Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Last week I wrote an admittedly bleak article comparing the Modern format to a Bear Market. The article sparked a great deal of valuable discussion--if you haven’t read through the comments section on that article, I would highly encourage it. I recognize my view isn’t the only one and I am always eager to engage in debate and hear what others believe. Often times, comments from others will help shape my own opinion and we all improve from the healthy discussion.

In that same article I promised an update on my Shock Lands. The jury is still out on these crucial Modern mana-fixers. Through this major price pullback on Modern cards, I continue to have an internal struggle on whether or not to hold my 91 Shock Lands as we navigate through strong headwinds: Standard rotation, Modern PTQ season ending, and continuous risk for reprints (no matter how unlikely).

I remain on the fence in a petrified state. I get a sense that Shock Lands will drop further due to the above factors. But, at the same time, I know the long term prospect for Shock Lands, barring unexpected reprint, is generally positive. The Lands are played heavily in Modern, a format Wizards continues to support feverishly, and they also do well in Casual formats like Commander and Cube. What’s more, I’m not sure if it’ll be worth my selling out of Shock Lands now to reacquire in the future. Prices have already drifted downward and the upcoming downside may be too small to justify any value saved.

Fortunately for me, I’ve discovered another way.

Options: Advanced Trading Strategies

On Wall Street there are endless ways to bet on the market. You can make money if a stock goes up, if a stock goes down, if a stock remains flat, if a stock fluctuates often, etc. Meanwhile, in the MTG Finance world, we’ve been restricting ourselves to buying and selling in order to make investments and generate income. It doesn’t have to be this way.

For those interested in utilizing advanced trading to make income from MTG Finance, may I present to you the concept of options.

An option is an advanced trading tool that can help someone generate income from various scenarios in finance, even if a card’s price doesn’t simply rise. Wikipedia explains options as:

A contract which gives the buyer the right, but not the obligation, to buy or sell an underlying asset or instrument at a specified strike price on or before a specified date. The seller has the corresponding obligation to fulfill the transaction – that is to sell or buy – if the buyer “exercises” the option. The buyer pays a premium to the seller for this right.

Put simply, an option is a bet on a card’s price movement within a specified period of time. It’s almost like saying “I want to buy your 50 copies of a given card in the future, but only if it goes above an agreed upon price. If it doesn’t, I don’t want to buy them.” But since the potential buyer has the option to buy or not buy those cards they have to pay a premium up front. The option seller is at the mercy of the option buyer. If the buyer “exercises” their option before the deadline, they pay the agreed upon price to the seller and the seller ships the cards no matter what the market price becomes.

The concept sounds complicated at first, and the complexity is likely to be a barrier to some who aren’t interested in advanced MTG speculation. They may be thinking that this concept is far too complex to merit trying, and that no one would be interested in making such bets.

They’d be wrong.

My Shock Lands struggle above is the perfect opportunity to leverage options trading in MTG Finance. The below example is really happening. It will hopefully explain options using in a concrete manner.

The Covered Call

I will concede that some options trading could be very difficult to regulate and control. How would you track who owns a given contract? How would you hold the sellers accountable months or even years after a deal is made? These limitations will admittedly make options an underutilized tool in MTG Finance. But, in some cases, options can be a preferred method, depending on the situation.

For example, I currently have a large bet on my Shock Lands. I think in the short term they will be underwhelming, but in the distant future they have upside. I don’t like the idea of sitting on 91 Shock Lands over the next 6-12 months because I will incur wasted opportunity sitting on these.

However, selling them and re-buying them in a year carries its own risks and costs. With a “Covered Call” I can make money by betting Shock Lands will do just as I anticipate: flat to down in the next 6-12 months followed by upward momentum.

Investopedia.com defines “Covered Call” as:

an options strategy whereby an investor holds a long position in an asset and writes (sells) call options on that same asset in an attempt to generate increased income from the asset. This is often employed when an investor has a short-term neutral view on the asset and for this reason hold the asset long and simultaneously have a short position via the option to generate income from the option premium.

Okay, enough complex terminology. Let’s talk numbers.

The Deal I Just Made

I essentially wrote a contract. The contract states “the owner of this contract has the right to buy the below cards for $9 each + shipping before January 10th, 2015.”

