Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Welcome back readers!

This week's article topic is courtesy of one of our fellow Insiders, who will stay anonymous unless they choose to out themselves. It is a story about a high-risk move, its potential for profits, and its potential for disaster.

Background

As you all know we've seen tremendous spikes in many Reserved List cards this year, and Legacy/Vintage/Old School staples have been hitting record high after record high. The potential profit is high, but so is the buy-in.

Given this, it might seem enterprising to use alternative forms of capital (i.e. credit cards or bank loans) to purchase these cards in advance of the anticipated market movement. It goes without saying that this strategy carries with it significant risk. Almost any type of short-term loan comes with interest fees, and the fewer hoops one must jump through to secure this capital, the more likely the interest rate will be high.

It's also important to note (especially with older, higher-dollar cards) that condition plays a big factor in card value. What might seem like a very good deal can quickly slip away if there is a condition discrepancy.

The Purchase

In case you haven't guessed yet, our Insider chose to pursue this strategy. They purchased the following cards, on the following dates, at the following prices.

| Card | Average Price | Days Since Purchase | Current Price | Profit (Sold Today) | Price Paid with Interest | Interest |

|---|---|---|---|---|---|---|

| 4x Volcanic Island | $290.00 | 112 | $435.00 | $134.12 | $300.88 | $10.88 |

| 4x City of Traitors | $117.00 | 112 | $248.00 | $126.61 | $121.39 | $4.39 |

| 4x Force of Will | $53.00 | 112 | $71.00 | $16.01 | $54.99 | $1.99 |

| 5x Gaea's Cradle | $230.00 | 106 | $353.00 | $114.84 | $238.16 | $8.16 |

| 4x Scalding Tarn | $56.00 | 112 | $68.00 | $9.90 | $58.10 | $2.10 |

| 4x Ancient Tomb | $30.50 | 112 | $42.00 | $10.36 | $31.64 | $1.14 |

| Black Lotus (UL-MP) | $3,000.00 | 82 | $5,000.00 | $1,918.04 | $3,081.96 | $81.96 |

| Bayou (Beta-MP) | $700.00 | 82 | $1,200.00 | $480.88 | $719.12 | $19.12 |

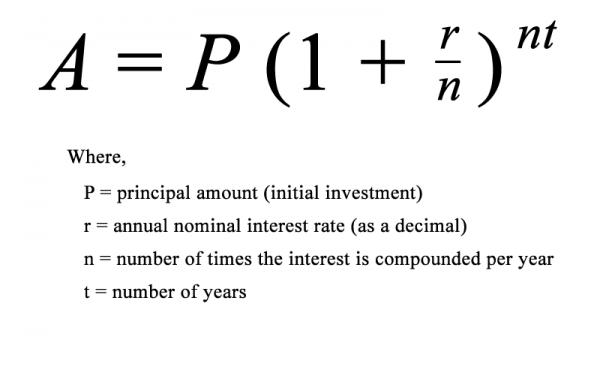

As usual I used this formula to calculate the interest.

As usual I used this formula to calculate the interest.

It's important to note that this Insider had a pretty low credit card interest rate of 12 percent APR. Most credit cards have APRs in the 16-20 percent range. So if we do this exercise at those interest rates, we have the following "Profit Loss Due to Interest" amounts.

| Card | Interest Paid (16% APR) | Interest Paid (20% APR) |

|---|---|---|

| Volcanic Island | $14.59 | $18.35 |

| City of Traitors | $5.89 | $7.40 |

| Force of Will | $2.67 | $3.35 |

| Gaea's Cradle | $10.94 | $13.75 |

| Scalding Tarn | $2.82 | $3.54 |

| Ancient Tomb | $1.53 | $1.93 |

| Black Lotus (UL-MP) | $109.77 | $137.83 |

| Bayou (Beta-MP) | $25.61 | $32.16 |

However, these cards still haven't sold yet, so what happens if it takes another year to sell them?To be honest, these numbers really don't come out that bad. Sure, it isn't fun to lose a couple hundred dollars. However, if this person was in a situation where they couldn't swing the cash to purchase these cards at all, it seems they made the wise financial move here by getting a loan via their credit card.

