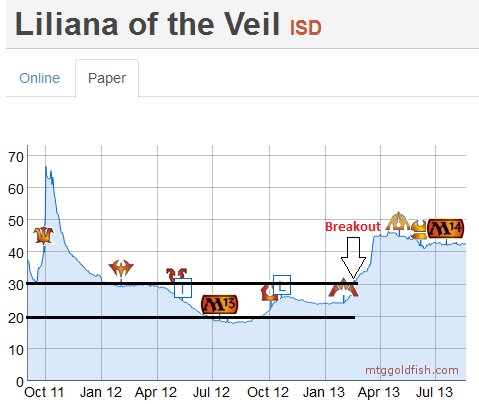

The paper version roughly mirrored this price activity. After ISD’s release, the price was usually in the $25 to $30 range. Like the digital version, there was a period of price weakness in the Summer of 2012 where it touched $18.

Things got interesting in January and February of 2013. On both of the above charts I have pointed out when the price broke above its trading range.

The Breakout

At the time, the Modern PTQ season was underway and Liliana broke out above 28 tix on January 11th. By the end of the the month, it was 30 tix. The rise continued in February, and by the 20th of that month it sat at 35 tix before heading even higher, briefly getting to 47 tix by March 7th.

On the other hand, the paper version took a few weeks to catch up to this shift. By the end of January it was still in its long-term price range, lounging around $25. The breakout occurred a few weeks later on February 19th, when it got over $31 for the first time in over a year.

In this case, the breakout was over a month after the price began moving on MTGO. Identifying the shift that was under way on MTGO could have yielded nice profits on the cardboard version.

Although looking at charts can guide decisions, often times it's only in hindsight that such trends become obvious. However, a synthesis of the value perspective and charting techniques can yield an actionable strategy.

From the value perspective, Liliana of the Veil had a number of things going for it on MTGO. In January of 2013, relatively few copies of Liliana of the Veil were coming onto the market as ISD was not being actively drafted. Besides a stable supply, playability of the card was good. It looked like the card was going to be an all-format staple as it was showing up in Legacy, Modern and Standard.

Lastly, the fact that it is a mythic rare ties the online value of the card to the value of paper ISD through redemption. Besides the impact of Liliana itself, the redemptive value of ISD on MTGO has been high due to the presence of Snapcaster Mage, the enemy-colour check lands, and Geist of Saint Traft.

All of these value factors were observable to anyone who was wiling to think about them. The strong technical breakout in price confirmed that Liliana of the Veil was the equivalent of a growth stock and had further gains to come.

Moreover, it looks like MTGO was ahead of the curve in this case, and that paper prices began following suit an entire month after the price move was already underway online. After the paper price started moving up, the feedback effect of redemption ensured further gains on the digital version.

Jace, Architect of Thought

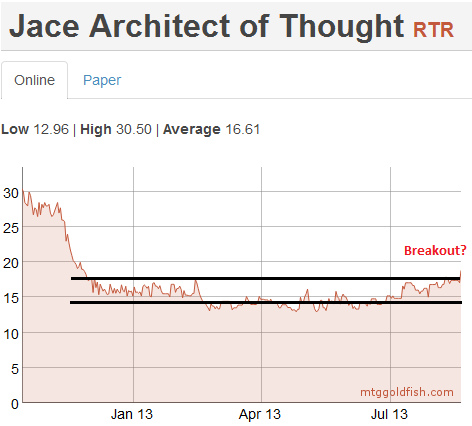

It looks like the Return to Ravnica (RTR) version of Jace is just at the start of a breakout online. Similar to Liliana, it had a long period of price congestion where it mostly bounced between 14 and 17 tix. This week, it has jumped above 18 tix. Let’s consider the fundamentals of this card to see whether this price move might be a signal for a period of growth.

