Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

After a wild roller coaster ride took us through Modern PTQ season, the MTG financial market has finally settled down a bit. My daily mtgstocks.com check have not yielded any surprises now for the past couple days. Nothing has doubled overnight and there have been no inexplicable jumps.

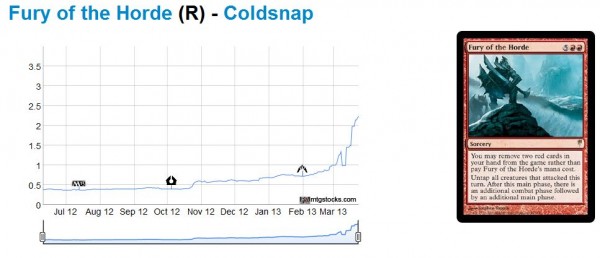

In fact the only cards to have gone up appreciably (>20%) in the past week are Ajani Vengeant, Fury of the Horde and Liliana of the Veil. It’s fairly obvious why Ajani Vengeant has jumped – it’s basically the last “hoorah” of Modern. Liliana of the Veil has been on a steady rise, and the shift from Modern to Standard PTQ seasons won’t impact demand in a negative way.

Fury of the Horde (chart from mtgstocks.com) is a bit of a question mark. Perhaps casual players are interested in the alternative-costing Relentless Assault.

Last week Corbin touched upon how significantly the casual MTG market is rising. I have no desire to repeat this effort – just make sure you add this Coldsnap sorcery to the list.

What Does This Leave Me To Write About?

In this quiet week, it may be a great time to talk portfolio rebalancing and diversification. When people think diversification, they sometimes fall into the trap of thinking it only refers to format balancing. You’ve got some Standard cards, Modern cards (hopefully less now), and Legacy cards, so you’re all set.

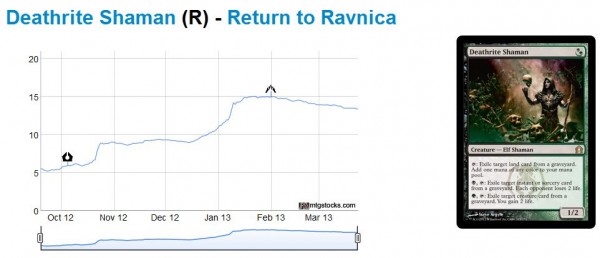

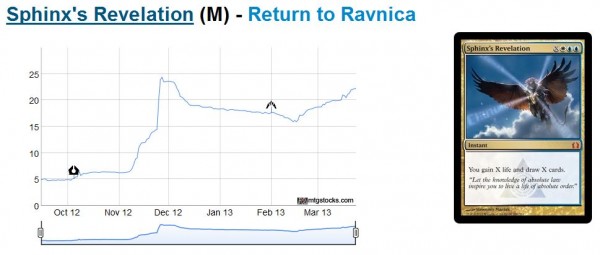

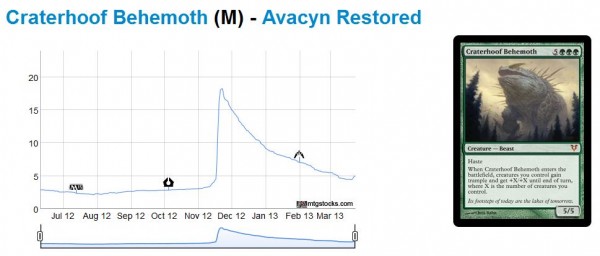

But there are other ways to diversify risk. For instance, I can name a group of cards which are all Standard legal but give you very different risk profiles. Consider: Hallowed Fountain, Deathrite Shaman, Sphinxs Revelation, and Craterhoof Behemoth.

The above cards are all legal in Standard. Yet their positions in our MTG portfolio serve very different purposes. The Shock Land is a solid investment for the future of Modern. Deathrite Shaman (chart from mtgstocks.com) is a great Eternal play in general, though the short term projection for this card is still sloping down.

I consider Sphinxs Revelation a mainstay of Standard, and with Standard PTQ season arriving, I am a believer. I know I show the mtgstocks.com chart for this white and blue instant every week, but with good reason. I saw the card was rising over the past couple weeks and this trend has continued.

I see this card returning to its previous height of $25 with a strong chance of breaking through this time around.

Craterhoof Behemoth is an odd one. It too is a Standard play, but one with a much different risk equation. The chart from mtgstocks.com tells the whole story for this creature.

The card was clearly a flash in the pan, and after quadrupling to nearly $20, the card plummeted down to $5 in just three months. But the story may not be over yet on this beast – he’s seeing play in Standard yet again. This is your go-to investment for high risk and high reward. He’s tough to find, but his time in Standard is also running out. If you want something risky to invest in, you don’t need to look far back to find it.

