Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Welcome to the MTGO Market Report as compiled by Matthew Lewis. The report will cover a range of topics, including a summary of set prices and price changes for redeemable sets, a look at the major trends in various Constructed formats and a "Trade of the Week" section that highlights a particular speculative strategy with an example and accompanying explanation.

As always, speculators should take into account their own budgets, risk tolerances and current portfolios before buying or selling any digital objects. Please send questions via private message or post below in the article comments.

Redemption

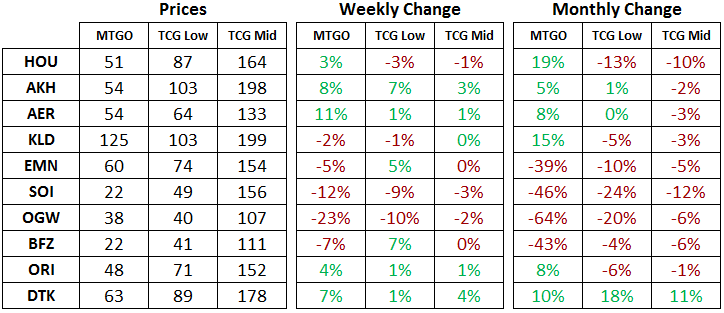

Below are the total set prices for all redeemable sets on MTGO. All prices are current as of September 5, 2017. The TCGplayer low and TCGplayer mid prices are the sum of each set's individual card prices on TCGplayer, either the low price or the mid price respectively.

All MTGO set prices this week are taken from GoatBot's website, and all weekly changes are now calculated relative to GoatBot's "full set" prices from the previous week. All monthly changes are also relative to the previous month's prices, taken from GoatBot's website at that time. Occasionally, full set prices are not available, and so estimated set prices are used instead. Although both Aether Revolt (AER) and Kaladesh (KLD) are no longer available for redemption, their prices will continue to be tracked while they are in Standard.

Standard

Hour of Devestation (HOU) and Amonkeht (AKH) have stuck to around 50 tix in recent weeks. If you have been wondering about speculating on these sets, the two weeks of drafting leading up to the release of Ixalan (XLN) is a fine time to be picking these up. I have been regularly adding sets of HOU into the market report portfolio in the past week. For AKH, though, I bought over twenty sets earlier this year, and am not adding more at this time.

The rotating sets are continuing to decline, although both Shadows over Innistrad (SOI) and Battle for Zendikar (BFZ) have a hard time dipping below 20 tix. The week-over-week price declines are slowing, but the bottom is not yet completely visible. I'll be begin purchases of all rotating sets over the next two weeks.

Vintage and Treasure Chests

Vintage is not a format where I usually go looking for speculative opportunities. Standard and Modern are big formats, widely covered and widely played on MTGO, while Vintage is still somewhat niche. However, this doesn't mean it's not worthy of Exploration from time to time. Two recent announcements triggered my interest in the format and helped me to solve a question that had been lingering in my mind.

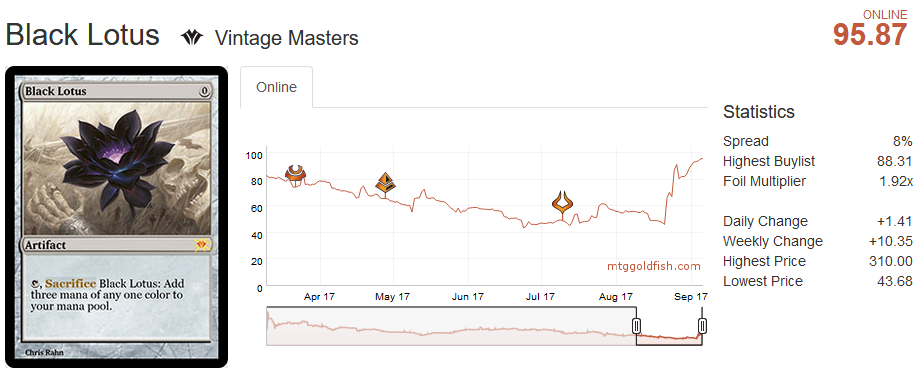

The announcement of Vintage Leagues on August 22 was a result of Vintage events firing regularly on MTGO. The hope is that leagues can support the hardcore aficionados as well as attracting newer players and building the playerbase. The market responded with a massive buying spree of Vintage staples such as Black Lotus, a card that has more than doubled in price in the weeks after the announcement.

The market is clearly bullish on the prospect that MTGO is finally exploring its potential for cultivating niche formats. With affordable prices on all sorts of Vintage staples, no Reserved List, and a central, global hub for organizing games and tournaments, Vintage on MTGO looks like its on its way to realizing this potential.

