Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Standard. Standard, everywhere. This truly is the format in focus this month as players and speculators alike attempt to predict what the new metagame will look like with Kaladesh in and Dragons of Tarkir/Origins out. I used to enjoy this challenge, and there were certainly times in the past that following the right folks on Twitter revealed profitable ideas in broad daylight.

Those days are gone.

Wizards of the Coast introduced Masterpieces with the intent of keeping Standard prices down. So while there will certainly be a few cards here or there that pop, the ceiling on everything from Battle for Zendikar forward will be lower than before. That means the land mines—overpriced cards likely to drop—are more plentiful. Additionally, the upside is reduced versus before. Seems to me like Wizards of the Coast’s success comes at the expense of part-time Standard speculators like myself.

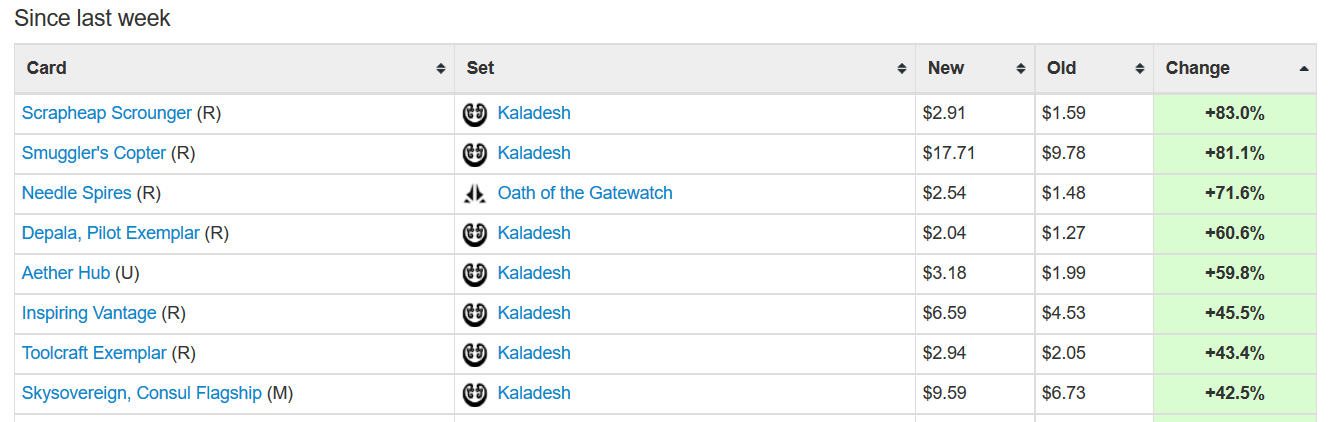

So what do I do at a time when Standard has taken center stage? The top eight movers over the past week were all Standard cards; seven of the eight were from Kaladesh.

Do I follow the mantra, “If you can’t beat ‘em, join ‘em,” and speculate on Standard despite headwinds? Do I buy recently poor performers such as Dark Confidant or Snapcaster Mage, knowing that reprints in Modern Masters 2017 could be right around the corner? Do I continue to get deeper and deeper into Legacy and Vintage cards, knowing these formats are stagnant and offer only slow, gradual growth?

None of these. This week I’m breaking down the barriers of MTG finance to offer you some thought-provoking alternate investment avenues. They aren’t MTG finance, but they are tangentially related and could offer some intriguing opportunities to profit.

Pokémon Cards

I follow hundreds of MTG players on Twitter (@sigfig8). If I had to rank the top five topics I see discussed in my feed, I would say PokémonGO probably falls in the fourth or fifth slot behind Magic-related items. In other words, I suspect there’s a strong correlation between those who play Magic and those who enjoy PokémonGO. The game has entertained tens of millions of people worldwide. And while the player base has dropped off significantly since the game’s initial release in July, loyal fans (myself included) continue to engage with the augmented-reality game on a weekly basis.

If I were to draw a Venn diagram with MTG Finance in one circle, CCGs in another circle, and PokémonGO in the third, the overlapping circle just may look like this:

You may be asking whether or not I believe Pokémon cards can truly be better investments than MTG. I’ll be first to admit that, as a whole, I’d prefer MTG over Pokemon. But there are two trends worth identifying regardless.

