Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Speculating on Magic Cards can be a lot of work – often it even feels like a second job. I spend countless hours in the evenings and on weekends trying to stay up with trends. With the recent creation of mtgstocks.com and resulting crazy market movements, the task of maximizing value in Magic has truly become daunting.

There has to be a balance. Not long ago I wrote an article describing how our time should have a dollar value associated with it. Negotiation of our time’s value should not be taken lightly, and it is up to us to always keep this in mind. After all, no one else is going to do that for you.

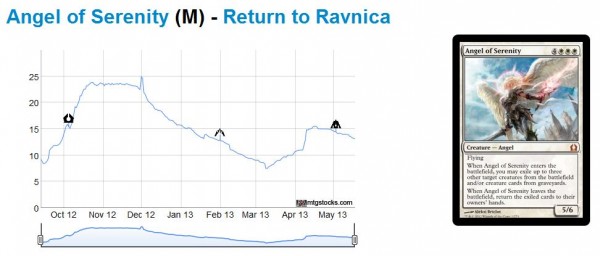

As I’ve thought about this concept some more, I've realized I should take this Magic speculation thing even further. I’ve made some rash purchases in the past in the hopes that I can eek out a bit of profit. I’ll eagerly purchase something like Angel of Serenity at $8 with hopes that come Standard rotation I’ll be able to sell it for $15.

Or better yet, maybe I should purchase fifty Aetherlings since the card performed well at the Pro Tour this past weekend. Surely I can grind out some value there, right?

Is This Worth It?

Even if those Aetherlings do double after the Pro Tour, fees and shipping costs are likely to eat into profits. At the end of the day, a $2 Aetherling purchase sold at $5, even if done so fifty times, is likely to net small profits.

Now, of course, the card could go higher. We could see a dramatic spike like we saw with Wolfir Silverheart last year. In this case, the profits would be much higher and the value vs. time equation would never even become a factor. But statistically speaking, how often does this happen?

Seriously. How often do we speculate on cards and they proceed to increase dramatically, and that price increase is sufficient to have justified our time?

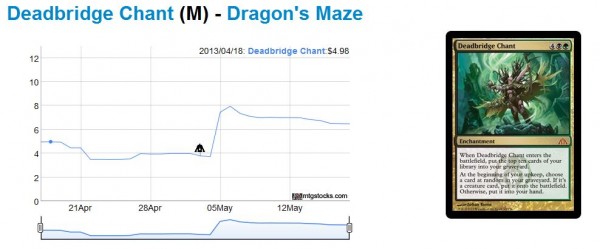

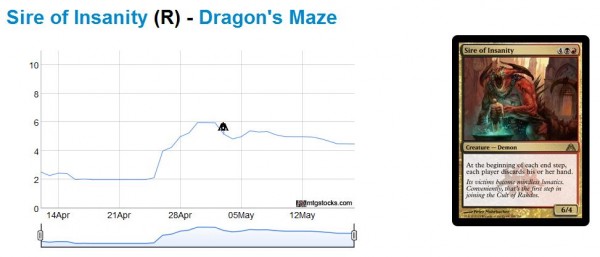

On quick flips like Wolfir Silverheart or, more recently, Deadbridge Chant, one must be highly engaged. The profit window may be a matter of a couple days before a card begins to decline again after an initial spike. Doesn’t it feel like this has become the norm lately, and not the exception? Doesn’t the chart below look familiar?

If you’re fast enough, then there’s definitely profit to be had with each of these spikes. But hesitate too long and you could be left with very little profit considering the amount of time spent. Holding the hot potato may or may not be costly, but it definitely implies greater risk compared with selling immediately upon a spike.

Speculation & Risk

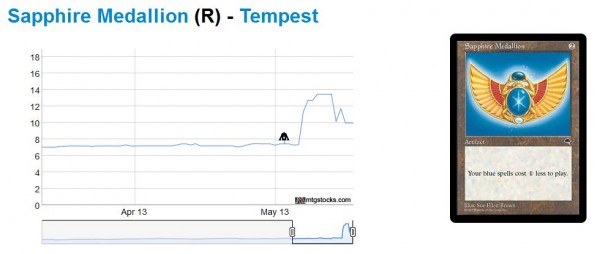

I have made the conscious decision to not participate in some recent jumps. Rishadan Port baffled me quite a bit. I ignored Earthcraft completely. And these Tempest Medallions are awesome and all, but I have no desire to attempt a quick flip on them.

