Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

As 2020 comes to a close, all we can do is say “good riddance”. I can’t remember a year in my lifetime that has been so trying. Everyone knows about the virus and how many people it has affected. To combat its spread, the lockdowns and restrictions on capacity has driven unemployment up to 14%, settling to a still-high 6.7%. Not to mention the emotional toll all the quarantining has on our psyche.

Needless to say, this has been a very trying year.

Despite all of this, we’re staring at massive returns in assets across the board. It seems like everything has soared to all-time highs, whether it’s cryptocurrency, the stock market, or a physical asset. This week, I’m going to examine this asset value growth, speculate on some of the drivers of this price appreciation, and look ahead to 2021 to see if things will continue or reverse.

Asset Value Explosion

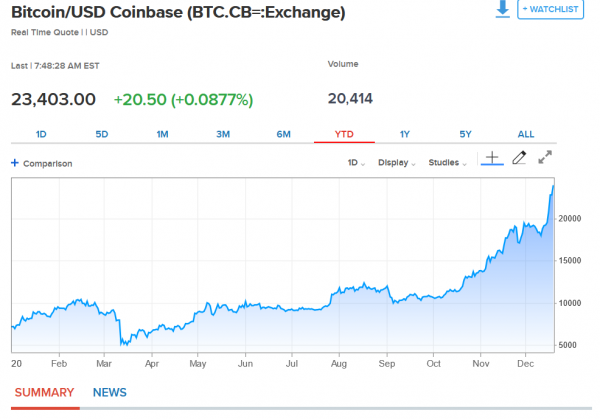

Before diving into Magic trends, let’s take a look at a few other assets first to clearly establish how broad these asset rallies are, in the face of everything going on macroeconomically. Take a look at these 2020 price charts for three different assets: Bitcoin, the NASDAQ, and a vintage video game index calculated on the Video Game Price Charting website (2020 is circled in red).

Everything has risen dramatically in 2020. Bitcoin is currently trading at its all-time high, roughly $23,000, after breaking the previous high in convincing fashion. The stock market has gone ballistic as many trendy tech stocks soar to lofty heights, sending the NASDAQ to an all-time high. Even vintage video games—something you’d expect less volatility out of given their physical nature—has seen tremendous growth in 2020. The index as a whole rose from $15.71 to $19.60 in 2020, a 25% increase in one year!

The list doesn’t end here, either. Pokemon cards have risen to nose-bleed levels as wealthy investors decide to participate in the collectible card game market. Star Wars (Decipher) CCG cards have climbed, with sealed product selling for never-before-seen prices. I suspect other collectible card games with any sort of following have also climbed in price.

Then there’s Magic, which is no exception to this trend. If we were to draw a Venn Diagram with two circles—Commander playable and Reserved List—the intersection of these two would be a collection of cards with skyrocketing prices.

Of course, many Reserved List cards from Magic’s first four expansions have taken off this year. This has also been the year of exploding demand for Collectors’ Edition copies of cards as budget alternatives for Old School.

In summary, almost every asset class has risen to values never-before-seen despite high unemployment and a fragile economy.

Attempting to Explain This Paradox

Why are Magic cards near all-time highs (we have seen slight retracement these last couple months) while so many families struggle to make ends meet in this pandemic? This seems paradoxical in nature—how can a weak economy equate to higher asset prices? Every time I see the stock market notch a new high, I’m baffled by its resilience.

I’m no economist, so all I can do is highlight a few potential catalysts and speculate on their impact. Despite my lack of qualification, I believe there are a few clear factors at play. This list certainly won’t be all-inclusive, but it will hopefully give readers a feel for the driving forces behind this asset explosion.

First, there’s the fact that, despite the high unemployment rate, many individuals are still gainfully employed and are now working from home. This population has seen a drastic reduction in weekly expenses: less dining at restaurants, less travel, less commuting to work, etc. So while they are still working the same job and making the same pay, their savings account is growing. Some individuals who fall in this bucket are most assuredly putting more money to work in various investable assets (into which I’m lumping Magic).

