Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Welcome to the MTGO Market Report as compiled by Sylvain Lehoux and Matthew Lewis. The report is loosely broken down into two perspectives.

A broader perspective will be written by Matthew and will focus on recent trends in set prices, taking into account how paper prices and MTGO prices interact. Sylvain will take a closer look at particular opportunities based on various factors such as (but not limited to) set releases, flashback drafts and banned/restricted announcements.

There will be some overlap between the two sections. As always, speculators should take into account their own budget, risk tolerance and current portfolio before taking on any recommended positions.

Redemption

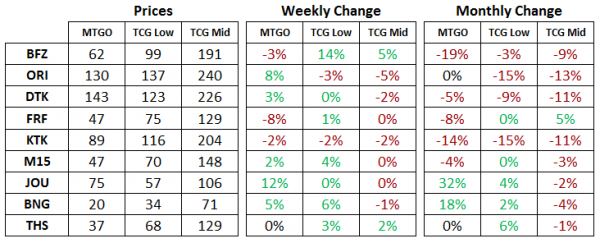

Below are the total set prices for all redeemable sets on MTGO. All prices are current as of December 9th, 2015. The TCG Low and TCG Mid prices are the sum of each set’s individual card prices on TCG Player, either the low price or the mid price respectively.

All MTGO set prices this week are taken from Goatbot’s website, and all weekly changes are now calculated relative to Goatbot’s ‘Full Set’ prices from the previous week. All monthly changes are also relative to the previous month prices, taken from Goatbot’s website at that time. Occasionally ‘Full Set’ prices are not available, and so estimated set prices are used instead.

Theros Block & M15

All of these recently rotated sets stayed out of the red this week on MTGO. Price gains were driven by interest in Modern and Legacy Constructed, with this past weekend holding both a Modern Festival and the Legacy MOCS.

Week to week these types of gains will be elusive for the sets as a whole, but individual cards can see steadier gains. For example, Modern and Legacy staple Thoughtseize from Theros (THS) is now difficult to find under 6 tix.

Elsewhere, Journey Into Nyx (JOU) marched higher on the back of its Modern-playable cards. It's unlikely there will be much demand from redeemers with the digital price currently at a significant premium on TCG Low. Steer clear of all junk mythic rares from this set as only utility in Modern will drive demand for cards from this set.

Tarkir Block & Magic Origins

Fate Reforged (FRF) and Khans of Tarkir (KTK) bled a lot of value this week. It's important to note that these sets will be rotating in the Spring, and there's no comparable historical price trend.

Last year, THS was stable in price heading into the release of FRF, but began a steady downtrend that lasted well into the summer. With an earlier rotation date, we may have already seen the price peaks for sets of KTK and FRF.

Dragons of Tarkir (DTK) and Magic Origins (ORI) are holding up nicely in comparison. Not only do they have another six months in Standard, they also benefit from being, respectively, a third set and a lightly drafted core set.

There are the makings of some large price moves in cards from these sets that gain utility after Shadows Over Innistrad (SOI) is released. Identifying which cards gain the most from the Spring rotation will be the key task of speculators and Standard aficionados over the coming months.

Battle for Zendikar

Dipping below 60 tix for the first time, it's entirely possible this set will drop below 50 tix before it has completely bottomed out. Selective speculating at this point can be considered, especially for rares priced at 0.01 tix or less and for mythic rares priced at 0.4 tix or less.

Akoum Firebird, Sire of Stagnation and Omnath, Locus of Rage are all priced below this threshold at the moment, each of them playable in the abstract.

As KTK and FRF rotate out of Standard in the spring, and then DTK and ORI in the fall, these cards will have two good opportunities to jump from the junk pile into the Standard playable pile. This may not occur---but with current prices below 0.4 tix the market is saying it's a guarantee, that these cards are junk and will always be junk.

