Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

This must be Magic euphoria. It seems every speculation target is working. You want to buy Old School playables? Those are still hot and some are seeing a second wind. You want obscure Reserved List chaff? Those are spiking left and right. You want Masterpieces? Those are all disappearing two at a time. Even Modern and Legacy staples are rebounding healthily.

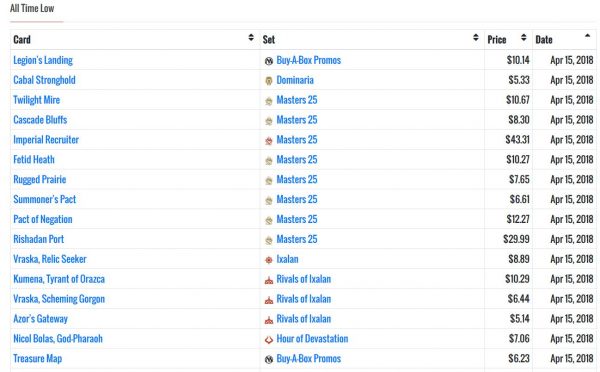

In other words, life is good in the world of MTG finance. About the only things that aren’t working for speculators are the smattering of cards hitting all-time lows on MTG Stocks:

It’s basically some Standard mythics and a stack of Masters 25 cards that haven’t bottomed yet, and that’s about it.

What Is Causing This?

This appreciation in cards is rewarding those who have stretched their investments and minimized cash positions. It seems you really cannot go wrong—as long as you’re avoiding reprinted stuff and eschewing Standard for the time being, you should be turning a profit. Perhaps if we can get to the root of this price growth, we can start to qualify how long it may last.

First, I do think there were two external factors that are at play here that have nothing to do with Magic: eBay’s coupons and tax season.

At the end of each quarter, eBay likes to offer additional incentives to drive up sales numbers. But they were more aggressive with coupons last March than I have ever seen before. For a week we had near-daily coupons for 15-20 percent off, and that has been unheard of in the past. Then once April 1st rolled around, did you notice the sudden disappearance of these coupons? Their quarter ended, so now there’s no need to juice up sales numbers to hit whatever targets they were aiming for.

What were folks doing with these coupons in the Magic world? I myself bought a couple of dual lands because I saw the recent price increases coming from a mile away.

Others put the money into Masterpieces. I’m sure there were some attractively priced Old School cards scooped up with these sales. Basically anything that is trusted to hold value and increase over time was snapped up to net the 15-20 percent discount as free money. This surely dried up the eBay market on sought-after cards, thus reducing supply and increasing price.

Then there’s tax season. The tax deadline just passed, and procrastinators everywhere have been getting their refund checks from Uncle Sam where applicable. Perhaps some of these refunds are being pushed into desirable Magic cards? It certainly seems feasible!

In addition to the external factors driving Magic sales, there are also some specific catalysts related to the game that are driving price growth. There’s the increase in team events that involve Modern and Legacy simultaneously, including the upcoming Pro Tour. If you want to play in one of these events, someone on your team needs a Modern and Legacy deck. The recent shake-up in Modern via unbanning of Bloodbraid Elf and Jace, the Mind Sculptor refreshed the metagame (so far it’s been healthy). Players love reasons to brew, and these two powerhouses are surely enough to scratch that creative itch.

More artificially, there are still some heavy-hitting investors out there moving aggressively into Reserved List staples. Rudy of Alpha Investments has not been shy about this. In a recent video, he claimed he is on a mission to obtain 100 complete sets of Arabian Nights. Only 20,500 sets can possibly exist based on the print run and we know that not that many copies survived the past 25 years. This kind of investing is putting a ton of pressure on the market.

Then there are the silent folks doing the same thing as Rudy, but without the silly YouTube videos. These people exist. I’ve sold a few dozen Alpha cards over the past couple months and I see the same buyers popping up time and again. No one needs twelve Alpha Spell Blasts.

Lastly, there’s the rising tide. All these price increases—dual lands, other Reserved List cards, Old School cards, Masterpieces, Modern staples, etc.—are creating more wealth within the Magic community. That newfound wealth is often churned into other Magic cards, driving prices up even further. It’s a bit of a feedback loop that could one day go awry. But for now, it’s working in our favor.

When Could This End?

I remember writing an article last year studying all the cards that were in the doldrums. It seemed like many cards—especially those not on the Reserved List—were seeing negative pricing pressures. And I wondered what would turn this market around.

Now we’re in the opposite situation, and I am left wondering what could crash this party. Could it be another Masters set? We know Wizards is cutting back on those, and this could be the unspoken “all clear” to the Magic community. Could it be the end of coupons and tax season? That would imply we’re near the end of this bull market cycle since tax season is just about over.

In reality, I don’t think there’s a negative catalyst on the horizon. The only downward pressure I see in MTG finance is the passing of the team Pro Tour and the big Star City Games event in Roanoke later this year. Those are both incentivizing acquisition of heavy-hitting Modern, Legacy, and Vintage staples. Once these events pass and we’re back to Standard week-in and week-out, we will see a decrease in demand for high-end cards.

But even this wouldn’t necessarily mean dipping prices. Are players going to immediately take apart their newly built decks as soon as these events are over? Unlikely. And these team events have been successful, so I expect Wizards to continue hosting Grands Prix with this team structure. No, I don’t think we’ll see a huge selloff anytime soon.

I believe as long as we are monitoring market trends, selling into buyouts and artificial price spikes, and parking our dollars in cards with healthy demand profiles and low reprint risk, we should be in the clear for the foreseeable future. I’ll reevaluate things after SCG Con in early June.