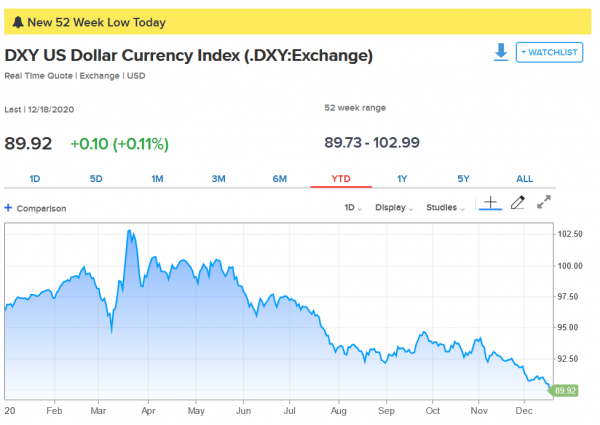

Second, there’s the U.S. Dollar index. The value of the U.S. dollar is at its 52-week low as of today.

As the U.S. Dollar weakens, other assets will grow in price on an absolute basis. This makes logical sense: as the dollar weakens, it’ll take more dollars to acquire a given asset.

Third, there’s the Fed (i.e. the federal reserve), headed by Jerome Powell. The Fed continues to be very market-friendly during this trying time. They’re keeping interest rates at virtually zero and continue to pump dollars into the economy by purchasing treasuries. Here’s an excerpt from the FOMC statement last week:

"In addition, the Federal Reserve will continue to increase its holdings of Treasury securities by at least $80 billion per month and of agency mortgage-backed securities by at least $40 billion per month until substantial further progress has been made toward the Committee's maximum employment and price stability goals. These asset purchases help foster smooth market functioning and accommodative financial conditions, thereby supporting the flow of credit to households and businesses."

“Accommodative financial conditions” is a key phrase here. Credit continues to flow alright, and at near-zero interest rates, providing liquidity for households and businesses in need. Speaking of which, this relates to a fifth factor at play: low mortgage rates. Mortgage rates are at generational lows, triggering record-high refinancing. When people refinance their mortgage, they generally reduce their monthly payment due to the lower interest rate. Instead of going to a bank’s bottom line, that savings is available for individual investment.

Speaking of individual investors, this leads to a sixth factor: new investors. With the advent of Robin Hood, stock trading has become completely commoditized. Now most brokers offer commission-free trading. This means nearly anyone with a few bucks to spare can buy stocks. The newest wave of investors are of the younger generation, and they’re scooping up shares in growing tech stocks, leading to these all-time highs we’re seeing in the NASDAQ.

Looking Ahead

What does this all mean for Magic prices in 2021?

I have no crystal ball, so the remainder of this article will be my opinion and is future-looking. So please take these predictions with a grain of skepticism.

I believe the next couple months will see a continuation of the slight reversion in Magic prices. So many cards skyrocketed in 2020 and really got ahead of themselves. This should normalize a little bit as the higher prices brings more copies out of players’ hands and into vendor inventory. We’ve already seen this unfold on Card Kingdom’s and ABUGames’ sites, where their recent buylist and price increases has helped them gradually restock Reserved List inventory.

But counterbalancing this reversion will be an extension of everything discussed above in 2021. The Fed will remain accommodative, interest rates will remain low, and people will still lack ways to spend money in the traditional sense. This will prop up asset prices, including Magic cards.

What’s more, I particularly like Power 9 right here—I’m seeing significant demand for these cards as players managed to cash out of other Reserved List cards to raise funds.

Collectors’ Edition Power 9 is especially hot—in fact, major vendors haven’t adjusted their prices on CE cards to match the newfound demand. Once this adjustment is made, we’re going to see record-setting buy prices for CE Power and Dual Lands, and this will cause a discontinuous price jump in the market. Eventually this will settle, but I still expect near mint CE/IE Mox Ruby, Mox Emerald, and Mox Pearl to retail for $1000 this time next year, with the other pieces even higher.