Did I miss some profitable opportunities? Definitely. If I played the quick flip game, I may have been able to find a few cheap copies left under some unturned stones on the internet. One week later and I could have sold them for a handy profit…assuming one week wasn’t too long to wait.

I sometimes get a rush with these speculations. When Craterhoof Behemoth spiked, I made a nice chunk of change selling my copies to Card Kingdom for a stunningly high buy price. But other times, my endeavors are not rewarded. Nivmagus Elemental still stings. Even if a quick flip attempt pays out, often times the net profits aren’t enough. This means I either should not have bothered or I should have gone deeper – sometimes, way deeper.

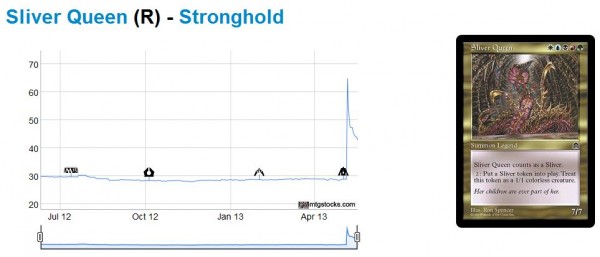

This means I would need to take on greater risk. Don’t get me wrong, risk is a necessary aspect of speculation. But at that point, it feels more like I’m gambling than investing. If I want to place larger bets on speculations, why wouldn’t I day trade? Surely doing some speculative buying and quick flips with the stock market would have proven more lucrative than doing so on my most recent quick flip, Sliver Queen, which netted me a measly $5 in profit so far simply because I could only find a couple copies underpriced online.

Hey, doesn’t that chart look familiar?

It’s Time To Focus

This risk/reward equation has been out of whack for me. I’ve been trying to get thrills out of quick flips with only moderate success. Meanwhile, other investments I’ve made in the past have been so obvious and provided much stronger returns.

My initial dive into Booster Box investing has proven highly lucrative. Are these difficult to move? Absolutely. But the limited downside and high likelihood of upside cannot be ignored. In the past, I’ve kept the investment in this area under control with the excuse that I wanted to remain diversified. I was fooling only myself – why did I bother buying Sliver Queens in the hopes I could sell within three days of ordering when I could be sitting on one more Return to Ravnica Booster box instead?

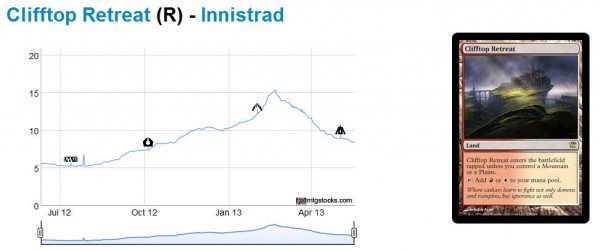

The same goes for other high confidence bets I’ve made in the past. After seeing how Scars of Mirrodin Dual Lands trended up in price, I had extremely high confidence Innistrad Dual Lands would follow suit. Many well-regarded members of the QS community agreed, strengthening my beliefs. Yet despite this, I was so concerned with diversification that I limited myself to a mere couple-dozen copies of these lands.

The result – I made a solid profit but missed incredible upside. And it was such a textbook opportunity.

My strategy needs to change. I need to increase the size of my bets, and stick with a risk-profile I’m comfortable with. I have a difficult time stomaching a purchase like Corbin’s 93 Splinterfrights or Jason’s Deadbridge Chants. These are speculative bets with measurable risk (Corbin’s more so than Jason’s).

Meanwhile I’ve been trying to accumulate Supreme Verdicts because I remember what Terminus did last year. By sticking to consistent performers like board-sweepers and mana-fixing lands, I ensure plenty of upside without the need to worry about flipping quickly. I had months to invest in Innistrad Dual Lands and another month or two to sell with plenty of profit.

