Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

There was a brief couple weeks at the beginning of the COVID-19 outbreak in America, when I didn’t track Card Kingdom’s buy prices. They had to put a pause on their selling, so they dropped their buy prices dramatically. The reduction in buy prices moved in tandem with the selloff in the stock market.

Since then, both the stock market and the Magic market have rebounded robustly. I’m back to monitoring Card Kingdom’s buy prices on a daily basis. I’ve also resumed sending in trade orders to ABUGames, exploiting corner cases of arbitrage where I can find it.

As recently as yesterday (Sunday, August 2nd), Card Kingdom increased their buy prices on some Reserved List cards to the highest they’ve ever been on the site. This week I’m going to provide some updates, highlighting where the pockets of strength are, and where we may see the next wave of increases based on the “out of stock” nature of certain cards.

Dual Lands Climb Again

I’m guessing the relentless climb in Dual Lands stems from persistent demand from Commander and Cube players alongside an inelastic supply curve (prices increase, but supply does not increase in kind). There are no major events where the everyday player can sell their cards (GenCon was just canceled) and not everybody is comfortable mailing cards into a buylist.

Thus, here we are seeing buy prices on Dual Lands hit all-time highs. Here’s the breakdown (Revised Edition, Near Mint):

Underground Sea: $360

Volcanic Island: $295 (this isn’t quite at its high but still close)

Tropical Island: $265

Bayou: $230

Tundra: $210

Badlands: $185

Savannah: $170

Taiga: $170

Scrubland: $150

Plateau: $120

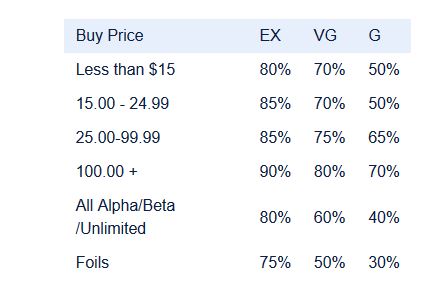

Not every one of these prices is the highest ever, but they’re all quite strong. Don’t forget, Card Kingdom’s downgrade for condition is very reasonable on these cards:

Since I’m not talking about Alpha, Beta, or Unlimited Duals here, and all buy prices are over $100, you get Card Kingdom’s best rate on EX, VG, and G condition cards. This makes Card Kingdom’s new buy prices highly attractive.

Or does it?

I will admit I saw the $170 buy price on Savannah and immediately thought about shipping my heavily played copy in for some cash. $119 after downgrades is more than I can remember ever being offered for a heavily played Savannah. But then I checked TCGplayer: the cheapest copy there, in Damaged condition, is listed for over $155. Therefore, I could probably sell my copy at $150 and net $135 or so after fees.

The cheapest Near Mint Savannah is listed on TCGplayer at around $200, or $180 after fees. So even nicer copies could probably fetch a little more than Card Kingdom’s buylist (though I’d argue there’s value to guaranteeing immediate sale to a buylist rather than posting and waiting).

This is all to say one thing: we may not be seeing peak Dual Land buy prices just yet. I doubt a wave of supply will suddenly hit the market unless prices climb higher. And it’s interesting how non-blue duals have climbed so much whereas some of the blue duals have moved far less—could blue duals be due for a bump up in step with the non-blue ones? Tundra’s buy price is only $40 more than Taiga and that seems abnormal.

It’ll be interesting to see where things go from here but for now at least, I’m not selling my duals.

Other Soaring Buy Prices

Outside of Dual Lands, other Reserved List staples are also relentlessly climbing higher and Card Kingdom’s buylist is following in kind. When I jump over to their hotlist this Sunday morning, I readily see some fresh new highs. Noteworthy buylist increases include:

Gaea's Cradle: $380 (higher than Underground Sea!)

Mox Diamond: $260

Lion's Eye Diamond: $190

Grim Monolith: $135

Wheel of Fortune: $140

Gilded Drake: $135

City of Traitors: $110

Serra's Sanctum: $95

Survival of the Fittest: $95

Like before, these all aren’t necessarily at their exact all-time highs. But some are, and others are closing in. Some of these higher prices are probably (again) driven by Commander. But I can’t imagine Lion's Eye Diamond sees a ton of Commander play given its hand-discarding clause. Yet this one moves up in kind with the others.

I wonder if another factor driving up these prices is that we have another reprint set being spoiled and players are again reminded of the safety offered by Reserved List cards? Having chunks of your collection suddenly lose 30-70% of its value can be a feel-bad for some, and maybe they’re seeing these trends and are picking up Reserved List staples in kind?

I don’t want to rehash the old debate of whether or not Magic is a good “investment”. Instead, I’ll merely point out the past performance has been awfully compelling and this could be motivating some individuals to acquire Reserved List cards as an alternate investment. Perhaps added stimulus from the government during COVID-19 is adding fuel to the fire.

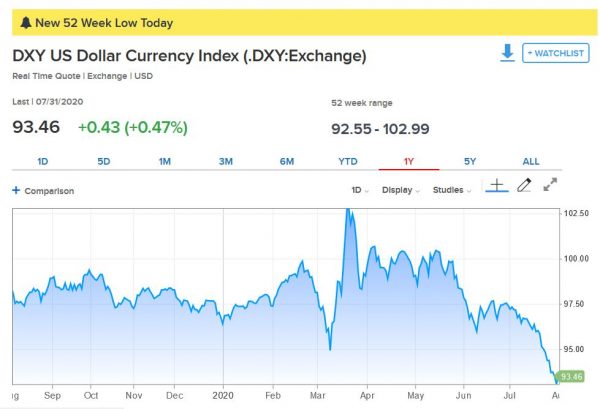

On top of that, the U.S. Dollar has weakened recently and this could be driving some high-dollar cards overseas. Perhaps the supply is dropping in the U.S. exclusively, and this is driving prices up? This could explain these new highs.