First, Jace, Architect of Thought is a Block Constructed staple, and has proven useful in Standard as well. Although playability in Block is not a ringing endorsement for future gains, its prevalence there points, at the very least, to continued usage in Standard.

Next, we have entered the period of core set draft with the release of Theros on the horizon. The supply of online RTR block cards will be relatively fixed at this point.

Lastly, RTR might not be as redeemable as ISD, but it has a number of staple rares with high value to redeemers. Half of the shocklands lead things off and then there are two Legacy staples in Deathrite Shaman and Abrupt Decay. The shaman in particular looks to be a fixture of Modern as well, a format showing continued growth.

Overall, Jace does not stack up to Liliana from a fundamental perspective, but the factors still suggest future price increases. I’ll be watching this card over the coming weeks, and if it gets to 20+ tix instead of heading back down into the 14-17 tix range, then this would be a strong signal for further price increases to come.

In terms of a speculative strategy, the paper price has not yet made a move. If the MTGO version continues to show price strength, then I’d expect the paper version to follow suit. This suggests two ways to profit. On a strong breakout in price, combined with good fundamentals, buy both the digital version and the paper version.

Advocating a paper buy is a new strategy I am considering in order to take advantage of the times when the MTGO market is ahead of the paper market. At this point, this is an untested strategy and should only be employed by those with a high tolerance for risk.

As for the MTGO version, if the paper price breaks out and starts heading higher, the feedback loop of higher paper prices leading to higher MTGO prices through redemption should begin. If you are thinking of buying Jace in order to speculate, keep your eye out for a price breakout in paper. This would signal further gains to come on the digital version.

Portfolio Update

This is a brief rundown of what I am buying, selling and watching in the market in the last week.

Selling:

- RTR and GTC boosters are both close their peak and I have started selling down my boosters. I don't want to be left holding these in October.

- Many of the junk mythic rares from RTR and GTC have jumped up in recent weeks as the shift to core set draft has cut off supply. I've been selling a few of these, but I expect another price jump in October once the new Fall Standard gets under way.

Buying:

- A few Modern cards have caught my interest lately, including Twilight Mire, Goblin Guide and the Modern Masters version of Knight of the Reliquary.

- Jace, Architect of Thought is a card that I have been accumulating in recent weeks, and I feel that is has strong potential for further gains in the Fall.

Watching:

- Obviously I will be keeping an eye on Jace, Architect of Thought. A breakout in the paper price would be bullish for both the paper and digital versions.

- M14 boosters have jumped up from the release event lows. I'm expecting these to soften in price leading up to the release of Theros online. Once these get into the 3.0 to 3.2 tix range, I will start buying.

- M14 continues to present good value as a whole and I'll be paying attention to how the prices on chase rares such as Lifebane Zombie, Mutavault, and Scavenging Ooze develop over the coming weeks. These should be on your short list of rares to pick up from M14.

- Mythic rares from ISD Block have started softening in price in recent weeks and I'll start buying these once they have bottomed out in price.

New Insider here, so I apologize if this question is just an ignorance of the trends. Why will you be buying M14 if it goes down to 3.0-3.2? Are they expected to bounce back up at some point?

Welcome to the QS!

Speculating on booster packs has been a profitable and consistent strategy that we’ve developed here at QS. Read up on the forums in the RTR, GTC, and DGM booster threads, and also in past columns and the comments in those columns. The QS community has built up the booster speculating strategy through sharing of knowledge and constructive feedback. I will probably be writing a booster spec ‘bible’ in the near future to summarize.

But first, go here for historical RTR booster price

http://www.mtggoldfish.com/card/Return+to+Ravnica…

You’ll see a big dip around the release of GTC to less than 3 tix, which was a good time to buy. 3 months later, you could sell each booster for about 1 tix profit. RTR dipped so much because they were awarded for months as prizes, but drafting switched to triple GTC. This meant a high supply of RTR, and a low demand. Prices fell as a result because players could use the tix more than the boosters.

