Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

My transparent ABUGames arbitrage article received a lot of positive feedback—thanks to all my readers who took the time to share their thoughts and reactions!

Among the responses, I received two questions that I felt I could not answer satisfactorily through social media. Therefore, I decided to address both legitimate concerns in a follow-up article. These responses will likely benefit many folks beyond just those who asked the questions. Besides, I think both involve a reality check that will be helpful for the MTG finance community to digest.

Question 1: Shipping Costs and Optimization

In last week’s article, I talked about how I purchase cards from Card Kingdom and other websites with the intent of flipping said cards for roughly 2x the store credit from ABUGames. I spend this store credit on cards that I can sell for cash, and the difference between my purchase and my sales would become profit.

This is true, except I glossed over one important factor: shipping costs. This practice incurs a significant amount of shipping expenses, and they tend to add up without realizing. I’m going to break things down step-by-step, and share a few tips on how to minimize shipping costs along the way.

First, there may be shipping costs when purchasing cards. Fortunately, these are easy to dodge because many vendors offer free shipping on singles above a certain threshold. I don’t think I’ve paid shipping to Card Kingdom or Channel Fireball in many months, as their threshold is so reasonable ($25 and $50, respectively). These are often my go-to places to acquire cards for this arbitrage game, especially when pursuing more costly Old School cards.

As for other sources like TCGPlayer, eBay and Facebook, I always factor shipping costs into my purchase prices. Sometimes sellers don’t charge shipping on these platforms, and that always helps. Otherwise, when I talk about converting cash into 2x credit at ABUGames, that cash purchase includes any shipping costs. More recently, sales tax also needs to be factored into the equation. If your conversion from cash to credit isn’t in the 2x range after these expenses, then the arbitrage endeavor isn’t worthwhile—look elsewhere.

Second, there is a shipping cost incurred when mailing cards to ABUGames’ buylist. This expense is unavoidable, but it can be minimized. Buying shipping supplies in bulk is a great way to cut down on the cost of shipping supplies—my bubble mailers cost me about $0.20, and this number can be driven even lower if you’re willing to purchase 500 envelopes at once.

The other way to cut down on shipping costs is to leverage PayPal’s USPS shipping label service. This service will net you discounts on your postage, while also saving you trips to the Post Office.

From here, the only way to minimize the hurt of shipping costs is to make larger buylists—keeping buylist orders over ~$300 ensures the impact of shipping is less than 1%.

Third, there are shipping expenses when cashing store credit out of ABUGames. There is no longer a threshold that nets you free shipping. At one point, I was getting free shipping from ABUGames on all orders above $150, and free FedEx shipping when purchases were even larger. I have a feeling ABUGames had to abandon this promotion when they implemented their inflated credit strategy. Otherwise, they would have to ship way too many orders at their own expense.

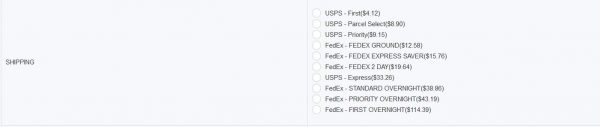

Now the only way to minimize the impact of this shipping charge is to make larger purchases with trade credit. Fortunately, no matter how large a purchase is, the USPS option is always available for $4.12. I’ve placed four-figure orders before and selected the first-class option—ABUGames still ships via FedEx, but they pay the difference.

I suppose this is still a promotional benefit, though now the threshold to obtain this benefit is not advertised. Therefore, there’s no reason to pick anything other than USPS-First as your shipping option. When you purchase with trade credit that you obtained at fifty cents on the dollar, you’re essentially paying just $2.06 for shipping, which isn’t too prohibitive.

The fourth and final shipping expense involves the selling of cards obtained from ABUGames with trade credit. To keep these costs down, follow the same strategy as step 2—purchase shipping supplies in bulk and use PayPal shipping for discounts. Finding higher dollar cards to buy with trade credit will help here, because it means fewer packages you'll have to ship when you sell those cards.

In total, you can see how these shipping costs can quickly eat into margins. That’s why transactions have to be relatively large, ABU credit needs to be spent very strategically, and at the end of the day margins can be razor-thin. Most recently, I’ve been primarily using this credit strategy to unload illiquid Old School cards. I would not advocate pursuing this strategy with cards that have robust demand from Standard, Modern, and Commander unless the numbers you’re getting in trade credit are more than 2x your cash price.

