Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Welcome to the MTGO Market Report as compiled by Matthew Lewis. The report will cover a range of topics, including a summary of set prices and price changes for redeemable sets, a look at the major trends in various Constructed formats and a "Trade of the Week" section that highlights a particular speculative strategy with an example and accompanying explanation.

As always, speculators should take into account their own budgets, risk tolerances and current portfolios before buying or selling any digital objects. Please send questions via private message or post below in the article comments.

Redemption

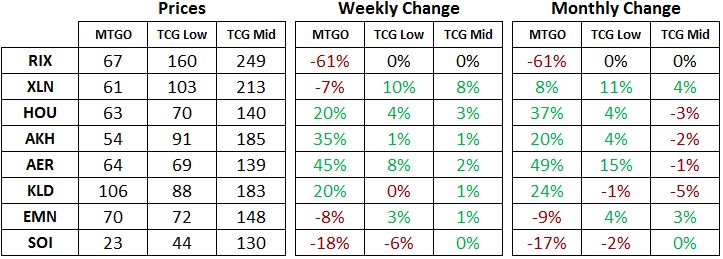

Below are the total set prices for all redeemable sets on MTGO. All prices are current as of January 23, 2018. The TCGplayer low and TCGplayer mid prices are the sum of each set's individual card prices on TCGplayer, either the low price or the mid price respectively.

All MTGO set prices this week are taken from GoatBot's website, and all weekly changes are now calculated relative to GoatBot's "full set" prices from the previous week. All monthly changes are also relative to the previous month's prices, taken from GoatBot's website at that time. Occasionally, full set prices are not available, and so estimated set prices are used instead. Although Hour of Devastation (HOU), Amonkhet (AKH), Aether Revolt (AER), and Kaladesh (KLD) are no longer available for redemption, their prices will continue to be tracked while they are in Standard.

Standard

Rivals of Ixalan (RIX) made its first appearance on the prices table, and one week of drafting has dropped MTGO prices by over 50 percent. Ixalan (XLN) is also dropping as drafters work on cracking the new Limited format and open a ton of product in the process. Otherwise, Standard prices are on fire this week, rising by up to 45 percent for a set of Aether Revolt (AER). Last week's bans in Standard have had the desired effect of stimulating interest, and brewers are having a field day in trying to figure out what is good in the new format.

If you've managed to catch the wave and are holding cards like Chandra, Torch of Defiance, Heart of Kiran, Hazoret the fervent, and The Scarab God, it's a great time to be a seller. Interest is high at the moment, and it's easy to liquidate a ton of cards at good prices. But don't be fooled into thinking this will continue. It's possible that Standard prices reach new all-time highs, but I think the next month or two is set up for declining prices as the metagame settles down and the focus shifts to Modern.

In terms of speculating on the buy side in Standard, XLN and RIX are the next two targets for full set purchases. XLN is getting close to my buy range of 55 to 60 tix, and I will start nibbling on this one soon if prices drift down below 60 tix. RIX looks like excellent value at the moment for redeemers, with TCGplayer mid prices nearly four times the MTGO price. But with months of drafting yet to come, the price on MTGO will still have a strong downward bias, so I am not getting tix ready to buy sets of RIX just yet. Buying into RIX in March makes much more sense, so hold your tix until then.

As discussed before, my strategy on full sets is to buy complete sets near the end of their draft window while they are still available for redemption. Prices are a function of demand and supply, so peak supply of a given set is while it is still being drafted. On the demand side of things, the end of redemption encourages people to redeem their sets, pushing a short burst of demand. The end of a drafting window also signals the approach of the newest set, which also triggers interest in Standard and fresh demand from brewers.

Capturing the value from the shift in supply and demand is the key to the strategy, but the whole thing wouldn't work without redemption. Redemption underpins the value of the set and by purchasing the whole set, you get to reduce your single-card risk by diversifying across all the cards in the set. The pool of value you are purchasing will be maintained even if there are fluctuations in the prices of individual cards. Diversification is a key aspect in the regular investing world, and it makes life a lot simpler for MTGO speculation as well.

Typically, I am looking for returns on full-set specs of 20 percent. Every now and then you get a much bigger return, which was the case for Hour of Devastation (HOU) due to The Scarab God. That card's increase helped full HOU sets returned fifty percent in a little under two months

