Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Welcome back, folks. This week I aim to conclude our discussion of low-converted-mana-cost (hereafter referred to as "cheap") mythics. Last week we covered the two extremes—the instant standouts ($10 and above) and the ones that were quickly scorned ($2 and below). We identified some broad rules that can be applied to help you make good investment decisions into cards in this category:

1) Cards whose investment lows don't dip below $10 before the release of the next set are very likely to increase in value. The average rate of increase has been 65.0% for the mythics in this category printed in the past four years.

2) Cards whose investment lows fall into the $1 to $2 range before the release of the next set will rarely increase in price or undergo a price spike. Depending on your cutoff date for selling, the average rate of increase has been roughly 0.0%, if not a tad lower, for the mythics in this category printed in the past four years.

But what about those in between? While half of cheap mythics fall into one of the two above categories, the other half fall between $2 and $10, indicating either that the card is seeing a non-zero amount of play or that the card has been deemed by speculators to have a lot of potential power that the current card pool has not yet unlocked.

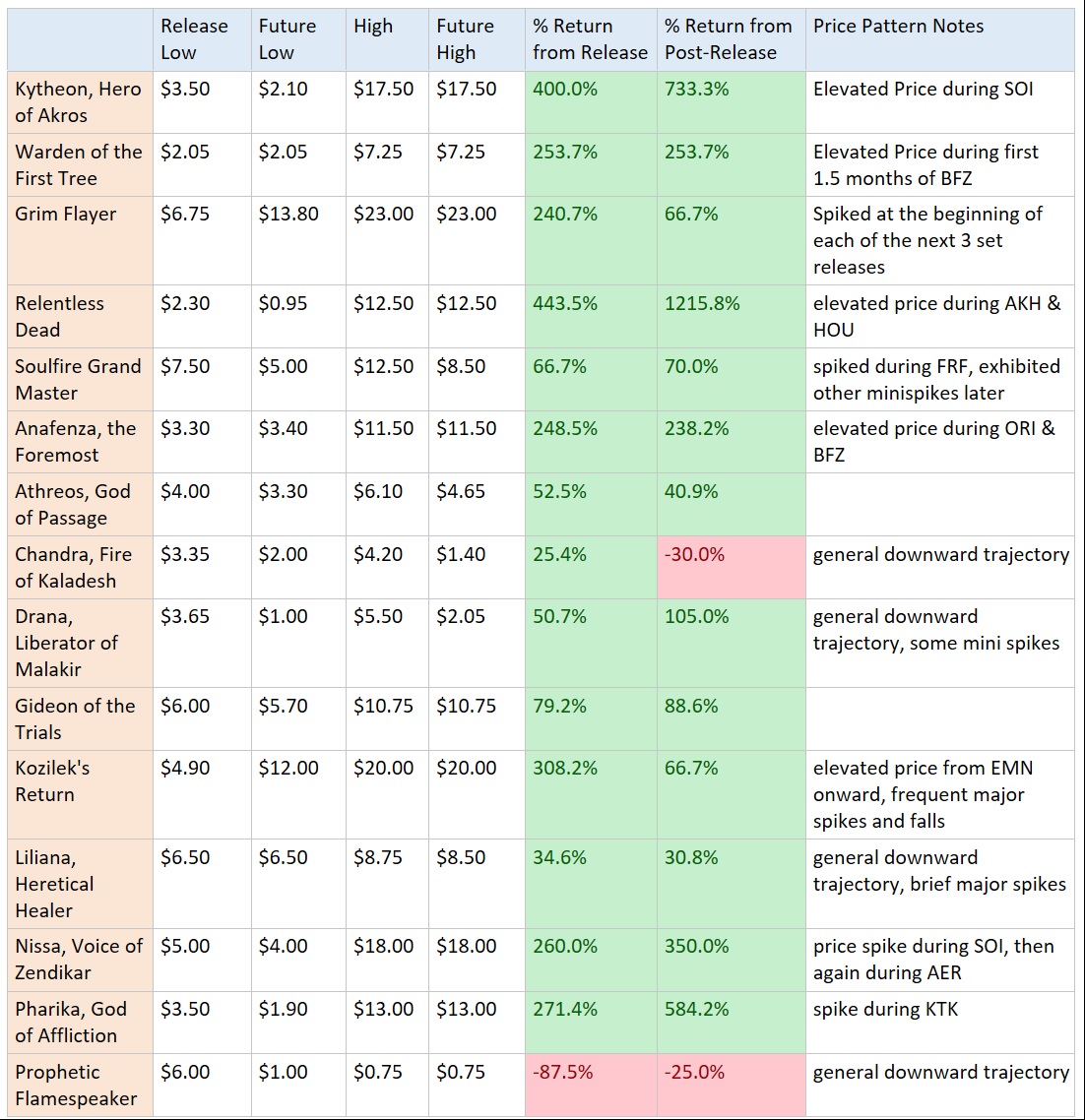

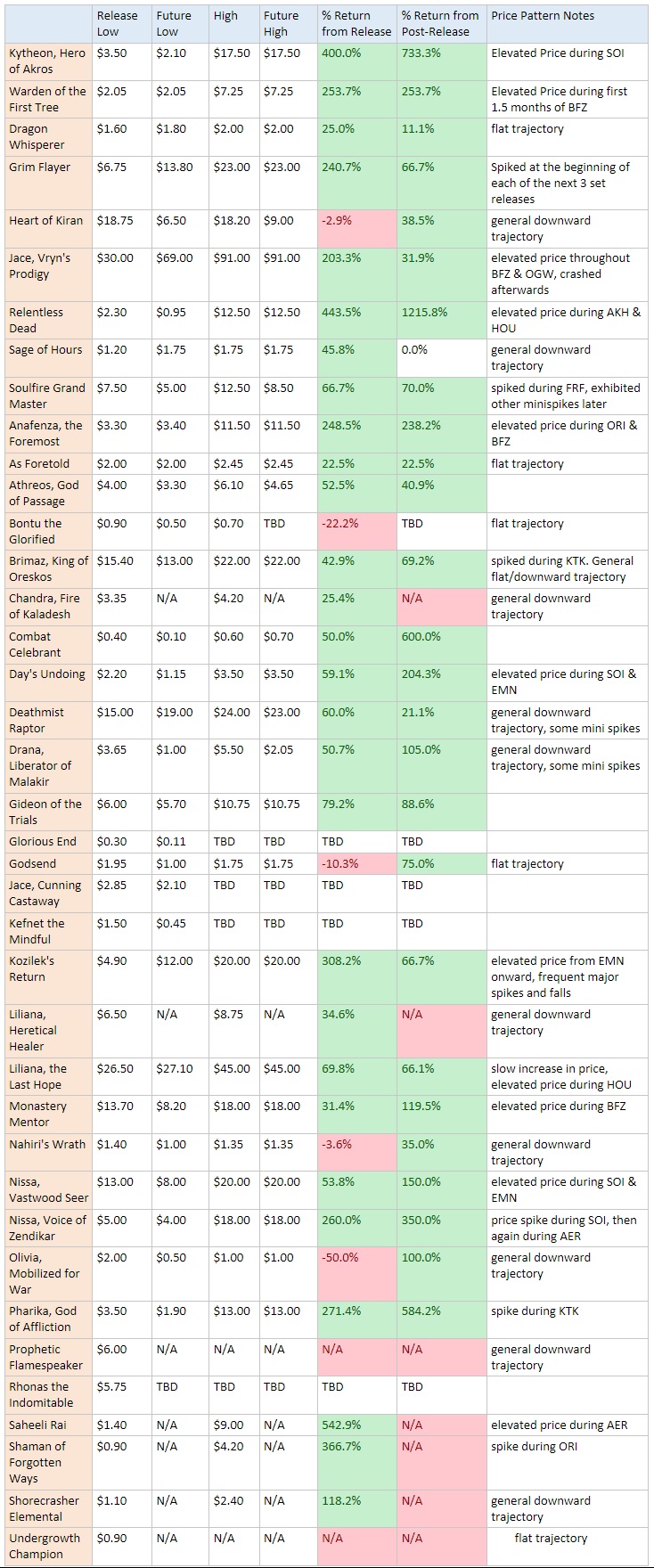

Can we discern anything about this category of card in this price range? Will we be able to create hard and fast rules for them like we could for those at the two extremes? Let's dig in! And click the spoiler below to see the data sheet we are working with.

Cheap Mythics Between $2 and $10: Surprisingly High Returns!

After conducting my research, I was surprised that the cheap mythics in this middle price range proved to have the highest overall returns. And it's not even close. Compared to the 65% returns for cheap mythics above $10, these mythics have had returns of a staggering 176.5% during the past four years! Let's take a closer look at the chart below.

1) Although the rates of return exhibit high variance, they are almost all positive.

