Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Welcome to the MTGO Market Report as compiled by Sylvain Lehoux and Matthew Lewis. The report is loosely broken down into two perspectives.

A broader perspective will be written by Matthew and will focus on recent trends in set prices, taking into account how paper prices and MTGO prices interact. Sylvain will take a closer look at particular opportunities based on various factors such as (but not limited to) set releases, flashback drafts and banned/restricted announcements.

There will be some overlap between the two sections. As always, speculators should take into account their own budget, risk tolerance and current portfolio before taking on any recommended positions.

Redemption

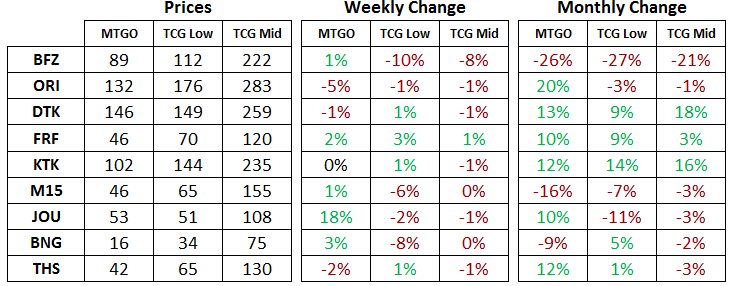

Below are the total set prices for all redeemable sets on MTGO. All prices are current as of November 2nd, 2015. The TCG Low and TCG Mid prices are the sum of each set’s individual card prices on TCG Player, either the low price or the mid price respectively.

All MTGO set prices this week are taken from Goatbot’s website, and all weekly changes are now calculated relative to Goatbot’s ‘Full Set’ prices from the previous week. All monthly changes are also relative to the previous month prices, taken from Goatbot’s website at that time. Occasionally ‘Full Set’ prices are not available, and so estimated set prices are used instead.

Theros Block & M15

Although the prices on these sets have bottomed on MTGO, weakness is still evident in paper prices, which usually bottom at the end of November or early December.

Until the bottoming process is complete in paper, there will be next to zero demand from redeemers. This leaves MTGO prices to fluctuate without a firm anchor, particularly for Theros (THS) and Magic 2015 (M15).

Speculators targeting cards from these sets should be cautious at this point. The best prices are behind us now, and gains on junk mythic rares will be uneven and sporadic until paper prices start to firm up.

One of the catalysts of this process will be rising interest in Modern Constructed leading up to Pro Tour Oath of the Gatewatch (OGW). That event will feature Modern for the constructed portion, so speculators should circle the weekend of February 5th to 7th.

There will be price spikes on Modern playables that get featured in coverage and show up in the Top 8 on Sunday. Speculators should be well prepared in advance of that weekend by accumulating Modern staples and playables.

Tarkir Block & Magic Origins

Keep in mind both Khans of Tarkir (KTK) and Fate Reforged (FRF) will be rotating out of Standard in April with the release of the just announced Shadows Over Innistrad (SOI). This has implications for both players and speculators looking to minimize the loss of value tied to rotation.

The trick is to avoid the panic selling period, which usually occurs in September for a Fall rotation. In this case, you will want to avoid selling cards off in March as other players rush to the exit with their KTK and FRF cards.

Target February as the month to sell cards from these two sets, particularly Standard-only cards which will lose the majority of their value after rotation.

Wingmate Roc is a prime example of a card that will lose most of its value after leaving Standard. Right now it's a staple, but as of April it will be unplayable.

Although this card has not peaked in price, be sure to whittle down your supply over the winter. 10 to 12 tix is a fine selling price, and any price spike beyond that should be considered a great point for exiting the position.

[tt n="Wingmate Roc" a=5]Out of FRF, Warden of the First Tree in the past month went from 9 tix all the way down to 4 tix, and stabilized at 5 tix. This card is a staple of current Standard, and often appears as a four-of in aggressive Abzan builds and G/W Megamorph.

