Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

These last few weeks it feels like I begin every article with a snapshot of what cards are on the move of late. I proceed to highlight particular winners, develop theories for what is fueling their growth, and use these theories to attempt predictions for future trends.

I reuse this formula week after week because tracking movers and shakers is one of the best ways of analyzing market trends. It’s easy to disregard some cards on the move if we didn’t make purchases prior to the spikes--no one likes to dwell on their missed opportunities, after all. But I truly believe we can learn a great deal from such trends by studying them closely.

Not All Trends Are Positive

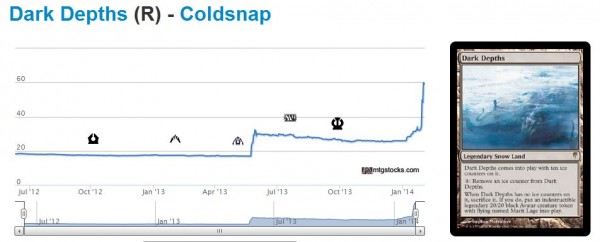

Through the implementation of this formula, I realized I’ve made an unintentional omission. When I browse mtgstocks.com and read through the latest Interests, I always sort by largest percentage gainer to see what cards are moving most drastically. The top couple movers (like Dark Depths of late) are often experiencing a buyout.

This alerts me to these pricing trends so I can do thorough searches online for remaining cheap copies. The newly learned information is also useful when negotiating at trade tables.

Through all this discussion, I’ve neglected the “losers” of mtgstocks.com. While we often make the most profit from recent “winners” like Dark Depths, there is still a good deal of information that can be learned through analysis of the “losers”.

Neglecting this data would be foolish--just because we’re not making money doesn’t mean we won’t gather additional data to help us make money down the line.

This Week’s Losers

Here’s a snapshot of last week’s losers--let’s see if we can learn anything new from the data.

Let’s face it: this week’s losers are much less exciting than the winners. Price drops tend to happen much more slowly than price increases. Actually, this is already valuable knowledge. We observe how cards can double or triple in price overnight, but a drop greater than 20% throughout the week is quite rare.

Price memory must be a major factor. Additionally, price drops must wait for more copies to be listed for sale. Sometimes it takes a while for stores and personal sellers to respond to such movement, creating a lag between drops in demand and drops in price.

But I readily identify three other themes that may lead to a card’s decline in price. Allow me to elaborate briefly on each one.

1) New Set Release

No surprise here--four of the eleven losers last week were from the newly released set Born of the Gods.

In past articles I’ve described the beauty that is selling preorders from a new set. Retailers can implement artificially high pricing simply because there aren’t any copies on the market yet. The “Invisible Hand” has yet to find the right price by matching up supply and demand because supply is artificially low.

But once a card is finally in the hands of players, these prices drop. Some drop pretty hard. Remember when Time Reversal was preselling for $25? That didn’t last long, did it?

While there is often a hidden gem in most sets, the vast majority of new cards are placed on a downward price trajectory immediately upon release.

This week four Born of the Gods cards are down more than 10%. Next week this number is likely to double. While this may not be news to most, it’s at least a validation data point to give us confidence that mtgstocks.com is capturing price drops accurately.

2) Buyout Retraction

You can recognize this type of price drop by the shape of a card’s price curve. You know the deal: a card spikes dramatically due to a buyout, only to retrace down again.

Granted many times the price retraction isn’t 100%. In the case of Norin the Wary, the price shed 33% before finally stabilizing much higher than before the buyout.

How far a card retracts is related to age and rarity (i.e. how many liquid copies there are) and the legitimacy of the buyout. When Star City Games increased their buy list price on blue fetchlands, these spiked very drastically. Guess what--SCG was right in doing this. The price hasn’t given back any gains.

But sometimes a buyout makes zero sense. Remember when rumors were flying around about Aluren and there was a rampant buyout? Turns out nothing legitimate did take place with this card, and demand eventually retreated all the way back down. Price gains were completely wiped out.

Last week’s top buyout retractors were Sygg, River Cutthroat, Cataclysm, and Vexing Shusher. Each of these has been on the move of late, and the Insider Forums have been all over this price movement. But the buying was overdone, and it’s completely normal to see some price retraction as each of these cards finds a new, stable, often higher price.

Oh, and I guess the stupid Elemental token from Dragon’s Maze also sort of fits into this category. I believe this card was “bought out” along with a number of other tokens.