I’m anticipating a similar (but smaller) effect with M14. Look for prices to bottom out during Theros release events. Core set draft and limited continues to be popular online though, so prices will start recovering at some point. I’d expect the price of an M14 booster to be in the 3.5 to 3.7 range by Christmas. Profit could be in the range of 0.3 to 0.8 tix per booster.

Boosters are very liquid, have predictable price patterns, and the bots offer a small buy/sell spread. All these factors mean they can be a part of your portfolio that can deliver reliable profits with low risk. They are like the bonds of MTGO speculating.

Very good analysis Matt!

It makes perfect sense as to why Liliana reached so high but I’m still amazed that she sustained such a price past June-July! Sure it’s a staple in several formats but she’s not a x4 cornerstone of one or multiple decks in standard or modern or I might miss read decks popularity?

Concerning Jace where do you see this going? considering, unlike Liliana, Jace won’t be Legacy playable and probably not Modern (not so sure though) Maybe 30 Tix? Providing Theros dosen’t bring a playable blue planeswalker?

The price of Liliana was something else. I think this is due to Innistrad having Snapcaster Mage, Geist of Saint Traft, and Lily herself. These staples ensured that redemption for ISD was probably quite high, leaving few copies online.

Also, the big unknown is casual appeal which might be contributing to Lily’s high price. I’m curious to see how low she goes in Oct/Nov.

Jace is not a for sure thing, but is a reasonable bet in my opinion. You are correct in saying Jace is not like Lily. Her breakout happened in the first half of the Modern PTQ season. Right now, we are not in any season. So, although I am invested in Jace (now in paper too!), I am still waiting and watching.

What I am watching for is a price breakout in paper. If Jace is a pillar of Fall Standard, then it will go up in price in paper. Many people feel it will be $20 in paper. If this happens, and Shocklands continue to tick up in price, then we’ll see redemption pick up in volume too, putting pressure on the online Jace to go up in price. This is the feedback effect which is possible if the paper price spikes up on a card like Jace.

Let me try another angle. To me, due to it’s prevalence in Block, Jace on MTGO is ahead of the curve in terms of price. When/If paper catches up, the digital version will bump up in response. If Jace goes to $20, I think we’ll see online go to 30 tix in the short term.

If Jace stays at $10-$12, Jace will probably drift down to 12-15 tix eventually. But between the shocklands, Deathrite Shaman and Abrupt Decay, these should ensure that redemption demand stays high, which will keep online Jace at a higher price relative to paper.

Interesting – My portfolio online which I just started is basically a set of shocks, set of checklands, and some cheap mythics/rares that I hope will go up. If I can get out of those in a little while, maybe I can jump onto the pack bandwagon or into some of the pricier mythics. Thanks for the info!

Great article Matt. On a side note here, when does it make sense to redeem Ravnica Block sets? I’m considering doing so in order to use the cards for live paper tournaments but want to make sure I am maximizing value, especially if I have to pick up additional Jace’s or other mythics to round out each set I redeem.

This is a tricky question, because I think it starts with the assumption that the value of a set in paper and digital are not well related. But I think they are, so maximizing value on two objects that are correlated in price doesn’t make much sense.

What I’d suggest is to pick up any cards you need in order to complete a set right now, before interest in constructed heats up in October.

Thanks for reading, I hope I answered your question!

What are your thoughts on DGM packs? They seem dirt cheap right now at <2, but if they'll never go back up, I'll stay away.

I opened a SRevelation in a Sealed event and sold it for 34 tix. Now I get to decide on what to spec on next – DSpheres, Mortars or maybe a set of Ral Zarek. I could get a couple Jaces though, so maybe that's the play if they're on the rise…

DGM packs have been moving up since the end of M14 release events. They are probably set to continue to rise in the next few weeks as M14 draft slows down. Be sure to sell them before the hype for Theros starts up, otherwise they will start dropping in price.