Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

It’s official—as of last Friday, the holiday shopping season has begun. Retailers far and wide are offering deep discounts to entice shoppers to stop by and spend their hard-earned cash. Doorbusters provide the initial motivation, and once shoppers are inside they are bombarded with irresistible deals on goods they didn’t even realize they needed.

Above all stores, there are two, in particular, I despise shopping at, especially this time of year: Ikea and Kohl's. The former drives me crazy because it’s virtually impossible to get in and out of an Ikea in under ninety minutes. The labyrinth-like layout ensures you walk past a maximum number of wares; some are bound to catch your eye.

The latter frustrates me to no end because of the pricing mechanism they employ: mark everything up and then offer “discounts” to help the buyer feel they’re getting a great deal. Every time I walk out of Kohl's, the cashier will say, “Thank you for shopping at Kohl's. You saved $82 on your order!” As if anyone in the history of the store ever paid full price on the goods I just purchased. The strategy is effective, but the deception drives me insane—if the prices were marked down fairly to begin with, I wouldn’t need to constantly hunt through my email and snail mail for coupons. It’s all so tedious.

It seems this Kohl's pricing strategy has begun to spread to the Magic market. In honor of Black Friday and Cyber Monday, this week I’m going to share a numbers-based analysis of some of the game’s largest online vendors to really dig into what’s a true “deal” and what is the Kohl’s effect.

Just a heads up: this article will be data-based and helpful, but it will be riddled with a cynicism that cannot be avoided.

Blanket Discounts

This past Black Friday, multiple vendors opted to offer a blanket discount or cashback reward for any purchase made on their website. Channel Fireball opted for 12%, Star City Games went with 15% off, and Card Kingdom incentivized via 10% in-store credit back (matching TCGPlayer).

These offers seem generous in their global applicability until you scrutinize prices more closely. After all, these major vendors often demand a modest premium above the rest of the market due to their top-notch customer service. So while these discounts certainly make shopping more favorable to the buyer, they aren’t exactly the doorbuster markdowns common this time of year.

Let’s choose a mainstream example: Oko, Thief of Crowns, one of the most dominant cards in tournament Magic right now. Channel Fireball lists the card at $50. I subtracted 12% for their discount and then added 7% for sales tax. Shipping would be free, so the total is $47.08. In similar fashion, I can calculate the out-the-door price from other online vendors using their Black Friday discounts:

- Channel Fireball: $47.08

- Card Kingdom: $48.50 ($49.99 + 7% tax, plus $5 back in store credit)

- Star City Games: $45.67

It’s true that all three online vendors above are offering a discounted price, even after taking tax and shipping into consideration. However, a comparison with TCGPlayer quickly reveals the above prices still aren’t that great. TCG Low for Near Mint copies is $43.40. Applying the same 7% sales tax assumption and you’re at $46.44. It’s true that Star City Games’ deal gives you a better price, but you have to remember TCGPlayer also offered 10% back in credit. Subtracting that 10% off the price nets $42.10, more than $3.50 below the best Black Friday deal.

While there are surely cases where these blanket discounts make for a compelling purchase, more often than not these discounts don’t really give you a deal worth writing home about.

Marking Down Old School Cards Doesn’t Count

The other deep discounts I’m seeing recently are on Old School cards. As an Old School player and collector, this should be exciting, right? Here’s the problem: the rest of the market has already adjusted prices downward to reflect the softening market. Larger vendors have been reluctant to adjust their pricing. But listing an Old School card at its peak-hype price, and then boasting a 40% discount doesn’t make the deal any more compelling.

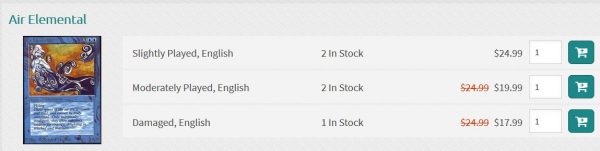

Then you have markdowns like these, on Channel Fireball’s site. See if you can figure out what’s wrong with this picture:

So we have Slightly Played Beta Air Elemental listed at $24.99, that’s not too bad. Moderately played copies are marked down $5 to $19.99. Wait a second… shouldn’t MP copies be cheaper than SP copies? How is that a markdown? It looks like they’re just using the SP price over and over again, and then crossing it out and putting the actual price. No one would pay $24.99 for a damaged copy, so that $7 discount isn’t really a discount.

By the way, HP copies of Beta Air Elemental are listed at $10 on eBay. That $7 markdown, combined with a 12% coupon code still doesn’t make for an attractive price.

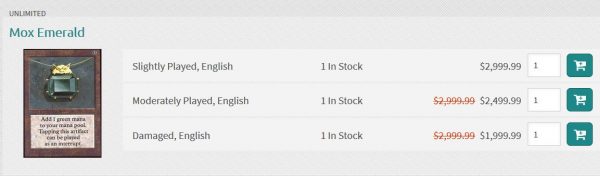

While this is mostly tedious on cards like Beta Air Elemental, it becomes egregious when looking at high-end cards, such as a piece of Power.

