Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

In case you missed it, I’d highly recommend checking out my Alpha and Beta article from last week. Why am I emphasizing it? Basically, this has become one of my favorite go-to investment segments.

I'm looking to convert my recent gains in random Reserved List staples into cards with the same upside potential and rarity, but without the inflated prices. There appears to be more natural price appreciation and less market manipulation with these classic cards that have no default presence on MTG Stocks.

Ultimately, when I see that Star City Games pays $8 on any Near Mint Alpha uncommon and $4 for Played, I know that these have a fairly reliable price floor. Card Kingdom’s prices are a bit more volatile (more on volatility later) but you could get lucky and find a buylist for a random Alpha uncommon that goes even higher. The limited downside with great upside is the exact kind of investment I strive to make in MTG finance.

In fact, such assessments of risk and reward remind me of another kind of alpha and beta terms when it comes to investing. Rather than referring to Magic sets, these terms are stock market concepts—though they still may apply to MTG finance. Let’s unwrap these two terms, explore how they are applied on Wall Street, and use these concepts to sharpen our Magic investing approach to make sure we’re making wise decisions when it comes to risk management.

Alpha and Beta: Measurements of Investment Risk

This website provides concise definitions and descriptions of these terms. For convenience, here are the simplified definitions below:

Beta: Historical measure of volatility. Beta measures how an asset moves versus a benchmark (i.e. an index).

Alpha: Historical measure of an asset’s return on investment compared to the risk-adjusted expected return.

In other words, Beta is a measure of how volatile an asset is relative to a benchmark, typically an index. A high positive Beta indicates a more volatile asset relative to the index, and a Beta between 0 and 1 suggests the asset is less volatile than that index. Negative Beta simply implies that the asset and index are inversely correlated: when one goes up the other goes down.

Alpha, on the other hand, is a bit more complicated. This term attempts to quantify an asset’s returns relative to its expected return, given the risk involved. A simple example should better illustrate this concept.

If a stock is extremely volatile and moves dramatically each day, you would want to make disproportionately more profits from that stock to make up for all the risk you’re taking. You should expect to make more money when you’re taking on more risk. Conversely if you buy a stock that hardly moves, you may be okay with smaller gains because you aren’t really risking that much to the downside.

With these concepts introduced, let’s now shift focus towards Magic investments to see if we can analyze different investment options for their Alpha and Beta.

Magic Investing: What is Worth the Risk?

It’ll be difficult for me to calculate precise values of Alpha and Beta for individual cards because there isn't really a solid “benchmark” to compare against. What’s more, I don’t intend on turning this article into an exercise in mathematics. Therefore I will use a more subjective approach to simplify content and deliver what I hope will be a clearer message.

So let’s start somewhere: how about we think about all these recent Reserved List (RL) spikes. What do we think about these with respect to Alpha and Beta?

No matter what index you compare these RL cards to, I’d argue that for years they had very low Beta. That is, they barely moved relative to the broader MTG market. They were a bit like your slow-and-steady blue chip gainers. As such, we would have been perfectly content sitting on cards like Lifeblood and North Star because we could accept smaller gains given the lower volatility (i.e. the Alpha was acceptable).

But that all changed back in August, and many of these once-steady cards suddenly skyrocketed in price. Then after going way too high, they quickly sold off to a new, albeit higher, equilibrium.

Suddenly these cards had Betas well in excess of one. If you compared these cards to the average basket of cards in Magic, they were moving disproportionately relative to the basket. This is where things lie today: these cards are showing up on MTG Stocks frequently with movements over 10%. They are much more volatile as the market continues to seek what the new equilibrium price should be.

With the higher Beta, we should only want to invest in these cards if we expect higher returns on our investment. But this is a bit backwards now, because the significant return on investment already happened! Thus the volatility was acceptable back in August, but right now I’m not sure if it’s worth holding some of these Reserved List cards. In the short term, they represent a little too much risk for what upside may remain.

With this analysis in mind, I’m still inclined to say that selling your random, unplayable Reserved List cards may be wise. This is what I’ve done lately as I attempted to move profits into an investment with lower Beta.

What About Other Cards?

Let’s take a look next at some Standard cards. The Pro Tour this weekend didn’t create tremendous buying opportunities as it has in the past. Perhaps this is an artifact of the new timeline, where Pro Tours take place over a month after a set’s release. In any event, the biggest gainer as of Sunday morning was Vraska, Relic Seeker. It jumped from $17.50 to $25 over the past few days.

Was this a worthwhile investment? I suppose if you only bought into Vraska, you would be feeling pretty confident about your Pro Tour speculation. But the fact of the matter is, Standard cards move in price with a bit more volatility. Downside potential for a Standard Pro Tour spec is substantial, should the card not appear on camera. Given that, I’m not so sure it was worth your money to bet on something as risky as Vraska when the upside was only about 20% after fees and shipping.

For example, the lack of tribal Dinosaurs at the Pro Tour meant a significant dip in Regisaur Alpha’s price.

