Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

One of the most difficult aspects of investing lies in the troubling decision of when to sell.

We find cards to acquire readily–-prices are favorable and we develop theories as to why they should increase in the future. But even when our theses occur as we predicted, we must determine when to sell out of a position.

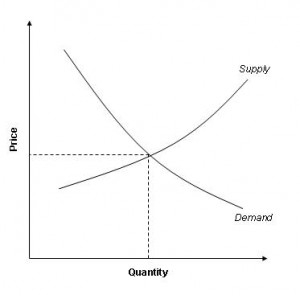

Fortunately there’s already a basic concept in Economics that can help us decide when to sell: supply and demand.

This may seem obvious, but the traditional supply and demand curves truly do highlight an underlying concept that many investors overlook. This week I will remind everyone of some Economics 101 and use these concepts to underline my selling strategies.

The Demand Curve

My selling strategy in both stock and MTG investing can be best defined by the basic demand curve depicted above. For those unfamiliar with it, the curve is simply a representation of the amount of demand for a particular item (on the x-axis) at a given price (on the y-axis). As price goes up, demand drops.

It’s becoming more frequent nowadays to see irrational behavior from speculators. That is, when a card gets notice and shoots up in price there is a sudden spike in demand which causes the price to rise even further.

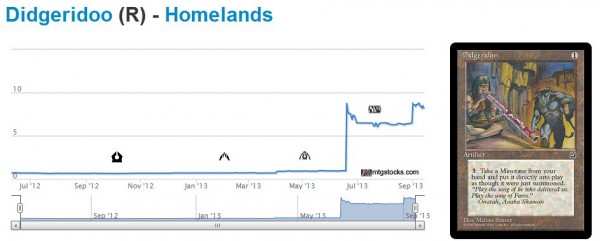

This type of irrational behavior is what occurred with Didgeridoo. The price inched up a little bit, got the notice of many speculators who then wanted the card even more, and drove the price up further on this unplayable Homelands artifact.

In rational times, as a card's price increases, demand gradually drops. Then eventually supply and demand match up when the “Invisible Hand” finds the appropriate price for a card.

This is how it’s supposed to work. I do my best to leave emotions out of my investment decisions as I focus on those basic curves.

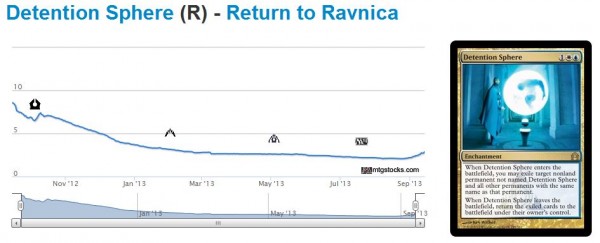

A Specific Case - Detention Sphere

Let’s take Detention Sphere as an example. I’ve been getting a little bit of heat from a few members of the QS community for already pulling the trigger to sell a couple play sets. The general consensus is that this card is going higher in price–-I don’t necessarily disagree, although I don’t think the “enchantment-themed” Theros is nearly as synergistic with Detention Sphere as many had hoped.

I acquired my Detention Spheres at an array of prices, mostly ranging from $1.50 to $2.50. I likely overpaid on the $2.50 ones but I also got a great deal (thanks SCG!) on the $1.50 ones. Now these are up to $14.50 a set on eBay-–after shipping and fees, I estimate that equates to $2.90 each.

Following the basic concept of the demand curve, I'm less in love with investing in this card as its price increases. Don’t get me wrong--this was a sweet pickup as early as a month ago, and I’ve been enjoying the healthy returns. But I would not want to invest in this card at $14.50 per play set, because I feel the upside from here is much less.

This is trivially obvious but worth mentioning as a reminder--as an investment increases in price it becomes a less and less attractive investment. And if a card’s price gets so high that you find yourself no long interested in acquiring, then it’s probably a good time to begin selling. Sure, you can sit on some copies to protect for further upside. But if you follow the basic demand curve, a higher price should mean you want fewer copies of a card.

Going back to the Detention Sphere example, I am beginning to sell some of my copies because the price is going higher. I’m profitable on every one that I purchased at the given price so there is no fear of loss holding me back. As the price continues to rise I will continue to sell more aggressively.

With this plain and simple strategy I admittedly won’t make the most profit possible on this card. I’m fine with that. Remember the name of the game is not “make more money in MTG than everyone else”. It’s “make money in MTG”. By buying low and selling at a higher price I am succeeding while also mitigating some risk (reprints, shifts in metagames, etc.)

A General Warning About Emotions

It’s easy to fall in love with a successful investment.

