Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

This week, we're going to take a bit of a deep dive into mythic rares. Specifically, we are going to look at mythics with converted mana costs three and below. This article will be a little heady, and a lot of data will be thrown at you, but I believe that you'll get a lot out of it. I'll be walking you through the data and will try to draw some conclusions from it. Standard is filled with these cheap mythics, and Rivals of Ixalan gave us three new ones, so there's no better time than the present to tackle this topic.

There are a few reasons for grouping these mythic cards by converted mana cost. The most important reason is that we want to identify patterns so that we can better predict any individual cases we come across. We think of lower converted mana cost cards differently than others because these can see a higher potential amount of play and be more core to the functionality of a Standard or Modern deck.

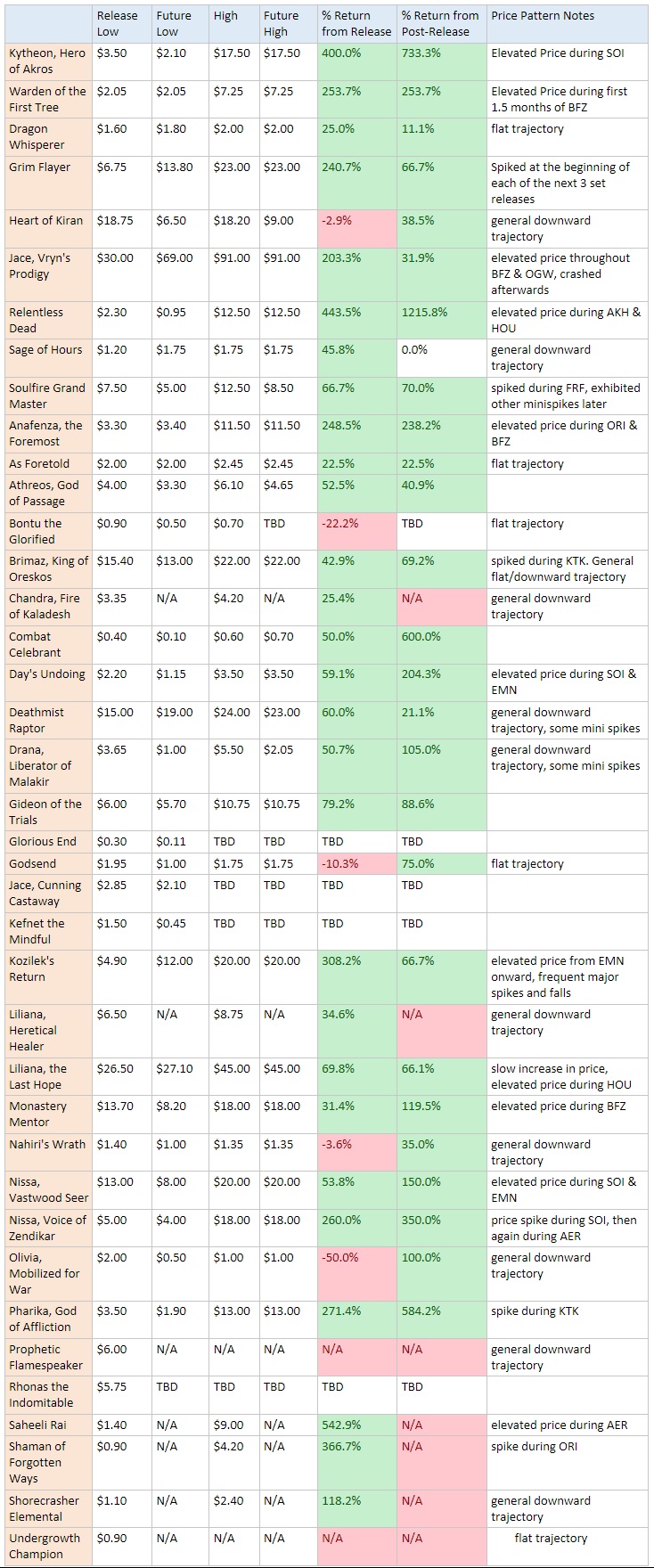

I've created a data sheet that shows how profitable investing in all mythics printed from Born of the Gods onward would have been. Click the spoiler below to see the whole table. I've collated the data in such a way that is friendly to investors – the low and high prices shown are those for which there was a wide enough investment window during which to buy or sell. The "release low" is the card's low price before the release of the next Standard-legal set. The "future low" is the low that the card reached subsequent to the release low. If a card's "high" and "future high" prices are different, that means that the card reached its absolute high prior to falling to the future low.

I added these variables to the graph in part because many often wonder whether they should invest in a card that was once incredibly vital to Standard and then gets booted from the metagame for various reasons. Sometimes these decisions are easy (Saheeli Rai), and sometimes they are hard (Nissa, Voice of Zendikar, Soulfire Grand Master). In the notes section, I distinguish between a generally sustained season-long price increase ("elevated price") and short-term price spikes ("price spike"). All returns with "N/A" would have been bad investments.

Should I invest in mythic rares that are popular right out of the gate?

