Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

For those unfamiliar with my interests outside of MTG finance, I am extremely passionate about investing in the stock market (some may find amusement in my dubbing this “RL finance”). In fact, the vast majority of my taxable savings lie in stocks and ETF’s---not MTG like many would believe.

With this interest in Wall Street, I tend to extend my research well beyond the realm of MTG finance when determining where to invest new funds. This includes various websites, Twitter users and Podcasts. As I pick up strategies and methodologies from RL finance, I often attempt to reapply the practices to MTG finance where possible. I’d like to think this offers up a unique paradigm for MTG investing that many others wouldn’t readily have.

Recently, I have been hearing debate about stock market strategy that could apply to MTG finance as well. Allow me to explain the concept of momentum investing versus contrarian investing.

The stock market is like a massive truck with poor brakes. Any time there’s a sudden shift in direction, the vehicle overshoots where it ought to end up and momentum yanks it beyond rationality. For this reason, some strategists prefer chasing momentum trades---stocks that are ripping higher day in and day out.

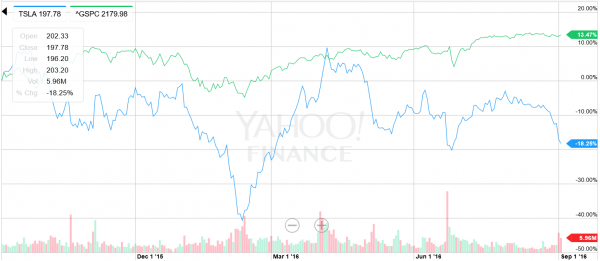

Valuation isn’t important when thinking about momentum stocks---as long as more people are jumping onto the bandwagon the price can overextend beyond any reasonable valuation. Tesla Motors is a momentum stock. Just look at that wild volatility over the past year as the company fluctuates between overbought and oversold territory.

Buying Tesla stock while it is on a run higher---such as back in February---can yield massive profits. On the other hand, buying the stock while it’s falling can lead to an awful lot of pain. Observe how it tanked over 40% in just a couple short months right after the New Year. Clearly this is one truck you don’t want to jump in front of.

Other investors prefer a different strategy of stock trading. This alternate style is best summarized by using Warren Buffett’s oft-quoted wisdom: “Be fearful when others are greedy and greedy when others are fearful.” Buffett wouldn’t go near a stock like Tesla Motors. But he certainly does find interest in top-notch companies with beaten up stocks. One example could be IBM, a company Buffett owns a significant amount of.

Observe how the company really fell out of favor most of this year. Instead of panicking, Berkshire Hathaway continued to build its position in the beaten and battered name.

Since the recent bottom, the company has recovered surprisingly well. Even though the stock is temporarily out of favor, faith in management and a great pedigree throughout history may make such a disliked stock a terrific buying opportunity. Someone buying into a disliked name like IBM (or Disney, Macy’s, etc.) could be considered a contrarian investor for buying stock in strong companies that don’t have momentum in their favor.

Parallels in Magic

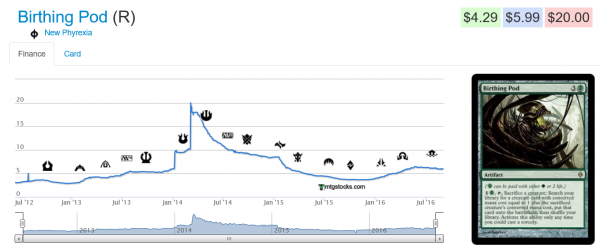

While Magic cards cannot be directly compared with stocks, there are interesting parallels when it comes to monitoring trends. For example, Magic cards have a tendency to “overshoot” due to momentum-based speculation. Birthing Pod is an excellent example because during its pre-banning hype in Modern the card became expensive very rapidly and unsustainably.

Once Birthing Pod received the ban hammer, you can see how quickly the card was hated. Ultimately, the card became oversold. After bottoming in late 2015, the card has actually increased in value by about 30%-50%. The momentum buyer would have been picking up copies during its 2014 hype, whereas a contrarian buyer may have been the one picking up copies for the long haul during its 2015 low.