For those who jumped in on Serra's Sanctum with me a month or so ago, we’ve made some serious profits by following our keen awareness of MTG speculator behavior. Enchantment Theme in Block + Reserved List + Fringe-playable Land = Good Investment.

This one was almost too easy.

The QS Forums went abuzz on this card when the TCG Player buyout occurred. Since then the price has about doubled on the legendary land. I sure enjoy 100% profits when they come.

But now this card is suddenly twice as expensive to invest in as it was last month. With the higher cost, my demand for this land has decreased drastically. On the other hand I am so excited about calling this one correctly, and I have an emotional feeling that they can only go higher. After all, they are on the Reserved List, right?

They may go higher eventually, and right now they probably won’t drop much either. But I'm just not interested in investing more money in this card at $35 each. The upside is so much less in the near-to-mid term than it was last month.

My decision: sell. Take my amazing profits and find the next investment. It is so easy to convince myself that these can go higher, and in reality they might. But I have to consider my demand curve, along with the fundamentals.

I don’t see any bonkers Legacy enchantments in Theros that may push Serra's Sanctum into Tier 1 decks. Casual demand may increase a little, but any price increase driven by casual demand should be much slower.

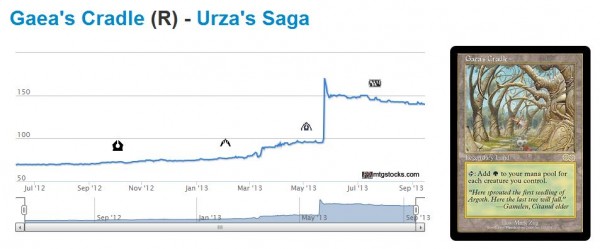

The drastic price spike we saw in the graph above wasn’t driven by casual players. It was driven by speculation--and largely irrational speculation at that. The same occurred with Gaea's Cradle once the new legend rule was announced.

Since the card peaked in June the value has been on a steady decline. The price became so high suddenly, and this gradually caused players to sell theirs. Price went up and demand went down–-basic economics.

The same trajectory is possible on Serra's Sanctum. If speculators drove the recent price jump, it may slowly trickle down in price over the coming months. I see no reason to sit on these investments waiting for the next catalyst when there are many other opportunities out there.

Always Anxious to Sell

Hopefully this article conveys my personal selling strategy to the skeptics out there hoping to time the market perfectly. I see no need to try to time every peak and valley perfectly. This strategy is time-consuming and carries additional risks I believe are unnecessary.

Instead, I implement the simple “buy low, sell high” strategy using a basic demand curve concept. As an investment’s price rises and I become profitable, I start to trim back a position. This strategy ensures I lock in profits while automatically keeping my behavior rational because it trims down my demand with a rising price.

Profit is all I’m after, and this strategy helps me remain disciplined to achieve my goal consistently.

…

Sigbits

Serra's Sanctum and Detention Sphere aren’t the only cards I’m trimming back for profit as prices increase. Here are some other recent sales:

- Desecration Demon was a $2 card not long ago. Now it sells in the $7 range on eBay. Many believe the price ceiling on this creature is Hellrider and I’m inclined to agree. But I wasn’t about to sit around and wait for the absolute peak because there’s no way Desecration Demon remains a great investment as the price jumps. I sold all of my copies for a handy profit–-even if the price goes higher, but I’m content to move onto the next bet.

- I picked up a handful of Keen Sense from Card Shark after noticing the TCG Player buyout that took place not long ago. When the copies arrived I had a tough decision to make: do I immediately sell into the recent hype of Reid Duke’s Modern Hexproof deck or do I hold until Modern PTQ season? With Modern PTQ season something like ten months away, I decided to sell now for fast profit. These will possibly increase further, but the 100% profit was too tempting to snag while it was readily available.

- Voice of Resurgence has done nothing but decrease in price the past few months, and for good reason. I don’t hear much about this card these days. Fortunately I invested in this card only indirectly by purchasing Dragon’s Maze Elemental tokens. This investment paid off nicely as these tokens reached $4+ each on eBay. Considering the Lifelink and Deathtouch Wurm tokens only reached $5 or so themselves, I decided to sell all my Elemental tokens while they were on the rise.

-Sigmund Ausfresser

@sigfig8

One of my fav articles, very relevent too with so many new people joining!

Thanks for the comment, Jeremy! Glad you found this article helpful – I live by the concepts above when I invest in both MTG and Wall Street. It’s so important to sell into strength and lock in profits from time to time. Greed can be a powerful force to overcome!

Excellent points Sigmund. I have to remind my friends all the time that the profit is profit (I even have to remind myself sometimes).

