Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

When Quiet Speculation’s content managers asked me to write about COVID-19 two weeks ago, I immediately assented. This topic was right in my wheelhouse, giving me the opportunity to explore what-if scenarios and market dynamics.

In signing up, however, I wasn’t sure which direction things would tip. At the time, I prevaricated by sharing both optimistic and pessimistic points of view. “Magic prices could increase or decrease” was the long of the short of my message track. There was simply too much uncertainty.

Not anymore.

Things have become a bit clearer to me over the last two weeks. The United States declared a state of emergency, other countries have taken even more drastic measures (and I think the U.S. is on that same trajectory), and in some localities, the restrictions are even tighter. In my home state of Ohio, gatherings over 100 are being shut down and schools are closed for at least three weeks.

With this new information and related announcements in the world of Magic, it’s time to revisit this topic with more definitive predictions of what could unfold next.

COVID-19’s Direct Impact

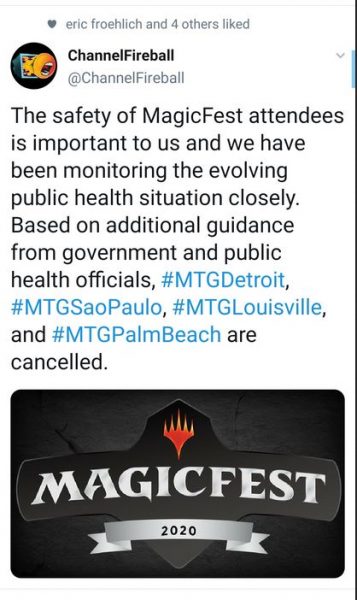

Events with large gatherings are shutting down across the globe. Conferences are getting canceled and major sports are all suspended. It comes as no surprise, therefore, that MagicFests and Star City Game Opens would also be canceled for at least a few weeks.

In addition to these cancellations, WOTC has canceled the Players Tour Finals, rescheduled upcoming regional Players Tour events, and canceled the Mythic Invitational. Some events may be shifted to online.

MagicFests are canceled through mid-April. Meanwhile Star City Games has only canceled events through the end of the month. In both cases, I don’t think the cancellations are over. Without getting into sophisticated models predicting the spread of the disease, I’ll merely cite that it is taking China about three months to get their outbreak under control. I believe in the U.S. we are going to see these profound measures lasting about as long (or else the spread of this disease will far exceed what it did in China). Be ready for further cancellations.

Impact on Magic Finance: Short Term

To understand the short-term impact of COVID-19 on Magic finance, I look at both the supply side and demand side individually.

On the one side, it does not take a crystal ball to predict that demand will diminish. If there are less Magic tournaments, then there will be less demand for tournament staples. Personally, I’d prefer to avoid even local events to help stop the spread of this disease.

Some players will surely still attend Friday Night Magic (while it’s allowed) and will continue to meet with their Commander playgroup for regular battles. Demand won’t completely grind to a halt—especially on casual and Commander staples. But there must be less buying taking place during this tumultuous time, if only because some people will be laid off while others will be reprioritizing their capital to purchase more critical items such as extra food and paper products.

On the other side of the coin, we have an impact on supply. Many large vendors use MagicFests and SCG Opens to restock on popular cards. They implement “hotlists” to advertise the cards they need most, in the hopes of acquiring sufficient copies to meet demand. Large events like these also enable the flow of cards via trades with people not seen on a regular basis.

Therefore, there could be a shortage of supply to match the drop in demand. The result: Illiquidity. The market could temporarily become very illiquid—it will be harder to convert large quantities of cards for cash (without offering bargain pricing). Likewise, it will be harder for some large vendors to restock sufficient quantities of cards.

In this scenario, I predict prices will drop in the short term. This won’t manifest as a crisis whereby prices tank on MTG Stocks on a daily basis. Instead, we’ll see fewer transactions take place. Those most desperate to raise cash will be forced to drop pricing. But the majority of players are likely to keep their prices where they’re at, and will simply see fewer sales in the coming weeks. Thus, the flow of cash will decelerate.

Impact on Magic Finance: Long Term

Despite my belief that the COVID-10 pandemic will get worse before it gets better, we know this will eventually pass. When it does, the world may be slightly different, but there is one truth I’m counting on: a return to normal will unlock pent up demand for certain goods.

A pandemic may stop me from buying dress clothes for work, a new car, or new Magic cards…at least for a little while. But it’s not going to change the fact that I will have to return to work, my car isn’t getting any younger, and my Magic decks could use some upgrades. These purchases will be postponed due to personal quarantines and event cancellations, but the purchases will inevitably happen at a later date.

Therefore, I believe there could actually be a small surge in buying once the pandemic is over and life returns to normal. Barring a major economic recession whereby players are losing their jobs in numbers, I’m actually quite optimistic that the liquidity will return to the market in spades.

What’s more, the current situation could make for an interesting opportunity for Magic’s newest releases. With less demand at the moment, perhaps newly released, print-to-demand sets will have suppressed supply due to the tapered demand.

This is what happened during the Great Recession in 2007—sets released during this timeframe were in shorter supply. This explains why any tournament playable card from Future Sight can become quite costly. This is also why so many tribal commons and uncommons from Lorwyn block are priced above bulk. Today’s demand for these cards, combined with shorter print runs, has led to higher prices.

Could the same trend happen with Theros Beyond Death or Ikoria Land of Behemoths? If this pandemic stunts demand for long enough, it certainly could! Perhaps sitting on some product from these sets is a worthwhile investment if you can swing the cash. Better yet, maybe some of the more premium products released this quarter are worth picking up.