Of course, this assessment is rear-facing. If the Pro Tour ended up containing a Top 8 of all new technology and breakout decks, then there could have been numerous opportunities to make significant profit. This is often why we bet on the Pro Tour to begin with: the potential Alpha is there despite the higher volatility. But lately, I just don’t know if it’s worth the risk.

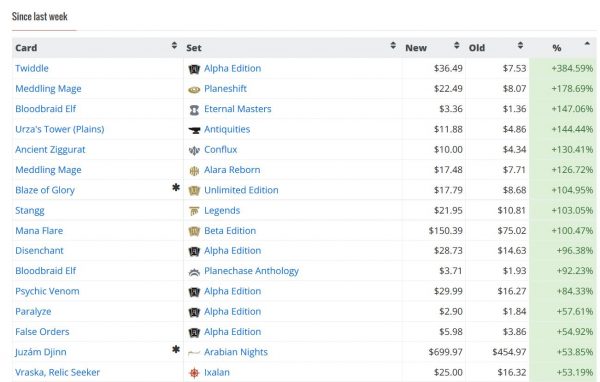

Consider how many cards moved more than Vraska over the same time period:

You can see there were plenty of better investments that yielded superior returns. What’s more, many of these investments would not have carried the same risk that Vraska had.

Now granted, some of these Alpha and Beta cards show more growth than they really experienced simply because supply on TCGplayer is so low. When one card sells or one seller adjusts a price, it moves the market drastically. But I still maintain that there are so few Alpha cards in stock on TCGplayer that these are bound to see a spike. Can you sell an Alpha Twiddle for $36 today? I highly doubt it. But will Near Mint copies be worth more than $7.50 three months from now? I would bet on it.

Besides those, you also have Modern hype around Meddling Mage and Ancient Ziggurat, and unbanning speculation on Bloodbraid Elf.

These would also have been better bets than Vraska from a performance standpoint. And when you consider the Alpha—how much upside you’re getting when considering the volatility—I would argue that these other bets would have been even more interesting compared to any Standard speculation.

Vraska has a ton of potential to drop in price over the next year…certainly when you extend to two years and plan for rotation, Vraska’s prospects get even worse. But a Near Mint Alpha card has virtually no downside over the same time frame. So you have less downside and more upside? That’s my kind of investment!

Wrapping It Up

When I sat down to write an article on Alpha and Beta risk in MTG finance, I had not planned on knocking Standard speculation. But no matter how I approach the field, I always net out in the same place: investing in Magic’s more iconic cards from the earliest sets has the least downside and an awful lot of upside. It’s hard to beat that when looking for the right investment strategy.

Other cards in Modern and Legacy can also be worthwhile buys, but you really need to have a catalyst in mind to make the purchase worth the risk. What risk? Risk of reprints, bannings and unbannings, shifts in the metagame, obsolescence with the advent of new cards being released, etc.

These risks just don’t exist with Alpha, Beta, and Old School playables. With those your only risks are systemic risks with Magic as a whole. Of course Magic isn’t impervious to retraction in its player base, but this is a risk I’m far more comfortable taking.

I know I’ve shared this sentiment before, but hopefully adding the Alpha and Beta context to my Alpha and Beta investing underscores my rationale more definitively. We have a ton of investment options in the world of MTG finance, and it’s impossible to buy everything. By using these Wall Street concepts to inform whether or not our buys are worth their risk, we can become more disciplined investors in Magic.

Applying this approach has strengthened my belief that the place to invest now is Alpha and Beta cards, preferably in Near Mint condition. It would take a fairly compelling shift in Standard’s metagame for me to move resources in that direction. It’s not impossible, but the Alpha must be favorable—I need to have significant enough upside potential to counteract the volatility Standard brings. If it’s not there, I’ll stick with what I know!

…

Sigbits

- Star City Games often has best-in-class buy prices on Alpha and Beta cards (though I would never count Card Kingdom out). One area in particular where SCG really shines is their buy prices on nonblue Alpha. For example they pay $1250 for Near Mint Alpha Plateau (they currently have zero in stock at $1999.99), and the next highest buy price according to Trader Tools is $1150. It’s incredible how few of these are available for sale on the open market!

- Soon after I completed my playset, Arabian Nights Erhnam Djinn got bought out and shot through the roof. While the $400 price point was far too high to realistically stick, Star City Games’ $249.99 price tag seems more than reasonable given the card’s utility in Old School. Not to mention they only have one copy in stock, played for $199.99.

- This past weekend I also decided to finish my playset of Arabian Nights Serendib Efreets. It’s painful paying so much for them given they were half the price just two months ago, but I think there may be another leg higher soon if I’m honest. The card spiked over $400 (sound familiar?) only to drop back down to $300. But Star City Games remains sold out at $249.99 and top buy price is $161 and rising. This will never achieve Juzám Djinn status, but this card is one of the most played Arabian Nights creatures in Old School and in my opinion thus deserves a premium.