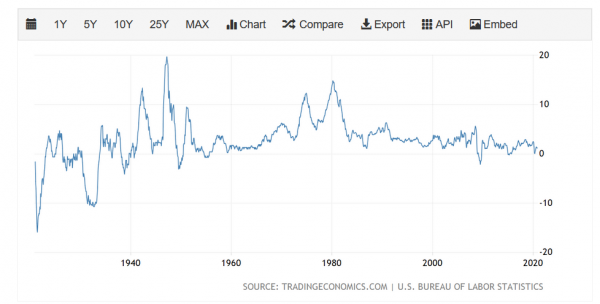

The biggest factor I’m going to be watching in 2021 is inflation. I’ve been banging the inflation drum for a year now, and it hasn’t quite materialized on the timeline I expected. So maybe I’ll still be early to the party in 2021. But if inflation does finally start to gain traction, it’ll mean higher asset prices across the board. Inflation has been stable and near 0% for years now.

While the Fed doesn’t want inflation at 10%, I do think a little more inflation coming into the market is long overdue. Will 2021 be the year for this trend to unfold? I don’t know, but if we see a vaccine helping us return to normalcy next year, and the economy recovers while the Fed remains accommodative, then it’s certainly possible.

In summary, I think 2021 will be another year of growth for investable Magic cards, assuming the game remains healthy. If large in-person events are still on hold for months into 2021, the supply will still be strapped, enabling prices to continue their rally. And as people start to cash out of cards that are suddenly more valuable, it could funnel demand towards high-end cards. This is what I expect to see next year.

Wrapping It Up

The pandemic has taken its toll on the world, that is for sure. Despite all of its negative impact, assets across the board are notching new highs. This is likely due to a combination of many factors at play, driving down the value of the U.S. Dollar while driving up demand for these investable assets.

As we look ahead to 2021, I don’t anticipate many of these factors to suddenly reverse. The Fed will still be accommodative, people will still eschew travel and instead invest their savings in stocks, cryptocurrency, and physical assets (e.g. Magic cards, vintage video games, etc.), and perhaps we’ll start to see some inflation kick in.

Don’t forget, as we speak Congress is working on a bill that would give most U.S. citizens a few hundred bucks to help them navigate these difficult times. I know there’s a lot of controversy around this measure, and I don’t intend to make this article a political one. I’ll just say that there’s a decent portion of the population who will receive this money while still being comfortably employed, and will use this unexpected influx of money to buy more of these assets.

These are all bullish factors at play, and it gives me confidence as I hold my collection tightly. There may be a bit more to the recent retrace, but I still like Magic as a store of value heading into next year. Only a major setback in the pandemic or the collapse of Magic as a game would make me feel otherwise. I don’t think either will happen in 2021 (at least, I feel optimistic they won’t) so I remain a long-term bull on Magic cards. I’m planning accordingly.

Investing in Magic the Gathering really is not much different than investing in sports cards. Many sports cards collectors have in fact been recently exposed to Magic and Pokemon cards as high value assets right there for grabs. So there’s reason to think that Magic as a profitable investment is not limited only to Magic players as it used to be. It’s finally reached a level of exposure it never saw before after so many years flying under the radar. Magic’s biggest advantage though is the relatively small release of the original vintage collection which lends itself to explosive growth. The fact that it exploded the way it did in 2020 might just have been coincidental, but all the things you just mentioned probably contributed even further.

As a serious collector, I’m more interested in all the current cinematic projects that will further increase its exposure and make Magic more mainstream. There’s a Dungeons and Dragons movie in the works with Chris Pine, which will be released along with the Dungeons and Dragons themed Magic set also in the works. And there’s also the animated Netflix show currently on hold because of the pandemic. So WotC definitely looks like it knows its game. That’s where my bet is at.

Your thesis seems reasonable…I just don’t know if and when a MTG movie will come to fruition. There have been rumors of one for ages and there never seems to be any progress on the matter.

I’m not sure how many people completely unfamiliar with MTG are willing to invest in the cards. Pokemon is far more mainstream–ask anyone on the street if they’ve heard of Pokemon and they will likely say yes. But so many people I talk to on a regular basis (co-workers, e.g.) have never heard of Magic. I think there’s a real order of magnitude difference in awareness.

Of course, that does mean there’s greater potential in MTG if it ever did reach the same notoriety as Pokemon!

I found this link in a private fb group fwiw

Collectables are a spontaneously occuring currency. People looking for stores of value outside of typical vehicles can and do drive prices. Further CD like growth with no money/ tax trail until sale works

I love that this article was shared on FB and Reddit. This one has gotten a great deal of attention, and for this I am grateful.