Cut A Different Way

There’s more than one way to skin a cat. If Standard’s not your thing, you can still achieve a solid balance of high and low risk positions through Eternal cards and other Magic products.

Consider these parallels:

- Hallowed Fountain -> Misty Rainforest -> Sealed Return to Ravnica boxes

- Deathrite Shaman -> Dark Confidant (post reprint in MM) -> NM Alpha Rares

- Sphinxs Revelation -> Felidar Sovereign -> Sealed Commander Product

- Craterhoof Behemoth -> Griselbrand -> Sealed Duel Decks

I’ll be the first to admit these aren’t perfect comparisons. But hopefully they convey my point – diversification does not necessitate cross-format holdings. The cards Misty Rainforest, Dark Confidant (after potential reprint in Modern Masters), Felidar Sovereign, and Griselbrand all yield different types of risk/reward structures without being as impacted by what’s going on in Standard (yes Griselbrand experiences it a little bit, but it’s also played in a variety of Legacy decks).

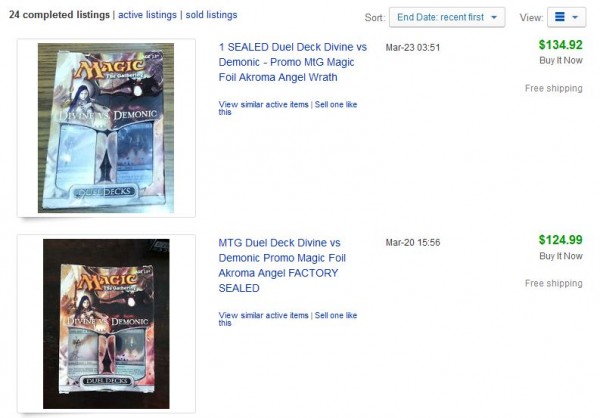

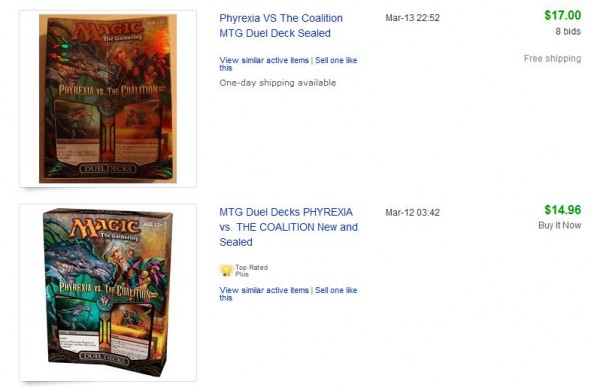

The other parallel is even more of a stretch, yet still enables some risk balancing within a portfolio. Like Shock Lands, sealed boxes of Return to Ravnica are a relatively known entity. Both will remain popular and should see steady price increases over time barring further printing. Meanwhile, some sealed Duel Decks are a huge success and increase in value (e.g. Divine vs. Demonic) while others flop completely (e.g. Phyrexia vs. The Coalition). They have their chance to shine, but they may not quite make it – much like Craterhoof Behemoth.

Take A Second Look

I’ll admit all is quiet on the western front in the world of MTG Finance. We’ve actually managed to go most of a week without seeing a card double in price, and this trend is likely to continue for a little bit as Standard PTQ season ramps up. My guess is Modern Masters will provide the next sudden jolt to the market, but there will of course be opportunities in Dragon’s Maze as well.

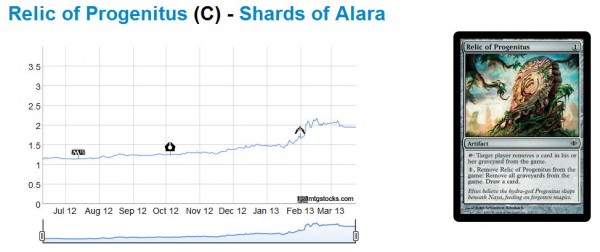

During this down time, it’s a great idea to do some housekeeping with collections. Last time I had some free time I sifted through my bulk to find the newest quarter commons and fifty cent uncommons to move to my trade binder. Stuff like Ponder has really increased lately. And have you noticed what Relic of Progenitus has done as well?

This card is the latest to join the two dollar Common Club!

In addition to this exercise, I’d also suggest adding a new one to the regiment. Perhaps it’s not even an addition as much as a modification – I’d reevaluate your diversification. Rather than taking stock based on format, try taking stock based on risk/reward potential as well. Sure, moving out of Modern and into Standard seems like the right thing to do right now (while keeping Casual always in mind). But what Standard to buy and what Modern to sell can also be influenced by your risk tolerance.