| Card | Interest After 1 Year (12% APR) | Interest After 1 Year (16% APR) | Interest After 1 Year (20% APR) |

|---|---|---|---|

| Volcanic Island | $49.23 | $67.43 | $86.60 |

| City of Traitors | $19.86 | $27.20 | $34.94 |

| Force of Will | $9.00 | $12.32 | $15.83 |

| Gaea's Cradle | $38.51 | $52.73 | $67.70 |

| Scalding Tarn | $9.51 | $13.02 | $16.72 |

| Ancient Tomb | $5.18 | $7.09 | $9.11 |

| Black Lotus (UL-MP) | $474.84 | $649.22 | $832.34 |

| Bayou (Beta-MP) | $110.79 | $151.49 | $194.21 |

These numbers also fail to take into account the typical fees associated with selling online (marketplace fees and shipping fees), which typically eat up another 13-14 percent overall. If we subtract those we get a more accurate, if not somewhat bleaker, picture.These numbers assume that all of today's prices remain constant, but you can see there are significant profit losses the longer this takes.

| Card | 12% APR | 16% APR | 20% APR | |||

|---|---|---|---|---|---|---|

| Final Profit | Margin | Final Profit | Margin | Final Profit | Margin | |

| Volcanic Island | $36.81 | 12.69% | $18.61 | 6.42% | -$0.56 | -0.19% |

| City of Traitors | $76.02 | 64.97% | $68.68 | 58.70% | $60.94 | 52.09% |

| Force of Will | -$3.55 | -6.70% | -$6.88 | -12.97% | -$10.38 | -19.58% |

| Gaea's Cradle | $35.98 | 15.64% | $21.76 | 9.46% | $6.79 | 2.95% |

| Scalding Tarn | -$9.68 | -17.28% | -$13.19 | -23.55% | -$16.89 | -30.17% |

| Ancient Tomb | -$2.53 | -8.30% | -$4.45 | -14.58% | -$6.46 | -21.19% |

| Black Lotus (UL-MP) | $884.16 | 29.47% | $709.78 | 23.66% | $526.66 | 17.56% |

| Bayou (Beta-MP) | $232.71 | 33.24% | $192.01 | 27.43% | $149.29 | 21.33% |

Conclusion

In this case, if it took an additional year to sell these cards at their current prices, our Insider would lose money. This in spite of having purchased the cards at buylist values, significantly below market value.

There's also no guarantee the prices won't drop—most of these cards have already spiked and it isn't out of the question for them to slip a little if the market finds them too inflated.

So while this strategy can still prove quite profitable in the short term, it requires a lot of things to go right:

- The initial buy-in must be extremely competitive (likely around buylist).

- The cards must go up or maintain their value. This strategy seems extremely risky for cards whose prices wax and wane a lot, like Standard.

- You need to be able to actually sell the cards in a short time frame. A spike doesn't do you any good if nobody is buying at the new price.

- Ideally you need as low an interest rate as you can get, as interest can greatly reduce (or completely eliminate) your profits.

I bring this all up because with card prices jumping so drastically, and many people not having a lot of extra capital lying around to invest in cardboard game pieces, it's easy to get blinded by huge potential profits without realizing the risks behind the opportunity.

It's up to every individual investor to determine how much risk they are willing to take. But I caution people who ignore or downplay risks that can easily come back to bite you. Though our current speculator has so far remained in the green, it's very easy for them to drop into the red with a bit of bad luck.

Personally I would not take these risks myself, but I tend to be a risk-averse investor who prefers more conservative strategies that yield steady gains over the long haul. If you have any questions or comments about my calculations or the concept, please feel free to reach out to me via Discord or in the comments below.