Contrarily, with Sliver Queen I had one day to buy. And I’ve already missed the window to sell one for profit.

I’m Doing As I Say

My risk-reward balance may not match yours. You may like the quick flips because you can maintain smaller inventory. You may love the thrill of profiting on something very speculative because you anticipated metagame evolution. I can appreciate these benefits, but I’ve realized they’re not for me.

Stability, higher likelihood of profiting, and longer time horizons are what make the most sense for me at this stage in life. You know what – this is comparable to my stock market investing strategy. Rather than trying to flip AMD stock on hype, I would much rather invest in Intel for a few years to earn a solid, relatively safe dividend. Reducing the amount of risk gives me the courage to invest larger amounts, which in turn yields me greater profit.

This sentiment is most recently manifested in my Innistrad Booster Box play. For the first time, I’ve had the courage to go deep on a Magic investment. But I only managed to do so because of the nearly zero downside I know I have taken on with such an investment. Will I make 1000% profit like some people did with Shared Animosity?

Of course not. But I am also taking on far less risk and I’ll have years to unload these boxes for profit. With Shared Animosity, you may be able to find cheap copies online but by the time they arrive it may already be too late to sell. I know which scenario I’m more comfortable with.

…

Sigbits – Safe Bets

In light this week’s article, I’ve decided to share some updates on safer MTG investments I’m looking at.

- Shock Lands. These are so obvious. I’m confident these will follow similar price trends to Scars and Innistrad Dual Lands. If I’m right, the time to acquire these at their cheapest prices is nearly past. Once Standard rotates, we are going to lose Innistrad Duals. If players are still going to play 3+ color decks in Standard, they are going to lean very heavily on Shock Lands. Naturally I like blue ones the most, but Overgrown Tomb and Blood Crypt seem solid with Jund being so strong in Standard.

- Deathrite Shaman has really stabilized in price. But when Modern season comes around, he should go up in price. Likewise with Abrupt Decay. In fact, I like most Modern-playable rares from RtR block.

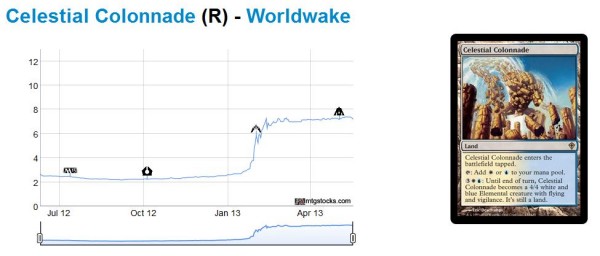

- If Standard’s not your thing, may I suggest Worldwake Manlands? These have been on a steady incline lately. They’re not in Modern Masters, and I expect them to increase further when Modern season returns. Honorable mention to Inkmoth Nexus for being like a Manland – this one is also solid.

-Sigmund Ausfresser

@sigfig8

Great article Sigmund, I could not agree more with some of your points. I myself am sadly more risk averse than many. I would prefer a 40% profit on something that’s 90% likely than a 90% profit on something that’s 40% likely. I also am going to enter the “sealed” investing some more as my 10x Ravnica:City of Guilds Tournament packs just sold on ebay for $29.00 each (I bought them about 1.5 years ago at $14 each).

Dave,

Thanks for the comments! And very nice job on the profit – the more I think about it, the more sealed product makes sense as great investments. There are some downsides to be aware of – they are harder to move, shipping is more costly. But the reduced risk often balances this out. Buying any booster boxes while they’re in Standard for like $89 seems like such a solid investment as long as the set is half-way decent. They inevitably go up in price if you’re patient enough. I need to think on this some more.

Sigmund, have you pursued buying collections instead of speculation before? If you want safe money, you just about can’t lose on those, but they do take significant time. I could understand if you prefer the low time investment of sealed product.

I’ve looked into collections on occasion but I haven’t ever found anything compelling. Often times this requires checking Craig’s list daily and sending out lots of messages without ever getting responses (kind of like MOTL). And it’s difficult for me to meet up with people since I work full time and have the baby at home.

So net, I love buying collections and I definitely condone the strategy, but they take up more time than I have at the moment. With booster boxes, I can buy them and sit on them for three years to make easy profit with minimal effort.

