Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

I rarely get to apply lessons learned from my primary career to my MTG finance writing position. Chemical Engineering for a consumer packaged goods company has little overlap with a collectible card game and its financial component. However a recent seminar at work spurred a series of thoughts that I felt could be related to this lucrative hobby.

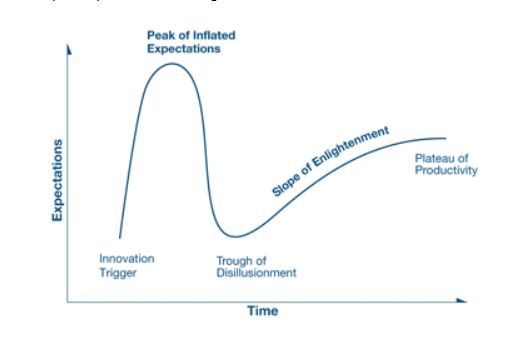

During a presentation on innovation, a guest speaker shared a slide on the Gartner Hype Cycle.

This graph is supposed to depict the hype associated with new technologies. However, “technology” is a fairly broad word. In fact, some Magic players refer to new deck strategies as new “tech,” which is of course shorthand for technology. Could this mean that the same hype cycle theorized above can be applied to our hobby?

I think so. But not only do I think it’s related, I think a ton of opportunities to profit stems from this very cycle.

The Buyout: Ultimate Hype

When word starts to get out of new card or deck strategy, it spreads very fast. Social media has enabled nearly instantaneously sharing of successful card combinations. This can easily be paralleled to the “Innovation Trigger” cited in the graph above.

For example, consider what happens when a new deck breaks out at the Pro Tour. The innovative deck idea hits the wire; players and speculators alike buy first and ask questions later. The result is a spike in expectation—normally associated with a spike in value.

Within a week of the Pro Tour’s conclusion, however, the expected value of the card starts to dwindle. If the deck doesn’t make Top 8, or doesn’t win the Pro Tour, it drops very rapidly in value as speculators race to sell their copies. The card enters the “Trough of Disllusionment” as nearly all of its value from the Pro Tour hype erodes.

Then, if the card is truly worth consideration, it bottoms and gradually rises in price. Perhaps other pros pick up the strategy and tweak it in order to improve its efficacy. People become enlightened to the card’s true utility, and if merited this will result in a rise in price. In the last stage, the card’s price will plateau while the supply and demand finally finds the right balance. In the case of Standard, the card will likely maintain a fairly constant price point until it is either disrupted by a new set or it rotates out of the format.

Sometimes the Standard card doesn’t even have to have seen play yet—hype during spoiler season can be enough to generate a similar pattern, as it did with Carnage Tyrant.

This kind of trend happens more often than just during Standard Pro Tour hype. It can happen when a new card is unbanned, a combo piece is spoiled, or a rumor is spread. Remember how excited people became when Sword of the Meek became unbanned in Modern? The expectations for this card jumped through the roof before settling back down towards a more normal equilibrium.

And I also remember the hype around Demonic Pact a couple years ago when it showed up on camera at a Pro Tour, only to fall just short of making Top 8. There were actually multiple spikes of expectation for this one:

Time and again we see trends that mirror Gartner’s Hype Cycle.

The “So What”

Okay, so the trends are there and they parallel the Gartner Hype Cycle in technology. How does this help? Well lately, it seems like this is the way to make money in MTG finance. Think about it: how often are we sharing new ideas or specs, feeding into hype, and jumping on a spec as it spikes? Then we aim to unload copies as close to a local peak as possible before the card sells off again. It doesn’t happen every time, but most of us have taken on this angle for profit.

With constant reprints, a lack of Modern interest, slowing Legacy/Vintage support, and new Commander products launching every year, it almost feels like our best option is to take full advantage of this hype. Other avenues for MTG speculation—perhaps outside of the Reserved List—carry with them greater risk. Some of the greatest profits I’ve made to-date is related to the hype cycle. I’m not going to sit here and declaim the strategy when I know it can be effective as long as I’m not manipulating the market for a pump-and-dump scheme.

When the Reserved List combines with hype, you truly have the best of both worlds. For example consider the price action on Yawgmoth's Bargain, which recently became unrestricted in Vintage. You and I both know that unrestricting a card in Vintage should have a very slight impact on its value. Vintage has a very limited player base and the number who actively play the format is unlikely to move the value of a card measurably. But that didn’t stop the hype from taking over…

You’ll also notice that even though this card did sell off from its peak, it held a lot more of its gains relative to Sword of the Meek. This is the benefit you get from focusing on older cards—especially those on the Reserved List. This is yet another reason I prefer to focus on cards in this category. You get much better downside protection and the hype is more likely to stick as compared to newer cards. Even something with virtually no utility can hold more of its spiked value if it’s old and rare enough.