With redemption providing a price floor, these three mythic rares are good value at current prices with some long-term possibility of seeing play in Standard. Be careful not to overpay for these. At the time of writing, they can be bought for 0.22 to 0.30 tix on Goatbots, which is a fine price to accumulate them at.

Standard Boosters

The end of Legendary Cube will deliver a temporary boost in demand for ORI, DTK, FRF and KTK boosters.

With the secondary market price of FRF and KTK boosters currently below the store price of $4, a pick up in demand will deliver higher prices over time as available supply gets consumed in drafts. ORI and DTK are priced much closer to the store price, so higher prices are not anticipated for boosters from these two sets.

FRF boosters are currently at 2.7 tix so demand will be evident if FRF goes to 2.8 tix or higher by next weekend. KTK boosters are currently at 3.4 tix. In a similar vein, if they hit 3.5 tix by next weekend, this will be evidence of demand from drafters.

Unfortunately, the return of the Vintage Cube will cut into any sustained demand for Tarkir block boosters. This powered Cube iteration will be returning for the holidays, running December 16th through January 6th. The popular draft format only accepts tix and play points for entry, so players will be more likely to convert their extra boosters in order to enter Vintage Cube drafts.

Combined with the release of Oath of the Gatewatch (OGW) in the second half of January, this dampens expectations for future price increases on KTK and FRF boosters. Time is running out for drafters to work through the available supply of boosters.

Those speculators holding a significant number of boosters should consider the next five weeks as a good time to reduce holdings. Converting boosters into tix before the liquidity crunch of a new set release is prudent. Don't be caught short of tix at the end of January when constructed staples and boosters start going on sale as a result of the OGW release events.

Modern

Last week we talked about Burn's lack of popularity right now in Modern. Reflecting on this trend we mentioned that some key cards of the deck such as Goblin Guide and Eidolon of the Great Revel might be underpriced, considering Burn is and always has been a serious contender in the format.

One week later Chris Andersen’s Burn deck finishes first at the SCG Premier IQ in Denver. With a second Burn deck featured in the Top 8 of the same event, prices of both Goblin Guide and Eidolon of the Great Revel gained between 15% and 20% compared to last week.

These examples perfectly illustrate the fact that discounted Modern staples are always great speculative targets, independently of the popularity of the deck playing these cards at the time of acquisition. In such a varied and balanced format that is Modern, it’s only a matter of time before almost any decent deck posts a result.

Modern cycles also affect cards that see only sporadic play in Modern, and which are barely even present in Legacy and Vintage. Those cards may not be on speculators’ radar but are certainly worth a shot as well. Phyrexian Metamorph and Goblin Charbelcher, for instance, have quietly doubled over the course of November.

Serra Ascendant could be in this same category. For the past three years the M11 monk has shown one of the most remarkable and regular price fluctuation patterns. Since September its price has flattened out around 4 tix, and it only appears occasionally in variants of Soul Sister decks.

With peaks between 6 and 8 tix this is an example of a potential target to consider at a time when most Modern staples have already gained 50% or more in the past couple weeks.

Last week WotC also announced the promo card for Grands Prix in 2016 as Stoneforge Mystic. An odd choice, considering the card is currently banned in Modern and only playable in Legacy and Vintage. The news raised the specter of a possible unbanning in Modern on forum discussions and articles, which would potentially explain the choice of promo.

This is only pure speculation at this point but Stoneforge Mystic bumped by 2 tix over the weekend. An even bigger spike would occur if this card ended up legal in Modern.

Coincidentally, if Stoneforge made a return in Modern it would affect Batterskull, a card we recommended buying last week. In such a case the equipment would surely return to 40 tix, turning an already decent spec into a gold mine.

Legacy & Vintage

The finals of the Legacy MOCS were held this past weekend. With all the usual suspects represented in the Top 32 decklists, the deck that won it all was Sneak & Show, which has flown under the radar since the ban of Dig Through Time. It defeated Elves in the finals.