Thanks, David! Yes profit is profit. I love this phrase and use it all the time for both MTG and Wall Street investing 🙂

Unsurprisingly, an article I really agree and identify with, as I think we are both risk averse speculators!

I prefer to sell into hype because a higher selling velocity (on the way up) is useful because you can reinvest cash from that sale into other specs faster plus you expend far less time and effort into selling and trading.

–

Lifebane zombie, desecration demon, burning earth and mizzium mortars are a few recent specs that I recently cashed out on in large volume (20+) with 100%+ profit after fees and very little legwork. They probably all have a bit of room to grow but happy to let someone else assume the risk.

You summed up exactly how I feel! Glad to see there are others out there like me who are risk averse and enjoy easy profit without all the hassle of trying to sell at the absolute peak. Nice play on the Lifebane Zombies and Mizzium Mortars by the way. I overlooked these completely and regret doing so.

In the meantime, I still have another couple sets of Detention Spheres and Supreme Verdicts I’ll likely be moving in the coming weeks. They may go up a little higher, but I honestly feel the remaining upside is much less compared to other opportunities I like better (like Raging Ravine for example).

Thanks for your comment!

I’m in serious need of advice. I have no idea what to do with my fetches–both zendikar and onslaught. On one hand, I got all of them for $10-20 each, so I could easily walk away with the money, yet there is the obvious issue that they will likely increase in price, or if nothing else the cheaper ones will rise to match the more expensive ones. I hate having that much liquidity sitting in a binder when it is at risk (hypothetically) of a reprint. Plus I play modern and legacy competitively when I do get the chance to play them, so getting back in to sets on the lands would be an enormous pain if they only go up in price and stay there. Any suggestions?

Wes you are faced with one of the toughest decisions imaginable when it comes to MTG Finance. But any advice I could give would be tailored to my own personal situation.

For me, I have a young family (an 18 month old son) now so I play Magic very rarely. Sad, but true. Legacy became a once/year thing for me. After some long debate, I decided I couldn’t justify sitting on thousands of dollars in cards which I could never really enjoy. So I sold. Sold all my fetches, duals, etc.

If you still play Legacy competitively and enjoy it a great deal, then you may be more inclined to hold onto your collection. It’s not ALWAYS about the money, right? This is also a sweet game which can be a ton of fun. For me, the fun is more in casual play so I have less attachment to valuable cards. But if fun for you is winning tournaments, then you’ll need to hold onto your more expensive cards.

At the end of the day it’s a very personal decision I’ve found. The proceeds from my Legacy collection went into the stock market to begun a fund for my son’s college education. Can never start too early, right? 😉

I’m in serious need of advice. I have no idea what to do with my fetches–both zendikar and onslaught. On one hand, I got all of them for $10-20 each, so I could easily walk away with the money, yet there is the obvious issue that they will likely increase in price, or if nothing else the cheaper ones will rise to match the more expensive ones. I hate having that much liquidity sitting in a binder when it is at risk (hypothetically) of a reprint. Plus I play modern and legacy competitively when I do get the chance to play them, so getting back into sets on the lands would be an enormous pain if they only go up in price and stay there. Any suggestions?

1) Pick a Modern deck that you like the best.

2) Pick a Legacy deck that you like the best.

3) See if these 2 decks share any fetchlands between them.

4) Anything else are leftovers.

5) Sell all the leftovers April/May/June next year.

Full disclosure, I am going to get rid of my 70+ regular and 40 Foil Zendikar fetches around the same time. This would be right before or right at the start of Modern season, which should be at or near peak prices for them. I don’t expect a reprint of Zendikar fetches until 2015 at the earliest since:

1) It’s too early for MM2. WOTC needs to do a lot of market research on MM1.

2) I doubt that WOTC will put shocks and fetches in the same Standard format.

3) Fetches will not be printed in casual-focused products since Competitive players would just buy them up, and they are not the intended audience for those products.

the point of this article is, if you can take profit, sell them now. The longer you wait, the higher the risk.

The may not reprint these during Theros block, but they can announce the reprints! That’s all it takes to make prices go down!

You will make a lot of profit, why keep waiting? Sell them and use part of that money to invest in innistrad block cards in the comming months.

Brecht brings up a good point here. If you can sell for profit (and a sizable one at that) then don’t fret so much. Laugh because you made 100’s of dollars on Magic and find the next investment 🙂

Great article, thank you so much!

This may seem pretty obvious, but I have found some good tools for getting a quick view of the supplies of multiple vendors. Do you have any favorites?

Also, this is the part less obvious to me, but what is the best indicator of the demand curve?

