Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Welcome to the MTGO Market Report as compiled by Matthew Lewis. The report will cover a range of topics, including a summary of set prices and price changes for redeemable sets, a look at the major trends in various Constructed formats, and a "Trade of the Week" section that highlights a particular speculative strategy with an example and accompanying explanation.

As always, speculators should take into account their own budgets, risk tolerances and current portfolios before buying or selling any digital objects. Please send questions via private message or post below in the article comments.

Redemption

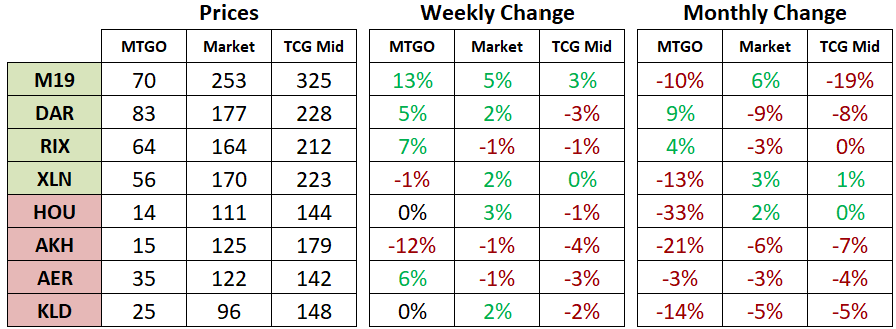

Below are the total set prices for all redeemable sets on MTGO. All prices are current as of July 31, 2018. The TCGplayer market and TCGplayer mid prices are the sum of each set's individual card prices on TCGplayer, either the market price or mid price respectively. Redeemable sets are highlighted in green and sets not available for redemption are highlighted in red.

All MTGO set prices this week are taken from GoatBot's website, and all weekly changes are now calculated relative to GoatBot's "full set" prices from the previous week. All monthly changes are also relative to the previous month's prices, taken from GoatBot's website at that time. Occasionally, full set prices are not available, and so estimated set prices are used instead. Although Hour of Devastation (HOU), Amonkhet (AKH), Aether Revolt (AER), and Kaladesh (KLD) are no longer available for redemption, their prices will continue to be tracked while they are in Standard.

Standard

Speculators should be prepared to be sellers this weekend during the Pro Tour. Any hype driven price spike on Standard staples should be sold into, particularly for cards rotating out of Standard in the fall. For the portfolio, I am holding mostly structural bets such as complete sets of Dominaria (DAR) and foil mythic rares from Core Set 2019 (M19) so I will not be responding to the results for the most part.

There are a few single card specs that I've made such as on the opposing-colour check lands and on Radiant Destiny. These are the types of specs that have better long-term potential as we get into the fall and winter. The returning mass of players at that time will drive significant demand for Standard staples, generating higher prices as a result. There's no need to rush to sell these types of specs.

One card that has been in demand this week is Nexus of Fate; available as the buy a box promo for M19 in paper, this card is on the curated list for Treasure Chests. As a result, the supply is severely restricted which generates the doubling of price seen this week as it's risen from 30 tix to 60 tix and remains almost completely out of stock with only one copy available on MTGOlibrary and zero copies available at MTGOtraders and Goatbots.

This will be a good example if Wizards of the Coast errs again with this type of promo. Treasure Chests deliver a steady drip of supply into the market which is not suitable to moderate prices on new, in-demand Standard cards. Speculators should use their best judgment for future promos to decide whether a card is Standard playable. If it is, then it's clear that accumulating supply before the price discovery process kicks off is a good bet.

Modern

Modern will also be a part of the Pro Tour this weekend and speculators should treat it in a very similar way. G/B/x components such as Liliana of the Veil, Tamogoyf and Voice of Resurgence have been trending up this week, possibly signaling the pros unease with the format. Although regular players love Modern, pros have a harder time cracking the format since there are so many viable archetypes making it impossible to bring a deck that is favored against the field. Choosing to run a deck like Jund is not unusual since it is deemed a coin flip against almost every strategy and a pro is often confident they can push that percentage up enough to make a difference.

In terms of market conditions, it's a similar outlook as for Standard. Be a seller into any price spikes. The best opportunity for speculating on Modern will be in October and November when Guilds of Ravnica is released and everyone's attention turns to Standard. That's when you want to be holding tix and be on the lookout for staples at bargain prices.