I love buying collections, but thanks to SCG nowadays people seem to think they should get SCG’s sell prices for every card in their collections. I’ve sent out numerous emails only to get replies that list card for card what’s in the collection with like SCG or TCG High next to each card and people unwilling to budge…I miss the days of people pricing out a collection based on just the top 2-10% of the cards and letting me enjoy finding the treasures in the other 90-98%.

I worked out a deal with the local store where I’m running the case and handling all the walk-ins… the collections in the first month have been insane.

Corbin, that sounds pretty amazing. But how do you have the time to do all this?!

I’m feeling more and more like this lately. With a career and family that takes up most of my time, I value my “free” time a lot higher. I don’t have time to keep up with quick flips, and still have boxes of bulk that I haven’t touched (especially thanks to your “Dont Waste Your Time” article, which really hit home the idea of valuing my time).

In the past I’ve been burned because I miss the window of opportunity to sell into the hype. I much prefer the slow and steady targets now.

Thanks for the article.

Christopher, thank you very much for your comments! I know exactly how you feel. I have a full time job and I have a young one at home which both keep me very busy. Buying into steady growth such as key staples and sealed product just makes more sense for me. Quick flips can be fun and exciting, but I get burnt just often enough to make the endeavor hardly worth it.

Thank you so much! I read out certain parts to my business partner even though they know nothing about magic. Just smart thinking.

I feel that diversifying our portfolios may be the answer. I’d love to get your feed back on some sort of rule that says something like

Remember even aggressive stock portfolios have some blue chips in them:

Defensive Portfolio:

Always have: 15% liquid in cash or pay pall or Store credit for quick pick ups.

have 75% in sealed or shocks

have 20% in spec targets but no more then 5% in a single target.

Aggressive Portfolio:

have 20% in cash or store credit for quick pick ups

Have 20% in Sealed or shocks

have 55% in spec targets with no more then 10% ever in a single target.

course the problem is I’m an artist and sure maybe for one day I keep up with my investments but then loose focus and just buy random stuff that makes me feel good.

Also we don’t invest in stocks because we would rather read about tournament play and play at prereleases then reading stock prospectus.

15+70+20=110% : /

20+20+55=95% : /

defensive portfolio steals from relatives, aggressive sacrifices to jim cramer

Hi Vincent,

Thanks for the comment! You are really thinking next level with this now. I try to come up with percentages to target in my stock portfolio, but I have never stopped to reapply the same concept to Magic. But the concept should translate in a way you described. And you could easily expand upon it too. Defensive blue chips doesn’t have to be sealed product – it’s just want I’m very confident in. But stuff like Reserved List and Alpha rares are also not likely to drop in price. I have a few graded NM Alpha rares I’m sitting on for long term myself. They don’t move easily, but they should not drop in price as long as the game is strong. That’s the only real downside risk on most defensive bets – it’s still betting on a game which is run by a company. It’s not like Hasbro is “too big to fail” and the government wouldn’t bail the company out. So we gotta make sure the game stays popular 🙂

About shocklands being so safe…something feels off about this to me. Sure, the pattern has *always* been that the dual lands from the previous block go up in price once the new block comes out. But this is different in a bunch of ways: first of all, shocklands are much higher right now than dual lands have been in the past several years at this time. That’s what gives me most pause. Second of all, there was a tremendous amount of this block opened. What are your thoughts on these two differences?

Also, regarding sealed product: what are your thoughts on Modern Masters boxes *as a long-term investment*? I think buying a box at current prices to crack and flip or flip immediately is clearly bad, but do we see them climbing to 400 in a couple years?

We don’t invest in stocks because you should always invest in your “circle of competence”. I don’t know shit about how most businesses and markets work, but I’ve been playing Magic for 20 years and following the card market for 5, so I invest in it because I know it well.

You bring up valid concerns. I’ve considered those closely as well, and I have still netted out with the decision to buy into some Shock Lands. They may not rise the same percentage that Innistrad Duals did when those spiked, I will grant this. BUT, compare the price chart of Clifftop Retreat and Snapcaster Mage. Clifftop has been on steady decline as rotation nears. Snapcaster Mage has kept a solid $20+ price tag despite those headwinds. I’m thinking Modern will help keep Shock Lands afloat as rotation approaches. Then, by the following year Shock Lands will become scarcer and the price will remain solid.