Thank you for the kind words, Brian!

For supply, I generally leverage mtgstocks.com (which is basically TCG Player). It doesn’t capture supply exactly, but the site does alert you on a daily basis as to which cards are on the move. If a card’s price is moving consistently and/or rapidly, I know supply is trying up in general.

The demand curve is related to your own personal thesis. For example consider Detention Sphere:

I bought Detention Sphere at $2 each because I saw that Theros had a pseudo-Enchantment theme and because these enchantments are one reliable way to rid of Indestructible Gods. I felt $2 was a good price to buy many ($1.50 was an even better price, and I bought all the copies I could find at $1.50). Now that these are nearing $4 each I am much less interested in them. Upside is much lower, so I demand fewer copies. If these hit like $6+ I want to own 0 because I don’t see any upside beyond there.

Could this analysis be wrong? Absolutely. But this is my thesis and I am making my investment decisions based on this thesis. Theses can change, but they should only change if there is a fundamental shift. Otherwise stick to your rationale and trade accordingly. That’s my suggestion – honestly this topic is a whole additional article though 🙂

Where are detention sphere’s $4? TCG has them at 2.75 on the mid? They were in pretty high demand in Atlanta..as was Jace AoT.

I have sold 2 playsets of Detention Spheres on eBay for almost $15/set. So that is nearly $4 each. Plus I thought SCG would have been $3.99 by now but perhaps I’m wrong there.

Well written. Let me add that liquidity is also a factor if you invest in large amounts of cards in Standard. Selling 100 cards within a month might be easy but selling 1000 of the same card within the same time span can be tricky and/or require a lot of work. This is yet another reason why you should sell earlier than peak price.

Great add, Yuka, thanks for the comment. I agree completely – moving dozens of cards without shipping to a buy list can be time consuming and try my patience!

I wanted to ask if you have a certain percentage you want your investments to reach before you divest. I have been speculating on several cards and want to make some type of spreadsheet on how many I have, how much I’ve invested in them, my target price, what % profit that will be, and what timeframe I am willing to wait before divesting. If you have any suggestions and/or know anyone that has something like this already setup please let me know.

Unfortunately I don’t have such a spreadsheet. I probably should, and I probably should be more diligent of tracking my gains. But I just don’t – all numbers I use are estimates based on my memory. But I assure you they are fairly accurate for discussion purposes.

I don’t aim for a specific percentage. Every purchase I make for MTG Speculation includes a thesis with a target price. In some cases I’m looking for a quick flip because I found cards listed for sale below a store’s buy price or something. In these cases where I’m taking on virtually 0 risk, I’ll take any profit possible becauseu it’s free money (just make sure to include fees and shipping!). But for other investments where I go deeper, I try to target much larger returns (think INN Booster Boxes). But it all really depends on the thesis behind the buy.

Whew… that was close. QS almost went 3 whole days without bringing up Digeridoo! Ugh, so hard to focus with all the horn tooting going on around here. 🙂

On the other hand, great article. It’s good to reinforce that it’s OK to make “some” profit, and move on. Don’t stress the coulda-beens. I just started investing a month ago and already have the jitters. When will i get to the point where i don’t feel like every decision i make i the wrong one?

Thanks for the comment! Glad the article was helpful – I know it helps me to keep the above concepts in mind! As for the post-selling regret: this seems like it’s in our blood because we’re so competitive. It’s SO easy to think “Man, I shoulda held and sold for XYZ instead!”. But in reality, this isn’t a zero-sum game we’re playing. Just because you made $10 on a spec doesn’t mean it’s bad if I make $8. Making money on Magic should give you a rewarding feeling no matter what the possible profit was.

You’ll get better with timing as you practice this more. But I’ve given up trying to sell at the exact peak. Instead I sell on the way up – some cards I sell too low, but each additional copy I sell nets me additional profit. Besides, you should never feel bad making money right???

It’s release week soon and the Legacy brewers could write about potential plays in Enchantress which could add to the hype. Basically I would wait another 2 weeks as I don’t think they will go down and could spike up. I would not wait for tournament results as they may never happen.

Talking about Serra’s Sanctum? I have been tracking these VERY closely on eBay. My $35 copies were at one point the cheapest listed. I sold 6 of my 7 copies, but the last copy has just sat there. In the past couple weeks I’ve noticed a couple new listings undercutting my one copy.

If some pro writes about a new Enchantress brew, the card could go higher. But there’s no guarantee there, and without such an article Sanctum could continue to drop a little more before stabilizing in price. I don’t think it’s worth the wait personally, especially because I don’t see Theros synergizing exceptionally well with Enchantress.