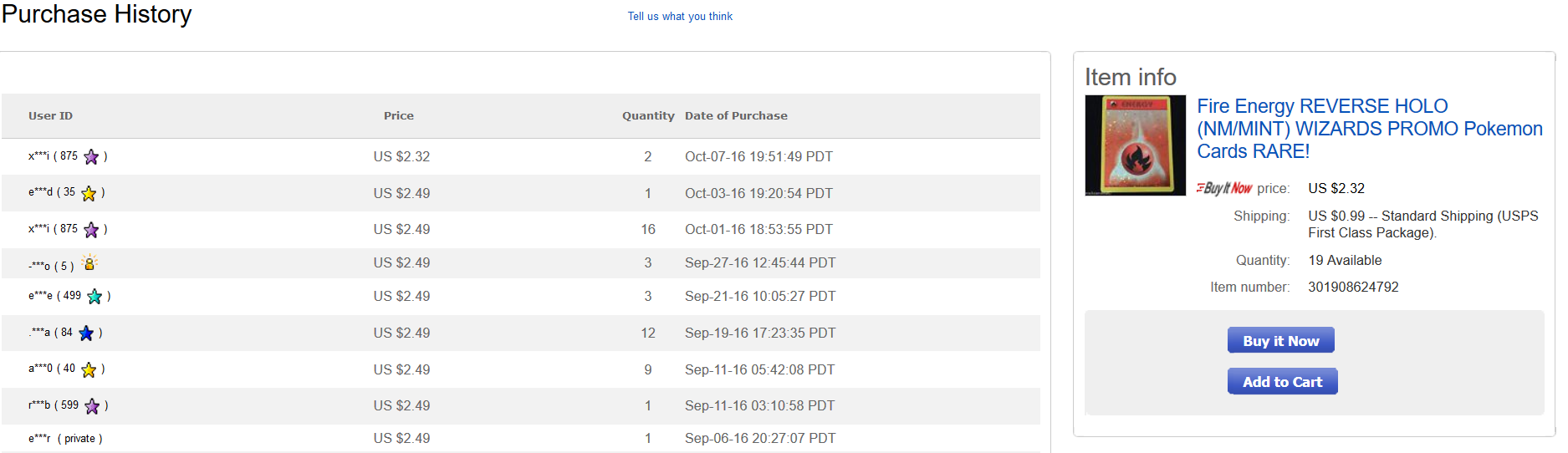

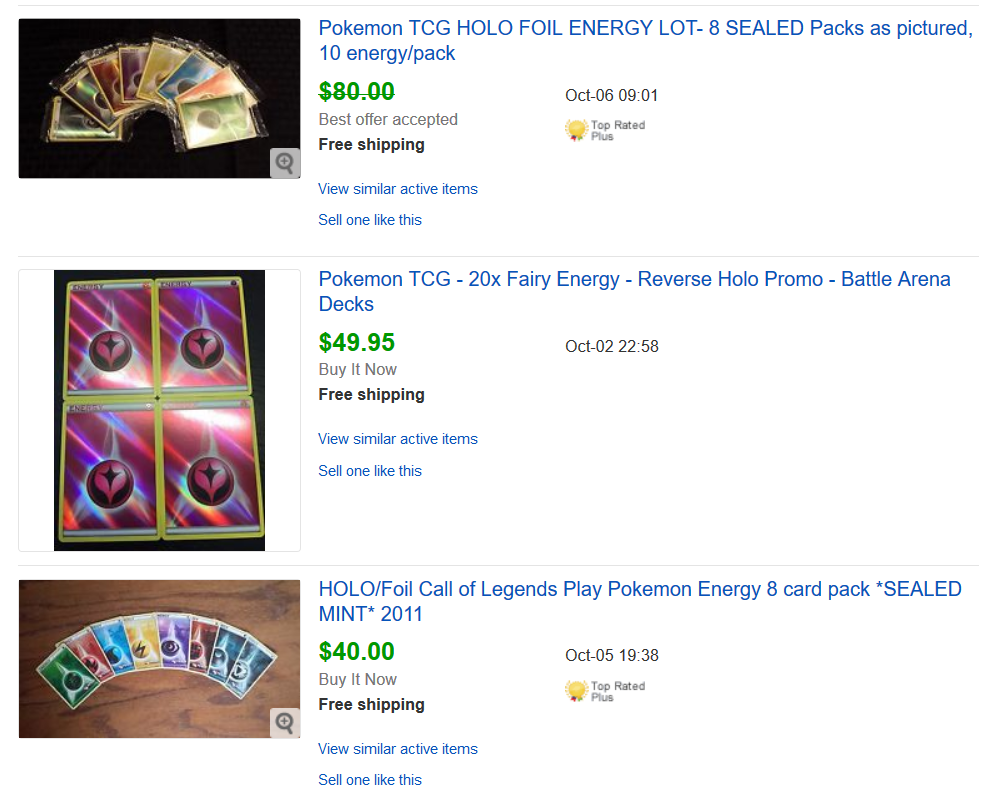

First, Kaladesh has quite possibly catalyzed growth in holo energy Pokemon cards. I’ve seen a handful of players pursue these Pokemon cards specifically because of the introduction of the energy resource in Magic. Take a look at the sale volume on these:

Selling one holo energy for $2.32 is hardly interesting. But when someone gets a handful of holo energies together, they add up quickly.

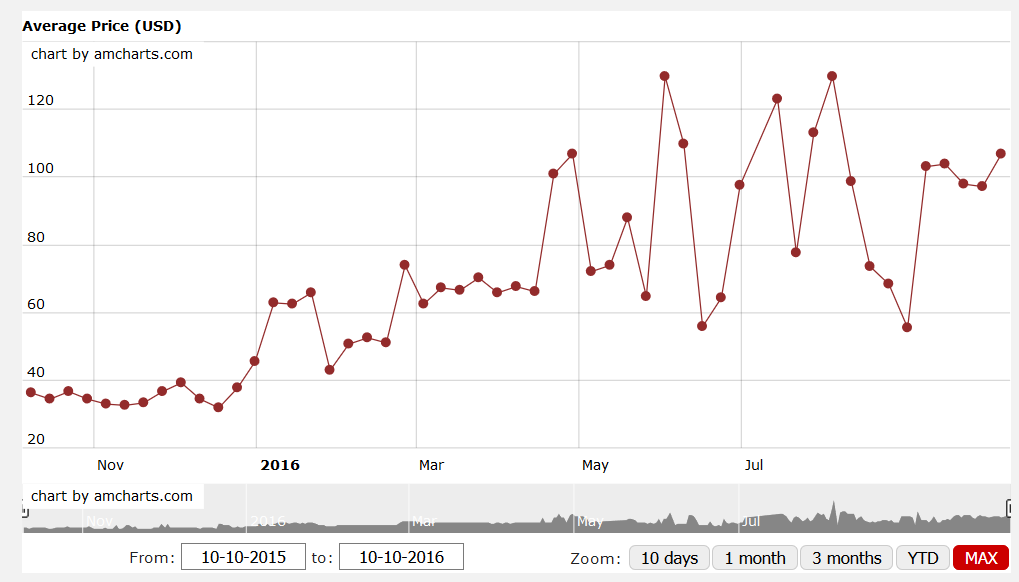

The second area I have my eye on is the iconic. Truly investible copies of Pokémon’s most classic cards have shown some price appreciation lately. Perhaps the most famous is the Base Set Charizard. While the data in the chart below is noisy, the overall trend is irrefutable: up.

Naturally, getting into graded versions of the Base Set Pokémon cards can offer an even more secure investment given collectibility. And if PokémonGO can convert at least a handful of players into collectors of the cards, you may have yourself a worthwhile investment. Stick to the most iconic cards, and you’ll minimize risk to this investment while gaining exposure to the returning phenomenon that is Pokémon.