This type of price movement is indicative of a supply crunch followed by a round of speculative selling. If the majority of speculators have exited their positions, then steady demand will result in steady price increases, and not the whipsaw up and down of the past few weeks.

Look for this card to move up in price into January. Holding out for a price of 8 to 9 tix is defensible with three months left in this iteration of Standard.

[tt n="Warden of the First Tree" a=5]The other big mover in recent weeks out of FRF is Ugin, the Spirit Dragon. At 15 tix, it seems to have found a stable price for the moment. Similar to Wingmate Roc, any price spike which sends this to 20 tix or higher should be considered an excellent opportunity to sell.

Unlike the white flier though, Ugin's spot in Modern Constructed is assured as a key part of Tron builds. This will be a good card to load up on at the right price around the first ever spring rotation.

Unlike the first two sets of Tarkir block, Dragons of Tarkir (DTK) will stick around in Standard until the Fall. Looking to the long term, this set focused on allied colours could form the backbone of Spring Standard, depending on the quality of mana fixing present in Oath of the Gatewatch (OGW) and SOI.

It's safe to say the current level of mana fixing is an outlier, and the rotation of the KTK fetch lands will result in a narrowing of mana bases. If a shift to mono-colour and allied-colour decks occurs, cards from DTK will be prime beneficiary of that shift.

Magic Origins (ORI) is paired with DTK in the rotation schedule, and it has the honour of featuring the first 60+ tix Standard card in years. A number of factors have combined to push Jace, Vryn's Prodigy // Jace, Telepath Unbound to these lofty heights, and it's worth considering how these factors will change in the Spring. ORI is sticking around, but what will happen to Jace?

As others have observed, the loss of the fetch lands from Standard will be a big blow to Jace's power level. First, it will be much harder for decks to splash Jace. Secondly, fetches are an almost costless way to fill the graveyard, allowing for a relatively easy path to flip Jace.

Lastly, although Jace is Modern-playable, it's not clear if it's a staple of that format. All of these factors point to Jace being at or near its price apex. Act accordingly over the coming months.

Battle for Zendikar

The newest set continues to underwhelm with its impact on Standard, and speculators should be biding their time in anticipation of lower prices down the road.

Attempting to speculate on cards from this set is a losing battle at the moment due to the relentless flood of supply from drafters. Any speculation should be short term in nature, usually tied to results from weekend events.

The release of OGW in January will trigger a shift in the draft format from triple Battle for Zendikar (BFZ) to one booster of BFZ and two of OGW. This means speculators should look to OGW release events for the probable bottom on cards from BFZ. Accumulating tix in advance will ensure speculators can acquire cards from BFZ at a good price.

Modern

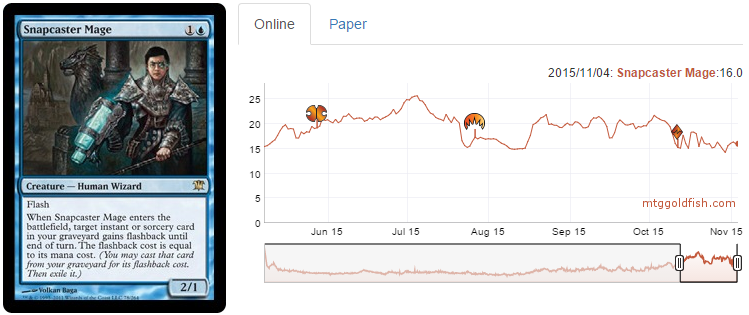

Innistrad special Halloween drafts end today. ISD prices have lost about 15% of their value on average and bottomed this past Saturday as anticipated. From bulk rares to Liliana of the Veil, all cards suffered a loss in value save for one--Snapcaster Mage.

This is a strong signal of the value players place in Snapcaster. If speculators might have wished for a better buying price after this weekend, Snapcaster Mage remains a strong speculative target and should be stocked up at its current price.

