Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Can you believe my first Quiet Speculation article went live nearly 8 years ago, in November of 2011? Since then, I've written hundreds of articles across an array of topics. This week, I stumbled upon an oldie-but-goodie I wrote back in June 2012. This column covers a basket of trading card collectibles that could fit into a long-term investment portfolio. While seven years isn't long enough to plan retirement, it is enough time to make some interesting observations.

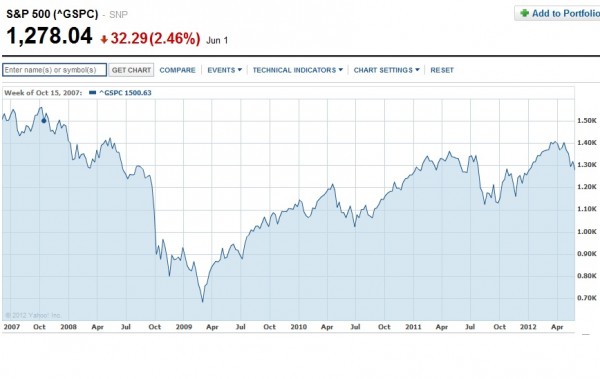

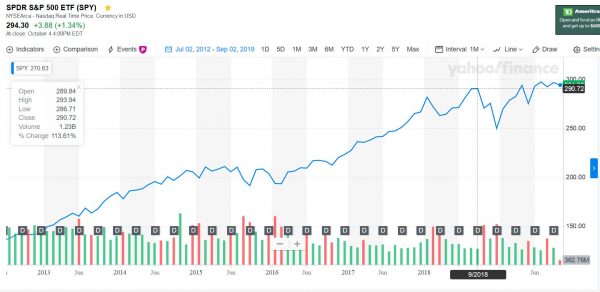

Did I make good suggestions? Were there any ideas that ended up as dead money? Would you have been better off buying my trading card ideas versus a general S&P500 market fund? Let's find out! (Updated text will be in bold italics throughout the article).

This past week, an interesting conversation on Twitter caught my eye. Chas Andres (@chasandres) was participating in the discussion, and since he’s a highly regarded finance writer in the realm of MTG, I paid close attention.

The topic: Magic: The Gathering cards as an investment. I am not talking about buying cards which may see an increase in play during the next PTQ season or the next biggest tier 1 strategy. I’m referring to investing in Magic Cards as an alternative to, say, a 401(k).

Here is a snippet of the conversation, which I eventually had to chime into since I am avidly interested in this topic.

A couple interesting tidbits and deductions leap out at me from this conversation. What are they? I’m glad you [maybe] asked!

Players are Fickle, Collectors are Dependable

Chas Andres agreed with my interjected comment – we both feel that one avenue for long term investing in Magic is highly graded Power 9. The reason is fairly obvious. These cards are exceptionally rare and collectors with lots of money are willing to throw thousands of dollars at these rarities. Because supply is so low, only a few well-off collectors need to “demand” the card in order for the price to fly high.

One may suggest that Dual Lands are likewise stable for investing. The return on Dual Lands has been remarkable these few couple years, especially relative to the stock market.

Underground Sea chart courtesy of blacklotusproject.com – note the chart only goes back to 2008, but I assure you the card’s value was growing steadily for a year or so before then as well. Compare this chart to the subsequent one, which is the performance of the S&P over the last five years, courtesy of Yahoo Finance.

Here are updated charts for both Revised Underground Sea and the S&P500. Which has been a better investment since 2012?

While the S&P500 has about doubled since 2012, it pales in comparison against Underground Sea, whose buylist value nearly quadrupled in that same time. Interesting...

But I hesitate to embrace investment in Dual Lands for the long term. My one reason for caution lies in the unpredictable nature of the player. The game of Magic, Legacy in particular, is very popular right now. An increase in the player base has driven up these cards in value multiple times. But they are still driven up mostly by their playability and NOT their collectability. I had not anticipated the explosion in Commander back in 2012, but I suspect this format offers plenty of price support for Dual Lands.