Older Video Games

I’m not going to draw a Venn diagram for this one. No one is going to challenge me when I state that there’s a solid correlation between Magic players and people who enjoy video games. In Magic, many players have aged along with the game. Now in their twenties and thirties, these long-time players have incomes they can use to acquire some of the more iconic and expensive cards in the game. This is one of my hypotheses for why Power and the like will continue to appreciate over time.

As it turns out, collectible and iconic Magic cards are not all that us thirty-somethings are buying with discretionary income. We’re also nostalgic for other happy memories of yesteryear. I’d posit that classic video game investment is an up-and-coming trend that merits a closer look. Much like with MTG, I equally enjoy picking up the classic games I remember as a kid…and I can’t be the only one with this longing for nostalgia.

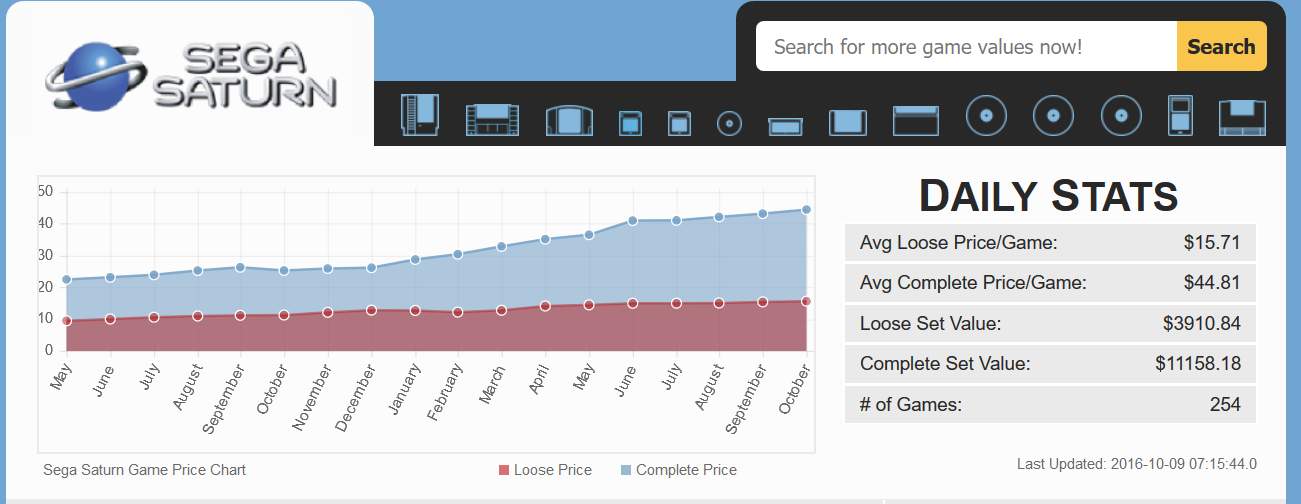

In this hobby, good luck landed on my side. The consoles I grew up with and had the fondest memories of were the Sega Genesis and Sega Saturn. It turns out these systems had some pretty rare and valuable games—especially the Saturn, which is generally considered a failure in the United States. So when I seek out games for their nostalgia, I simultaneously find myself investing in some rare games with appreciating value. According to GameValueNow.com, the average complete (read: collectible) Sega Saturn game has doubled since May 2016!

