Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Greetings, Manipulators!

It's been a while since we talked about the Greater Fool Theory and how it applies to Magical cards, and with spoiler season upon us, let's talk about something that will help us every time we think we see an opportunity.

Flashback

In October of 2013, I wrote a piece I'm pretty proud of for MTG Price. It was called "The Greater Fool Theory" because it was about the Greater Fool Theory and I thought that was a pretty evocative title. The piece is still up and I am pretty proud of it and won't mind if you pause here to go read it. I'm going to reference some of the same concepts and it couldn't hurt. If you don't, I won't be offended. Just a little surprised. You're willing to read one article from me, but another is too much? I want to understand this mindset. Help me understand you.

You don't need to read the entire article to understand what the Greater Fool Theory is. The Greater Fool Theory is an economic theory that says, basically, that in a situation where the price of something is not driven by its actual intrinsic value, but by expectation and speculation, irrational buyers will set the price. Therefore irrational buyers will justify purchasing at a price that is above its likely intrinsic value by theorizing that someone even more irrational will come along and buy it from them. They are buying to sell to a greater fool than they are.

I feel like understanding this phenomenon is of two-fold benefit.

First of all, understanding that some prices are being set by irrational buyers can caution us and potentially make us not want to be the fools and buy in. "Irrational" doesn't always mean "stupid" or "ill-informed" or "crazy" either. There are lots of reasons people behave irrationally.

Emotional attachment to a card or concept can cause that. I didn't behave rationally when I bought all those copies of Séance for example. It was a good card in a deck I liked playing, it was a low-risk spec and as it became more of a joke, I bought more and more copies because they were cheap and it was funny. People started sending me copies of the card in the mail.

People behave irrationally because they compare a card to something it shouldn't be compared to. It's easy to do. Evaluating cards is pretty difficult to do in a vacuum (something Derek Madlen did a good job cautioning against this week) and sometimes people get the wrong idea.

You could be forgiven for thinking that eBay seller with Pain Seer at $4 was doing it wrong when Star City sold out at $12 a copy. Seems like a pretty easy triple-up, right? Even if you recognize that Pain Seer isn't fit to sniff Dark Confidant's farts, you could be forgiven for thinking that there is money to be made in the short term, right?

Secondly, understanding what kinds of trends are potential Greater Fools scenarios can help us profit by knowing what to be holding when they begin buying. Whether or not the card ever sees play, we have to be equipped to sell into hype. Buying into hype is generally a risky proposition unless you're very quick. Hype needs to be sustained, your orders need to ship in order for you to flip them and you need to have a significant number of copies so you can resist the race to the bottom when the irrational set the new price.

Cold Irons

Real demand has a few stages where money can be made on a card, if you're either very quick or if you had foresight. I didn't have to scramble to try and buy Thragtusk at $12 and ship them for $15 on their way to $20 because I preordered for like $5 each. I had quite a few socked away and I got to sell at their peak because I didn't have to wait for my copies to come in before I could list them.

That was as much me guessing correctly as anything else, and a mistake in preorder pricing that significant is pretty rare, usually relegated to the first set of a block. It doesn't have to be preorder pricing either; it took actual weeks cards like Sphinx's Revelation, an eventual format staple, to move. Buying when demand was low puts you in a position to sell on your own terms calmly and not have to scramble.

However, we're not always in that position. I wanted to talk about the Greater Fool Theory because card demand has stages, and it's important to identify which stage you're in to make sure you don't buy at the wrong time.

I bought Thragtusk in the pre-demand stage. With markets getting more efficient, information sharing becoming more prevalent and reporting becoming up-to-the-minute with coverage and social media, this window is smaller than it used to be. The only way to assure you're buying in this stage it correctly predict that something that isn't in demand now will be later.

This is either by surmising that people have misjudged a card's applications, which is rare, or by looking at an "event". An event is basically anything that could change something else.

I realize that's vague, but we're trying to define a term that's pretty evocative and useful already. You know what an event is. A deck getting Top 8 at a tournament is an event. A card being shown on camera is an event. A duel deck being announced in an event. A spoiler is an event. Events can change the circumstances surrounding a card and cause its demand to change.