- 13x Breeding Pool

- 10x Watery Grave

- 7x Godless Shrine

- 5x Sacred Foundry

- 8x Stomping Ground

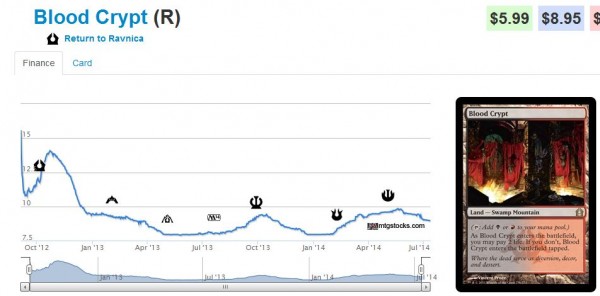

- 7x Blood Crypt

- 9x Temple Garden

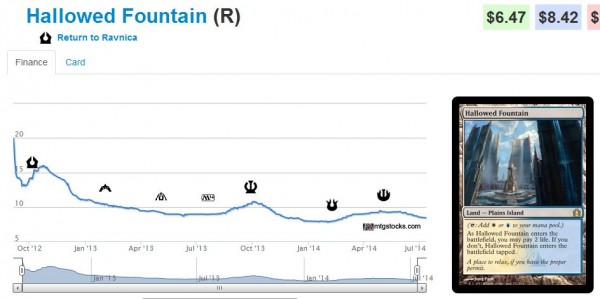

- 10x Hallowed Fountain

- 16x Steam Vents

- 6x Overgrown Tomb

After I wrote this contract, I sold it to a Twitter follower – Adrian P. (@apaniyam) for $50. That’s all there is to it. I now have $50 more than I had before and no one can take that away from me. Now if Shock Lands stay flat or go down in the coming months, at least I made a little bit of cash off them. And if they go up after January 10th, as I expect, I will still be holding the 91 Shock Lands to sell for more profit. Sounds like an easy win, right?

Well, not exactly. With any trade there is risk. I’m essentially selling any profits I may make on these Shock Lands should they exceed $9 each over the next 6 months. So if the average Shock Land price were to hit $12 in 6 months, Adrian will exercise his right to cash in this option. I will be obligated to sell him all my Shocks at $9 each + shipping despite the higher market price. He will easily make $3 on average per Shock Land in profit that I gave up the right to make with this option.

In fact, this is directly related to Adrian’s motivation to buy this contract. I’ve already explained in detail why I like my side of the deal, but Adrian asked me to share his side:

“Coming from a 80 (2 playset) position I have sold out 100% of my shocklands as I believe the market is going down. However we also know there have been some massive swings in volatility over the last few years of mtg finance. When you chart the basket you sent, it is actually par value to the market when you include the premium and shipping (i think it works out to a dollar out overall on tcg mid). Here in Australia we don't have many opportunities to hit a large position like this, so I have paid a fraction of what it would cost me to travel to a large event and pick these up if the market is looking healthy and ripe to rise in 6 months. I will probably call the option if the market is in the final price range of 7-9. Paying a premium to get a wide exposure early.”

So Adrian is gaining exposure to 91 Shock Lands without having to pay all the money for them up front. He sold his large position in Shock Lands already, meaning he can do whatever he wants with his cash. But for $50, he now has significant exposure to Shock Lands via my contract. If Shock Lands drop, he loses $50 and I’m stuck holding them all. If they go up, he gets Shock Lands at a discount. If they stay flat, he may still take all the Shocks due to the fact they are harder to track down in Australia.

Wrapping It Up

There you have it. Possibly the first options trade in the history of MTG Finance. The tool can seem complex at first, but once you make that first transaction and you look at the numbers, options can be much more concrete. In the case of my deal, I’m going to make the most value if Shock Lands remain below $9 over the next six months. If they go above $9 in the next six months (in Australia), than the contract buyer makes profits.

But even still, I’ll be selling my Shock Lands at $9, which I will likely be happy to do. That to me is the beauty of this deal. I’m essentially hedging my bets – either way I’m making money. I certainly couldn’t get $9 each for my Shock Lands today since I’m not a retailer. Buy list prices are unfavorable right now. I’ve just limited my upside for a while.

One last note: Adrian now owns this contract. One of his rights is that he can sell the contract himself to someone else. He was willing to pay $50 for the right to buy my Shocks at $9 each, but maybe he knows someone who is really bullish on Shock Lands. They may be willing to pay $100 for the same right. Adrian could theoretically sell his contract to that other person for $100, netting $50 of profit without having to actually deal in cards. Pretty cool, right?

Options aren’t for everyone. They can be complex and intimidating, especially at first. But if we as an MTG Finance community truly want to take this to the “next level” and find new opportunities to add value to our portfolios, then I would recommend considering options. They enable trades even when markets are stagnant. And because people have such differing opinions on cards, there should be plenty of opportunities for such option trades to happen once there is a robust platform that drives accountability.