While subtle, this difference separates the safe long term investments from the short term bubble. All it would take would be a major migration for Star City Games from Legacy to Modern and Dual Land prices could collapse. Same comment here about Commander--thank goodness for that format! Alternatively, even if Legacy continues to receive the same support, but players lose interest or become flustered with a hypothetical banning/unbanning, the prices still could drop further.

If I am moving significant quantities of cash into Magic Cards and not into other retirement plans, I want to make sure a card’s playability will not negatively impact my portfolio. This leads me to my second observation from the Twitter conversation.

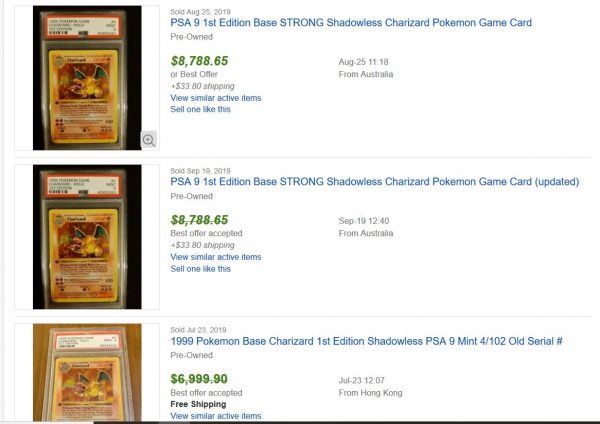

Charizard Transcends Pokemon

How many people do you know who still play The Pokémon Trading Card Game? For me, the number is virtually zero, and I would wager this is not an uncommon trend. But if few people are still playing this game, then why in the world does a first edition Charizard still sell for hundreds of dollars???

The answer is consistent with my previous point – the card is highly collectible and rare. The card needs no player base to maintain value because it is rare enough such that even a few collectors will drive the price up substantially. Don’t believe me? Check out this eBay ended auction:

If you think nearly $700 is ridiculous for a Pokémon card, then you will be completely awe-struck to hear that a PSA 10 copy of this card sold for $1,826.00! All this despite the fact the game’s player support has dwindled significantly since its peak. Without realizing it, I mentioned one of the best long-term investment ideas right here. Thanks to the resurgence of Pokémon, these same cards reliably sell for thousands of dollars. A PSA 10 copy would clear $10,000, over 5x the initial investment.

The main takeaway here is that a card can lose popularity amongst players, but if that same card is very rare and collectible, it will maintain value. Hence why I support highly graded Power 9 as dependable avenues for investing. Any Near Mint copies of Power have skyrocketed in price since the writing of this article.

This Is Getting Costly

I don’t know about you, but if I were to purchase a PSA 8 Alpha Black Lotus, which retails for nearly $5,000, I would need to sell the vast majority of my collection. If only we could travel back in time! Assuming PSA 8 equates to EX condition, that same Alpha Black Lotus would now retail for around $60,000. Forget Dual Lands, this one purchase could have netted me a 1000% gainer if I had actually pulled the trigger in this long-term investment strategy. If only I had the liquidity at the time to make such a purchase! This is the opposite of diversification and I would not condone this strategy. If $5000 was too concentrated an investment, $60,000 sure must be!

There must be a happy medium. There must be a way one can invest in highly collectible cards which should increase in value while not having to shell out five grand on a single card.

I see a couple alternatives here, but they each have their drawbacks.

First, we could purchase lesser cards, such as a graded Bazaar of Baghdad or the like. At a few hundred dollars instead of a few thousand dollars, this option is much more affordable and, as long as the card’s condition is high enough, collectors should still keep this card’s value high. This was a great suggestion, as highly graded Bazaar of Baghdads now DO sell for thousands of dollars.

But let’s face it – there are fewer people interested in a PSA 8 Bazaar of Baghdad than a PSA 8 Alpha Black Lotus. So it will be more difficult to find sellers in the long term and the card may not appreciate as much.

Second, we could consider purchasing highly graded Unlimited Power. High-quality Unlimited Black Lotuses sell in the $1500 range and other Power should be even cheaper. This is an affordable way to still have a chunk of cash invested in high-quality Power. Near mint Unlimited Lotuses retail for $15,000, another 10x gainer. If only I had listened to my own advice!