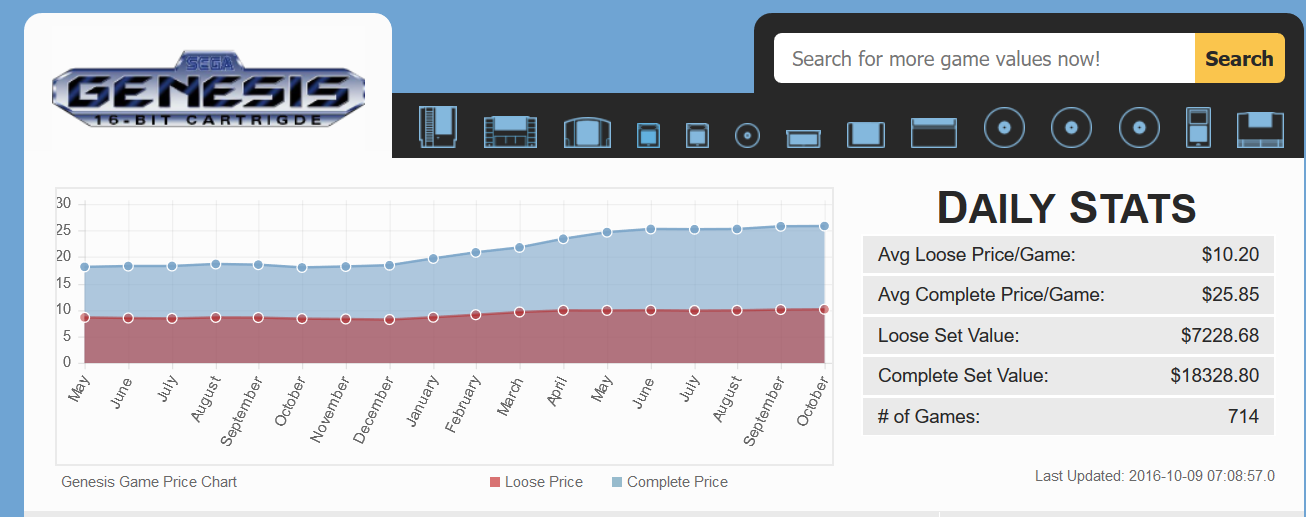

The Sega Genesis was much more popular in the U.S. So it’s no surprise that the price growth in Genesis games has been more gradual—there’s simply much greater supply on the market. Still, the direction has been upward over the last 16 months.

The same can be said for the Super Nintendo and the Nintendo 64, by the way. Their indexed charts both show decent price growth since May 2015.

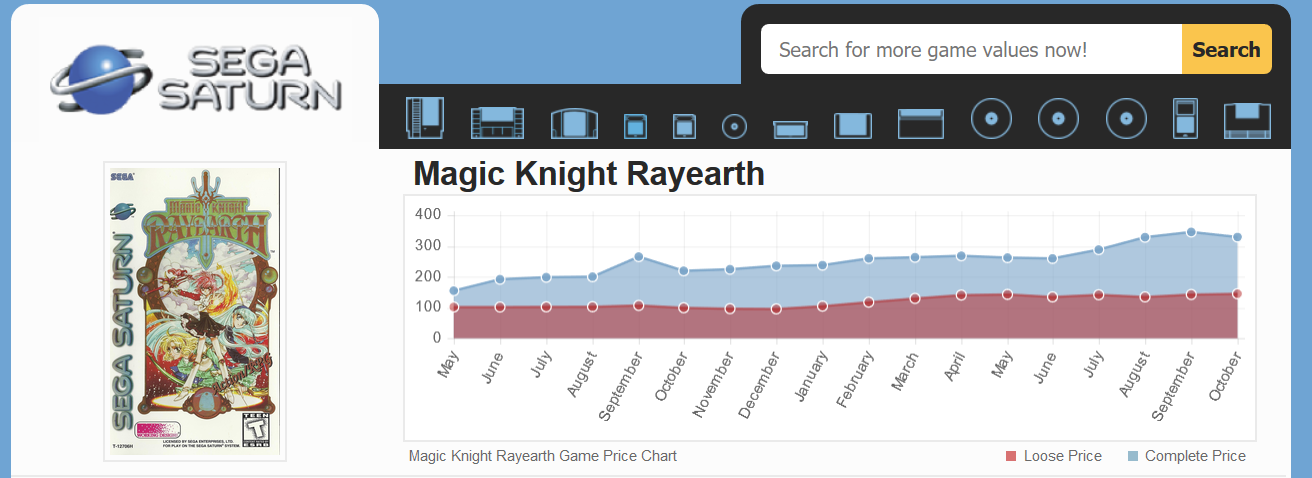

As an individual example, consider the last game ever to be released in the United States: Magic Knights Rayearth. It’s an RPG based off an anime, which I personally think is an awesome theme. Naturally being released so late in the Saturn’s cycle, not many copies were made. Thus, you have yourself an expensive game with a rapidly growing price tag.