…

Sigbits

- Star City Games has upped their pre-sale price on M15 Chord of Calling to $14.99. I don’t think this price will stick as copies are opened, and I’d encourage you to move yours as close to this price as possible in the coming weeks. There should be ample opportunity to re-acquire in the single-digit price range over the coming months.

- Enemy colored Pain Lands recently reprinted in M15 maintain a high price tag and SCG still has low stock. They only have a few Yavimaya Coast in stock, for example, and the preorder price for M15 is $3.99. More copies will be available of this card as well, though older card frames may maintain a small premium.

- The five “Souls” of M15 are generating a great deal of hype. Star City Games is sold out of three of the five in pre-orders: Soul of Zendikar at $9.99, Soul of Shandalar at $11.99, and Soul of New Phyrexia at $29.99! Soul of Ravnica remains cheapest at $5. Thinking back to the Titans of Core Sets past, $3-$5 should be the price floor on any of these “Souls” while they’re in Standard.

how legal is such a contract?

If by legal you mean enforceable, then yes it should be assuming it has all the normal elements of a contract.

If by legal you mean permissible under securities laws, I have no idea (and we may not have enough facts to determine it).

Enforcing the contract has got to be one of the largest barriers to have it become mainstream in MTG Finance. The time horizons are very lengthy.

However I do feel some larger stores and sellers in the MTG Finance community have enough credibility that they could offer such options. If people are uncomfortable with the concept they certainly aren’t obligated to participate.

In the case of my deal above, I will 100% ship the Shock Lands if Adrian chooses to exercise his right. I stake my reputation on this. Even if Shock Lands hit $20, they will be his at $9 each as long as he pulls the trigger by the specified date. This is a risk I accepted knowingly when I wrote the covered call.

An option contract is not a secured transaction. Securities law is not applicable in this context. This is a simple contract for the sale of goods, and UCC Article 2 controls. The contract described is legally enforceable.

This contract is perfectly legal, and represents Sig’s irrevocable offer to sell at the specified price for the duration of the option period.

That said, this contract does have an enforceability problem. Let’s assume that the holder exercises the option, but Sig breaches by refusing to tender the cards at the agreed-upon price. The option holder can sue for money damages. In theory, this is an easy win for the non-breaching party.

However, the fact that one party is domiciled in Australia complicates things. It would be most convenient for the option holder to ask the Australian courts to enforce the contract. But an Australian court would have no jurisdiction over Sig (who does not live in Australia, afaik).

The option holder should probably assign (sell) the option to an individual who lives in the same country as Sig. This way she is not left with a contract that is so difficult to enforce.

Dan,

Thanks for your perspective. I don’t think anyone in this MTG Finance business is interested in going to court over their option trades, but it’s good to hear there is enforceability at least in the highest sense.

In regards to my specific contract, Adrian will have to trust me completely that I’ll deliver (I have no motivation to damage my reputation here). But in the future, perhaps limiting these things to within country is best.

One thing to note in your “Sigbits”, while SCG is pre-sold the souls for those prices…the current TCG is WAY lower…well played SCG because they just made 4x what some of these are going for….

Dang, they are good. Pi mentioned to me an interesting thought: pre-selling is like selling a mandatory contract. You are selling something at a fixed price to be obtained in the future. Only with pre-ordering, the buyer has to pay for their cards up front and can’t choose to let their contract expire.

It’s not a perfect parallel, but the same issues of trust exists. Especially when a pre-order is placed greater than eBay’s 45 day protection dictates.

Yep…I was thinking the same thing as I read your article…I’ve heard numerous times about people who pre-sell on ebay shipping only the cards that are much lower at release and just refunding on any cards that are more expensive…thus they can never lose. This process is really scummy, but it is in a similar vein to your proposal.

Yep, and when these sellers get the 10 negative feedback ratings for their shadiness, it’s well-hidden amongst the 1000’s of positive feedback. This is because 99.9% of card prices drop once they release! It’s unregulated just like MTG options!

If the contract is written as a contract should be (and if it’s a simple covered call contract, it wouldn’t be hard), then it IS legally enforceable. I like the idea of using a covered call strategy, Sig. But what significance is in Jan 10, as opposed to Jan 1? And it least it wasn’t the third Friday of the month. That always annoys me.