Foil Mythic Rare Strategy

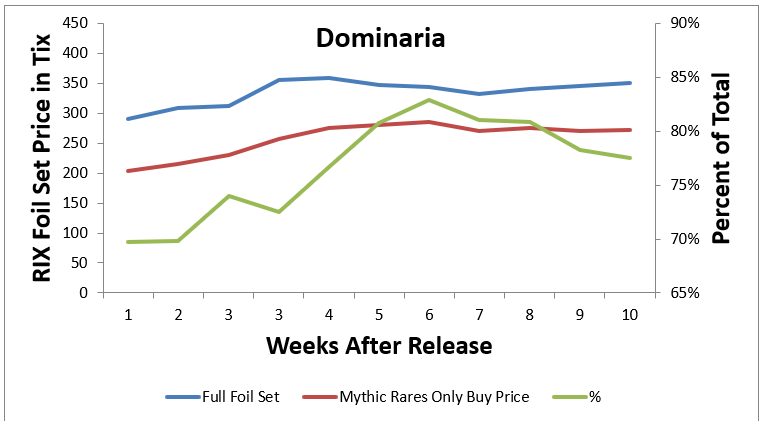

M19 has been out for a little under a month on MTGO and it's time to check in on how foil mythic rares from this set are doing. Coming off of DAR, expectations were sky high as foil mythic rares from that set rapidly increased in price to deliver substantial profits after only six weeks. Have a look at how two key measures evolved for that set in the chart below. The blue line is the sum of the sell price for all foils and the red line is the buy price of foil mythic rares only. The green line is the percentage generated by dividing the blue line by the red line. All prices are courtesy of Goatbots.

Two things we can see in the chart is that the percentage peaked at over eighty percent and that the price of a foil set saw substantial appreciation going from under 300 tix to over 350 tix in the first month of its release. For speculations, the first point is crucial to timing the sale of foil mythic rares in order to maximize profit. If RIX and XLN are also included, we'd see that the percentage peaked at eighty-three and seventy-seven respectively. So, for M19 we have a pretty good idea that sometime in the second month of release, if the foil mythic rare buy price over the foil set price hits about eighty percent, then we should be ready to sell.

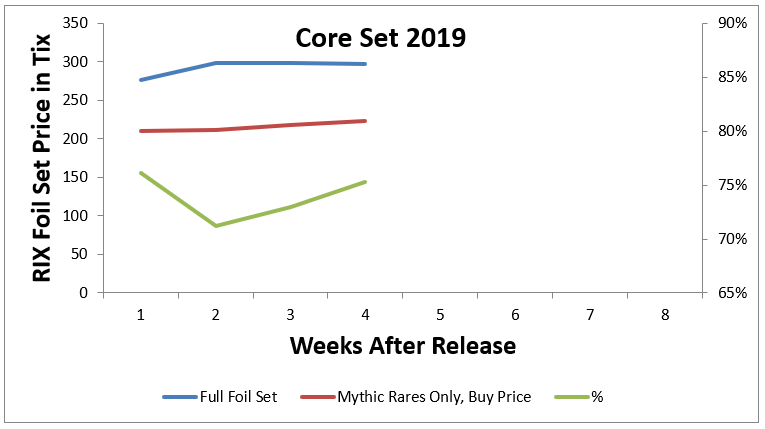

Below I've reproduced the foil mythic rare chart for M19 to see how things are evolving and to compare with DAR. Right off the bat it looks like this set will not be seeing the same rapid price appreciation that DAR did as the blue line has been steady at about 300 tix for the last three weeks. The red line has been rising steadily and the percentage is currently sitting at seventy-five. M19 looks like it is on track and I will be looking for a peak in the percentage as redemption opens for this set in the coming weeks.

The question of whether or not this is worthwhile trade for speculators remains open. After steady profits on all recent sets, the trade on M19 is not yet profitable although it is trending in the right direction. I think the theory around this strategy remains robust but that the trade is getting crowded. As more and more people try to buy the foil mythic rares after a set is released, it drives up the price and reduces the profit potential for all speculators looking to get in on the trade. All speculators will need to judge for themselves whether or not this is a strategy worth pursuing in the future, but it's clear that foil mythic rares are still a good store of value for players looking to conserve their tix.

The question of whether or not this is worthwhile trade for speculators remains open. After steady profits on all recent sets, the trade on M19 is not yet profitable although it is trending in the right direction. I think the theory around this strategy remains robust but that the trade is getting crowded. As more and more people try to buy the foil mythic rares after a set is released, it drives up the price and reduces the profit potential for all speculators looking to get in on the trade. All speculators will need to judge for themselves whether or not this is a strategy worth pursuing in the future, but it's clear that foil mythic rares are still a good store of value for players looking to conserve their tix.

Trade of the Week

For a complete look at my recent trades, please check out the portfolio. There are no new trades this week, but I wanted to check in on last week's purchase of Sarkhan, Fireblood. After peaking at 9 tix, this card has dipped back down to around 7 tix. For speculators, it's always nice when a winning trade only goes in one direction, so a drop in price always generates some fear that something has gone wrong.

For Sarkhan, the market now looks well supplied at around 7 tix. The uptrend is over, at least for the short term. When redemption opens, the link to paper prices will also open and that gives some hope. The paper price is up another five dollars this past week, so I still think the market is grappling with the power level of this card. Another high-level finish will trigger another price increase in paper which will feed back into the digital price. This trade is a hold at the moment pending further results from constructed and the opening of redemption.