Since I’m risk averse, I’m moving my high-risk Modern cards (high risk of reprint, that is) and buying Standard. But the Standard I’m seeking is Eternal in nature. I am very heavily seeking Abrupt Decay, Supreme Verdict, and Shock Lands because of their safe nature. I also want some short term potential, which is why I like Sphinxs Revelation as well. Being risk averse, I’m trying to avoid Craterhoof Behemoth and the like. Though I may pick up a couple extra Angel of Serenity, which is a much stronger high risk / high reward play in my opinion – especially after the solid performance of the Angel at SCG Kansas City.

It all comes down to your preferences. I only suggest you think about your preferences in a slightly different way next time.

…

Sigbits

- I for one am completely shocked at the price of some Duel Deck products. Elves vs. Goblins ($249.99), Divine vs. Demonic ($149.99), and Jace vs. Chandra ($99.99) have all paid for themselves many times over. I wish I had these! Meanwhile Ajani vs. Nicol Bolas, Venser vs. Koth, and Phyrexia vs. the Coalition have all been a bust. Fortunately the rest have also increased marginally in price. This is why I see investment in these products as somewhat risky – you could increase your money fivefold or sit on a stagnant position for years depending on what you buy!

- Fat Packs, on the other hand, almost always seem to exceed retail when they go out of print. There must be some Fat Pack collectors out there because some relatively undesirable sets still have costly Fat Packs. Scourge is a bit older, but SCG is sold out of these Fat Packs at $99.99! Shards of Alara is much more recent, but SCG only has two in stock at $119.99 each! This is a very strong return for just a couple years’ investment, and could be another low-risk MTG investment avenue to consider.

- I think it’s noteworthy to highlight Deathrite Shaman’s recent pullback. Even SCG has 25 copies in stock at $12.99. Considering the card once traded at $20, this is a significant drop. Although I regret picking up a couple copies near this price, I still have high hopes for the longer-term prospects of this Eternal staple.

Fury of the Horde went up because Jacob Kory made day 2 of GP San Diego with a deck running it, which you can read more about here: http://www.mtgthesource.com/forums/showthread.php…

You had trouble with the reasoning behind the Goryo’s Vengeance price jump as well a couple weeks ago (funny enough, also a jump because of Mr. Kory). Frankly it seems like you need to familiarize yourself a bit more with the goings on of competive Magic.

Typically if a card doesn’t show up in the forums or in a Top 8, it doesn’t cross my radar. This is admittedly for better or worse – I simply don’t have time to read about every novel deck that makes Day 2 – especially on The Source, where new decks are thrown up every day.

Is there a reason no one has mentioned this card in the QS forum yet? If it was so impactful, someone would have caught it.

I thought I talked about it for a minute in the forums, but maybe it was somewhere else. The reason I haven’t said much about it is that I think it is just not very good. Fine for a surprise when people aren’t expecting it or prepared for it, but I don’t see it making a significant and lasting impact on the eternal metagame. I don’t think it is impactful and I don’t think you need to spend any more time than you did on it.

Even if the card stays at $2, I only have, like, 2 of them anyway. I’m much more interested in Relic of Progenitus since I have a bunch of them from drafts and throw-ins on trades. I need to dump the Relics NOW since there is a decent chance it will be reprinted in Modern Masters. Actually, I would say a STRONG chance it sees reprint.

Nathan, thanks for chiming in. I might have missed it in the forums, but a quick look at the Single Card Discussion threads and I don’t see the card listed. So it doesn’t have its own thread at least. Agree with your assessment – the card really isn’t worth pursuing.

Glad the Relic caught your eye. I reacted the same way. Man, I wish I drafted that set more! I need to dig through my commons/uncommons to find as many of these as possible! And I agree a reprint is possible. But do you think this gets the nod over other graveyard hate?

I’m pretty sure someone in the last 1-1.5 month mentioned the Fury as I remember deciding whether I wanted to get in on them. I decided against it as I don’t really see the card going far. I had a hard time seeing casual players throwing away 2 cards or paying 7 mana for the effect, while I also didn’t envision more than a side role in competitive play.

I just made a post in the forums about this too, but my knowledge of the rise of Fury of the Horde was this deck http://forums.mtgsalvation.com/showthread.php?t=4… . I was also mentioned in Brainstorm Brewery. I would think that the adoption of such a deck for Modern brewers would be a reason for Fury and Goryo’s Vengeance trending upward, aside from Vengeance’s use in Legacy TinFins.