Other ISD positions discussed previously represent great speculative opportunities at this point as well. As Kelly discussed yesterday, buying penny targets can be a very profitable play. Several bulk or near bulk Innistrad cards have just reached their all-time low, with only one direction left to go--up.

Although Shadows Over Innistrad was announced for April 2016, speculating on potential reprints is fairly pointless at this time. However, speculators should exercise caution when investing in ISD block positions over the next few months. Especially for Eternal staples, selling this Winter before any potential SOI spoilers will be recommended.

This weekend's Modern GP in Porto Alegre was marked by an aggro-oriented Top 8, featuring four Zoo variants (De Jesus Freitas’s Naya Zoo won it all) and one Hexproof deck. G/R Tron, Splinter Twin and Living End rounded it out.

That being said, this Top 8 doesn’t represent the much more diverse metagame seen on Day 2, which was actually heavy on Jund and Affinity. As usual, a plethora of viable archetypes in Modern gives speculators dozens of potential targets to choose from in this period of relatively low prices.

Finally, while the Modern Total Format Price index remains mostly flat, the MM2 Total set price keeps strengthening, with prices on the rise since the release of BFZ. MM2 positions should certainly be kept for a few more weeks, if not months, for greater profits.

Legacy & Vintage

Season 12 of the MOCS started last week. Although the peak of Legacy demand is expected by the end of the month during the preliminaries, prices of Legacy staples such as Stoneforge Mystic, Wasteland, Deathrite Shaman, Show and Tell and Mox Diamond remain mostly flat.

As Miracles is still a popular deck in the format, Sensei's Divining Top and Counterbalance are among the few Legacy-only staples to be on the rise for more than two weeks.

[tt n="Counterbalance" a=5]In the Vintage world, the effects of the first Power Nine Challenge are still in full motion, with the VMA Full set, VMA Mythics and P9 indices on the rise again this week. Since finding their floor about two weeks ago, mythics from Vintage Masters have posted gains of more than 25% on average.

For speculators holding Vintage positions, the second P9 Challenge could definitely be the tipping point. Another successful round of this large Vintage event would certainly put Vintage prices on a longer-term upward trend.

Pauper

In Pauper, Mono-U Delver and Familiar decks are back in the top three most successful archetypes this week. Adaptive Snapjaw, Ninja of the Deep Hours and Spire Golem have rebounded markedly from the floor reached around the BFZ release. They might reach their previous heights this Winter.

Stompy is another popular Pauper deck this week and Nettle Sentinel is now back to 3 Tix after venturing below 1.5 Tix earlier in October.

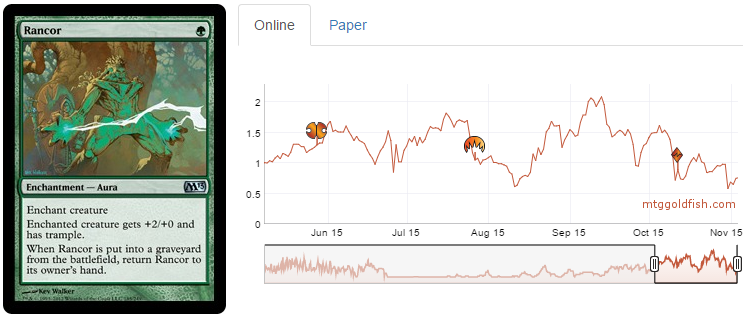

Another feature of this deck is Rancor, whose price hasn’t rebounded similarly to other cards in popular decks. The green enchantment, only printed in Urza’s Legacy and M13, is lagging in the 0.8-to-1 Tix range.

With applications in several Pauper and Modern decks, Rancor is expected to bounce back to 2 Tix sooner rather than later, and is a speculative opportunity to consider.

Targeted Speculative Buying Opportunities

None

Targeted Speculative Selling Opportunities

ORI boosters