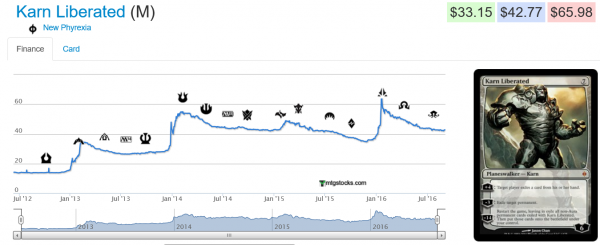

The more I research, the more I realize many Modern cards exhibit this kind of “momentum” type behavior. Check out the historical chart of Karn Liberated as another example.

This card’s price never changed gradually---it always seemed to rise in spikes. Karn spiked in 2013, 2014 and 2016 (even after it was reprinted). Momentum has really taken this card temporarily higher, only to sell back off either quickly or gradually afterwards depending on the year.

Momentum buyers would have been buying during each spike; contrarian investors would have picked up copies after each dip (including right now, where it appears to be bottoming yet again).

Which Strategy Should You Take?

There are pros and cons to these two strategies. If there was a clear-cut superior strategy, the other wouldn’t exist---everyone would follow the same trades, and the strategy wouldn’t really be a “strategy” anymore because the opportunity would be erased. Having these two balanced approaches means one can work in some circumstances and the other can work in others.

I like the momentum trade when a major market disruption occurs. This can manifest itself as a buyout or a major metagame shift. Standard rotation can also catalyze significant movement whose momentum can be capitalized upon.

For example, when Reserved List cards were all the rage a couple months ago I enjoyed locating copies at the “old price” or even at a slightly elevated price. This happened most recently with Aluren, which recently spiked. I found a single copy at ABU Games at $16 and I was eager to grab it knowing that the card was seeing significant movement and had potential to jump again in the future.

Of course I’m heavily biased by Reserved List cards. I figure if I don’t get my copies at the “old” price to flip for immediate profit, I have no qualms sitting long-term. These are cards that will never be printed again after all.

Beyond those I still like other, narrow opportunities for momentum buying. During a Pro Tour it can be favorable to acquire hot new Standard cards if you’re early enough to buy in (i.e. by Friday). When a card is unbanned in Modern or Legacy there’s also a huge buying opportunity off momentum. Ancestral Vision is a great recent example.

On the other hand, contrarian investing also offers some attractive returns when played correctly. Buying Modern staples during an “off-season” has been a robust strategy for years now.

Dual lands tend to jump, fade, and jump again in price---picking up copies when they’re temporarily down is extremely attractive because you know it’s just a matter of time before they tick higher (especially with Eternal Masters being a thing now). Even Power has a tendency to jump, fade, and jump again.

While momentum trading is best when a card can be sold immediately after it is purchased, contrarian buying allows you a longer time horizon. You don’t have to worry about buying in too late and being unable to sell before the price tanks. Because you’re buying during a local “bottom," you are banking on an increase in price sometime in the future but not necessarily right away.

In reality, some Modern staples are excellent contrarian trades right now. Check out Flooded Strand, which is only $2 off its all-time low.

We all know fetchlands aren’t going anywhere. They’ve been Legacy staples since their printing and they are a dominant force in Modern as well. Therefore, a contrarian investor may be thinking it’s the perfect time to acquire copies. The same goes for a number of Modern staples.

Or how about stuff recently reprinted in Conspiracy 2. One day, many many moons from now, something like Serum Visions or Inquisition of Kozilek will be an excellent pick-up. It’s going to tank in price due to its reprinting, which should yield a reasonable contrarian play for profits.

With contrarian trades you have ample time to move in and out of positions. However there’s one significant downside: reprint risk.

If you’re going to buy something while it’s out of favor with the intent of selling after a long waiting period, you incur risk of having your card reprinted in a subsequent set. Snapcaster Mage can look awfully tempting now that it has pulled back in price, but the risk of reprint in Modern Masters 2017 is enough to keep me away. This is essentially why I prefer to stick to Reserved List staples.