Just traded 19 shallow graves to various dealers at gp Pittsburg for $15/per card in trade.Is this card really being played or is it another conspiracy to corner the market by someone?I honestly could not sell any of these for $4 in the last 3 years

Lol, wow that sounds excellent – well done! Shallow Grave is one of those cards which kind of breaks out in a deck in one tournament and then fades away. At least that’s my interpretation. Moving these at $15 seems fine by me, especially if you made a nice profit on them.

@Lochlan – “Frankly it seems like you need to familiarize yourself a bit more with the goings on of competive Magic.”

Sigh.. you really come across as patronising and ungrateful. Not cool man, the guys who write articles here are human.

Sigmund made some reasonable predictions and reinforced some staples that we already knew about, backing it with analysis and solid reasoning.

I realise we’re in a bit of a lull right now in terms of the speculation yearly calendar and market movement, but I’d prefer to have articles posted, than not to have. They’ve got to write about something.

Lee, thanks for your support. Like you said, it’s tough during lull times to conjure up insightful articles. I’ll try to brew up something more creative for next week.

Lochlan does make a good point – next time I mention a card spike, I should at least do a quick Google search to see if the card is mentioned recently. Although it was a bit harsh, I appreciate positive and negative feedback and I will be a stronger writer for it in the future.

Another good article sig! I’m in the same place in that for the first time in a while there’s nothing majorly crazy happening this week.

Thanks for the comment! It’s eerily quiet this week. Though I learned that foil Liliana is a million dollars and that Innistrad booster boxes aren’t under $110 anymore. This was news to me.

Sigmund, what do you think of the newest Duel Deck’s projected value? There are some good cards in there that should at least hold their value due to Modern demand. At the moment, I see this being worth more than retail (I bought the last 2 at Target for $19.99), but I’m not sure how it will look in a year or two when these cards (like Hellrider) rotate out of Standard.

Nathan, I’ll need to re-visit the list before I get back to you on that one. But I think there’s more to a Duel Deck’s value than just having eternal playable cards. I don’t even know what’s in Elves vs. Goblins, but I do know that in Divine vs. Demonic, there really is no single card worth a ton in the set. The alt art Demonic Tutor is nice (as are the Angels) but they aren’t played much in a constructed envrionment. So there must be some sort of “coolness” “collectibleness” factor that goes into the equation. This part is tricky though – I’d actually look to reach out to others in the community to theorize on what drives up a Duel Deck’s value.

Alt art foil Akroma is gorgeous, but it is mainly the sweet alt art demonic tutor. I enjoyed the article as a whole and I do remember reading mention of Fury of the Horde (enough that I picked one up yesterday as a throw in), but it’s really only sweet tech in a possible red splash for the TinFins deck.

Hey Sig, lately i´ve been looking into the possibility of getting some sealed stuff. how do you feel about intropacks from worldwake and zendikar?

i might be able to get some of these, and they bring a booster so it´s the closest you are going to get to buying a booster from those sets that you know is un-mapped.

Also what would you think is worth paying on these?

I’m not Sigmund, but my 2 cents on the matter…if you can get them for about the price of the booster pack in side it..maybe, but there’s not a big collector market for sealed intro decks (they are too mass produced) for real collectability. The Duel decks are produced in much lower quantities and tend to have extra value sealed, whereas, intro decks are usually bad cards + booster pack (with some exceptions).

The intropacks are absolute crap!! i only mentioned them because of the booster that comes attached to them…

I agree with David – these are worth pennies more than the booster packs inside. I once heard a rumor that the boosters in Intro Packs have better rares inside, but that may be bogus? It’s true they won’t be mapped, but I don’t think they provide much added value beyond that. Unless you want the stuff in the intro packs for some reason or another. From a collectibility standpoint, I’d stay away personally.

Does the Zendikar intropack have a first print booster? Might make a bit of a difference.

The reason i can see to buy this is that both zendikar and worldwake sealed boxes allready command a high value, and with the increasing price on foil JtMS it´s almost like playing in the lottery a single ticket isn´t too expensensive and can give you a good prize, but the probabilities are very slim…

i don’t know that you could call buying duel decks risky. buying 5 of each @retail and your returns are great. you hedge risk there by diversifying. you don’t need to know more, just approach each new release as another chance to diversify.

This is a sound approach, Mathieu, great add! If you bought all of them, you’re bound to make out well – assuming Wizards continues to print deseriable ones. But if you could buy the ones that end up being most sought after, then you’d really make bank. I personally wouldn’t want to be sitting on 5 Phyrexia vs. The Coalition right now 🙂

In case of doubt: buy them. I normally do the opposite but seems DD work fine this way