Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Last month, I began an article series detailing the profound differences between the stock market and the Magic market. There are numerous reasons why the parallel between the two only runs so deep; underneath the surface, differences in regulation and trading complexities make the two assets like night and day.

Now, amidst the coronavirus panic, I’ve observed one commonality between the two assets: emotions. It seems, whenever money is involved, emotions play a major role in investor’s decisions. This is unfortunate, because emotions tend to lead to suboptimal choices. This week I’ll explore how these emotions are manifesting in the stock market, drawing a parallel to the Magic market with a word of caution.

Stock Market Fear & Hype

We’ve seen this show hundreds of times. A new card is spoiled, or a breakout occurs in the Modern metagame, or a new Commander product is released, and suddenly demand for a specific card spikes. Speculators swarm, and the buyout ensues, leading to significant price gouging for the particular card. This happened recently with Flash and Orim's Chant.

What did surprise me last week, however, is observing this same trend occur in the stock market. As the coronavirus spreads, nearly all stocks are taking a nosedive. Volatility has taken hold of the market, leading to gigantic swings upward and downward on a daily basis.

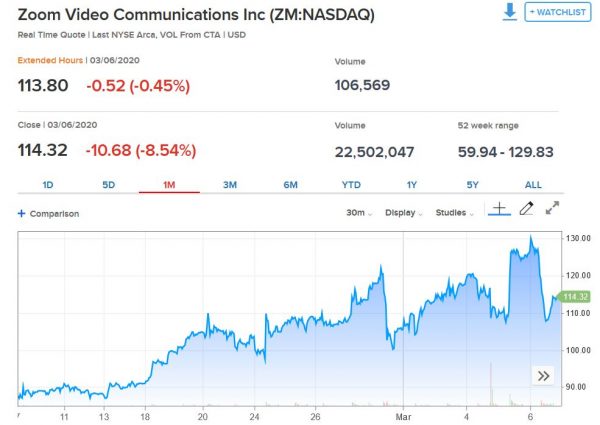

Meanwhile, a tiny basket of stocks have seen their prices suddenly spike. I’m referring to stocks that enable work-from-home environments for corporations. This includes stocks like Zoom (ZM) and Slack (WORK).

Does this look familiar? Zoom’s stock had gone from $90 to $130 in just a couple weeks as the virus began to spread. Don’t forget, the stock market is down over 10% in that same time frame! Over the last couple days, the stock sold off sharply, giving back some of its gains. This volatility is being driven by hype (articles written about the stock) and speculators grasping at a singular thesis.

I’m not here to comment on the stock’s investment prospects (Disclaimer: I own a small position in WORK but not Zoom). This is not investment advice and you should consult your financial advisor before making investing decisions.

Now that the disclaimer is out of the way, doesn’t that stock chart look familiar? There’s a thesis that forms around a given stock, speculators buy in, the price spikes, and then there’s a quick sell-off afterward. Someone could have told me the chart above was for Orim's Chant and I would have believed them.

This is the emotional trap that investors can fall into when dealing in stocks. I, myself, fell prone to emotions when I purchased Slack’s stock—I bought into the hype, and am now looking at red ink in my portfolio. If I had exercised patience and eschewed emotional influence, I could have recognized the stock was spiking due to short-term speculation and made a more informed, better-timed purchasing decision.

The Magic Parallel

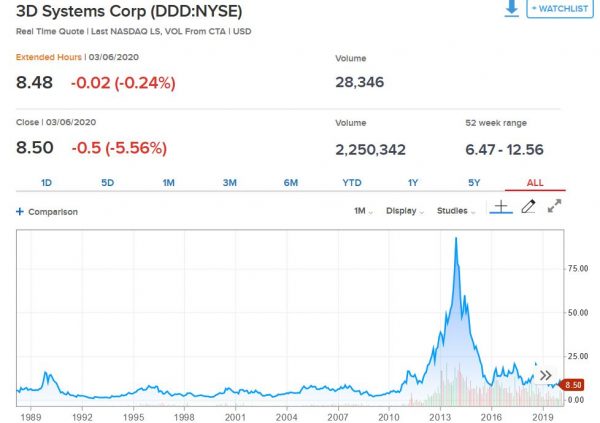

Stock market speculation happens more often than you’d think. I’ve seen the same hype-train take off with various trends: solar energy, marijuana, and 3D printers. Check out the price chart on 3D Systems (DDD). Talk about hype!

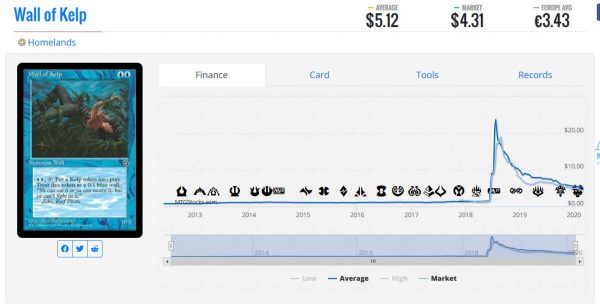

This chart parallels perfectly with many Magic cards over the years. One example I’m particularly fond of is Wall of Kelp, simply because I have a soft spot in my heart for Homelands.

When Arcades, the Strategist was spoiled in Magic 2019, speculators flocked to any wall that looked semi-playable. Wall of Kelp had a lot going for it: it’s a wall itself, it’s on the Reserved List, and it has a special ability to make additional walls every turn. It was the little value engine that could, and this drove its price (temporarily) up towards $20.