The drawback here is related to the supply. There are far greater quantities of Unlimited Black Lotuses than Alpha ones. Even though the demand may still be very high on this poster-child card of Magic, the supply keeps the value in check. Of course, you could find one of the few PSA 10 Unlimited Black Lotuses, as these are likely very rare. But these will again cost thousands of dollars, so the cost of entry barrier is still there.

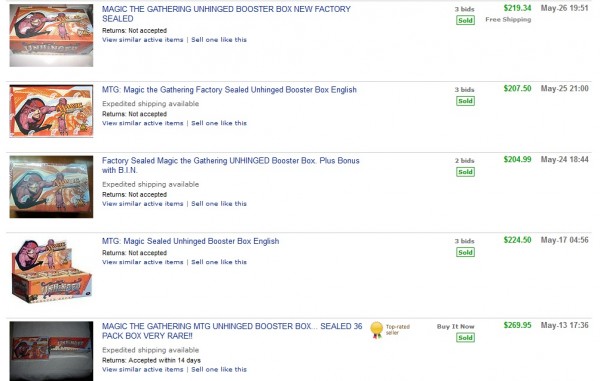

Lastly, we could try to brainstorm other Magic products which are highly collectible, rare, and should maintain value even should the game of Magic lose popularity. Many of you already know I have a sizable investment in sealed Magic Booster Boxes. I feel these should not drop in value because they will assuredly decrease in supply while a sufficient casual market will maintain a sizable demand. There is no need for a Star City Games tournament circuit for a sealed Unhinged Booster Box to grow in value. These now sell for $600 on eBay. This is nearly triple the price from 2012--better than the S&P500 over that same time period, but a far cry from Black Lotus.

If Booster Boxes aren’t your thing, perhaps there are other options. Off the top of my head, there are misprinted cards, high-quality altered cards, or even sealed booster packs of older sets. I’m sure there are many other options and I would love to hear what other considerations you have come up with for a long term Magic investment.

Collectability And Rarity Are Key

The goal is to find a Magic product or card that is highly popular amongst collectors and somewhat difficult to find. These are the gaming assets that should maintain and build value in the long term. They rely little on the game’s popularity and even less on individual playability. Like a rare baseball card, they merely grow in value because they are very hard to obtain for the well-off collectors.

While Dual Lands, Force of Wills and the like have all returned terrifically in the past few years, I’m wondering how much room these cards have to run. Don’t get me wrong – I have no intention of selling my 40 Dual Lands and 40 Fetch Lands any time soon. I still like to play the game and I see the utility in these cards. But in terms of longer-term holdings, I see some significant advantage to something much rarer. Dual Lands would have been a stellar investment given their placement on the Reserved List. Thankfully, I talked folks away from Force of Will and Fetch Lands since they both got hit with reprints (though Force of Will has recovered from its reprinting).

-Sigmund Ausfresser

@sigfig8

Final Thoughts

I hope you enjoyed this trip back in time. It was certainly eye-opening to me, reading through 7-year-old predictions and realizing just how insightful they were. If only I had the confidence to acquire large positions in the ideas I suggested, I would have outperformed my stock market investments handily. Alas, I was even more risk-averse then than I am now, so I am not surprised I held back.

Looking ahead, one may ask the same question that triggered this article years ago: Are Magic and other trading card games good bets for long-term investments? The challenge in 2019 is that so many prices are inflated already. The Reserved List buyout spree of last year really spiked prices hard, and the market is still finding equilibrium in recovery. I don't advise making any long-term investment purchases in Magic at this moment. Then again, everyone's talking about a recession on Wall Street...so maybe a few pieces of Power and some Dual Lands will outperform the S&P500 over the next 7 years as well? I'm not sure, which is why I diversify between the two. Only time will tell which strategy is the optimal one!

https://www.quietspeculation.com/2012/06/insider-…

The original comments, some from the people in the Twitter screenshot, may be interesting.