As the dollar drops, other currencies strengthen on a relative basis. Someone holding Euros, Pesos, or Yen have suddenly gained buying power from U.S. Magic shops. They could possibly make profit via arbitrage, and this could be driving up prices stateside.

Perhaps it’s just a combination of all these factors and more. But either way, the data doesn’t lie: prices on Reserved List staples continue to climb!

Not All Ships Are Rising…Yet

With the recent increases in Dual Land and Reserved List buy prices, I’m surprised to see certain pockets of the market are bucking that trend; particularly at Card Kingdom.

For example, I have a small collection of Arabian Nights cards that I would be tempted to sell if prices climbed enough. Something like Library of Alexandria has historically climbed in tandem with other Reserved List cards. This time around, that hasn’t been the case so far. Card Kingdom’s buy price on the card remains fixed at $780. They have a couple copies in stock, too, so I doubt they’re about to up that buy number.

What’s more, there are some heavily played Libraries on TCGplayer in the low-to-mid $700’s, where they’ve been for months now. The same goes for most Arabian Nights cards, in fact. Prices have not climbed on these nearly as much as they have on Dual Lands.

Another set that hasn’t seen much price action lately is Unlimited. There was a moment when Card Kingdom paid very aggressively on Power and Unlimited duals, but those days are behind us. Now they offer less-than-competitive numbers for these cards. $6600 for Black Lotus, $1650 for Ancestral Recall, and just $467.50 for Underground Sea? These prices just aren’t competitive.

But unlike the Arabian Nights cards, the difference here is that Card Kingdom is completely wiped out of the high-end Unlimited cards. Their buy prices are just too low to bring in sufficient stock. They do have a near mint Black Lotus for sale at $11999.99. They also have one Mox Sapphire and two Mox Emeralds in stock. After that, though, the next most expensive Unlimited card they have in stock are two G Shivan Dragons at $56 each. They are completely out of stock of every card in between (and there are a bunch!).

I wonder if someone will make the call to up buy prices on these cards soon. I imagine they should at least increase their buy and sell prices on Unlimited Dual Lands, right? This way the Unlimited copies keep pace with their Revised counterparts?

Are the high-end cards ignored because people aren’t wanting to spend $1000’s on a Magic card right now? Maybe there’s a sweet spot around $100-$300, a much easier pill to swallow? Maybe some vendors just aren’t interested in stocking up on such high-dollar cards at the moment? That would explain the underwhelming buy prices despite being out of stock. It seems like buy prices on Power are down across the board.

I have to imagine the rising tide will lift these ships eventually. When is a tougher thing to say, but I will definitely be following this market closely in the coming months and will report back any movement I observe.

Wrapping It Up

Dual Lands are more expensive now than they’ve basically ever been before. Other Reserved List staples in the $100-$300 range continue to climb in lockstep, including Mox Diamond, Gaea's Cradle, and Wheel of Fortune. These are all notching new highs as supply doesn’t get refilled as quickly as before.

However, the high-dollar cards such as Library of Alexandria and Power are not climbing. Their prices have really stagnated lately, and many vendors are offering pitifully low buy prices for these iconic cards (did I mention ABUGames is paying just $3861 in cash for a near mint Unlimited Black Lotus??).

There could be good reason for this discrepancy. I suspect players are willing to splurge $200 for a Dual Land to optimize their Commander deck, but less interested (or unable to) splurge $1600 for a piece of Power. The big question is, will the high-end cards eventually play catch up? The gap between a playset of Underground Sea and a piece of Power can only get so small before players may be tempted to make the trade. It’s this trend that I’ll be watching out for.

In the meantime, I’m holding the Reserved List staples, for the most part. I may sell a couple cards I’m less attached to; as long as COVID-19 shuts down all large events, vendors will have a tough time re-stocking and this will lead to higher prices. The weakening U.S. Dollar is another tailwind for card prices as buyers from overseas take advantage of their new buying power.

All this to say Reserved List staples have climbed significantly in recent weeks and I don’t see that trend reversing anytime soon!

I’m pretty new here but I’ll throw my two cents in. I opted to buy into some reserved list cards rather than buy the flashy new products which are selling at the same price. For instance I bought Taiga rather than Jumpstart and Tropical Island rather than Double Masters VIP. These are iconic cards that will only get harder to get while WoTC will continue to print super duper VIP boxes every year for eternity.

The Alpha, Beta, and Unlimited are settling down from a huge drop off during the past few years, so it’s unlikely that they’ll see any movement in the short term. But the fact that the other sets from Legends to Urza’s Saga are steadily climbing is good indication that the others will eventually follow. The market is healthy. I prefer to view it as a portfolio type investment where I can grow money gradually, especially now that the dollar might drop big time due to the pandemic. I recently bought a Mox Diamond in mint condition on Ebay for $330, which is now selling on Cardkingdom for 439.99$. I see no reason for selling it. Gaea’s Cradle is already at $629.99 and climbing. It may seem like chump change at the moment, but the way I see it the money’s protected and it’ll eventually pay off big in the long run. If you’ve had them all along, I think it’s better to hold on to them and see how far they will go.