Having sold so poorly, Sega Saturn and its games are quite limited in supply. But that doesn’t stop an aging fanbase from acquiring the games from their childhood. Add in a rising average income for these fans, and you have an equation that looks very similar to that of Power and iconic Magic cards: gradual, steady growth. I like these price charts most because they’re predictable and offer a terrific risk-reward equation.

The Ultimate MTG Investment: Hasbro Stock

Let’s quickly walk through a stream of logic.

- Player growth in MTG has become somewhat stagnant over the past twelve months.

- Wizards of the Coast is printing many more sets to increase sales growth.

- These sets have largely been successful lately, which indicates more product is being opened than before.

- Increased WOTC sales helps Hasbro’s bottom line.

In a vacuum, the natural conclusion could be that Hasbro’s stock is a screaming buy. Of course in reality there are many other factors at play that impact the toy maker’s stock price.

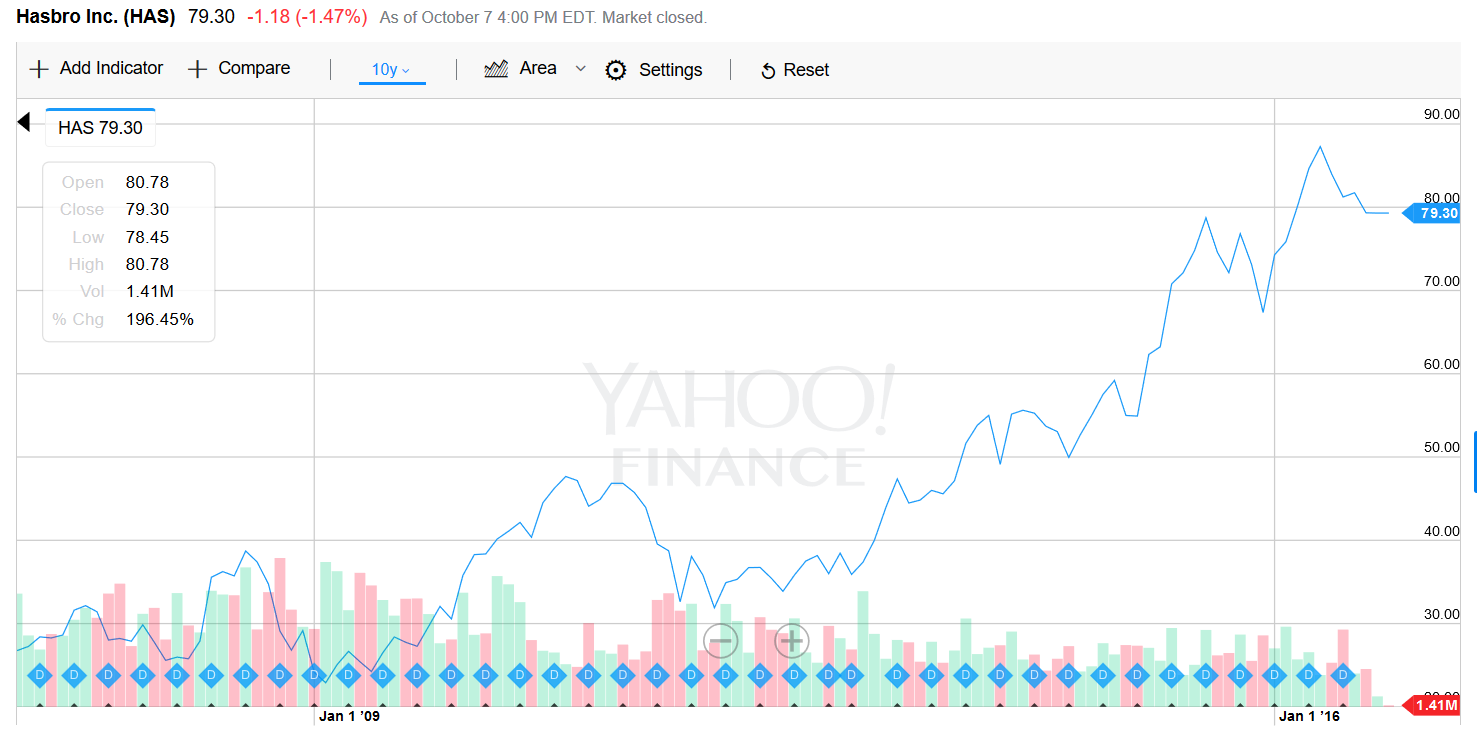

There’s no way someone can follow my analysis above and conclude that Hasbro stock is a worthwhile investment. I don’t even know if there’s a direct correlation between Magic: The Gathering sales and Hasbro’s stock price. What I will say, however, is that Hasbro stock has performed fairly well over the past ten years, far outperforming the S&P 500.

If we as MTG speculators truly thought Wizards of the Coast was striving to keep Standard prices down by introducing a new rarity and increasing product releases to drive sales growth, perhaps the most logical conclusion is to put that MTG money into Hasbro’s stock itself. If Hasbro and MTG speculators are butting heads, it almost feels like buying Hasbro stock is like betting on the house.

While I wouldn’t make the investment based solely on this article, I do suggest looking more seriously at this idea. MTG won’t be around forever… but Hasbro is highly likely to outlast Magic.

Wrapping It Up

I know this is an MTG investing and speculating website, but sometimes a little outside-the-box thinking is worthwhile. If nothing else, it provides alternate investment avenues you may decide to look into further.

Many people are aware of some alternate investments: artwork, coins and antiques are just a few. But I think Pokémon cards and vintage video games both merit a closer look. They correlate well with MTG investors, so if we make the argument that MTG investors have more discretionary income to spend, then it’s logical they’d spend that money on their interests outside of Magic.

Hopefully the data I presented support this hypothesis. I don’t own many Pokémon cards, but I have a friend who can attest to price appreciation on some highly graded collectibles from the game’s inception.

