Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

If you've been reading this column, then you know that one of the pillars of speculating on MTGO is redemption. (For background on this aspect of the MTGO economy, read my column on redemption.) Redemption provides predictable demand in the digital market, supporting prices on all redeemable mythics. For sets that have rotated out of Standard, redemption reduces supply of mythic rares over time, leading to rising prices. In a subsequent column I talked about mythics from Scars of Mirrodin and Mirrodin Besieged as the cards most likely to see gains from this effect.

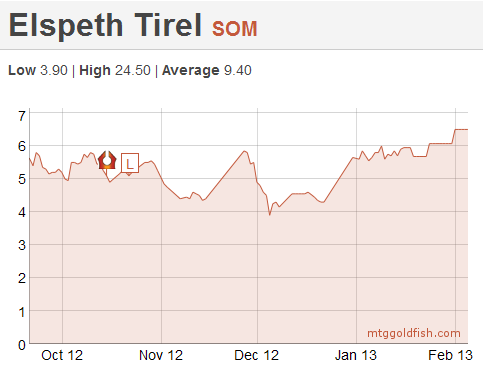

To see evidence of this effect, look at the chart for Elspeth Tirel below (charts courtesy of mtggoldfish, which takes its pricing data from supernovabots). The bottom occurs early in December, about two months after Scars block rotated out of Standard. Since then it has seen steady price increases.

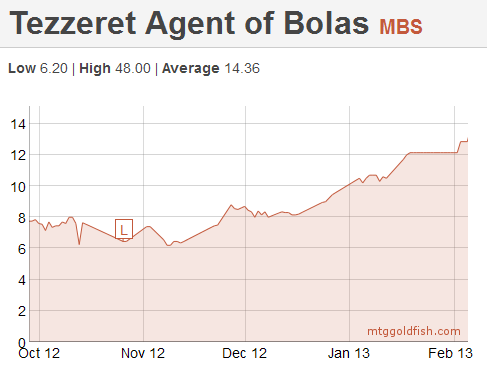

The chart for Tezzeret, Agent of Bolas is similar (see below), but in this case the bottom occurred in early November and the subsequent increases in price have been bigger. Both charts exhibit the predictable effect of redeemers buying up mythics from sets that have just rotated out of Standard. Paying attention to these patterns and buying up these cards, after they rotate and thus become "worthless," has been a consistent way to make profits on MTGO.

Changes to Redemption

This week, WoTC announced that the per-set surcharge for redemption would increase from $5 to $25. Set redemption has become a large enterprise, and people have estimated that 2000 sets are redeemed each week. Here's a Twitter conversation from a few days ago (Feb. 6th, 2013), that included Ted Knutson (@NextLevelSpec) and Casey, the owner/operator of The Card Nexus (@TheCardNexus).

This sounds like a big deal. If the underlying market dynamics are going to change, then it's important for speculators to get a handle on what that might look like. Using economic theory, experience and some intuition, we should be able to get some idea of what to expect from the MTGO economy going foward.

A Tax on Redeemers

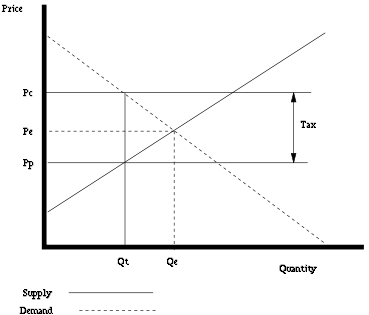

The image below is a typical supply and demand graph used in economics to analyze the impact of a tax. In this case, the downward sloping dotted line is the demand curve, representing in our case demand from redeemers for digital cards. Let's imagine this is the market for junk mythic rares. The upward sloping solid line is the supply curve, representing supply of junk mythic rares in the MTGO market. Drafters are the suppliers in this case.

Where the two lines intersect determines the prevailing market price and market quantity, which is respectively Pe and Qe in the graph. Market price is easy to think about. It is the prevailing buy price for a junk mythic on the classifieds. Market quantity is a little stranger to think about, but if you just consider a given time period, say 24 hours, then some quantity will be bought and sold at that price in that time period. This is what Qe represents.

In thinking about how this increase in the cost of redemption affects the market for junk mythic rares on MTGO, it neatly resembles a per-unit tax. Instead of a single, uniform price, suppliers of junk mythics will see a lower price, and demanders will see a higher price. In the graph, the tax acts to increase prices redeemers pay for junk mythics (Pe goes to Pc) and reduce the price drafters get for junk mythics (Pe goes to Pp). Market quantity drops too (Qe goes to Qt). WoTC is capturing the gap that has opened up between the supply and demand curves.