Actions Taken

Everyone is finding their niche and having success with it right now. My strategy may not be a fit for everyone else. But I want to be transparent with how I’m approaching MTG finance during this boom.

First of all, I am not involved with the Masterpiece buyouts. I pursued them the first time they were targeted and made some modest profits. They are awfully tempting to chase. But they’re not for me. They require a high buy-in and a high level of agility as prices move with such volatility. The optimal way to play these involves international arbitrage, of which I have little interest in pursuing. These are working extremely well for many folks; it’s not for me.

My focus continues to be in domestic arbitrage. I continue to buy Alpha cards directly from Card Kingdom, which has rapidly become my favorite vendor. People keep selling Alpha cards to their buylist, and I keep pouncing on them because so many are underpriced. Just last night I bought four more Spell Blasts for $5.99 (VG) and $4 (G). These reliably sell for $9-$20 on eBay depending on the day. With these Alpha cards, I buy what I can get my hands on for reasonable prices, sell extras and keep a few for myself. This approach has helped me acquire a nice pile of low-end Alpha cards for the long-term investment.

My other focus continues to be Reserved List cards. Many of Magic’s earliest sets have already gotten prohibitively expensive. But there are plenty of cheaper cards I think are worth a closer look. Last week I wrote about Revised, and I continue to see Revised Reserved List cards and Old School cards on the rise. It’s not just dual lands hitting all-time highs—Fork, Copy Artifact, and Vesuvan Doppelganger are all climbing steadily. Even non-Reserved List Revised cards, such as Birds of Paradise and Demonic Tutor, are on the climb.

My other recent focus has been on Reserved List cards from 1995-1997. I’ve really taken a liking to Thawing Glaciers, which sees some Commander play and is a beautiful card from an under-appreciated set.

Cards like Ritual of the Machine and Heart of Yavimaya show up on MTG Stocks’s Interests page now and again, and I could easily see these reaching a tipping point. I don’t exactly understand why a card like Reparations or Chaosphere would spike, but this is the world we live in now. It seems worth grabbing any near-bulk Reserved List card and throwing it in a box. I still prefer playable ones, but can you really go wrong?

Wrapping It Up

It’s a great time to be a Magic speculator! As long as you are avoiding the obvious pitfalls of Standard rotation and Masters 25 reprints, you should be doing quite well. I know my sales trends are very strong and I am on pace for a record year. And I don’t see the parade ending anytime soon—there are plenty of catalysts that encourage more price appreciation going forward.

Could there be a bubble forming? It’s possible, I suppose. I think if there is a bubble, it exists in specific areas of the market and not Magic as a whole. I don’t think every Masterpiece should be $100, so there will likely be some sell-offs there. Perhaps after SCG Con we’ll see Legacy prices cool off a bit. But I personally believe we’re seeing a general reset of pricing and that we will hit new plateaus going forward. This type of reset happens around this time each year, and that trend will continue.

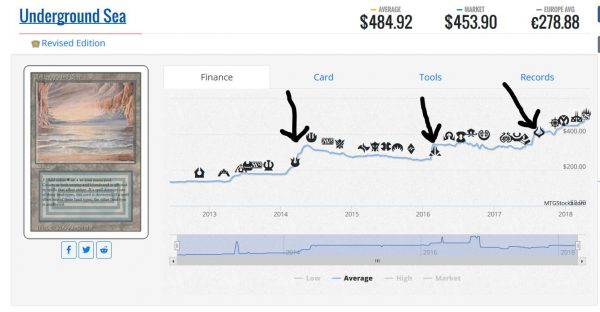

As the market gets used to the new prices, expectations will be updated and it will become the new “normal.” People were shocked when Underground Sea hit $100. After hitting $300 it felt like that was the new ceiling. Now a Near Mint Underground Sea is a $500 card with a $350 buylist price. This pattern will continue to repeat itself, and it’s why I remain confident in MTG as an investment vehicle. That could all change one day; but for now, I’m happy to be involved.

…

Sigbits

- When I decided to pick up a few Thawing Glaciers, I noticed Card Kingdom had a few EX copies in stock in the $9 range. I picked up three copies from them. Now they’re completely sold out and EX copies are listed at $11.19. I think they will increase their pricing on this one again as it continues to slowly grind higher.

- Card Kingdom has multiple Masterpieces on their hot list now, and I see this trend continuing as they seek to restock after all these buyouts. Some heavy hitters include Chalice of the Void at $100, Mana Vault at $90, Force of Will at $90, and Engineered Explosives at $80. I think these are all substantially below TCGplayer’s mid pricing, so it’ll be interesting to see if these buy prices climb higher in light of recent trends.

- I’ve noticed some popular Beta cards are jumping in price recently. I knew Card Kingdom’s buy price on Alpha Unholy Strength was already steep at $15. But they also pay $4 on Beta copies, and this I did not realize. They also pay $4.95 on Beta Paralyze. If you’re interested in this market, I’d recommend browsing what’s expensive from Alpha and then picking up Beta.

I really like the call on Fork. EDH crowd seems to enjoy this a lot. As well, I believe Helm of Obedience is an underpriced reservelist card as it sees fringe play in Legacy.

Thanks! Fork is going to go up nonstop and it is an EDH favorite (it’s in my EDH deck as well).

Helm of Obedience IS underpriced, I really like that call. Alliances cards are starting to move and I think that continues through 2018. Great pick!

I think you did very well with those boxes. Especially Stronghold, as you put it. So many high dollar reserved list cards – sure to appreciate over time. The only downside is the hassle of storing the boxes. You may have been better off buying the hot RL staples within those sets rather than boxes from those sets. That said, you won’t lose money on those…it’s basically impossible. From a risk/reward standpoint you found the cream of the crop.