Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Author Disclaimer: I bought no cards when Pioneer was announced. A few days after the announcement, I finally picked up a few Kaladesh Fast Lands, a couple foil Abrupt Decays, and a lone Hangarback Walker using some spare ABUGames store credit I had. That’s it.

Was it just me, or was Magic finance becoming a bit stale this season? Throne of Eldraine was an impactful set that carried an interesting theme. The Showcase cards created a new way of opening cards of value from booster packs, much like Masterpieces. Elsewhere, Modern unbannings were supposed to catalyze newfound interest in the format.

But none of this seemed to matter.

Then on October 29th, 2019, Magic finance was given a shot in the arm thanks to the Pioneer announcement. This new format awakened the sleeping beast that is Magic finance—let’s just say there were no hangovers.

The Awakening

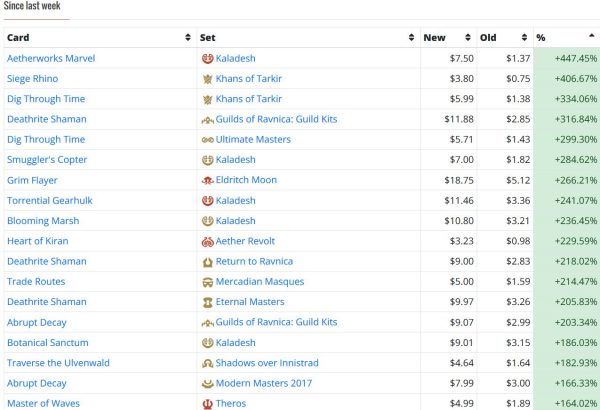

The picture above depicts the top movers over the past week—notice anything? Other than Trade Routes, every spike above is driven by MTG finance speculation on Pioneer. In fact, there are no less than 30 Pioneer card/card printings that more than doubled since the announcement. Even Felidar Guardian, an uncommon from Aether Revolt, spiked to over two bucks!

Speculators wasted no time guessing what would be most powerful in the format. No stone was left unturned, no strategy left unexplored (or unexploited). Energy, Jund, Copy Cat, Blue Control, Abzan, and even Merfolk / Mono U Devotion were considered sufficient strategies for speculation, amongst others. No matter what new Pioneer deck you’re excited to test, there are at least some components of the deck that now cost at least double their price previous to the announcement.

This is exactly why I use the “sleeping beast” analogy. Other than an unbanning or random one-off buyout, Magic finance had been very quiet for months. Many older cards, such as the Old School cards I particularly appreciate, have retracted in price so drastically that it has created attractive entry points. My focus had been on ABUGames arbitrage (of which the opportunities have been dwindling). To me, Magic finance was asleep.

Not anymore. The Pioneer announcement poked the sleeping beast aggressively enough to awaken it. The consequences are dire.

Consequences

Wouldn’t you think the awakening of MTG finance would be good for the hobby? It reinvigorates the flow of cardboard from peer to peer, increasing cash flow and liquidity in a market that desperately needed action.

I won’t deny that many parties will benefit from the new format. Any time a new source of demand arrives on the scene, it generates sales. Vendors will see increased activity, strengthening their balance sheet. Players who were sitting on Standard table scraps post-rotation from the format may suddenly find their collection is more valuable. These are positive catalysts for market health.

Now, consider the downside impact. A relatively new player has been interested in Modern, but couldn’t take the plunge due to the financial barrier. This Pioneer announcement may have energized that player because they, too, could now afford a non-rotating format. After deliberation, and perhaps watching the first couple online events unfold, they may decide what deck they want to play.

They look online, and suddenly all the rare and mythic rare components of their preferred deck are suddenly double or triple the price they were just a short time prior. What gives? Now, instead of paying a couple hundred bucks for a tier 1 deck, they are stuck paying $500+. I suspect this experience will leave a sour taste in many interested players’ mouths.

Even me. I wasn’t about to pick a deck to play the first day of Pioneer’s announcement. I wanted to see how the metagame evolved first. Now if I want to play Pioneer, the cost is twice as high. It’s very frustrating!

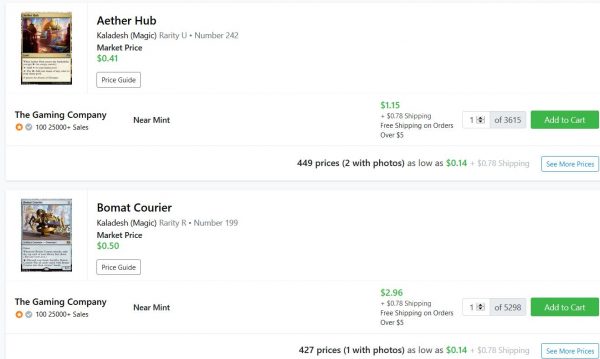

What’s even more frustrating is watching stores and speculators alike suddenly post Pioneer cards for sale in large numbers at high prices. I don’t know who this vendor is, but their listings are most egregious when it comes to supply…notice how their asking price is around 3x market price?

