Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

A couple weeks ago I pulled the trigger on a card I’ve been watching for a while now: a Beta Lord of the Pit. For those who haven’t been playing this game since the 1990’s, this black creature epitomizes peak nostalgia for the time period. A 7/7 flying, trampling creature was virtually unstoppable. And unlike the Elder Dragon Legends, this one had a palatable casting cost.

My dream was always to combine this card with Breeding Pit—the two cards together ensured your Lord of the Pit was well fed turn after turn.

The copy I purchased was on the nice side of heavily played (it was listed on TCGplayer with pictures) and cost me upwards of $300 after tax.

Fast forward two weeks, and this happened:

I never thought I’d regret the day I purchased such an amazing, nostalgic card. But here we are. Maybe I shouldn’t have rushed out to purchase the card given some imminent factors at play.

Reason to Wait #1: Competition Is Heating Up

I’m exaggerating for effect. In reality, I could never regret buying a Beta Lord of the Pit—the card is far too awesome. But I do regret that I didn’t purchase it during this 15% bonus bucks promotion. That purchase would have netted me about $40 in store credit—enough to pick up a bundle of the latest set, a couple low-end Alpha commons, or a random Reserved List Legends card for my collection.

In other words, I missed out on some real money.

Taking a step back, though, I appreciate that this is actually a really encouraging sign for buyers of Magic cards. We hadn’t seen a TCGplayer promotion in quite some time. In addition, one of TCGplayer’s primary sources of competition, eBay, has scaled back their eBay bucks promotions drastically. What was once a weekly occurrence has become an exception—a true rarity.

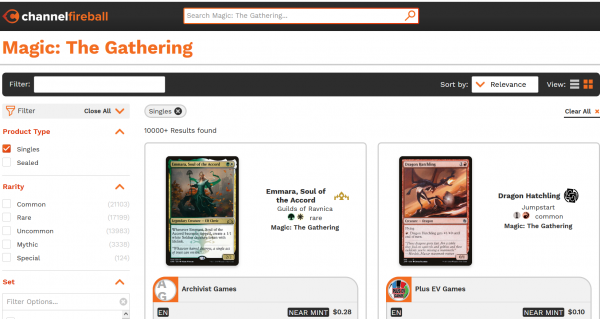

But all of that is about to change thanks to Channel Fireball. Why is Channel Fireball the catalyst for the 15% Bonus Bucks promotion? It all comes down to their new marketplace, designed to be a direct competitor to TCGplayer.

In fact, with the launch of the Channel Fireball marketplace, they included a 20% bonus buck promotion of their own. Was it coincidence that shortly after this launch, TCGplayer initiated a 15% bonus buck promotion? I highly doubt it!

In the grand scheme, this competition will be a fantastic thing for individual buyers like myself. Not only will I have another spot to browse for the best price on my Magic cards and products, but the competition will hopefully fuel more promotions like the ones we saw last week. What better way to get a sudden influx of sales on your platform than to incentivize with a cash back incentive?

It may take a little while for events to unfold. But if I don’t miss my mark, I’d predict we see a number of cash back promotions in the coming months. My advice: I’d hold off on purchasing cards unless you absolutely need them immediately. There may be some compelling reasons to make your purchases from certain marketplaces at certain times…you’ll know when the time is right.

Reason to Wait #2: Holiday Season Discounts

In addition to the potential for more promotions, I believe the incoming holiday season is yet another reason to hold off on purchasing cards in the near term. Black Friday and Cyber Monday are notorious for cash back deals and significant discounts offered by marketplaces and individual vendors alike. I seem to recall last year’s discount shopping season was underwhelming; with the advent of the Channel Fireball marketplace, I suspect promotions will be more aggressive this year.

This is a second reason to put any non-urgent Magic needs on hold. Over the next three months, we should see a wide array of incentives, bonus bucks, discounts, etc. To purchase cards now could mean leaving cash on the table (as I had done with my Beta Lord of the Pit. Fool me once shame on you, fool me twice shame on me.

I will not make this same mistake again.