Prices of most Legacy staples are anticipated to lose value in the short term after what was supposed to be a peak for interest in Legacy on MTGO. With the upcoming release of Oath of the Gatewatch, Modern and Standard should capture players' attention for the next two months.

Although Legacy leagues may help support prices to some extent, this format has never been a predictable or stable place for speculators to park their tix. It is therefore advisable to close any Legacy positions at this point.

Legendary Cube is ending today and with it the supply of PZ1 boosters. These packs contain not only valuable Legacy and Modern cards but are also the only source on MTGO of cards from the new Commander 2015 set.

Historically, cards with competitive constructed applications from Commander sets have always seen rising prices during the few months following their release on the MTGO store. With an even more limited availability, we believe Commander 2015 cards, and therefore PZ1 packs, should follow the same trends in the months to come.

On the heels of the second Power Nine Challenge, both the Total VMA set price and the P9 Index plateaued towards the end of November. Just one week later Vintage prices as a whole seem to have resumed their upward trend.

P9 pieces are up by 6% compared to the previous week and Black Lotus has gained 40% in value since October. Such a fast price increase on MTGO is unprecedented for the most iconic of Magic cards, indicative of the strong recovery of Vintage online.

Pauper

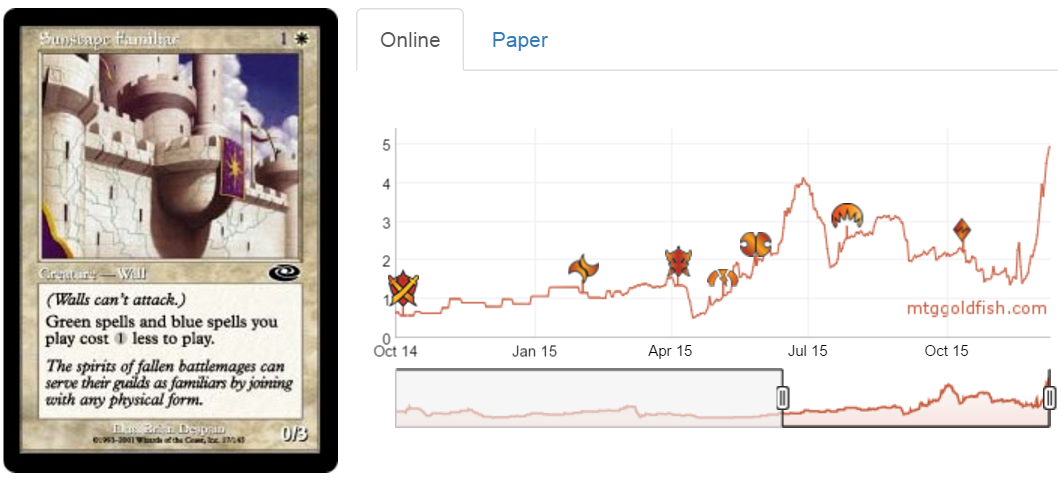

The outlook in Pauper remains unchanged and again this week prices are moving up. Many Pauper staples, including Sunscape Familiar, Mental Note, Exclude, Snuff Out, Adaptive Snapjaw and Firebolt have set new all-time high records this past week.

Thanks to the introduction of Pauper leagues, the format has never been so popular. Some staples may reach ridiculously high prices for commons as they have only been printed once, in old and under-opened sets.

Pauper speculators may want to consider locking down some profit as prices are shooting through the roof. A sustained inflation of Pauper prices may encourage WotC to schedule flashback drafts sooner or later, which always has a radical effect on common prices.

Targeted Speculative Buying Opportunities

Standard

Akoum Firebird

Sire of Stagnation

Omnath, Locus of Rage

I want to express my dissatisfaction with these “speculative targets” from the weekly reports. What I really want to see is Modern/Standard cards on the downswing, but have proven price history and reasons to rebound. You know, like most target Sylvain buys and tweets about FOR FREE on his 100tix twitter account.