Look at that $1000 markdown on damaged copies of Unlimited Mox Emerald! It looks like a deal. However, I've seen these sell for $1400-$1500 on social media recently.

I’ve seen similar discount techniques applied by Star City Games during weekly specials. Their discounts can sometimes be very compelling; other times, their markdowns still don't enable a competitive price relative to the rest of the market.

Beta Kormus Bell: A Case Study

I purchased one card on Black Friday—a Beta Kormus Bell. I wanted a copy to try in my Mono Black Old School deck. It looks like it’d be a fun card and a decent finisher.

Obviously, demand for this card is low. Not many people are actively looking for a played Beta Kormus Bell. I was hoping to leverage one of the Black Friday deals to pick up a cheap copy.

Channel Fireball had SP copies listed at $89.99 and Star City Games had Played copies at the same price. Card Kingdom was sold out completely, and I didn’t have any trade credit immediately available for ABUGames. After applying their respective discounts, my total price was about $84.75 and $79.67, respectively at Channel Fireball and Star City Games respectively. That’s not too bad considering TCG Low is $81 plus tax for a heavily played copy.

I had my cart ready, the coupon code applied, and I was just about to check out at Star City Games to make the purchase. Before I did, I decided to check eBay one last time to see what was listed there. It turned out ABUGames had a heavily played copy listed at auction with a $48.75 starting bid (no bidders). I submitted an offer of $48 and they accepted. After shipping and tax, my total cost was $51.90, or $51.42 if I subtract the 1% eBay bucks earned for the purchase.

Sure, this was a heavily played copy and not slightly played like Channel Fireball’s. But $51 is a much more compelling price point for a card I intended to shuffle in a deck. As a result, I didn’t take advantage of any Black Friday special this past weekend—the discounts just didn’t create a compelling enough proposition.

Wrapping It Up

In years past, stores offered compelling discounts on specific cards. I remember shopping around and purchasing singles priced below TCG Low pricing. Those discounts are exciting, and make browsing Black Friday specials worthwhile.

This year, I didn’t see as much of that. Instead, major vendors applied a blanket discount or store credit back to try and entice buyers. This works well on peer-to-peer sites like TCGPlayer and eBay, but I have to wonder how much of a bump in sales major vendors like Channel Fireball and Star City Games saw. Discounting retail prices tends to fall short because the starting prices were a little high to begin. It’s the Kohls effect applied to cardboard.

Because the math didn’t work out, I failed to take advantage of any store's Black Friday special. The discounts just couldn’t make prices competitive enough. The deals that did catch my eye were discounts on sealed product. Troll and Toad had Rivals of Ixalan bundles for $17.95, for example. Magic 2020 bundles were discounted to $22.95. These are both cheaper than what you’d pay buying from TCGPlayer.

Cool Stuff Inc had Ravnica Allegiance and Magic Origins Bundles marked down to $26.99 and $27.99, respectively. Those prices are pretty solid as well.

Net, the best deals of the weekend may have been in sealed product rather than singles. Now my question becomes, what does this all mean? Do vendors refuse to take losses on singles? Are they anticipating a rebound in Old School prices? Is there latent demand for singles, precluding vendors from marking prices down too aggressively? It’s tough to say.

All I know is that sales this year looked quite different from last year, and it left me shrugging my shoulders. Sure, a blanket discount is nice, but it doesn’t make for the exciting “doorbuster deals” Black Friday is known for. Channel Fireball offers blanket discounts on their site almost weekly anyway, and there’s a perpetual 5% off coupon. That means the incremental discount last weekend was really only 7%, which is pretty much eaten up by sales tax.

Card Kingdom never offers blanket credit back, so that was admittedly special. But I shop from Card Kingdom regularly as it is—if there was something I wanted from Card Kingdom, I would have already purchased it. The 10% back wasn’t enough to motivate me to open my wallet again.

Hopefully, we haven’t seen the last of the deep discounts and individual card markdowns. Those tend to yield better opportunities. In the meantime, I’ll stick to shopping eBay and TCGPlayer while leveraging the store credit arbitrage that has worked so well for me over the past couple years.

…

Sigbits

- I’ve noticed Card Kingdom’s buy price on a couple Old School cards have recently shot higher. Mishra's Workshop and Candelabra of Tawnos are two examples, and they both top Card Kingdom’s hotlist today. They pay $980 and $420 for the two Antiquities Reserved List cards, respectively.

- Card Kingdom has also been upping their buy price on Gaea's Cradle lately. Last week they were offering $200 on their hotlist. Clearly they aren’t getting enough copies in at that buy price, because they upped their number to $225 over the weekend. Could this be another signal of a recovering Reserved List market?

- One card that hopped onto Card Kingdom’s hotlist recently is the Mythic Edition Jace, the Mind Sculptor. Their buy price is currently $130. That may seem interesting at first glance, but TCG low is $205 so I suspect Card Kingdom will have to bump that buy price further if they want to take in a few copies.