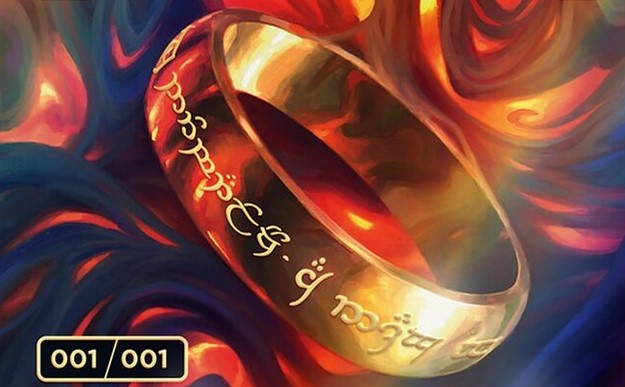

It appears serialized cards are here to stay, and every time Sig opens social media, he sees more of them. This week he explores the future of these novelties.

Mana Crypt

Tony’s shining a spotlight on another local game store: Pack Fresh in Amelia, OH. How do they get the gathering together and make the Magic happen?

Tony’s shining a spotlight on another local game store: Knighthood Games in Cookeville, TN. How do they get the gathering together and make the Magic happen?

This week Sig shares his thoughts on Double Masters 2022 preorder prices and his optimism for the secondary market. Where are preorder prices headed?

Paul examines an unusual piece of Magic media, the paperback novels from Magic’s earlier days, and explores the collector’s value in such a product.

It’s no surprise some older cards have peaked and are now pulling back. What DOES surprise Sig is that some cards are back on the climb and nearing previous highs. Why the split? This week, Sig looks at the numbers.

When spoiler season started, the community panned the Double Masters for having underwhelming reprints. Since the rocky start higher-value cards have been spoiled, increasing the set’s EV. This week Sig looks at the numbers, making his initial judgment of the set.

David takes a look back at Mystery Boosters, going in-depth on the reprints that mattered the most.

The unthinkable has happened: MagicFests for all of 2020 have been cancelled. When Sig predicted this possibility 3 months ago, he didn’t seriously think it would happen. He’s dusting off that article and updating his predictions for Commander card prices going forward.

You may be tempted to walk away from Magic finance during this time of uncertainty. Sig doesn’t think that’s the ideal strategy. This week he shares creative ways he’s engaging in this soft market in order to refresh his collection and maintain liquidity.

When asked to write about COVID-19’s impact on Magic, Sig did his best to speculate on potential outcomes. Now, two weeks later, the pandemic’s impact has come more into focus, and Sig has a clearer viewpoint on how this is likely to unfold in the world of Magic finance.

Emotions. Whether we’re speculating on Magic cards or stocks, we all have to handle emotions in order to make optimal choices. This week Sig explores examples where emotion led to poor investments to help avoid these pitfalls in the future.

It’s unavoidable: the Coronavirus is all over the news. Things can become quite dire, and Magic is far from important in the grand scheme of things. However, this is a Magic website–this week Sig explores the virus’s potential impact to MTG finance from both an optimist’s and a pessimist’s lens.