Once an event causes demand to change, you end up in the demand stage. A card being shown on camera or being revealed to be hot on Pucatrade or being bought out on TCG Player is in demand. It's a race at this point, and it's hard to win the race. It used to be you could watch coverage and see what did well and buy some cards that were cheap from Top 8 decks on Monday. Not anymore. If you don't order cards on Friday, your order is likely getting cancelled. It's tough to buy when you notice the card at the same time as everyone else and manage to profit.

After this stage, you see if the demand was real or not. If the demand was real the cards will likely sell. If you bought in early enough, you may have made a decent profit. If not, you still don't eat the cards. If the demand was all hype and you didn't find any greater fools to ship to, you're out of luck. You hold the bag, eat the cards and do a third metaphor if there's time.

It's important to buy in at the right time, especially if you think the demand won't be all that real. I have two great examples.

Too Small a Window

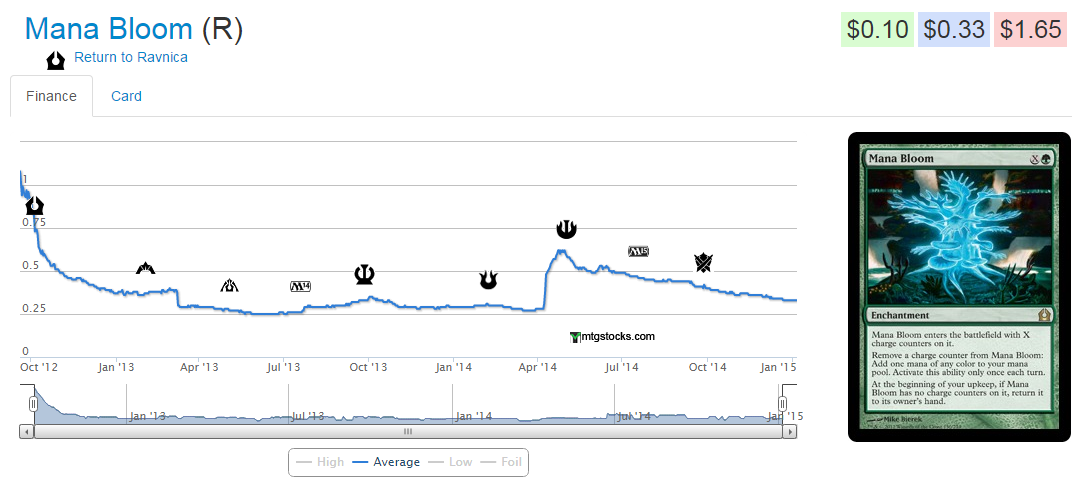

If you bought Mana Bloom the second they announced that Theros would be an enchantment block and a lot of QS Insiders predicted there would be some sort of "enchantmentfall" trigger (most likely "draw a card") worth continuously exploiting, you bought in cheap.

During Journey Into Nyx spoiler season, they revealed Eidolon of Blossoms almost immediately. If you were sitting on copies, you didn't see much hype because people were immediately down on the cards Bloom and Blossoms. They saw what a fragile, silly combo it was, and how bad Mana Bloom was without the Eidolon in play. Still, someone was buying right before it doubled in price, and some greater fools bought at the peak price so the people who bought in early made enough that they probably did a bit better than break even, hopefully.

If you bought Mana Bloom because you saw a YouTube video that said it was a great idea, it was already too late and you likely ate it. With no greater fools buying, the hype train derailed and spilled its cargo of mana blooms and dreams, dreams which broke on impact.

Buying in ahead of time let you sell at peak price, but even that wasn't great.

