Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

With the rampant buyouts and crazy price spikes taking place on a daily basis, I’ve been distracted by the less-than-playable cards. It’s for good reason: these are the cards I’m most inclined to sell / flip for a quick buck.

Despite this focus, I haven’t lost sight of what’s going on in the broader market. I’ve started getting questions on Twitter about the time to sell and how they should sell older cards. As prices continue to climb on Dual Lands and the like, the opportunity to cash out to pay for “real life” necessities becomes all the more tempting to folks.

But I wouldn’t rush to sell out just yet. This week I’m going to touch on a couple factors that highlight why selling now could still be “too early”, and that there still remains a decent amount of upside.

The Buylist Wars

Here’s a challenge for you: what is the highest buy price you can find on the internet for a near mint Revised Underground Sea?

This is a bit of a loaded question, because it feels like the number changes on a daily basis. As of February 7th at 7:50AM EST (I tend to write these articles pretty early in the morning), here are the buy prices from a few major online vendors:

Card Kingdom: $730

Star City Games: $750

ABUGames: $673.20 ($1045 in store credit though)

Channel Fireball: $730

These are all aggressive buy numbers, and such competitive buylists will likely provide a floor for the card’s price in the coming weeks. If the rise in price on Underground Sea was a short-term, market manipulation type event I don’t know if vendors would be offering such high numbers on the card. This is a bullish sign.

Then there’s the international component, something I haven’t discussed in quite a while. International arbitrage still exists, but it’s much more challenging in a COVID environment. At one point in time, Americans could not order cards from some Japanese vendors due to shipping restrictions. That certainly puts up a major barrier.

Perhaps that’s what’s driving some ludicrous buy prices in Japan. This list was posted three weeks ago, well in advance of some of the price increases within the U.S.

For reference, a USD is worth about 105 Yen. A simple rule of thumb is to cut off two zeroes and round down a little bit to determine prices in US Dollars. Therefore, a buy price of 120,000 Yen for a near mint Revised Underground Sea equates to something in the neighborhood of $1,100! Their Volcanic Island buy price is equally strong, and Tropical Island’s is nothing to sneeze at.

Strong numbers out of Japan could definitely be influencing pricing within the U.S. That, and the fact that vendors appear to be competing somewhat aggressively to buy old cards. Buy prices are being adjusted frequently to try and stay competitive.

Beyond the Dual Lands, stores are also scrambling to buy your high-end, Old School cards. Card Kingdom is now paying $1040 on Moat, $1105 on Chains of Mephistopheles, and a whopping $1625 on Library of Alexandria!!

ABUGames has reacted by upping the store credit numbers they offer on such cards, though selling them anything for cash seems bad. Star City Games lags in some areas (they’re only paying $650 on Moat, for example) but they are ahead of the game in others! For starters, SCG pays an impressive $1750 for a near mint Library of Alexandria! Even their HP buy price of $1250 is attractively strong. Heavily played Libraries sold for $700 - $750 just a month or two ago!

Lastly, let’s touch briefly upon cards from Unlimited. It took a while, but in sudden, drastic moves the buy prices on Unlimited cards have exploded. A Black Lotus can be sold for $12,000—I think this number is still a bit low, though, because I don’t think heavily played copies can be found for under $10,000 anymore. After a temporary period where vendors paid more for Revised Duals than Unlimited Duals, the trend was finally corrected. Now Unlimited Duals are much more expensive; Underground Sea buylist is up to $1380 at Card Kingdom, Volcanic Island at $1100, and Tundra / Tropical Island are at $1200!

Even non-Reserved List, playable Unlimited cards have much higher prices. Card Kingdom is paying $250 for near mint Unlimited Birds of Paradise, for example, and $210 for Shivan Dragon.

These cards are not just climbing in price on MTG Stocks and TCGplayer. Vendors are following suit and this is a very good sign that higher prices will be around for a while.

Other Economic Factors

When vendors pay aggressively for cards, it instills confidence in the market. I don’t expect vendors take losing money lightly, so I suspect they will not be so quick to drop prices should the market soften (though they will eventually drop buy prices once they get some actual inventory!).

But the reality is, there are other economic factors at play here that will likely prop up this market for at least a little while longer.

First of all, we’re entering tax season. I honestly have no clue where my tax refund will stand this year after a wild 2020. However, it’s safe to assume many people, on average, will receive a refund. Every year during tax season, we see a strengthening in demand for Commander/Legacy/RL staples as players spend their refunds on Magic. This year offers no reason to expect an exception.

In fact, since everyone is still stuck at home in the pandemic, there’s less competition for tax refund dollars. Not many people will be choosing between a couple Dual Lands, a vacation, or tickets to a high-level sporting event. For the most part, we are all kind of…stuck.

Secondly, the U.S. government is actively pursuing another round of fiscal COVID relief, especially targeting working-class families. While fewer people may qualify, the amount of money issued per person is expected to be the highest amount yet. There will certainly be at least some folks who will put that money to use in their hobbies, including Magic.