Speaking of Razor Thin Margins…

The second question I received about last week’s article came from another active member of the MTG finance community. They were inquiring about the value I place on my time. After reading last week’s column and the above section on shipping, one can quickly get the idea that margins from this arbitrage pursuit are very thin. Is it really worth the time?

Rather than get into economic and philosophical debate, I’ll boil this down into something fully transparent at the risk of coming across overly simplistic: This is how I engage in the Magic hobby nowadays, and I enjoy doing it. Because I do this for entertainment, I don’t consider value of time in the equation.

Some people spend hours a week playing casual games of Magic. Some go to FNM every week to scrub out of a Standard event. Others play Commander every weekend with their friends. I wouldn’t question how these people value their time as they engage in gameplay.

Because I don’t have the opportunity to play Magic for fun anymore, I have found a different way to remain engaged and interested in the hobby. Credit arbitrage still enables me to “trade” cards, build up my collection, and interact with others in the community. It has become my replacement for gameplay.

I don’t consider time-value while I read a book for pleasure, or attend a sporting event, or bowling with my friends, simply because I enjoy these hobbies.

I also genuinely enjoy credit arbitrage to ABUGames. If money was my primary motivator, then pursuing a part-time job would be far more productive. But money is only a secondary motivator here (plus it helps that I can do it on my own time from the comfort of my home). Engagement with community and finding deals for everyone, myself included, are the primary motivators. Profit is an added bonus that I'm using to gradually fund my kids' college funds.

For that reason, the value of my time isn’t a part of the equation.

If you’re interested in pursuing this credit arbitrage, you need to be in the same mental place. Time has no value because this is a pursuit of passion and enjoyment. You may be able to grind out profits with large enough purchases, but if you’re number one goal is to make money there are far more efficient ways of doing so that don’t involve Magic. Rather than ignore this truth, I encourage folks to embrace this reality and enjoy the fact that this hobby can be enjoyed while also making a few bucks. Most hobbies are purely cost sinks!

Wrapping It Up

I always appreciate feedback on my weekly column. I used to have to skim through comments on my articles, replying there in the hopes that folks will see what I have written in reply. Nowadays things are more direct—comments can be sent to me directly on social media (Twitter) or within the QS Insider Discord.

On Twitter, I’ll do my best to reply with the given allotment of characters. With the Insider Discord, I’m able to get into a much deeper discussion and answer questions more thoroughly. And in rare cases, your questions and comments trigger ideas for whole new articles!

This is precisely what happened this time around. Questions about shipping costs and the value of time are connected, in a way, as they both involve profit margins. The former has to do with how to maximize margins, while the latter considers the hourly rate at which these margins are obtained. Hopefully I’ve done a thorough enough job explaining where I’m at on each.

Lastly, I’ll reiterate this as bluntly as I can: If money is your motivator, stop wasting your time on Magic finance! Other than the Old School boom from the last couple years, I make far more money on an hourly basis writing these articles than I do on flipping Magic cards. MTG finance is a hobby of mine, first. I do hope to use this hobby to help fund my kids’ college costs. But if it was solely a money-driven interest, I would have applied for a part-time job as an Uber driver a long time ago.

…

Sigbits

- Old School prices have gotten really soft lately, but they aren’t exactly collapsing. Every once in awhile, Card Kingdom sells some copies of a given card, and it returns to their hotlist. This week I noticed Eureka return, with a $200 buy price.

- Another returner to Card Kingdom’s hotlist is Beta Lightning Bolt. They currently pay $180 for near mint copies. This sounds impressive, until you look at ABUGames’ buy price. They offer $280 cash for near mint copies—a full $100 more than Card Kingdom! ABUGames also offers $642 in-store credit, which could easily be converted to over $300 using my credit arbitrage strategy. It’s no wonder Card Kingdom remains out of stock on this card!

- Stoneforge Mystic’s unbanning in Modern has certainly made waves in the singles market. Sword of Fire and Ice remains one of the big winners from the move by Wizards. Card Kingdom has Modern Masters and Darksteel printings on their hotlist for $65 and $59, respectively.