Jeremy,

Good question. That third Friday thing would have been hilarious! Alas I have no such clever explanation. The deal I proffered was originally for a 6 month contract. We agreed on the terms on July 10th, thus the January 10th expiration. 🙂

Wow.

I had been thinking how cool it would be to have options products in MTG.

Now you initiated one for real, which is both innovative (to a certain extent as options have been running for decades on other markets)… and brave : setting up a future contract agreemen with a guy on the other side of earth is reminiscent of ancient italian or german merchants requires some guts.

My thoughts are that now you kind of POCed it, the next step will have to be some major trading platform to set these up to ensure that options contract are enforced correctly.

Failing to have this, I believe this will stay very limited as it requires heavy trust, especially on the buying part to agree such deals.

Yeah, a major platform with very strong accountability rights would be necessary to make this work broadly. I could envision a scenario where people deposit hundreds to thousands of dollars into their MTG options account. This way if a contract is executed, some overarching “power” takes funds from the option seller’s account and uses it to buy the basket of cards if they don’t ship voluntarily.

But yeah, it’d be complex and difficult. Still, in tight circles with strong trust this could be a thing. 🙂

This is a fascinating idea. The biggest obstacle to widespread use, however, I think will be the practicalities of enforcement. If the optioner decides to take the money but refuses to honor the agreement when exercised, its rarely going to worth the cost of using the courts to enforce the deal. Even small claims court would be difficult to use, since the parties will typically reside in different jurisdictions.

This means that, unless the option turns out to be worth a significant amount of money when exercised, the optionee risks paying money up front for nothing (beyond the expected risk). Considering how often many online sellers already refuse to honor contracts for immediate sales when a card spikes, I’d worry many options aren’t worth anything. Functionally, they could simply be interest-free loans to unscrupulous optioners who decide it’s more profitable to breach and refund than perform.

Agree with your comment above – enforcement is 100% the largest barrier to making this a widely adopted tool. I still maintain that there could be certain high-profile members of the community who would be trustworthy. But they may be few and far between.

The purchaser of my contract can rest assured I will honor its execution should they choose to proceed. My reputation is worth more to me than the $$$.

I have to say that I really enjoy reading your articles Sigmund, even this one as controversial as it may be. I have a couple of things to point out though, especially concerning option contracts like these.

1. I have been scammed before involving Magic Cards and I have to say when you have to deal with court systems and law enforcement over these cards (my value was 2500 dollars lost) they do not really help you. By providing options would make it very easy for people (credible and non-credible) to start taking advantage of making a few quick dollars, and although I try and be optimistic about peoples morals, you really can’t trust people these days.

2. Small claims courts (in California) do not allow you to make claims against people outside of California, I know I tried, therefore people selling options would have all of the advantages of selling contracts and running.

3. One idea to push options forward (although I would agree with Chaz I think they are not in the best interest) If a site opened up where they offered to take on the legal liability of these options contracts and provided a market place for these then perhaps there would be more balance between the contract holder and seller. Basically what ValutAge mentioned at the end of his comment.

Options involve too much trust in the selling party, it would be a buyers nightmare.

Byron,

Sadly you are 100% correct (as is everyone else making the same point). I am very honored that Adrian P., the contract buyer, has enough trust in my integrity to proceed with the deal. But not everyone has such trust for individuals in the community.

Imagine if SCG offered these contracts. I think everyone would be able to trust them, and it would be quite awesome! But I don’t think that’s going to happen.

My bad Sigmund, I was not trying to say that you are an untrustworthy person. I feel that the members of this community can for sure be the most trusted as far as I can see. My points were more concerned about seeing options hit market places such as ebay and such where people might get a false sense of security under ebay, then realize by the 45 day mark that the person who sold the contract can now essentially do whatever he or she pleases. I really liked your comparison to pre-sales though, that is something I did not think about.

Cheers,

Byron

Byron,

No offense taken. MTG Options is definitely not for eBay. I suspect a whole new platform would be necessary to keep track and regulate MTG options. Honestly, it’s not likely something that will happen (at least not successfully) in the near future.

Maybe one day….

Yeah, Pi’s pre-sale comparison is actually interesting. It makes the concept of options less intimidating because in a way, preordering is very similar. The big difference is that the “contract” must be executed once the new set comes out. But essentially you’re agreeing to pay for the pre-ordered cards at a set price knowing that market fluctuations may move the market price before you get your order!

