Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Before launching into this week's article, I first want to introduce myself. My name is Sigmund (AKA Sig) and I'm very passionate about Magic finance. I've been writing on the subject now for nearly five years---if you've been around long enough you're already familiar with my old column here on Quiet Speculation.

While I've covered a broad variety of topics, more recently I've found my niche. Rather than trying to predict the next Standard metagame shift or speculating on hundreds of copies of a given card, I focus on leveraging MTG as an alternate investment vehicle. My focus is typically on older, more collectible cards because they offer some of the best risk/reward equations in the finance game.

Hopefully, through my weekly column, you will develop interest in the opportunities Old School Magic, Legacy and Vintage have to offer. With that said, let's get to it!

...

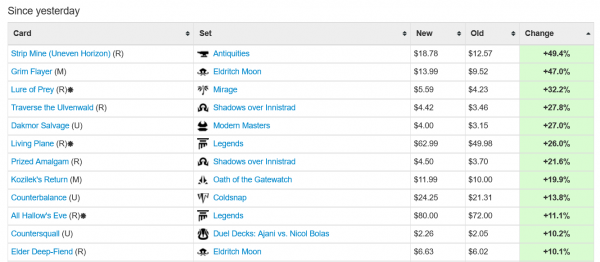

This morning I woke up and did my daily check of the top Interests over at MTG Stocks. What I saw was an array of Standard cards. If there was any doubt in my mind about Standard speculation and the Pro Tour, it’s completely erased now!

In the list above I count five Standard cards ranging from the 10% move in Elder Deep-Fiend to the impressive 47% gain in Grim Flayer. And here’s the beauty of using MTG Stocks for Standard cards: there’s no ridiculous price manipulation due to a single seller’s inflated price. Volume is so high with Standard cards that you can pretty much trust the price reported here…

…for about a day.

What Goes Up…

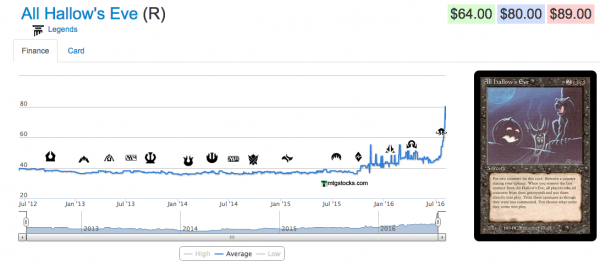

Did you notice there were three Reserved List cards on the list above intertwined with the Standard stuff? I sure did. While I don’t particularly care about Lure of Prey, I do expect Living Plane and All Hallow's Eve will retain these higher prices---at least Near Mint copies should. However, I don’t think we can guarantee the same trend will continue on something like Grim Flayer. Eldritch Moon is loaded with powerful cards, so the ceiling on any individual card within the set will be a bit lower. Add in the fact that the set is still being freshly opened, and I see a risk/reward equation I’d prefer to avoid altogether.

In fact, most of the time when a card spikes after a Pro Tour, there is a notable sell-off in the days that follow. One of my favorite examples is from a couple years ago, when Jon Finkel showed off the power of Dungeon Geists at the Pro Tour. His performance sent a jolt of energy into the card’s price, rescuing it from bulk for about a month.

But after that initial hype, interest in the card died down and its price rapidly deteriorated. Selling at the peak was clearly the right play.

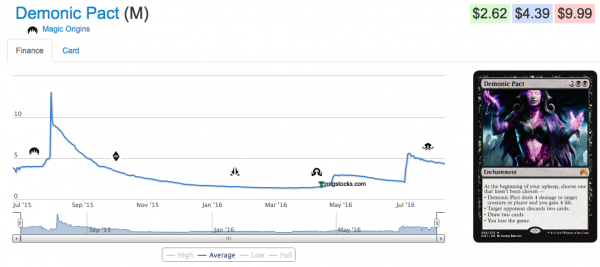

Or how about a more recent example? Remember all the hype behind Demonic Pact?

I sold copies for over $10 during Pro Tour Magic Origins. Now the best you can hope for is a cute combination with this and the new Donate in Standard. But even this will only give you a small gain given Magic Origins’ lame duck status in Standard. A few months from now it’ll be gone.

And who could forget the classic card spike in Pyromancer's Goggles during Pro Tour Shadows over Innistrad just a few short months ago?

Net, the general trend for Pro Tour spikes has been a short-term inflation in price followed by a rapid decline. In some cases there’s even 100% retracement. In other words, the card that spikes gives up its entire price jump, netting a profit of zero over the timeframe.

Expanding the View

I have a confession to make: the charts I picked above were purposefully selected to illustrate my point. Of course there are exceptions---on occasion, cards spike at a Pro Tour and then maintain their elevated price because those cards redefine Standard for a longer period of time.