Now don’t get me wrong. I’ve advocated speculating on tokens in the past, and I made a good profit on these Elemental tokens in particular. But paying $5 for a token as part of a buyout??? Don’t. Just don’t.

3) Small Volume Cards

One nice feature of mtgstocks.com (and in turn TCG Player) is that the site separates out different printings of a card. This even includes promo printings, special deck appearances, etc. It’s important to track these separately because often certain variations of a card garner larger demand than others.

But sometimes the number of copies of these less common printings in stock is fairly low. This isn’t because of a buyout or anything. It’s just that not many copies are listed for sale and there is comparably light demand.

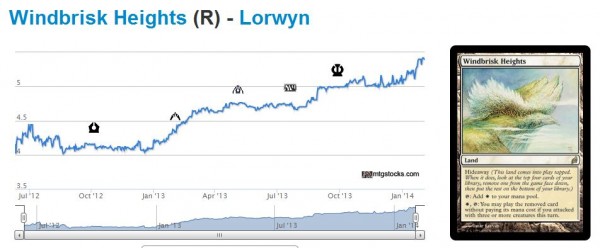

This results in an odd consequence. When a new seller comes to TCG Player and lists their few copies at a cheap price to make a sale, mtgstocks.com registers this as a significant price drop. Do you really think the From the Vault printing of Windbrisk Heights is suddenly out of favor while the regular set printing is on the rise? Not likely.

You can even compare the charts and readily see how price movements of the Lorwyn version of this land are much finer than the FtV counterpart.

The number of copies being bought and sold differs significantly between printings--hence a much coarser chart for the FtV printing. Any newly added listing at a lower price can trigger a large enough price drop to be registered by mtgstocks.com. A minor nuisance, but worth dealing with for the other benefits gained from this feature.

Opportunities?

This detailed analysis merits being revisited once in a while. Price decreases may be less exciting because they don’t directly translate to profit. But they can also be a source of valuable data. Rather than overlook the losers, we should assess their trajectories all the same.

After all, today’s winners could become tomorrow’s losers. Understanding what makes a card tank in price can help us determine timing and likelihood of a price drop for future cards. Avoiding such losses will make us money, even if not directly.

…

Sigbits

- I’ve noticed Meddling Mage on mtgstocks.com a number of times now. SCG’s stock is consistent with the price rise: they have only one non-foil copy in stock between both print runs! I’d look to trade for these and subtly acquire them as they seem to rise steadily in price.

- After dipping down as much as 20%, I’ve noticed foil copies of Liliana of the Veil gain traction once again. Now that SCG’s promotions are finished they have just a few copies in stock with NM versions retailing for $199.99. Once these sell out, I expect the price to go higher--especially once Modern season rolls around.

- Avacyn, Angel of Hope is on a tear! I made a few quick bucks on this card a while back but I guess holding out for more gains was the right play! SCG is sold out of nonfoils at $24.99 and sold out of foils at $59.99! My play: consider sealed boxes of Avacyn Restored, which should attract the attention of angel collectors and casual players as singles like Avacyn and Griselbrand get more expensive.

“My play: consider sealed boxes of Avacyn Restored, which should attract the attention of angel collectors and casual players as singles like Avacyn and Griselbrand get more expensive.”

Did you move into a house with a lot more storage space? 😉

LOL I already have a few Avacyn Restored boxes, myself. I won’t be buying more, but for those who fear they’ve missed the jumps on Avacyn and Griselbrand this is a safe alternative.

But you’re right – it’s difficult for me to advocate moving heavily into boxes while I have so much precious space taken up by them. To be fair though we did move from an apartment into a house, so we DO have SOME more space to work with. But I doubt the wife would appreciate it if I purchase many more of these. 🙂

Well, I’m definitely pretty unhappy about the banning of Deathrite Shaman. It also won’t be easy to go back since Bitterblossom is unbanned – those two cards together would give so much value in Modern Jund. I’m gonna hold onto my Shamans though, for god knows how long.

And I think it’s still a buy at $5 or below, even though I already bought a lot at $12.

Yeah DRS is definitely going to take a hit, but will bounce back in a few years. I wouldn’t bother buying up copies now even at $5 though. I’d probably wait for him to leave Standard and then acquire a few. Remember, a TON of RtR was opened due to its popularity.