This will be in my opinion just like when people began to trade outside of ebay, just by trusting others and spreading the voice. It will create a more close circle of people that trusts each other because its going to be very probable (and sigmund may correct me here) that these kind of deals will not be for huge amounts of money because they are like a layaway thing. The people involved have to think very hard if they want to screw someone over, because of the consequences. I liked the article a lot and I hope someday my budget allows me to do these kind of deals.

Depends on what you consider to be “huge”, to me 91×9=$819 is a significant amount, getting close to “huge” when it comes to Magic expenses (I’ve only made bigger purchases a few times).

Frank,

Thank you VERY much for your comment and feedback! I am always open to others’ thoughts on the content of my articles.

On the one hand, the cost of doing an options trade is cheap – in my case, it was just $50. On the other hand, the cost of executing the contract is MUCH higher. This is essentially what Pi mentioned in his response above.

I can complicate things a little further if you’d like – this type of tool is in its infancy when it comes to MTG Finance. We have the power to influence its development if we choose. What if there was a caveat in the contract which allowed the contract buyer to accept a cash payment = market price minus strike price at execution instead of having to purchase the cards. This would mean they would never have to pay $800ish. I’m not aware if such an option exists on Wall St, but it would certainly help avoid unnecessary shipping costs and large cash outlays…just an idea, probably not a good one. 🙂

Definatly not the first option. I Optioned 4 LOTV’s to my buddy at 40$ for a 5$ fee over a 2 month period. When they hit 50$, he did not have the capital to pick them up cheeply and the 2 month period expired.

He Got the idea from someone who wanted to buy his Foil Jace the Mind Sculptors but only after the FTV was announced as someone had rumor mongered it was going to be FTV Planeswalkers (It was Realms hahahaha) Paid him 30$ to hold them until it was spoiled further and he didn’t have to risk as much capital.

And I’m not sure how much futher back it goes but definatly not the first options contract i’ve heard of, Had been calling it a Futures Option, and now am uncertain how accurate that term is.

Benjamin,

This is terrific info, thanks for sharing! I am actually relieved that this wasn’t the first option trade in MTG Finance. The fact that this is already a “thing” suggests there is precedence for its limited success.

Perhaps this contract has the largest basket ever, then? 🙂

MTG option trading? 1. You broke the internet. 2. Don’t tell the SEC…

1. LOL

2. Noted. 😛

I’d be interested to know how you decided on $50 as premium – Did you price it based on historical volatility of the shocks?

Shoey,

Great question! Unfortunately I have no advanced theory for determining the contract premium. I figured $50 was enough to be worth my time, but not too much to make it too much risk for the buyer. I basically decided $50 was a solid price, and then I chose the strike price from there. With almost 100 shocks and a $9/shock strike price, I’d essentially be getting $9.50 per Shock Land if the contract executes. That felt solid to me. Thanks for asking! 🙂

My knowledge of derivatives is quite basic, but I plugged your numbers into DerivGem as an American at-the-money and got an implied vol of 22%/year. So I’d dare say if the volatility of shocklands is lower than that you scored a good deal in theory. 🙂

With respect to other comments who raise the concern about scams. Your trade is essentially an Over The Counter deal as opposed to Exchange Traded – these are commonplace and essentially the risk of scam is counterparty credit risk. The way it could be mitigated is in the pricing. If I lend $100 to ten people and know generally that the probability of default in the population I’m lending to is 1-in-10, then even if interest rates were zero, I would have to charge the ten people 11.1% each. Maybe in the future there could be an ebay style market where option sellers are rated and a new seller would have to cop lower premiums until they build up a rating. As RyeAbc said MTGO could facilitate this even more easily – a reputable bot essentially makes this an Exchange and they could hold on to an initial margin in tix or the cards themselves as collateral.

I returned to play MTG after a 15 year hiatus and find this finance aspect is really intriguing. It’s its own game within the game – as you guys on QS have said, the whole thing is like a model of stockmarket (maybe more like commodities market?). The price relationships between draft supply/tournament seasons/mtgo redemption is a real eye opener & I really enjoy reading this!

You propose some very realistic options, Shoey. I think one’s “premium” for contracts could vary in price depending on their feedback ratings! So if someone is brand new and starting out, they can only get a small fraction of the overall potential for selling a covered call. But once feedback is accrued, the fraction gradually approaches 1, which would be the market rate for such contracts.

MTGO could work even better for this, I agree! If this feature were available in MTGO I would be much more tempted to try it out :).

Glad you’ve enjoyed this content. I am a very active stock market trader, and there are so many parallels I see between MTG Finance and Wall Street. That’s what drives my interest, and I try to incorporate some of my Wall St. learning into these QS articles…at the hopes that I don’t bore others to death for the technical rigor involved!