Who cares about these 3 standard mythics that have almost no chance of being playable in the current Meta, and MIGHT be slightly profitable in a rotation or two?

Even spending 10 seconds on MTGGoldfish I can count the speculative targets that have much higher ROI potential… uncommons such as Exarch, Witness, Ghostly Prison from PZ1 prize packs, Sulfur Falls and certain shock lands that are trending down, etc…

I love both Sylvain and Matt as writers, but come on guys you can do better than Sire of Stagnation. And there should be absolutely ZERO weeks where there are “no” targets. Additionally, you should list the acceptable entry price for the targets.

Thanks for the comment!

Each week we do our best to cover all the best targets and we generally have to agree on the picks together. Sometimes this means we have no picks to offer. We do our best to scan all the opportunities, but the MTGO market is deep enough that we often miss out on many cyclical modern specs.

As for entry prices, I will generally talk about acceptable prices in the written section. Ultimately though, it’s up to every speculator to decide what a reasonable price is for themselves since the market changes so quickly.

Hope that helps!

Hi Xing,

Thanks for commenting. There’s a fair amount of truth in what you say and I understand your “frustration”.

To corroborate your critics, buying/selling recommendations in this report are nice but far to be perfect.

Still on your comment, I would even say that the 3 picks of this week have NO chance of being played anywhere. With these, you are playing on a price trend not on playability. And if you want to talk about ROI (so % and not absolute Tix value) these 3 mythics may actually have a much better ROI than most specs you can spot in 10 sec.

Recommending cards once a week (and keep in mind that we are writing these lines 1, 2 or even 3 days prior to publishing date) is often not optimal. We really want to recommend what we consider has the best chance of profit, in % at least. A great pick on Sunday easily turns into a borderline pick by Wednesday. Same is true for selling, I have many time thought about recommending selling a card on Sunday to realize that the price is already not adequate by Tuesday.

We also try to put cards for all bankroll sizes, which increase the complexity of the choices. Many specs I “give” for free with the 100T1Y project would not be suitable for a 500+ tix bankroll. Cheaper cards often fluctuate faster and with more amplitude, making the process of recommending them obsolete easily. For more expensive cards the spread can sometimes be a problem.

We also try to be accountable for our picks and even the model we chose to monitor that is far from being perfect. At the end of the day if our recommendations (within the evaluation model we decided to follow) only increase by 5% at the end of the year then some might say that our recommendations are not worth much, so we try to only put the best of what we see and try to make it as relevant as possible for people who follow them.

Finally both Matt and I have other obligations that limit the time we can spend searching the MTGO market for specs. We are trying to emphasize trends, news, general and seasonal price movements so they can make the most sense for speculators. Hence our frequent recommendations for speculators to monitor prices fluctuations, Movers & Shakers, etc. In the end this report reflects our views and beliefs on different sections of the MTGO economy.

To be our own critic and moving forward I think for instance that the Pauper market fluctuate in general to rapidly to recommend anything in a weekly report such as this one. Although Pauper is great for speculators (as it has been for the 100T1Y project for instance) it’s very difficult to be efficient recommending buying/selling Pauper cards only once a week. I also think that the recommendation system as we know it may not be as efficient as we initially thought. We would probably be better citing more potential targets in the text, leaving more power decision to our readership and deleting the targeted recommendations section.

Also, the nature of making public recommendations for a broad audience is that they have to have a high expectation of success, ie they have to be low risk. We cannot control what people do with the information we provide and the recommendations we make. Therefore, we have to consider that a new reader might follow a recommendation with a large percentage of their available tix. If that recommendation doesn’t work out, or they lose patience with it, the whole exercise will end up being frustrating for that person. The recommendations have to be able to accommodate the newest speculators, which means that more experienced speculators could feel that the recommendations are not aggressive enough. We don’t want people to have a bad experience.

test