Thirteen of these 15 cards exhibited substantial growth or significant price spikes during their time in Standard. Eight of these 15 cards exhibited release growth between 200% and 400%, and the majority of those that didn't still grew by about 50%. That suggests that investing in these cards is well worth the financial risk.

Unlike cards that settled below $2, the vast majority of these cards managed to see substantial play in Standard eventually, even if they didn't find an immediate home. I was surprised to find that even more niche cards like Liliana, Heretical Healer and Athreos, God of Passage saw a sell window wide enough for casual or amateur investors to turn a nice profit.

2) On average, you will maximize your profits if you exercise patience.

Although you would have garnered a marginally higher rate of return with the $10 mythics by waiting (71% compared to 67%), the rewards for waiting in this category were substantial (252.6% compared to 176.5%).

I suspect much of the reason has to do with precisely the category of card we are dealing with here—cheap mythics that aren't seeing much play or have garnered substantial investor interest. In order to even be in this category, these cards can't have blossomed in Standard, and usually it takes more than one new set release to vault these cards to tier-one status.

Sometimes that is not the case (Grim Flayer and Soulfire Grandmaster), but usually mythics in this category dip lower before spiking upward at some point in the future. Buying a month or two after the next set's release is usually a wise move for those wishing to maximize returns.

3) Be prepared to hold these investments for a while.

There is one downside to investing into cards in this category—the time to exit your holdings is open-ended. Oftentimes you won't be holding these cards for more than a month or two, but sometimes you will be stuck holding them for a year or more.

Relentless Dead is an extreme case but one you should be prepared for, a card that sunk all the way to $1 until Amonkhet's release. A good exemplar for the average-case scenario for this category of card is Warden of the First Tree, both in terms of expected returns (250%) and in terms of the length of time you will have your capital tied up in the card (six months).

Applications to Today's Mythics

Some of the recent mythics in this category are a bit odd in that they are fairly narrow cards. Jace, Cunning Castaway demands an aggressive blue shell. So long as Heart of Kiran is in the format, I think Jace has a shot at seeing a major price spike. I took a major gamble with Jace (I wanted to invest before the release of Rivals of Ixalan), and so far I've lost bigly. His price is now 1.77 tix, which strikes me as a good buy for those wanting to take the risk (now that Rivals has come and gone, my recommendation is not to invest in Jace).

Kumana, Tyrant of Orazca, like Jace, is extremely narrow. His price will depend solely upon how successful the Merfolk deck is in Standard. And, since that is but one deck, I don't think his ceiling is all that high.

Rhonas the Indomitable is one that I do believe is worth investing in, and he stands to benefit from the recent Standard bans. I bought about ten copies when his price was below 3.00 tix, and I think anything under 3.50 tix will see a positive return. I plan to sell Rhonas if and when his price reaches 5.00 tix.

More so than anything else, though, this article is about giving us historical awareness to inform our investment decisions moving forward.

Signing Off

I'd love to hear your comments and questions about the articles in this series. Do you like them? Do you find them insightful? Did you notice something important I missed? Do you have any additional perspective on this class of mythic rare?

Here is a copy of my portfolio. I've begun to slowly sell off some of my positions of Vraska's Contempt and the Rakdos duals which have risen in value due to the rise of Grixis Energy Midrange. Based upon the research I did for the Ixalan lands in September, I think that selling Dragonskull Summit for anything higher than 1.25 tix is acceptable, and anything above 1.75 tix is excellent.

This week I'd like to share a cute dinosaur creature card I designed for a design competition. Although I had to scrap it because I couldn't get it to meet the strict confines of the design challenge, I like the way that it enables fight spells in a competitive environment.

Wow great research. This will help me in my future specs. In the past I tried to use the broad basket approach which worked maybe 2ish years ago. But now in the “pushed for constructed” era where it seems that the meta is only 2 or 3 decks, I have found that being really narrow on only the best cards seems like the place to be. This article will really help to eliminate negative specs. Just to ask the question, in the expanded view of the chart, is that just about all of the cards that would fit into this category? Or did you determine the sample size a different way? Just curious. But I cant wait to implement this in my future specs.

I’m excited to incorporate this research into my future speculations as well. The list wasn’t curated in any way – it contains *all* of the cards that qualify from Born of the Gods onward.

Great research. I tend to look at card with potential with no time frame in mind, and I clearly agree with Rhonas. Unfortunately, as you mentioned, there is not much else to look at now…