While I don’t see options ever working on a large scale through paper, just too many ways to be scammed, MTGO could be the place for it. Ideally MTGO itself would hold the cards until the contract is finished or acted upon, however the chances of WotC going that extra step to code that is a pipe dream.

If a reputable bot/company acted as the middle man holding the cards they could potentially make it work and make tons of money as well charging some percentage to be the middle man. IF they pick up and run with everyone’s product then that’s a lawsuit I’d imagine would go through so it would be a much more safe environment to do something like this.

Ive got a question about your reason for selling the option.

So is your stance that shocks will go up or down before the end of the option?

What happens if they drop drastically? Didn’t you just shackle yourself to selling low and opened yourself up to getting bought out if they spike?

Just trying to understand the reason behind it all and why you decided to go this route.

Great questions! I would say my overall view on Shock Lands in the next 6 months is “Neutral”. I expect them to drop no more than 10-20% and rise no more than 10-20%. Basically I don’t see enough value in selling all 91 Shocks to rebuy them again in less than a year. There’s no point. But the opportunity cost of making such minimal gains was too steep for me to accept at face value.

I did shackle myself to the position by selling this covered call. If shocks tank, I’m left holding the bag. That’s the risk I am taking, and it’s the benefit Adrian P. gets by buying the option. But I’m ok with holding because I think the LONG TERM view is positive enough. That’s the rationale.

Likewise, if they spike then Adrian wins big time. I think the likelihood of this is low enough though…certainly in the coming couple months.

If you see signs they are going to drop really hard you could sell them and rebuy if/when Adrian wants to buy (or whenever you feel they are at their lowest).

Assuming you can obtain them again in a small enough time frame this should work, right?

I suppose I could, but it would mean greater risk. Selling a naked call (uncovered) means that if Adrian exercises his option I need to go buy those 91 Shocks and ship them to him. If I sell mine and they suddenly spike and I have to re-buy this could mean significant losses. Shipping, fees, time all should be factored in, and likely results in the need for a major drop in price for this to be justified. One example where this is the right choice could be an announcement of Shock Lands in Khans of Tarkir – of course there’s a 0.00001% chance of this, but it makes the point.

I’m confused, Soul of New Phyrexia is like $7-$8 on TCGPlayer… who bought these @ $29.99?

During the great modern gold rush earlier this year I spent some time thinking about what an MTG derivatives platform would look like. I actually think TCGplayer has most of the infrastructure in place to do this with the new TCGP Direct program. They have the processes in place for inventory, storage and drop shipping. Essentially the modification required would be for traders to pre-ship any cards they want to write options on to TCGP for their account inventory, plus a of margin account. This would allow for all sorts of covered derivatives, and be a very efficient way to speculate as it would prevent the need to ever ship if the buyer just wants to hold the cards in their own trading account.

I think this sort of platform allowing strictly covered derivatives would be beneficial and actually reduce price volatility. Spikes are frequently caused due to shipping time, so removing that barrier will smooth out the price action in many cases. Also the ability to take the other side of a bet introduces negative feedback further smoothing it out.

The fact that the news has been full of the effects of massive UNcovered derivatives for the past decades has created a legitimate fear, but I think the risks be safely mitigated.

Todd,

Thanks for your perspective. You have clearly thought about this concept some in the past! I’m not sure if TCG Player or any other platform would be willing to take this sort of endeavor on, but I would certainly be thrilled if it were to gain traction. To your point, being able to bet against a card hasn’t been possible before outside of friendly wagers, but it could be a way to temper volatility. When cards spike, people can only buy out cheap copies and try to sell into the hype. But if people could do options, they’d be able to bet against such a spike and there’d be no shipping involved!

Not sure if we have the power to make this happen, but I’m excited to hear others would be interested! Thanks for commenting!

This system might actually work. Essentially, you’d have a third party hold optioned cards in “escrow” during the option period, facilitating trust between arms-length parties. They’d take a small fee, but their only investment would be storage and administration.

Yeah, it is essentially escrow in that your optioned cards are encumbered for the duration of the option. It consolidates your counterparty risk onto TCGP or whoever is running the platform, and the fees end up being a trust tax. The additional benefit is that it precludes leveraged trades which mitigates potential volatility.

Well, one extension to escrow is that the platform – say tcgplayer, might as well sell you a future to hedge ur short call. If u get exercised, then they can deliver straight from their shop which has a large card pool anyway and a standardized grading system and insured delivery.