What I can attest to firsthand is the return on investment I’ve tracked on my growing Sega Saturn game collection. Seeing as I don’t expect there to be a “Sega Saturn reprint” anytime soon, I believe the trajectory for the next few years should remain upward. After all, these games are only getting rarer and harder to find.

Much like the iconic Power Nine in Magic, high quality, desirable video games will gradually fall into the hands of collectors. Supply will dwindle and prices will rise. I can’t wait to see what prices look like ten years from now—I suspect these “antiques” will have quite the price tags!

…

Sig’s Quick Hits

- There appears to be sudden demand for Gavony Township. Star City Games is sold out of English, non-foil copies with a $5.99 price tag. This is sure to be relisted higher once the dust settles. The question is: where is this demand coming from? Is it just simple Modern speculation? If so, why now all of a sudden?

- There have been 22 Halloweens since All Hallow's Eve was printed. Yet it seems this year the card has received some undue attention. I don’t think copies are moving at the $100 cited by TCGplayer mid, but it is true that stock is low. There are only a handful of copies on TCGplayer and Star City Games has just one English copy available: MP at $49.99. I think this one will disappear by All Hallow's Eve (couldn’t resist, sorry).

- I’ve also noticed a little price traction for Singing Tree from Arabian Nights. The card has been hitting new highs, and Star City Games only has one copy in stock at $39.99 (SP). This is another one of those Reserved List cards that will just gradually dry up from the market over time. There’s no major demand for this card, but it’s still going to grow in price simply due to its age and classic feel.

Really enjoyed this Sig, for the audience of QS I think this makes a lot of sense, to think about if not act upon.

Also no idea what is up with Gavony Township!

Ben,

Thank you very much for the feedback! I was admittedly a little nervous about writing this column as it deviates from MTG finance via a tangent. But it’s related, and as you put it, I think it is something speculators of Magic should consider. Especially since we know Magic won’t be around forever.

Gavony Township was very sudden and I don’t quite understand the catalyst. I mean…the card is good don’t get me wrong. But why now, when so many other Modern cards are dropping and we know a reprint could be on the horizon with Modern Masters 2017? Utterly strange.

By the way, a special thank you for sharing your thoughts in the comments section. As one of my primary commenters, you can have significant influence on what I write on. So please keep the feedback, both positive and constructive, coming. 🙂

Thanks!

