Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Every morning I conduct the same MTG research – I check my Twitter feed, I review the Daily MTG page on The Mother Ship site and I often scan my watched eBay auctions to identify which cards are selling and which aren’t.

But no morning would be complete without reviewing the top Interests on mtgstocks.com. This daily update has become a cornerstone of my research because it enables me to keep my finger on the pulse of the MTG market constantly. While a few outliers can skew numbers, often times the insights I gain from reviewing this site are of great value.

But “value” is a fairly generic term. Sometimes the most useful information from mtgstocks.com is not the next hot buy. Instead, general insights into metagames, casual interests, and how the market is ridiculous can all surface from the data on this website. How we react to the data and utilize it is how we extract this “value”. Allow me to explain further.

Sunday’s Interests – A Case Study

Where is the value from Sunday morning’s feed?

I often skip over the From the Vault cards since their supply is generally lower and so their prices tend to move more readily. Additionally, the price increases on smaller cards like Mana Echoes and Propaganda aren’t very interesting.

But inevitably there is something worth reviewing. This time I have taken note of two important tidbits here which I can gain “value” from.

First, I notice that Burgeoning has continued its slow, steady rise in price. Over the course of the past year this Green Enchantment has gone from $5 to $9 TCG Mid, an 80% increase in price. While this is a steep increase, the rise has been gradual in nature. This indicates to me the possibility that this price increase will stick – more on that later.

The second mtgstocks.com Interest I took note of this morning was Chord of Calling.

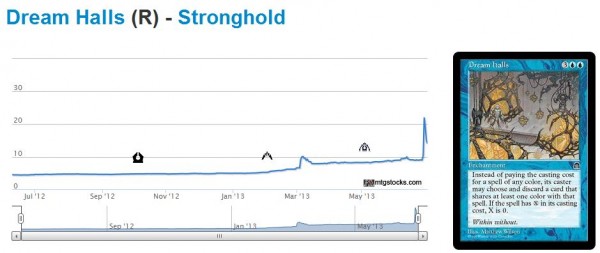

What I like about this data point is the fact that the price continues to rise despite already jumping in price significantly. So many times we watch a card jump in price drastically only to see it retreat in the subsequent week. A recent example of this would be Dream Halls, which after doubling has dropped 14.8%, 20%, and 6.7% in three consecutive days. Despite the sudden spike in Chord of Calling’s price, I feel the sustained subsequent price rise indicates to me this higher price may stick.

The Factors That Matter

Why is this so important? Why do I like Chord of Calling’s new price but not Dream Halls? I’ll try to explain a bit further what I look for in a price chart and what card characteristics I consider when determining if a price spike may stick or not.

An Unsustainable Rise

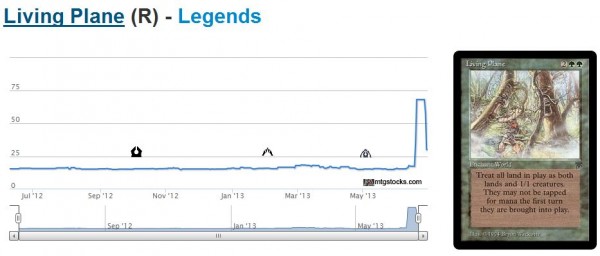

So often a card’s price will spike due to a coordinated buyout. A player or dealer decides he or she wants to manipulate the market, so they go online and purchase as many copies of a single card as possible. This happened recently with Living Plane.

Being a rare from an older set and on the Reserved List, it certainly qualifies as one of those potential “buyout targets”. Someone noticed this and decided to make the spike happen – the card’s price tripled overnight.

Upon seeing this jump I had to make a quick decision. Do I scrounge MTG shops all over the net to find copies at the older price or do I let this one go? (Since I owned zero copies I didn’t have to debate selling, but I’ll touch on this later). To answer these questions I first consider the formats this card is relevant to and also its playability. In the case of Living Plane, I deemed this card relevant in zero formats. Seriously, zero. Maybe someone can convince me this is playable in EDH but it’s just so pointless to use. The artwork is probably the best part of this card.