Word of Caution

There is one factor that gives me pause when I think about Magic’s recovery from the COVID-19 pandemic. During this slow-down, I suspect more players will turn their attention away from paper Magic and toward Arena and Magic Online. This is great for Hasbro because they’ll still have income coming from the game.

However, for those who prefer to deal in cardboard, it could be a detriment. What if players who pick up Arena decide they like that better than paper Magic? Could this trend accelerate the inevitable, gradual transition from paper to digital play? Could this motivate Wizards of the Coast to favor innovations tailored toward the digital player rather than the analog player?

These are important questions to ponder.

Wrapping It Up

Everyone will have to make decisions in accordance with their own financial situations. During this time of turmoil, I expect the market’s liquidity to drop significantly. But the slowing transactions will be short-lived relative to Magic’s age of 27 years. If Magic could withstand 27 years of tragedies, diseases, and economic meltdowns, then I’m sure it will be perfectly healthy coming out of this pandemic.

In the meantime, I’m prepared to see fewer transactions in the coming weeks. On the demand side, I have little reason to acquire new cards because I’ll not be playing at any events for a while. On the supply side, I don’t think vendors are going to be paying aggressively for cards if they’re not selling as many.

I closely monitor sale posts in the Old School Discord, specifically, and I’m seeing a flood of cards for sale. Granted, they’re still selling…but prices have softened a bit. For example, for a while I could not find an Unlimited Chaos Orb for under $500 if it was in one piece. Recently, I’ve seen a few hit the Old School Discord in this price range. Such data won’t be sufficient to create waves on MTG Stocks, but there will be pockets of weakening prices that folks may observe.

Rather than attempt to sell during this illiquid time, I will simply hold and hope. I expect the pandemic will eventually pass, hopefully in a couple months, and pent-up demand will catalyze growth in the market. When that happens, I’ll have my opportunities to sell. Until then, I’m content to wait and I’d recommend you do the same. Just make sure you do your best to dodge all these reprints in the meantime!

…

Sigbits

- There are still a bunch of Dual Lands on Card Kingdom’s hotlist, still, but they’ve all seen a drop in pricing. Underground Sea ($280), Volcanic Island ($270), Tropical Island ($215), Bayou ($170), Badlands ($150), and Taiga ($100) all make the list. These are very liquid cards and should hold up fairly well even in a recession, but their pricing will probably see some softness in the short-term.

- Card Kingdom must have fully restocked their Mana Crypts because they’re not paying nearly as aggressively as they once were. At one point they were paying upwards of $190 for the book promo, and now their buy price is down to $140. They also have the promo ($140) and EMA ($100) printings on their hotlist but at significantly lower numbers.

- There must have been a small uptick in Sliver demand, at least on a local level, because Card Kingdom has both Sliver Queen ($70) and Sliver Legion ($55) back on their hotlist. Casual and Commander cards will probably hold up best during a pandemic because you don’t need a major tournament to play these formats with a couple friends.

With the ports of Los Angeles closed, China 6 weeks behind in their shipment orders, our own food production factories being systematically shut down to avoid mass infection. Our supply chains will have massive stop and go volatility. We can’t stop the spread but we can slow it down while people get infected in orderly waves over time. Most will be fine but 12 per cent will need immediate medical attention. All our truck carries including the United States postal service as well as private companies will need to work together to get food, medical equipment and supplies shipped all over. If our hospitals are over run, Magic will not be even an after thought. It is vital players stay at home immediately. I personally believe we will see massive selling of Magic product to offset the increase in price of common household goods which are worth their way in gold during the pandemic. Short term I see people panic selling their of non essentials and further panic buying and hoarding of essentials. Cash or credit is king now and this will most definitely become a buyer’s market in Magic. It’s 12 to 18 months to vaccine. Which means that if we truly want things to go back to normal, we have to either get vaccinated or

become infected, recover, and have developed antibodies and immunity for the virus. We also don’t even know how long that immunity could actually last. Don’t even mention a mutation of the virus! No no my friend we are in the beginning, we are just starting this Magic bear market. No one will visit another’s home to go play Magic once they see the infection numbers and the initial over capacity at hospitals on tv. It will take many weeks for food production facilities as well as shipments from China to even start arriving to equip our homes and hospitals. Guess where we and India get most of our raw medical ingredients and medical manufacturing? China! We need to be proactive and positive but we can’t possibly believe the Magic secondary market will not tank.

“Panic selling their non-essentials” C’mon. I’m not selling my TV to hoard toilet paper. Just as Sig says above, there’s a liquidity problem. If I can’t leave the house, I’m not buylisting my modern staples so I can buy a bunch of overpriced hand sanitizer? Price gouging is illegal, and Amazon and other online retailers have halted those practices. I realize the situation is going to get worse before it gets better, but panic leads to more panic. Break the cycle.

I meant non essential investment assets. Meaning people selling those asset classes to shift money to more important things. Not a tv to buy toilet paper. I should have been clearer to avoid the extreme examples people like to make. No income for 6 to 8 weeks even with government help is a scary idea for many Americans. Raising a bit of extra money is never a bad thing. Price gouging is still rampant and it will not stop, either off line or online. Amazon has allowed illegal counterfeit products to proliferate for years and ditto for eBay. Illegality is one thing and effective enforcement is another. You can buy prescription medication from Ebay long before the seller is shut down and he reopens another account. I hope my response clarified my mistake in making it seem that my original post meant selling non essential ‘anything’ to raise money. Stay safe and in the comming days stores will implement ration controls, so that can effectively stop price gouging. The cycle of panic can stop when the incompetent and late mishandling of this pandemic situation comes under control. Not only did the Administration mess this up but we as Americans as a whole were far too complacent when we saw what was happening in China. We sure as hell got a wake up call.