But no matter how you slice it, hype seems to be the way to play your MTG speculation if you’re looking for short-term churn and burn. You can leverage the hype curve depicted above to maximize profits while minimizing risks. It’s no wonder this strategy is so popular!

Where is the Hype Now?

To continue down this path, we need to now assess where the hype is about to happen via an innovation trigger. I see a couple possibilities on the horizon.

First, we have Pro Tour Ixalan coming up in a couple weeks. While Standard isn’t my area of expertise, I try to pay attention to the popular decks at Pro Tours because they have such high potential to move markets. Remember how far Walking Ballista jumped when it displayed overwhelming popularity during Pro Tour Aether Revolt? Something like that can very readily happen again once the innovation trigger is displayed on camera during the next Pro Tour.

Second, we have Pro Tour Rivals of Ixalan in early 2018 to showcase the latest professional-level metagame for Modern. Will there be new technology on display during the event? My inclination is perhaps not, but you’d better believe I’ll be tracking this event closely for any potential breakthroughs. Given the fact that some Modern cards are much older, we can have a very significant shift in a card’s price should it suddenly demonstrate utility in the non-rotating format.

Even speculation on a breakthrough is enough to catalyze some movements. Be ready.

Third, Masters 25 could be a catalyst for cards that are not reprinted. There may be some latent demand for certain cards like Rishadan Port and Jace, the Mind Sculptor. Should these iconic staples dodge this reprint, it may mean they will not be vulnerable again for a year or two. Of course there is always the outside chance something is used as a Judge promo or Grand Prix promo, but the odds of a reprint of a high caliber card such as these will dwindle drastically for a year or two post-Masters 25.

Lastly, you have all the persistent Reserved List buyouts that continue to take place. It’s difficult to predict these, but strategies I’ve outlined in previous articles should help. It essentially requires constant searches on TCGplayer by set to detect which Reserved List cards are on the move. Last weekend it was Ice Cauldron. Next week it could be Ashnod's Cylix, who knows? Best to stay on top of these trends on an ongoing basis if you’re interested in them.

Wrapping It Up

The Gartner Hype Cycle may be developed with technology in mind, but I certainly see parallels in MTG finance. The hype cycle has never been more pronounced than it is now. It seems that as soon as something budges in price, the hive mind pounces and drives the price up an exaggerated amount. While there is often a period of disillusionment following such a spike, selling into the hype is an ever-present way to make profits.

The key is to get in and out quickly, and to try and keep on top of potential innovation triggers. Right now I see a few possibilities on the horizon: Pro Tours, Masters 25 absentees, and Reserved List hype round out my list but I’m certain there are others.

That’s where keeping engaged with the community on the Insider Discord and Twitter is most useful. It helps you track all trends in centralized ways that don’t involve excess work on your end. By investing some time strategically in these media, you can monitor trends to jump on innovation triggers at the most opportune moments. This sets you up to sell into the hype and lock in those profits!

…

Sigbits

- When Star City Games ran their Legacy/Vintage sale a couple weeks ago they placed their played Beta Lord of the Pits on sale. The thing is, their prices were already below TCG low, so it’s no surprise that all four copies they had in stock sold during the sale (I myself purchased one of them). Now they are out of stock and I suspect they will need to increase their buy/sell prices in order to get some back in stock again. Expect that $149.99 price tag to bump up at some point.

- The price of Rainbow Vale has truly jumped and I am amazed a Fallen Empires card could move that much. Perhaps the concept of using these for pack wars or cube is catching on. Either way, I see that Star City Games has just two NM copies in stock at $4.99. Card Kingdom, Star City Games, and ABU Games all have fairly generous buy prices on these as well, considering it was a dollar card just a couple months ago.

- In honor of my visit with Quiet Speculation’s Niels (pi) last weekend, I wanted to share one idea of his. He encourages collectors and Old School players to finish their sets of Beta Psionic Blast sooner rather than later. The card has gotten some Modern attention lately and this will fuel demand. In fact, Star City Games is sold out of Alpha, Beta, and Unlimited copies at $99.99, $99.99, and $19.99. The fact that Alpha and Beta pricing is identical makes little sense to me. I suspect they’ll be increasing Alpha very soon (and possibly Beta as well).

So in reality Sig was short a Sigbit and I had to help him out 😉

I definitely see hype cycles coming and going when it comes to Magic finance.

I don’t think so! There are infinite Sigbits but you seemed delighted when I offered you a spot. 🙂

LOL, sure, I am always happy to help someone in need.