Since the card’s uselessness was so obvious to me, the decision to pass on this hype was an easy one. I neglected to buy any copies even at the old price – this turned out to be the right decision. The card has already retreated almost entirely. If I had pulled the trigger, I would not have received the copies in time to sell at the peak price, and fees would likely have eaten away at whatever profits I could possibly gain.

A Sustainable Rise

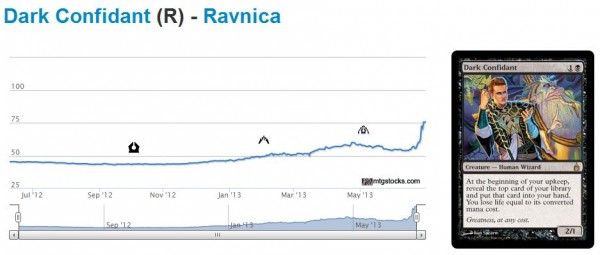

When Dark Confidant spiked in price, my analysis went very differently.

During GP Vegas major retailers were increasing their buy prices on Dark Confidant to $50. It became very clear that the increased supply from Modern Masters would not outweigh the increase in demand driven by a newfound interest in Modern. The result – a moderate price spike in cards like Dark Confidant and Tarmogoyf.

The same analysis this time yielded very different conclusions. Dark Confidant and Tarmogoyf are both very relevant in Legacy and Modern. Demand has seen a legitimate increase, driven by increased interest in Modern and increased aggressiveness from retailers to increase stock in anticipation of Modern season.

The conclusion: this card was a buy once the spike begun. I regretfully missed the opportunity on Bob despite watching him sell out on eBay all weekend. Instead I focused my resources on Tarmogoyf. This decision has also paid out, fortunately, so I have less regrets on missing Bob’s spike. It seems that an increase in demand from both retailers and players for very relevant Modern and Legacy cards is a very sustainable factor to increase a card’s price. This is also why I think Chord of Calling’s higher price will stick.

In-between Cases

Sometimes a card’s price spikes and it’s not obvious how the trajectory will continue. These are where the tougher decisions need to be made. For example, consider the recent spike in Dream Halls.

The card was steadily rising – a very sustainable trend – over the past few months. Then suddenly the price spiked over 100%. Considering the factors I outlined previously, this card is somewhat relevant in Legacy. It’s shown no dominant performances but has seen a steady increase in play thanks to the printing of Enter the Infinite and Omniscience. But is this enough to merit a 100% price increase overnight?

I believe the answer is no. There were no major tournaments where Dream Halls occurred in significant numbers within the Top 8. The price jump seemed too artificial for my liking. And I’m not just saying this because I have 20-20 hindsight. When spikes like this happens, and you determine it’s largely artificial, the best thing to do is to list any copies you have for sale immediately. I’m talking the morning of the price spike and no later.

This is precisely what I did with my three copies of Dream Halls. I had picked these up a month or so ago after noticing this card’s increase in play. As I mentioned before, steady price growth can be very sustainable. But once the price spiked artificially overnight, I listed my copies on eBay with the lowest buy it now price. Within two hours, they sold for $14.99 each. Just a couple days later, the TCG Mid price has already dropped below this price. Selling into artificial hype is always good. Take your profits and move on – let someone else juggle the hot potato to try and make a little more profit.

Don’t Be Emotional

It’s always exciting to see cards on the move every morning. But we need to keep emotions out of our decision making process when it comes to price spikes. If a card jumps overnight, it can be tempting to buy more copies online with plans to sell at even higher prices. The old mantra of “buy low, sell high” should remain at the forefront of your strategy. Don’t buy into a spike unless you truly feel the price rise is sustainable based on fundamentals.