My concern is that the Pioneer market has already run dry, not because everyone immediately went out and purchased a deck or two to test, but because speculators bought up dozens of copies at a time in order to profit from this announcement.

Obviously, the new format will bring more cash flow into the hobby. But it feels like the speculators and vendors will be the ones reaping the financial benefits. Newcomers to the format, or anyone that hesitated from buying, will be paying the price.

Death, Taxes, and MTG Finance?

If this experience teaches us anything, it’s that MTG finance can’t really die. As long as Hasbro continues to invest in Magic, players will look for ways to extract value from the game. We could bury our heads in the sand like a bunch of ostriches hiding from reality, or we could choose to accept this fact. Perhaps the only things certain in life are death, taxes, and MTG finance.

Rather than ignoring these trends and feeling disgruntled because costs are much higher, we need to be proactive and engaged in the community. Participating in discussion on social media—especially Discord channels—will keep you in the loop on any news that may impact the market.

This engagement doesn’t mean you have to flip over to the “dark side” that is MTG finance. You can follow along so that you can acquire a couple key playsets of cards you want to brew with before the price goes insane.

Just because others are buying dozens of copies with the sole purpose of profit doesn’t mean you have to.

When Pioneer news was announced, the Quiet Speculation Discord was abuzz with cards that are likely to spike. That could be your cue to buy your playset before the card spikes. Or, if the spike already occurred, you could get a feel for how likely such a spike will stick or if the price will retrace. Perhaps some patience would yield a more attractive entry point. MTG finance can help with such assessments.

For example, within the Quiet Speculation Discord, there was much abuzz regarding what cards would be safest to buy given no one could really predict the metagame. Rather than go after niche cards that fit only into one strategy, some Insiders had recommended sticking to cards that could fit into multiple strategies. This especially applied to the lands. Therefore, you may have taken that as your cue to pick up a playset of each Kaladesh Fast Land as well as Mana Confluence. These are likely to be played across the format thanks to the banning of Fetch Lands, and may be worthwhile pickups.

As bad as it may feel, the old mantra “If you can’t beat ‘em, join ‘em” comes to mind. Not all MTG finance needs to be manipulative and exploitative. There are many ways to engage in the practice without catalyzing buyouts and re-listing cards at 2x their previous price. If nothing else, the awareness can save you the hassle and frustration of acquiring cards. Saving money be keeping ahead of trends can be just as valuable as profiting through speculation, while perhaps being less morally ambiguous.

Wrapping It Up

I would be remiss if I didn’t touch upon one last MTG finance event that occurred concurrently with the Pioneer announcement. This is the alleged leaks that made it into the community before October 21st. I can honestly say I knew nothing about the rumor. It sounds like those in the know may have speculated using MTGO in an attempt to acquire key cards ahead of the inevitable buyouts.

All I want to say on this matter is that it reflects very poorly on the MTG finance community. This led to more negative press. Let’s face it: the community didn’t exactly need more reasons to be hated. But please be aware that even bad press still places attention on MTG finance. It draws attention to the practice of speculation and the potential rewards for doing so. To use the sleeping analogy, putting down the practice can unintentionally keep it awake.

This is why I preach passive, persistent engagement with the community. To ignore MTG finance altogether is to voluntarily pay higher prices whenever news hits the wire. By remaining in touch with the community, we can be aware of trends. From there, the decision on how to act is upon the individual. As long as you’re comfortable with the decisions you’re making, you can remain engaged with the hobby without violating any personal morals.

This fine line may be the best way to engage in the hobby going forward. Or else, accept the fact that speculation practices will persist and higher prices will be the result.

…

Sigbits

- I thought Dual Lands were all dropping steadily in price. Yet, out of the blue, Card Kingdom puts Unlimited Tundra on their hotlist. Though, to be fair, their buy price is only $390 whereas ABUGames’ is $526.50 cash. Despite dropping their buy prices on many Old School cards, it appears ABUGames is still aggressive when it comes to Unlimited Dual Lands. Their Near Mint cash number on Unlimited Underground Sea is most impressive, $947.70!

- Not long ago Card Kingdom had Guru Islands on their hotlist. This week I noticed Guru Mountains show up, sporting a $210 buy price. I’m not sure how this compares to other online vendors, but it does reflect a recent increase in demand for the card to suddenly see it on Card Kingdom’s hotlist.

- On the negative side, I’m surprised to see Card Kingdom’s buy price on Judge Promo Mana Crypt to drop so low: $95. It remains on their hotlist, but who would sell any version of Mana Crypt for less than $100 nowadays? The card has been hot for a while now, and I don’t think it retraced that drastically. ABUGames pays $124 and change for the same card. The fact that Card Kingdom pays $130 for the EMA version but only $95 for the Judge version tells me they must have a real imbalance in supply.