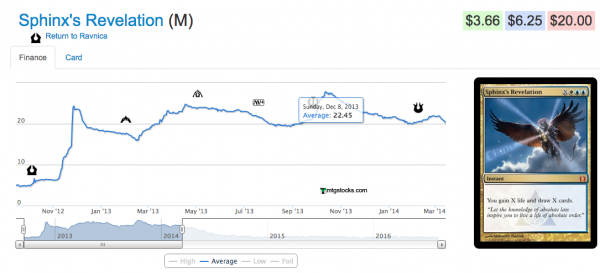

When Sphinx's Revelation broke out in Standard, instead of selling off the card spiked again and again, driving higher highs.

Look at that beautiful chart---it’s a stock trader’s dream because it performed so predictably from a technical basis. On Wall Street when a stock makes higher highs and higher lows, it’s a bullish sign. This is an example where selling after the immediate spike could have meant sub-peak profits.

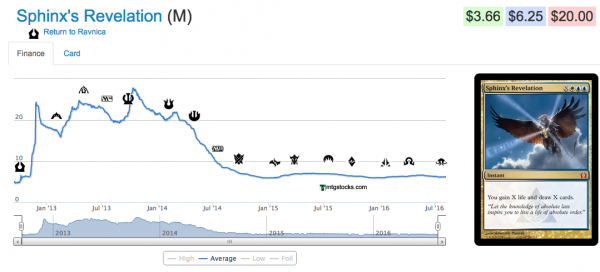

But here’s my real concern: zoom out on the chart to look at data since January 2014…

Yikes. What once looked like the perfect trade quickly deteriorated into an abysmal chart. Holding through Standard rotation would have meant a 66% depreciation in value. (I’ll toss in an aside here and acknowledge that the card could be bottoming here---if you have your eye on this card for casual or Commander use I’d recommend grabbing a copy now while it’s bottoming.)

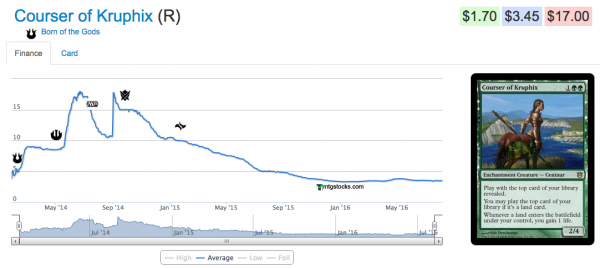

Courser of Kruphix was another example of a card that broke out in Standard and maintained its dominance for a long period of time.

The trend is identical to Sphinx's Revelation. A couple spikes, healthy price appreciation over a one-year period, and a dramatic sell-off at rotation. Clearly, consistent financial prominence is not a common trend for Standard all-stars. With history's tendency to repeat itself, I would study the charts above closely before thinking Kozilek's Return or the new Emrakul will behave differently.

Speculating over the Long Term

With this data in hand I want to emphasize two points consistent with all of my weekly columns.

First, if you’re watching these Standard spikes I want to encourage you to avoid chasing any of them. Don’t be tempted by the jump in Kozilek's Return---buying now will almost assuredly lead to financial losses unless you have access to a retailer’s buy and sell prices. And whatever you do, please stay away from Eldritch Moon cards that spiked. While there’s always a possibility that you miss out on the next Jace, the Mind Sculptor it’s far more likely that you’re chasing the next Pyromancer's Goggles.

The vast majority of Pro Tour profits have already been made. If you’re trying to chase something, you’ll likely get burned. Unless, of course, you’re chasing the Reserved List cards on that Interests list above. And this brings me to my second point. The long-term trajectory of Standard cards is almost always downward. The long-term trajectory of classic Reserved List cards is generally upward as long as the game is alive and thriving.

Take a look at the three-year chart for All Hallow's Eve below. The card has been gradually climbing the entire time. If you bought in at $40 in 2013 you would be in the green on the investment. If you bought in at $50 in 2014 you would be up today. If you waited until it was $60 and bought into a small jump in 2016 you would be up today. Now the card is $80---do you think it’s done climbing? Only if you think Magic as a whole has peaked.

This is why I like buying iconic Reserved List staples so much. Rather than speculating on a metagame shift or hoping to find a greater fool, you can invest in stuff like Juzam Djinn knowing you’re making a bet on the game as a whole. As long as there are 30-somethings with full-time jobs interested in re-living the past, these older cards will be in demand. Sprinkle in a little bit of growth for the game as a whole, and you’re looking at a monotonic increase in price.

Which chart would you rather be engaging in: the rapid rise and fall of Sphinx's Revelation or the steady growth in Juzam Djinn? Granted the recent surge in Old School Magic’s popularity has driven Juzam’s price to a whole new level, but even before the format caught on do you think there was any money to lose buying into Juzam Djinn? With inevitability on his side, I would posit it’s unlikely. And the same can be translated to other iconic classics in Magic: Power, Library of Alexandria, dual lands, etc. As long as the game is healthy, these cards will move in one direction over the long haul: higher.