Sig

I’m not so sure about the Magic not being around forever. While it may not exist as is I can see some version being almost with us forever now. Some card games that existed for much less time and fanfare in the 90’s still have a vibrant community keeping it going and cards still retain some value (Decipher Star Wars and Babylon 5).

I have a really hard time seeing at this point in time how Magic dies which is good news for all us investors 🙂

Magic won’t “die”, but I can certainly see a popping bubble where only the most collectible/iconic survive. For example, will something like Snapcaster Mage really be worth a ton if there are no tournaments anymore? Would a Moderately Played Black Lotus continue to fetch $3000+?

Hey Sig,

Good article, I like your thoughts on diversification having dabbled in Pokemon for a few years and having Hasbro stock too. I don’t understand video games at all so I don’t touch them but it seems still sealed ones would be a good investment. Shopping the bargain stores in my area it looks as though a lot of the Nintendo games sell for a good price loose as well as sealed, but other games appear to only be marked up if sealed.

Anyway, the original Pokemon sets are very collectible and a number of the iconic character, Worlds, etc promos are too and might be worth some small-scale investing. For the DJ in all of us, Pokemon bulk provides a better return than any other CCG.

Colin,

Thanks for sharing your thoughts and the recommendations! I agree sealed and complete games offer a nice premium – these should provide the best returns from a video game standpoint.

As for Pokemon bulk…this is most intriguing information! How does one go about liquidating a bunch of Pokemon bulk – especially some of the older stuff from the first 3 years of the game? Sometimes I can’t even distinguish between one printing and another for a card, so submitting a giant buy list of $0.05 cards to Troll and Toad seems very unappealing. 🙂

Thanks again!

Sig

Hey Sig,

I would think any buylist to Troll & Toad would be unappealing. Anyway, usually I pull Pokemon by putting 1st Edition cards to the side, pulling rares from about 1 through 25, rares at the end of the set and anything higher than set count, for example 106/105. Pull popular foils in c/uc, Energy, etc then bulk out. At $60.00/1,000 and $20.00/1,000 for Energy its worth it. I’ll sell as much as I can to Untapped then figure out moving the rest.

From the first 3 years, the c/uc have some value but most not enough for me to worry about that deeply. I’ll leave some money on the table when the pennies don’t match my willingness to spend the time. Though again 1st Edition I move individually, Shadowless and unlimited I bulk.

Colin,

I have much to learn in this space. I don’t think I’d be able to pull out all the cards you listed so easily. I could do it…it will just take me a long time. But $60/1000, that’s incredible! Untapped offers this kind of buy price on their website?? That’s for any Pokemon cards at all?

Thanks for the details,

Sig

As someone who dabbles in all types of “investments” (aka: nostalgia from my past) I can appreciate this article! LOL you and I even traded $ + a textless damnation for a 3D0 waaayyy back in the day (which still gets used, Twisted is good fun!) so we KNOW there’s cross interest. It’s important to note that the typesd of games you should be aiming to aquire are mostly RPG’s, as they survive the test of time due to their stories, in contrast to things like “sports games” which are constantly upgraded and are the same thing repackaged with different characters / stats.

I would also add “Comic Books” to your list, as of all my “investments” they’ve paid off the most (Amazing Fantasy #15 I bought for $1800 around 5 years ago and is worth > 8K today in CGC 1.5, Incredible Hulk #1 CGC 2.0 I bought for $1500 and is now > 6K)

Great article, thanks! 🙂

Carl,

Great builds on the video game thoughts! RPG’s are definitely the best investments in vintage video games, whereas sports are mostly trash. Agree 100%. The nice thing about the Sega Saturn too is, the games are just so rare because the system was so unsuccessful in the U.S. With some of the best games on the system released AFTER the Saturn was already discontinued in the states, you end up with some very desirable items.

Comic Books are intriguing – I know nothing about these. I would be investing in the dark. But I absolutely believe there are some good returns there as well!

Glad you enjoyed the column, thanks again for the comment!

Sig

P.S. I still miss that 3DO dearly. I just never had the time to enjoy it. I’m glad it’s getting some love now. 🙂