The last time we were faced with this sort of dilemma was with The Scarab God but, as the above chart indicates, we are presented with such a card with some regularity. If Kumena, Tyrant of Orazca maintains a price above 10.00 tix for the next few months, it too will present us with this dilemma. Past history tells us that these cards do, on average, prove to be good investments, even when made within a few months of their release. The only one, in fact, that would have proven to be a bad investment was Heart of Kiran. The average rate of return for this class was 65 percent. Waiting, in some instances, proved financially advantageous, and in other cases disadvantageous. The average rate of return for buying in at a later date was slightly higher, clocking in at 70.9 percent.

I think there are two reasons why these cards prove to be safer investments than we'd normally expect. First is that a $10 card on MTGO has significant competitive demand and has proven more than capable of clearing the hurdle of Constructed playability. I am always a tad hesitant to invest in expensive cards because I am afraid of the potential fallout of a price crash, but the reality of the situation is that low CMC mythic rares that have proven to be major players in Standard are just unlikely to fall off the map. And when the infusion of supply comes to a halt after a new set is released, these cards tend to become more valuable.

The second reason is also a reason to invest mythic rares that seem powerful – Standard rotations and cards yet to be printed will affect future Standard environments, and that allows for different cards to shoot upwards during different seasons. When these $10 cards spike, they really do spike hard, and some of them like Monastery Mentor and Liliana, the Last Hope can command their elevated prices for significant periods of time. Usually there will be a future Standard environment that will spotlight the card in question more than the present one - like The Scarab God, usually it takes some time to figure out how best to use a card. All of this makes investing in these proven mythics safer than you would otherwise think, especially early on in their Standard life.

Of these $10 mythics from the past several years, it would have been advantageous to wait a while before investing in 3 of them (Brimaz, Mentor, and Nissa). By contrast, it would have been better to invest in three others on the list earlier – Liliana, the Last Hope, Deathmist Raptor, and Jace, Vryn's Prodigy. The takeaway message from the data, in my view, is that if a mythic rare sees significant time north of $10 during the initial months of its release, we can expect it to spend some time north of $20 in the future. In general it is a safe conservative option to not wait to pull the trigger.

Should I invest in unproven mythics?

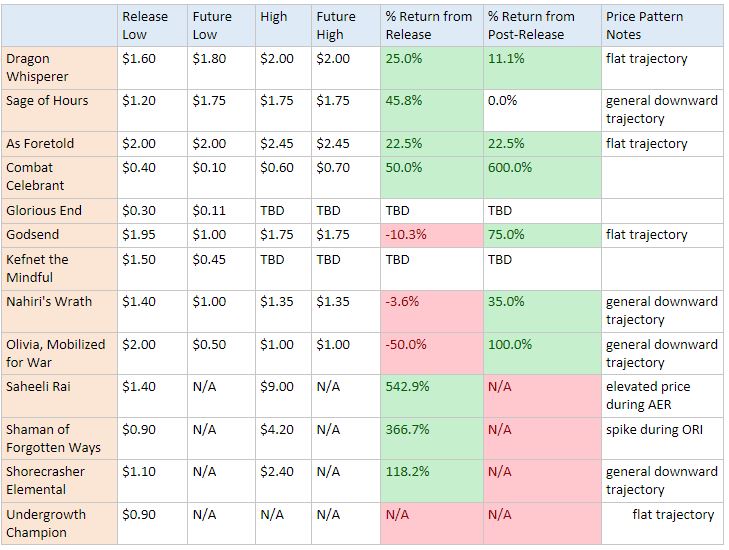

This is a question that will take some more time to answer, so I will be writing a Part II to this article for next week. Here I will discuss one distinct trend that I found when I was conducting the research for this article – mythics that dipped below $2 during their initial months of release rarely proved to be good investments. I was actually quite surprised by this finding, but here is the supporting data:

What a list! And I was being generous to count the recent price spike of Combat Celebrant! A few things interest me about this list. First is that, unlike mythics at a higher converted mana cost, these rarely fall to bulk. Glorious End and Combat Celebrant are the only two to ever fall well below $1 so quickly. In my mind this means that speculators tend to pick these up and sit on them more readily than higher converted mana cost mythics, but the competitive market values them just the same as a bulk mythic, and these eventually slide slowly downward until rotation.

The investment track record of these cards is abysmal across the board. The one exception – Saheeli Rai – only saw an elevated price because of the mistaken printing of Felidar Guardian. As we will see next week, unproven mythics that generate enough speculation interest to stabilize north of $2 during their first few months have a much better track record. These cards tend to have greater spike potential and have a significantly higher chance at clearing the hurdle of Standard playability. Unless you have a high degree of faith in a single one of these sorts of cards going forward, do not invest in this class of card. I suspect Azor's Gateway from Rivals of Ixalan will fall into this category and settle north of $1 over the next few months, and I think you should avoid it.

Signing Off

Next week I will conclude this topic, so please let me know your thoughts and questions down below! I will try to incorporate any questions you have into my next article. Also let me know how much you've liked drafting Rivals of Ixalan. I've had a rough go of it - the format feels oddly disjointed in that certain decks really prey upon other decks. Presented for your (morbid) viewing pleasure...