But, just like with 3D Printing, people quickly learned Wall of Kelp was not the second coming of Rhystic Study, and the card plummeted back down to a reasonable $5 (it’s still arguably the most valuable card in Homelands, next to Didgeridoo and Koskun Falls).

These buyouts are very one-dimensional. In other words, there’s a single catalyst that generates the hype. In order for a higher price to stick, the thesis that drove the card’s price up needs to become a permanent fixture. Speculators realized the 3D printer wasn’t going to proliferate into every household like the television, and 3D printer stocks sold off aggressively. In the same way, Wall of Kelp didn’t evolve into the most popular inclusion in Arcades decks (it’s not even a top card on EDHREC). Once the hype died down and emotions were drained, prices returned to where they should be.

The Lesson

What we can glean from this parallel can be articulated succinctly with a single heuristic: before conceding to emotions and buying into hype, ask yourself first if your investment thesis involves a singular catalyst. Is there only one reason this stock or card is spiking or can spike?

If the answer is yes, then you need to be confident that one thesis will play out completely. Were you and your friends and neighbors rushing out to buy 3D printers (no offense to those who did, I love the 3D-printed knickknacks my friend made me)? This could have been a warning bell to investors in 3D printing stocks.

Likewise, do you really think Wall of Kelp will become extremely popular in Commander? I don’t know about you, but if I asked myself that question when Arcades was spoiled, I would have quick concluded that a deck built around walls a) would not be one of the most popular Commander strategies and b) would not be so desperate as to play Wall of Kelp. After all, blue has far superior card-drawing engines that Wall of Kelp plus Arcades is merely “cute”.

This should have triggered a loud enough warning bell to dissuade speculation. Of course, this doesn’t mean you shouldn’t have went to your secret online store or favorite LGS to buy up their $0.50 copies—clearly, the card was going to be more in-demand than ever before. But anyone who paid more than a few bucks for the Homelands card is sure to be left scratching their head.

Now, if you have a speculative idea and there are multiple potential catalysts then it merits deeper thought. A card that can see play in both Commander and Pioneer offers a more attractive demand profile, which could be bought into with higher confidence. Alternatively, if a one-dimensional card does show tremendous promise, then it may be smart to buy in. For example, when Felidar Guardian was printed, it didn’t take a Ph.D. to realize Saheeli Rai was going to break Standard. These are clear “buy” situations.

The key to avoiding the pitfalls of the duds and to focus more on the hits is to remove emotions. By asking yourself questions like the examples I presented above, you may be able to take your emotions out of the equation.

Wrapping It Up

Whether it’s Magic cards or stocks, emotions can interfere with logical investment choices. This is one consistent facet of both asset classes.

It can be difficult to combat emotions in situations where hype is extreme—whether it is when a new Commander is spoiled or if a worldwide coronavirus is necessitating alternate working arrangements. The best thing we can do in such situations is to take a step back and ask ourselves two questions. First, is the buying (or selling) thesis one-dimensional? Second, is the thesis likely to become a dominant force for the long-run?

In the case of Slack Technologies, I believe in the company’s long-term disruption to how corporations operate. I’ve used the product myself when interacting with this website’s content team, and I have heard others sing its praises. The coronavirus will catalyze a shift that I believe was already happening.

In the case of cards like Wall of Kelp, the thesis doesn’t hold enough water (no pun intended). There aren’t enough Commander players who want to attack with walls and want the cute synergy offered by a mediocre card-drawing engine. This is what made cards like Wall of Kelp and stocks like 3D Systems poor investment choices.

Hopefully, with this lens on, we can make better speculative investments no matter what asset we’re researching. With any luck, we’ll discover the next Amazon stock or Roil Elemental while avoiding the 3D Systems or Wall of Kelp!

…

Sigbits

- After last week’s buylist increases at Card Kingdom, a few cards I track have tapered off a bit. The Dual Lands, Mana Crypt ($150), Gaea's Cradle ($215), and Grim Monolith ($85) have all decreased. I’ll continue to watch these closely to see if this is a trend or simply an adjustment that reflects weekly variation in CK’s inventory.

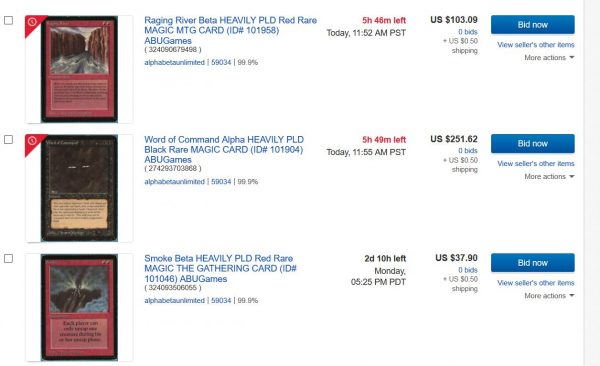

Rather than share new buylist prices on Card Kingdom’s site, I want to flag an ongoing phenomenon I’ve noticed with ABUGames. They continue to sell Old School cards on eBay via auction. They start the bidding high and if the card doesn’t sell, they re-list for approximately 10% less. They do this every few days until the card does sell. This is essentially a Dutch auction style, and it can lead to some attractive prices on less-than-playable cards.

Here are a few example auctions I’m watching, just to give you an idea.