Reason to Wait #3: Strengthening Dollar and an Uncertain Market

I may have studied microeconomics and macroeconomics in college, but that hardly qualifies me as an expert. I can’t explain all the trends and their inter-relatedness, but I definitely follow them closely as they have profound impacts on my investments and my dollar’s purchasing power.

Right now, the dollar is relatively strong. Below is a 1 year chart for the DXY, the US Dollar Currency Index that tracks the strength of the greenback.

As you can see, the U.S. Dollar is currently flirting with its 52-week high. I can understand this much. What I can’t reconcile is how inflation numbers are coming in hot month after month, yet the dollar remains this strong. If there’s high inflation, it means prices are climbing and a dollar buys less goods than it did before. This is happening, and yet the dollar is the strongest it’s been since this time last year? Perhaps someone more well-versed in economics can explain what seems like a paradox to me.

Nevertheless, I wonder if the strengthening dollar will prove to be a headwind for Magic card prices. While off recent lows, gold and cryptocurrency have both pulled back from their highs. I’ve grown used to seeing Magic cards following in lockstep.

I’m not going to pretend to make any confident predictions here, but it does give me reason to pause. The crypto market and stock market are both showing pockets of weakness. Is this another headfake, or will we see an actual pullback in the market this time around? If stocks were to sell off, I’d be inclined to allocate more of my liquidity to these traditional equities rather than cardboard. If others follow suit, it could mean a softening of card prices—yet another reason to hold off for a little bit to see where things head.

Wrapping It Up

I don’t claim to have a crystal ball—not one that works, anyway. But I’m seeing a few factors unfold that could lead to more attractive prices for buyers in the coming months. Increased competition leads to lower prices, the holiday season should bring along numerous discounts, and the recent market volatility could lead to a pullback in non-traditional investing.

These three factors lead me to believe that rushing out and buying cards right now (unless their prices are no-brainers) may not be optimal. Of course, attempting to time the market is also a fool’s errand—card prices could jump 20% from here before pulling back…or we may have already seen the peak and prices are already on a downward trajectory. It’s hard to tell just yet.

In light of this uncertainty, my advice is simple: wait. Don’t rush out and purchase cards. This is especially true for collectible, investment-type cards. Cards such as Alpha and Beta commons/uncommons, Four Horsemen cards like Eureka and Island of Wak-Wak, and lesser Reserved List cards may offer more attractive entry points in the coming months.

As for Alpha and Beta rares, I believe those may be transcending traditional market dynamics given their scarcity. It’s highly unlikely any catalyst suddenly shifts demand for something like an Alpha Fungusaur or Beta Wrath of God. Those I consider in a class of their own. Still, any cash back incentive could make purchasing these far more attractive at a later date rather than right here and right now.

As a result, I’m not going to be rushing out and purchasing anymore cards for the time being. I’m going to wait for some of these factors to play out. I am especially confident there will be more promotions and bonus bucks deals throughout the remainder of 2021. If nothing else, I’m going to try and time my purchases to line up with such promotions for the rest of the year. I’m not going to be stuck leaving money on the table again. You shouldn’t, either.

Sig, great article! With regards to your question about how interest rates and the dollar’s strength go together, that’s because as interest rates go up, there is more foreign demand for dollars due to increased demand for USD bonds. The Inflation that we are seeing now isn’t due to rising interest rates but due to supply shortages due to supply chain issues (like food, clothes, semiconductor chips etc.) or rising oil / natural gas prices (supply/demand mismatch). Finally, crypto prices are on an upswing, so if you think card prices are correlated with crypto prices then prices may actually go up over the next 3 months instead of down.

I follow the Magic financial trend based almost exclusively on the crypto trend as of late. Given the massive jump the Bitcoin made yesterday, I think the time is just right. Interestingly I’m basing it on an article you wrote earlier this year comparing the Magic trends with the crypto trends. It made perfect sense to me that the earliest Bitcoin investors were actually Magic players, or so it seems like it. Crypto and non fungible tokens are very closely tied to my Magic investment.