Lessons from the Stock Market

The Pro Tour is over, and while Standard prices are going to rise and fall I continue to beat the same, steady drum. Apparently my big Standard bet this year was a total flop: I picked up 16 copies of Matter Reshaper and there was a grand total of four copies in the Top 8.

While this isn’t a disaster, I think upside on the card over the next 12 months is minimal. And as I watch sellers undercut each other on eBay, I immediately feel relieved that ABU Games was willing to graciously offer over $3.30 in store credit for each copy I shipped them. And with live coverage of the Pro Tour taking place during the hours I most usually sleep, any chance of further speculation this quarter was out of the question.

Oh well. I never claimed to be a Standard expert. With some luck, I’ll be able to take this modest gain and convert it into a high-flying Reserved List card.

I want to conclude this week’s column with an analogy to the stock market.

Let’s travel back in time to 2004. A time of rapid change. Picture your friends talking about this newfangled way of renting movies called “Netflix.” You’re intrigued by the convenience, absence of late fees, and the future potential of the company. But when it comes time to invest some money in the stock market, you hear of terrific earnings from Blockbuster LLC, sending the stock price to over $20 a share. The hype is irresistible, and you buy some Blockbuster shares while everyone on Wall Street is clamoring for how great the quarter was for the company.

Then time passes…

Does the chart above remind you of anything? I look at the price chart for Blockbuster and I think of Courser of Kruphix. On the other hand, the chart for Netflix is reminiscent of Juzam Djinn. With the former you have inevitability and with the latter you have unlimited potential.

And here’s the beauty of it all: you don’t need to be a fortune teller or expert analyst to know what lies ahead for Magic. As long as the game remains healthy, you know a card like Nether Void, All Hallow's Eve, or Juzam Djinn will continue to rise. In the meantime, Standard cards will ultimately drop unless they make a once-in-a-lifetime shake-up to Modern and Legacy (e.g. Snapcaster Mage, Liliana of the Veil).

And with print runs being as huge as they are nowadays, is that really a bet you’d want to make? Even Polluted Delta can't gain price traction and that card is everywhere in eternal formats. The risk/reward equation is so much more attractive for older cards that the premise of playing around with a short-term spike in Standard cards---the Blockbuster stock of the moment, if you will---seems preposterous to me. I’ll stick with the classics, thank you very much.

Sig’s Quick Hits

- Every so often I see Wheel of Fortune on the list of “Interests” and I’m reminded the card is on the Reserved List. Since it was given a promo reprinting, it’s easy to forget about the card’s RL status. Nevertheless the card can’t be printed again and it has gotten some notice. Now Star City Games has just seven Revised copies in stock for between $26 and $35, depending on condition. Honestly this card is so iconic and useful that I see virtually no downside save systemic risk of Magic’s end.

- Star City Games is sold out of Koskun Falls at $4.99. We’re talking about an Enchant World from Homelands. Though it’s interesting the card doesn’t even show up on SCG’s buylist. It’s like they know the card is worth more now but they refuse to acknowledge it with their bank account. I sold the copies I’m not using (which is nearly all of them, believe me).

- I’m keeping a close eye on Power Artifact, a Reserved List card from Antiquities. While the card will probably never show up in a Grand Prix Top 8, it has noteworthy relevance in Commander and Old School Magic because of its ability to combo with other cards to make infinite mana. Star City Games restocked a few Near Mint copies at $30 and I’m tempted to buy them all. The cheapest LP copy on TCG Player is $35 and the TCG Player “Market Price” is $31, indicating copies do actually sell in this price range. If you visit Star City Games’ site tomorrow and the card is sold out, you’ll know why.

It’s good to have you back 🙂

Great to be back. Thanks for the opportunity.

Welcome back Sigmund! I enjoyed the article.

Thanks David! Glad to be back!

Welcome back! As always – great stuff Sig.

Thanks, Chaz! Glad to be back.

Welcome back Sig!

Thanks, pi!

Nice article, very interesting, and welcome back even if I have not read about you before (New to Spec)

Mathieu,

Thanks for the kind words! Glad to be be back and I hope you enjoy what I have to say.

Sig

Glad you’re back Sig! This was my first time betting on standard going into a pro tour. Every pick went up (thanks to QS for great suggestions!) but sadly I bought them during the week before the Pro Tour. The first batch just got here and they’ve already dropped in value since yesterday :/. Ah well, a small burn with a learning experience attached is always good. Thanks for the article!

Chason,

Thanks for the warm welcome! Indeed to really maximize profits from the Pro Tour hype, you need to have the cards in hand ready to sell before Friday. Otherwise you risk exactly what you’re encountering now. Hopefully you can still eek out a small profit like I did on Matter Reshaper.

As I always say, “no one ever went broke selling for a profit.”

Thanks!

Sig