Lastly, everything the fed is doing regarding monetary policy remains dovish. In other words, they’re doing everything they can to maintain liquidity for companies, leading to a steady flow of cash and a propped-up stock market. This may cause problematic inflation in the long term, but for now, it’s all gravy. Expect asset prices to remain frothy as long as this environment is unperturbed.

Others Chiming In

I’m not the only one who feels these elevated prices are here to stay, for at least a little while longer. I’ve outlined all the factors that are driving this market and will continue to drive prices higher. But don’t just take my word for it.

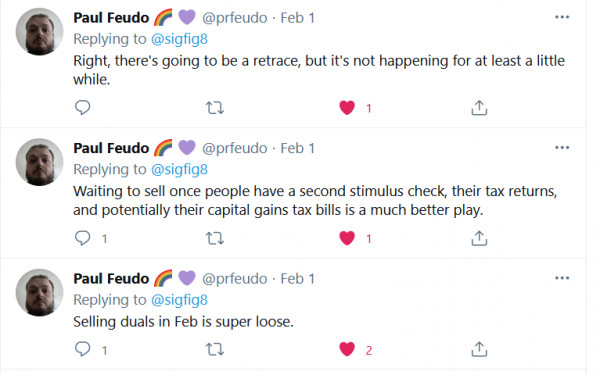

Paul Feudo is a frequent booth buyer at large Magic events, and he’s intimately familiar with Magic market dynamics. Therefore, I trust his views on all things MTG finance without question. Recently in response to a tweet of mine, Paul replied with the following dialogue:

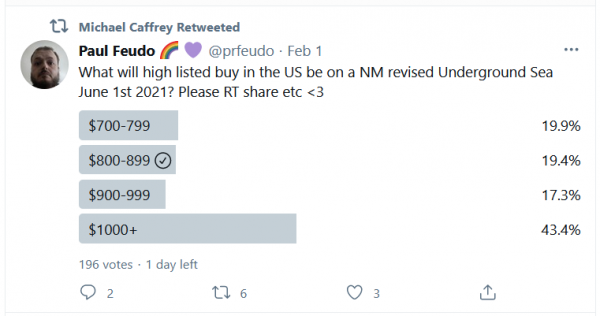

Paul emphasized each of the points I made above, listing the catalysts that could drive prices even higher. Then Paul posted a fascinating Twitter poll…

Considering the buy price on a NM Revised Underground Sea is $700-$799 today, over 80% of respondents believe the buy price will be higher on June 1st of this year. Liz (@DevotedDruid), another highly respected booth buyer, chimed in with a more specific target:

There’s the other factor I mentioned: the international arbitrage. It has slowed, but has not halted. Long term, prices will equilibrate across region. And it’s more likely that prices in the U.S. increase rather than prices in Japan decreasing.

Don’t just take my word for it. Large vendors are buying aggressively and people who live and breathe Magic transaction week in and week out are also seeing higher prices. There’s a lot to unpack here, but the long of the short of it is, I think prices on the most desirable stuff goes up from here.

Wrapping It Up

If you message me on Twitter and ask when you should sell, don’t expect a direct answer. Especially as prices continue their relentless climb, there are so many personal factors that should go into the decision to sell. What debts do you currently maintain? Do you have robust health insurance? Do you have a 401k? What are your long term goals? Do you use the cards in decks?

All these questions and more are relevant when deciding whether or not to sell, especially as we’re easily talking about 4- or 5-figure collections.

Also, I should mention I have no crystal ball. I can’t time the market any more than anyone can.

What I will say, with all the support mentioned above, that I think we haven’t seen the “top” yet for card prices. As some of the less interesting, less useful cards in my collection spike in price, I will be strategically looking to trim back. I recently sold a Su-chi to a friend on Twitter because I had no use for the card and could offer an attractive price. Likewise, I didn’t mind selling my spare Force of Will, since it appears out of scope for all the rampant buying going on.

But as for my Underground Seas and the like? I have no plans to sell anytime soon. These cards are in decks, and I don’t want to make those decks worse at this point. If there was a sudden major expense in my life, of course I would not hesitate from liquidating. But as long as I don’t need the money, I’m not going to liquidate. Not yet, anyway.

When asked what Underground Sea would have to be before I’d consider selling, my answer is surprisingly direct: $2500-$3000 (for my heavily played, Unlimited copies mind you). That gives you a frame of reference for where I’m at. Do I think we’ll actually get there? Not in 2021. But someday, it seems very possible—now more than ever.

What I did was write the prices of all the vintage cards from Cardkingdom at the end of 2019, right before the big drop off. I used those prices as each card’s target price. A card like Force of Nature from Alpha was valued at $1,299.99 Near Mint at the time. The same price that it’s valued now. I bought it when it hit bottom at $849.99. So that’s a healthy $450 gain. The big difference was the number of cards in stock. There were 3 Force of Nature in stock back then if I remember correctly. There are no cards in stock right now. So it’s fair to speculate that the price will only go up. Even if it drops, it leaves me in a fairly comfortable position. That’s more or less how I’ve invested in it.