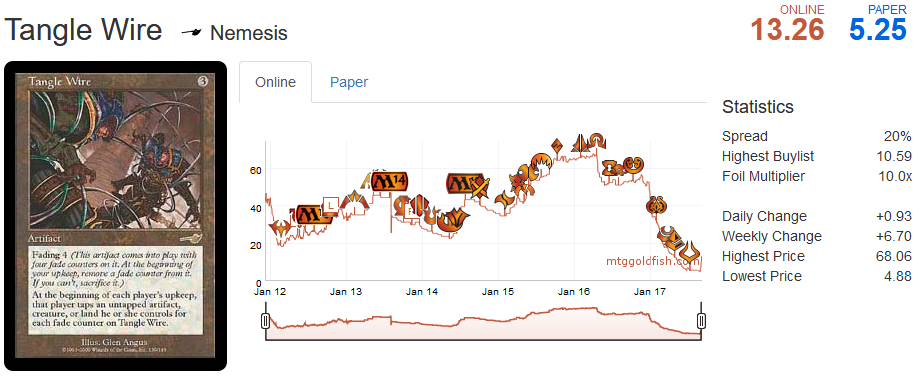

Although I didn't capitalize on this announcement, nor pursue any Vintage specs, I had been watching the price of an old favorite of mine, Tangle Wire. Since being printed on MTGO in the online-only compiled Mercadian Masques block booster packs, this card has been at least 20 tix with a peak last year at over 60 tix. The recent decline down to below 10 tix coincides neatly with the introduction of Treasure Chests last year and the inclusion of Tangle Wire on the Curated List.

Originally, Treasure Chests were not completely replacing boosters as prizes, but boosters were discontinued as a prizes in Constructed formats with the release of AER. This change seemed to hasten the downtrend on many cards, including Tangle Wire. Over the past six months, my thinking around Treasure Chests and their impact on the market has evolved and I now firmly believe that the steady supply of cards from these prize packs means that speculators can't be long-term holders of just any card. It's essential that speculative targets are seeing Constructed play and preferably a growing portion of the metagame.

This is all old news, but the recent Banned and Restricted announcement has triggered a shift in the market that has forced me to revise my thinking on Tangle Wire. It's no doubt in my mind that Treasure Chests have exacerbated the downtrend, but the key driver was the coalescing of the Vintage metagame around Ravager Shops and Mentor Control decks.

Last year, Shop decks had been running multiple copies of Tangle Wire, check out the top Shops deck from the Eternal Weekend Championship. The winning deck from that event featured Monastery Mentor, a card that Tangle Wire lines up poorly against. Mentor makes lots of permanents that can be tapped for Tangle Wire's effect and the printing of Walking Ballista gave Shop decks a much better card to help in the fight against Mentor. As you can see from the Vintage Challenge at the end of August, Ravager Shops had moved away from Tangle Wire completely. This shift helps to explain the substantial price decline in this card's price in 2017.

Now that Monastery Mentor and Thorn of Amethyst have been restricted, Tangle Wire has started reappearing in Shop decks. Check out these two Shop deck from the latest published league lists; from September 4, the latest Ravager Shops list sports three copies of Tangle Wire, while yesterday's results bring a Goblin Welder variation on the Shops archetype. It sports four copies of Wire.

No longer completely hindered by the token generating Mentor, Tangle Wire is slotting back into Shop decks, replacing the mana disrupting component Thorn of Amethyst. This all became apparent to me this week when I noticed that Tangle Wire had jumped in price from 6 tix to 9 tix. That's when I started revisiting my thinking about this card in particular and the impact of Treasure Chests. If the steep price decline in the past year was partly explained by a shift in the Vintage metagame, then the latest changes will start pushing the price of Tangle Wire back up.

Trade of the Week

For a complete look at my recent trades, please check out the portfolio. With the analysis of Tangle Wire complete, I jumped head first into this spec and bought up a number of playsets. This card is lightly printed online and a continued shift to including it in Shops decks will support the price going forward.

Key to this strategy is the matter of price discovery in the MTGO market. Prior to the end of 2016, the market had decided that Tangle Wire was a 20- to 40-tix card, with some extended periods of higher prices. With the changes in the Vintage metagame and the introduction of Treasure Chests, the market had soured on this card, driving it's price down to below 6 tix. But the market is the sum of a whole bunch of actors working together over time. And the way these actors work together is through the bot chains.

The way that the bot chains "discover" the price of a card is by setting their buy and sell prices based off of their buy and sell volumes. The goal for the bots is to maintain an inventory while collecting the buy and sell spread on their transactions with players. If players are selling a lot of a single card, then the bots will reduce their prices, both buy and sell, which is what was observed for Tangle Wire through most of 2017.

It's important to realize here that the bots iterate prices around market activity; they don't set a price, the price evolves over time. The bots do not decide on what the price should or could be based off of metagame results, and this is where speculators have an advantage. Observing a shift in the metagame means a speculator can theorize the true value of a card before the bots can go through the process of price discovery.

If the shift in the Vintage metagame continues, then the upward trend on Tangle Wire will also continue. This means that players will be adding this card into their collection, and the price will continue to rise. The price discovery process will unfold until players get the cards they need and the bots maintain their desired inventory levels. It's my belief that the price discovery process is now under way for Tangle Wire and that the market will end up back in the 20- to 40-tix range over the coming months.

The risk of this strategy is that I can't predict where the Vintage metagame will go in the future. The early signs support the hypothesis that Tangle Wire is back in the mix for Shop decks, but this could change. If the trend stops or reverses, then I'll be stuck with a significant position in an illiquid card that is declining in price. Identifying any potential trend reversal will be key to exiting this position successfully.