I’m not saying I can promise you Shock Lands are cheaper now than they’ll ever be again. But I think these are relatively safe compared to something like Advent of the Wurm or Jace, Architect of Thought.

Warren Buffet said one should invest in what they know – if you know Magic more than stocks, I cannot fault you for your move. But stock market can provide faster gratification because shifts are faster.

This article hit the nail on the head for me. I used to try and get in on every quick flip I could and the result was that by the time I received the cards and were able to flip them, cards I got for $6 and climbed to $15 went back down to $10 by the time I received them in the mail (see Spellskite and Thrun). Once you add in fees and shipping, it was hardly worth it. Much like you and Chris, I’m also in the “full time job with small child” boat so time to dedicate is limited.

I focus on Standard now since the demand is consistent and the format is easier to stay on top of via SCG opens and twitter. Standard cards also sell very quickly on tcgplayer.

I haven’t been able to bite the bullet on sealed specs but I’m thinking of buying some $89 RTR boxes and sitting on them. Seems like a no-brainer to hit $150+ in the next 12-18 months.

Jim, thanks for the comment! I’m glad the theme resonated with you, and we are all indeed in the same boat family-wise. 🙂 This quick flip thing is really tough because large quantities need to be purchased, acquired quickly, and sold right away in some cases. That’s time consuming and risky. Standard staples in RtR block are stable and more reliable. Something like Deathrite Shaman or Abrupt Decay may not grow 1000% in a week, but they should creep up in a few months to a year and yield you better profits per unit time of effort.

Great article Sigmund. Personally, most of my profits come from investments on key cards /staples so, I have to agree on this. Regarding the sealed product…most likely due to my inexperience on it, I find it kinda risky. 1/2 years to unload such a big investment in mtg cards seems like too much for me and besides it, I do not have much experience on selling in ebay… I sell in mkm or to local players and those very rarely look for sealed product from older sets. Also, I am unsure if in EU there is such a tradition on buying sealed product from older sets… The player base is smaller (and different) than the one in US.

Thanks for the comment! I will say that I have heard that booster boxes are tougher to move in Europe. I’m not sure if it’s just a difference in player base or in culture.

To the risky aspect – only the magnitude of the purchase makes sealed product seem risky. But let me ask you this: what’s riskier? A $1000 investment in Intel stock or a $100 investment in AMD stock? The magnitude of investment is higher on Intel, but I would argue the reliability of the company far exceeds that of AMD. Therefore even though the initial layout of capital is higher, the likelihood of making profits vs. the likelihood of losing money is much different between the two stocks. I’d argue booster boxes are like a stable stock because they rarely drop in price, (never do, these days). Some singles may run up and down more rapidly, but carry much more risk (and demand more of your time to watch closely).

Really linked this article and i will refer back to it in the future to better determine my next paper investments. Thanks Sig!

Thanks for your comment, Sebastien! Glad you appreciated the article. It’s taken me a while to realize that my strategy has been more emotional-based and not based on true goals. If I just want to profit from Magic, I can do that with much less effort by buying safer things rather than trying to catch every quick flip. I will try to live by this.

develop outlets for your cards = reduction in overall risk.

if you question shockland plays, you must think modern is going to do nothing. modern players will want these even if they were not also forest/island/mountain/swamp/plains because they can come in untapped when you need them that way. less conditional than fastlands for example.

nothing wrong with easy.

how much is your magic stuff worth? buying a sealed product looks like a big investment until you compare its value to other stuff in your inventory. this is just sticker shock. get over it and make some money.

another nice way to address risk is proper card evaluation. identifying constructed playables, 4 ofs, etc make sinking cash into mtg easier.

Agree with you on Shock Lands. I have been accumulating them over the past few months. I have my set of 40 now at a minimum, plus a few extras. I could go deeper, but I liked Innistard booster boxes better :).

Same. Got my 40 in paper and on MTGO since I’ll likely use those for a while, and moved onto other pastures.