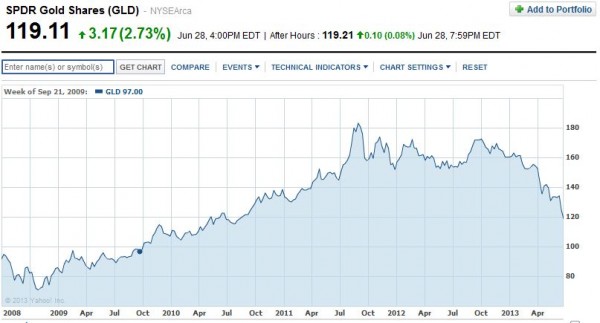

In the case of Dark Confidant and Tarmogoyf, the price increases were 100% justifiable. Buying these out of necessity is perfectly fine (though I don’t know if buying today would net you much profit vs. the risk you’d have to take). In the case of Dream Halls, insufficient fundamental support for a card makes for a weak foundation. In these cases, don’t buy into the hype. Instead, sell spare copies you have immediately. Even waiting one day can mean less profit because the faster these cards spike, the faster they tend to drop. Selling into hype for significant profit is always right even if you don’t sell at the peak. If people had done that during the recent gold bubble, they may not be riding a terrifying roller coaster right now (chart from Yahoo! Finance)…

...

Sigbits

I love Star City Games’ feature where you can ask to receive email notification that a card is back in stock. It helps me stay on top of price increases and measure supply/demand of certain cards of interest. Here are some alerts I currently have set because SCG is sold out:

- Elemental Tokens from Dragon’s Maze! I’ve had an alert on these for weeks now and I don’t remember receiving an email they were restocked. As long as Voice of Resurgence remains relevant, these tokens will be hot. SCG offered me $2.00 each on my copies at GP Providence but I turned the offer down. Now they are sold out at $4.99 – I should be able to get $3 on these very soon.

- Both regular and foil copies of Chord of Calling are sold out on SCG. This is more evidence that the recent spike is sustainable, and I suspect that when I do finally get that email alert, these prices will be higher.

- On the other hand, you know how Mana Vortex recently spiked to $10+ on mtgstocks.com. Well, SCG currently has two NM copies in stock at $3.99. Unlike Chord of Calling, this card isn’t sold out. With the highest buy price on Mana Vortex being a mere $2 according to mtg.gg, I see no reason for this spike to last. Sell your copies now, but make sure to set an alert on SCG for this card should it sell out. The restocking price will be a tell as to whether SCG believes in the price jump.

-Sigmund Ausfresser

@sigfig8

Living Plane works well with Elesh Norn, Masticore, Goblin Sharpshooter, etc. There is a reason it was not at Legends bulk level. That said, obviously the spike is bogus.

Fair, I can see Living Plane being stellar with Elesh Norn. Making all your opponents lands into 1/1’s so they’re easier to pick off does sound fun. That being said, it seems like a very specific strategy requiring specific cards and color combinations. It’s not enough to merit the spike, as you said.

Fun depends on the perspective, most groups do not appreciate mass LD. It is however something you could possibly focus on in a deck, Green Kamahl and other cards can also be used to animate lands and there are quite a few ways to kill 1/1’s. If you pick Sliver Queen as your general you can generate the fodder required for something like Goblin Bombardement.

I’m very happy to see that you had the same line of tought I had about dream halls. At the time, I post it on forum alerting people. Most of the answers I had were to hold them.

Fortunately I kept with my opinion and made the right call.

Yeah, I couldn’t rationalize the price jump completely. Should Dream Halls be $5? Not at all. But it had been steadily increasing in price in a very sustainable, healthy way until someone decided to change that. The spike was artificial (not driven by demand). The price will never be $5 again, but $15+ is not supportable without better tournament results.

Good call in selling!

This article is a good answer to the doomspeakers on the forum.

Artificial buy outs are new. They don’t screw us. We just need to learn how to adapt to them.

Identify, Analyze and react correctly.

You got it, Brecht! I used to panic with these price spikes – I would scrounge websites looking to buy any copies I could find all the while worrying I missed out on some super awesome opportunity.