Modern

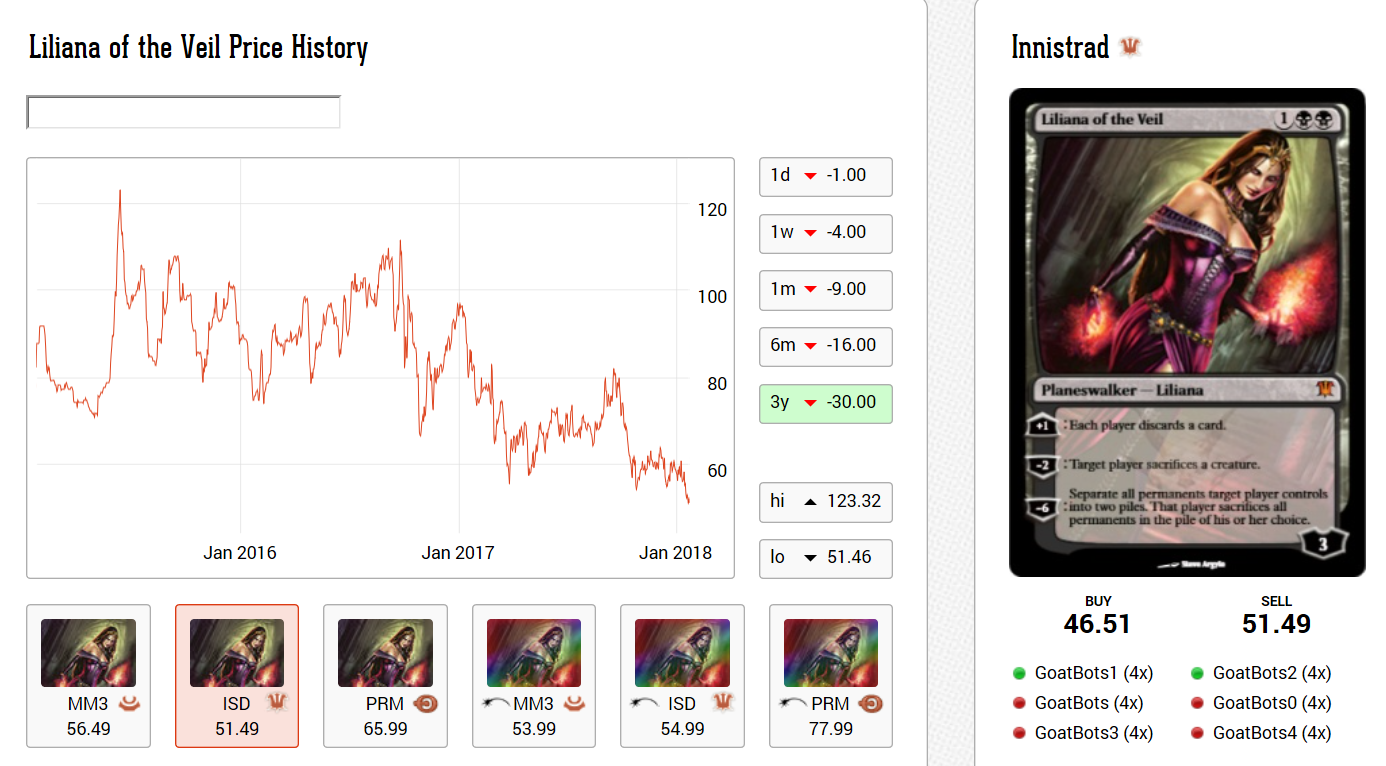

With Standard attracting all the attention the past two weeks, Modern has taken a back seat and prices have drifted lower. Liliana of the Veil has dipped to a three-year low despite being a flagship card. Check out the price chart below, courtesy of GoatBots.

With Treasure Chests bringing in a constant trickle of supply, it only takes a downturn in the metagame for a card like Liliana to plumb new depths. If you are holding this one, like I am, look for the Modern Pro Tour in two weekends to reignite interest in the format and to give prices a boost. Liliana will need some more help to get back to 60 tix, though, either through a strong showing in the top 8 or a shift in the metagame.

Otherwise, I am preparing to exit almost all Modern positions over the next six weeks. I've been selling off some positions and reducing others into price strength, but the time has come to take a close look at all remaining Modern positions with the Pro Tour almost here.

Trade of the Week

For a complete look at my recent trades, please check out the portfolio. This week I have been deploying tix into RIX foil mythic rares. To start, I have bought a complete playset, four foil copies of each of the thirteen mythic rares. I've also bought another four copies of each, excluding Kumena, Tyrant of Orazca and Rekindling Phoenix.

I want some exposure to each of the mythic rares in case something crazy happens and the price of one of them jumps up over 40 tix. Buying complete playsets keeps this possibility in place. But my research into maximizing returns on foil mythic rares suggests it's better to avoid already-expensive cards in favor of the cheaper ones. There's going to be some losers among them all, but the winners will outweigh them. Diversifying and buying the full variety basket of mythic rares is a key part of this strategy.

I'll be on the lookout for more opportunities to buy RIX foil mythic rares at a good price, but there's no rush at the moment. Prices are looking a little stretched at the moment, perhaps as a result of more readers pursuing this strategy. A potential return of 20 percent or more is something to shoot for, but at current prices, potential returns look to be ten percent or less, suggesting it's a good time to take a step back and wait for a better opportunity.

It’s worth mentioning that Limited is not as popular this go around. The competitive league is rarely topping 700 (Ixalan topped 800). And Sealed is miserable, so I imagine less people are doing that. I’m surprised draft participation is down.

We are still seeing RIX and XLN set prices drop though and it looks like XLN might breach 50 tix. Maybe participation is down, but the flow of supply is still meaningful.