Essentially, redeemers perceive this "tax increase" as a higher price. This will lead redeemers to demand less. In the real world, those redeemers who were not making much money will be forced out of the market as their small profits go to zero or possibly negative. The low cost redeemers will still be able to make a profit and they will stick around, continuing to redeem sets. Drafters will see less returns to drafting due to the lower price of junk mythics. The worst drafters will end up drafting less, while the best drafters will see their profits reduced.

Impacts on MTGO

The effect on the player base as a whole is a little more complicated, and needs to be broken down in a few stages. Let's start with drafters. This group sells the contents of their drafts and uses any prizes they have won in order to continue to draft. With lower prices on the cards, this will discourage drafters from entering into repeated drafts. Drafting activity will decrease as a result.

As for Constructed players, they will see lower singles prices in general, which should encourage more Constructed play, assuming card ownership is a barrier to entry. But reducing the barrier to entry for Constructed is just part of what determines if a player will take up or play a format such as Standard. Adequate prize support encourages repeated play and for Constructed players that means they have to sell their prizes into the market for tix. In this case, more Constructed play means more booster packs on the market, which means lower costs for drafters.

At this point, drafters are seeing two competing effects. First, they have a harder time doing repeat drafts due to the lower prices they receive on their cards. But, initial drafts are cheaper due to more boosters on the market from Constructed players. Which effect will dominate?

A little intuition and experience with the MTGO market suggests that the market for drafts and sealed deck play is bigger than the market for Constructed play. When prices fall due to higher redemption fees, the dominant effect will be a reduction in Limited play. The increase in Constructed play will only be a second order effect and will not fully compensate for the drop off in drafting.

Impacts on Speculators

As speculators, we will have to adjust our expectations about price floors for mythics. Our job is to identify good value, find low prices, and wait for the market to move higher. If redemption were ending completely, then this type of speculating would end too. Without the support on prices from redemption, the value of digital cards would steadily fall due to the large amount of Limited play relative to Constructed.

The increase in redemption fees signals that WoTC wants a piece of the profits that redeemers have been making. It does not mean that redemption is over. The theory around how redemption supports prices is unchanged. For speculators, we can continue to employ a strategy around redeemable cards. The level of prices will change, but the direction and trends will be the same. As an example, the lowest price I can remember for a mythic was around 0.26 tix, which Elbrus, the Binding Blade briefly touched while Dark Ascension was being drafted. The change to redemption means that we will eventually see a mythic priced at 0.10 tix.

Prices will adjust downward to take into account the lower amount of redemption activity, but there will still be profits to be made on buying low and selling high on redeemable mythics. For speculators who are buying and selling digital objects on MTGO, the increase in the price of redemption should not affect your speculative strategies. Just be on the look out for consistently lower price floors and price ceilings.

Isn’t there a good chance that the increase in price for redemption will also increase the price of IRL cards? 2,000 copies of a given mythic hitting the market a week is not an insignificant number. If this results in a drop to a redemption rate of 1,500 sets a week what could be the result in the upward trend of the IRL cards?

This is not only possible, but likely in my opinion. As an initial guess, I think we’ll see the price for digital sets fall by 10-15 tix on average, and we’ll see a corresponding price increase in paper.

It’s possible there will be a period of adjustment among the redeemers too where their margins are reduced as they figure out the changes to the market. In that case, some of the changes in price will be absorbed, at least temporarily, by redeemers accepting lower margins.

I think what you say about accepting the margins, at least temporarily, is quite likely among the better-established or larger redeemers. A very small increase followed by gradually pushing the margins to find the eventual equilibrium is probably the best business play long-term.

Also, I think the WotC hike is a little steep. They couldn’t have just made it a flat $20? Just my gripe.

I agree, the $20 increase seems steep. But, if redemption activity is as large as is alleged, then maybe WoTC felt it was necessary to correct a (from their perspective) market imbalance.

Thanks for reading and commenting.

crazy. i am not sure this hurts huge mtgo bots as much as wizards intends. looks like you just force the smaller guys out by making it too expensive for them at a smaller scale. in any case it is bullish for paper and bearish for digital at first glance.

Is Modern Masters going to be redeemable? If so now is the perfect time for them to up the price, because I have a feeling everyone that has ever even thought about redeeming would be all about redeeming MM. I do not know if this is print only, I have not seen anything either way. To be honest even at 25 per set…. would still draft it a ton and redeem.

They’ve come out and explicitly said that Modern Masters would not be redeemable. Cards from this set will see some decline in paper, but on mtgo, these cards are going to tank hard.

That is just another reason I only draft online, not play anything else.