You know what – I did miss out on an opportunity…the opportunity to sell at ridiculously inflated prices. Any time I see a spike I cannot rationalize, I’m going to sell any copies I have.

Chord of Calling tempted me, but I can mostly rationalize that one. The price may not stay this high, but I think $20 Chords going into this Modern season is very likely. Dream Halls though? No way, I moved those the day of the spike without regret. If only I owned stupid Legends Reserved List cards like Living Plane…would make a killing on these spikes.

gold at 1000$ and i’ll sniff. until then looks like dollar ^ versus it. if i want gold today, buy it in yen.

sofi MM is a spike in progress. i want one, but it isn’t an investment. the easy way to evaluate these without waiting for retracement is to simply look at supply, a spike on more available cards is more likely to hold up. legends spikes on fringe cards, less so. sword of fire and ice is an interesting case, i think everyone likes the new art and it is limited supply, making foil copies insane. i don’t think there is much juice left, as 33% of the price gets you a judge foil with old borders on ebay.

there is always another chance to profit. don’t react to spikes. learn from them.

Precisely – It’s best to learn first and act second. I guarantee we haven’t seen the last spike.

Your suggestion to look at supply is an interesting one. You suggest the larger the supply on a spiked card, the more likely the rise is sustainable. This makes some sense, but I think there are more factors that should not be ignored. On the whole, though, you are right. Some exceptions might include Chains of Mephistopholes and The Abyss, which are low on supply but maintained their hike.

You said that Dream Halls has “shown no dominant performances.” Do you not consider winning BoM, the biggest Legacy tournament in Europe, a “dominant performance?”

Winning the tournament alone is not dominant. I’m talking about what Survival of the Fittest did to Legacy a couple years ago – that was dominant. I want to see at least 3 decks running 3-4x of a card in the Top 8 of a major tournament (preferably more than once in a given month) before considering the strategy “dominant”.

I won’t lie – I am not familiar with the BoM tournament results this past year. Did other decks in the Top 8 run Dream Halls? If so, then I may be more inclined to believe in the price spike.

Regarding Survival the joke was made that Legacy was very diverse, there was Aggro Survival, Control Survival and Combo Survival, Survival was perhaps a little beyond the kind of deck you should be looking for.

I’m pretty sure the Dream Halls spike is somewhat related to Bazaar of Moxen, which is one of the largest Eternal tournaments you’ll come across. If a deck wins a tournament like that people will be paying attention even if there are not 2 more decks like it running 3-4 copies in the top-8. The fact that it made top-8 at all should be a good indicator in such a large field.

I know Survival is a more extreme case, but even Show and Tell didn’t become a $50 card until after it started putting up consistent numbers at major events. Reanimator always played a copy or two of Show and Tell back in the day yet the card remained in the $20-$25 range. It wasn’t until people started to abandon reanimation strategies for Show and Tell strategies that SnT really responded in price.

I’ll maintain my stance – I feel the Dream Halls spike was unmerited until I see Dream Halls occurring in 3 or more decks of Top 8s.

I think at least partially players want to be sure to have the card now that it has done well. If I didn’t have my set already (since ’98 no less) I know I would be looking to get at least a playset. These are not cards you often find in binders. People like us could at least check if anybody locally wants them and make sure to get them for those people. Getting in when the card does put 3 decks in a top-8 might be too late for getting good deals.

Of course on the other hand it might as well be a one-day fly, anybody remember the Eureka spike?

It seems very unrealistic to expect any deck to occur 3+ times in a top 8. Yeah, it happens sometimes, but it’s very rare. Legacy is diverse enough that results are very match-up dependent, so luck is a huge factor–even when you’re playing the best deck.

What you’re suggesting is that for Dream Halls to jump in price and stay there it has to not only be the absolute best deck, but also completely annihilate everything else in the format. I think you’re setting the bar way too high.

Did you see the results for Baltimore on June 2? The deck placed 7th, 10th, and 16th. Three results in T16 is incredible, as any experienced tournament player can tell you that the difference between T16 and T8 is not large.