Wrapping It Up

Momentum trading and contrarian investing---there’s a time and a place for both. I tend to prefer picking up cards for longer time horizons. As a result, I think I tend to favor contrarian investing a bit more than momentum when it comes to MTG finance (and RL finance for that matter).

I just can’t stand buying cards when they’re hitting all-time highs. I’d much prefer allocating resources to positions that are suffering in the short term but have great long-term prospects. It’s akin to how Warren Buffett invests.

With this in mind, I continue to target Old School staples as well as playable Reserved List cards that haven’t jumped in price crazily yet. A recent picture I Tweeted (@sigfig8) sums up the kind of stuff I’m after.

Notice any trends? With the exception of Beta Gloom and Unlimited Dingus Egg (two pickups for Old School play), each of these cards are on the Reserved List. They all offer plenty of long-term upside potential. The fact that most haven’t really spiked yet (besides Aluren) means I am picking up these cards in the hopes that one day they do become suddenly more desirable than they are today. If not, I can wait. I got time.

Just as you can find a strong company with a broken stock, I am confident we can find a Magic card with a ton of utility but an out-of-favor price. By targeting powerful cards, you can set yourself up for plenty of upside with minimal downside. Add in the requirement of targeting Reserved List cards and you avoid the turmoil of reprints. This ultimately enables you to acquire your cards and then sit and wait. That’s my kind of MTG finance!

…

Sig’s Quick Hits

- I did not realize Engineered Explosives became so expensive recently. There are only a few dozen copies in stock on TCG Player across both printings, with “Market Price” in the $32 range! I could have sworn this was a $20 card just a short while ago. This is a great example of a momentum card---it continues to hit all-time highs day after day. Eventually it will sell off a bit, but as long as it runs higher, people buying in are making decent money on this one!

- Another recent all-time high came last weekend in the surprising form of Arabian Nights Ali Baba. I knew the card was rising in price, but I did not anticipate a sudden buyout. I always thought the card was a common, but according to TCG Player it is uncommon so I suppose that makes sense. No wonder there are only ten sellers with copies in stock left on TCG Player. But beware: the $10 price tag on MTG Stocks is highly misleading given the “Market Price” is only $3.22. Still, with Card Kingdom paying well over $4 for Near Mint copies, this card’s price was bound to jump!

- The last card I wanted to highlight was one I recently acquired (pictured above): Beta Gloom. Black bordered copies of the black enchantment have really spiked in price lately, driven by utility in the Old School format. There are under ten copies of Alpha and Beta copies in stock, combined. “Market Price” is $10 and $8 for the two sets, respectively, meaning the recent jumps in their price is 100% legitimate. As long as Old School MTG remains relevant, these cards will only rise. They’re not on the Reserved List, but Gloom reprints are meaningless in the world of Old School!

Snapcaster is an interesting one. My thought is now you should buy in on the current low prices.

A Modern Masters reprint I expect to be at Mythic rather than rare and with the new RPTQ art so these older versions will receive some protection? With the increased availability and interest in the format and with no GP mass opening that this will do a Tarmogoyf/Force of Will and actually bounce back higher.

Even if reprinted at Rare I think Noble Heirach shows the card can still bounce back higher.

Ben,

Noble Hierarch is certainly an interesting specimen – it bucks most trends I’m seeing on other Modern staples. I guess it really has become a major staple in the format so perhaps demand is just robust enough to overcome the recent reprint?

Meanwhile, I have to imagine there are fewer Snapcaster promos than there were Hierarchs printed in MM2015, yet Snapcaster is getting cheaper by the day. It’s hard for me to explain. On the one hand, Snapcaster can be an excellent contrarian pickup here. But the risk of reprint in MM2017 is significant, and I’m not sure demand will remain strong enough to overcome the surge in supply. That’s my perpetual conflict with non RL cards – there’s just always that looming reprint risk.

Best of luck to you either way. Thanks for commenting!

Sig

Oh I am almost certain it will be reprinted but I still cant help but wonder,

Thanks Sig keep up the great content