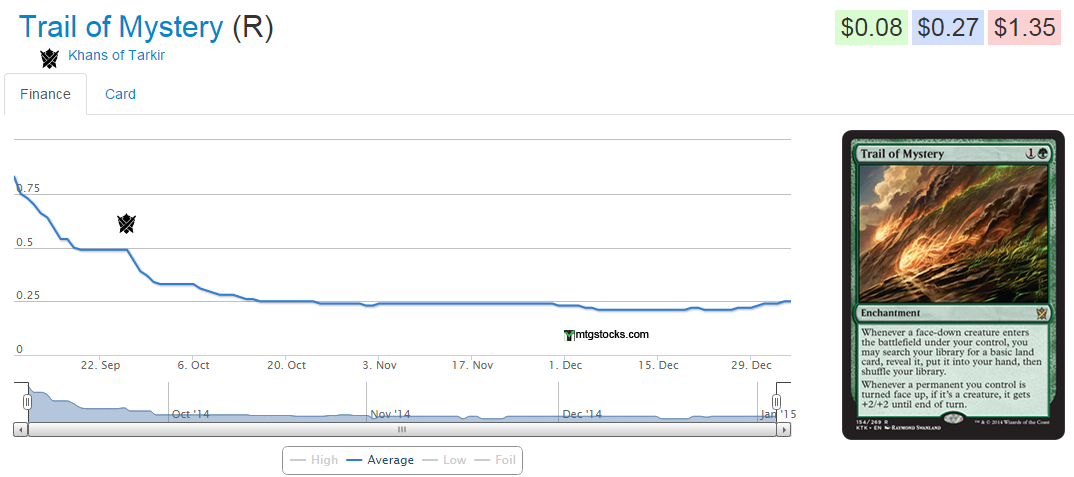

Do we see parallels here? Despite being the most-requested card on PucaTrade, no one is really buying heavily on TCG Player yet. The large number of sellers with a small number of copies deters single actors but not greater fools. In this way, TCG Player is often the last place for the actions of anyone but people reacting to hype to register.

Is manifest going to make a card like this, one that seemed very suspicious in the context of just Khans of Tarkir, playable? It's not really important because hype is already nipping at this card's heels.

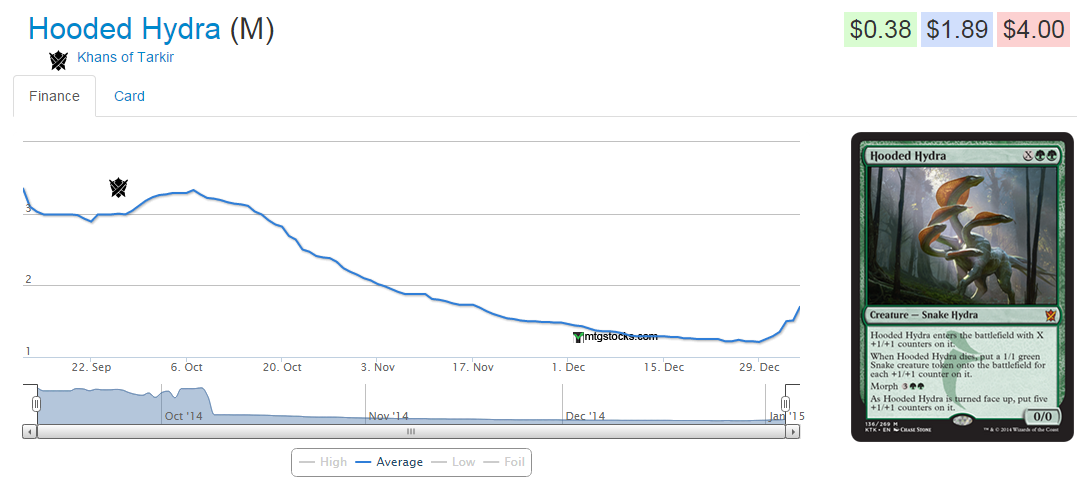

We can actually register movement here because this card flips up for two mana and becomes a 5/5 if manifested, something people are more keen on.

Do we need to see sustained, actual demand to make money on these cards? Absolutely not, and that's the real point of this article. Hype is going to drive these cards above the price they are now, and Hooded Hydra being good in EDH is going to make people rationalize how deep they go on it.

But we need to realize that we need to have our copies before the hype train leaves the station because we're not selling these to people who will use these in a deck. They aren't likely to spike in price multiple times. You won't be able to buy these after they go up and find sellers. When you see a card like Trail of Mystery that likely only goes up based on hype, you need to realize that your target audience will be greater fools and buy in early enough. If you can't do that, you might want to stay away.

Manifest is a better ability than Eidolon of Blossoms' trigger is. It's possible people will test more and try to break these interactions. Hype is just getting started. Hydra is a mythic and even a middling amount of play will make it a few bucks.

Stay away from cards you don't believe in. Sustained demand gives you the time to act, make informed decisions and sell on your own terms. However, that's not to say there is no money to be made on hype alone. There is. But if you're getting in, get in now. Strike while the iron is hot, because when it cools down, you don't want to be left with a stack of them. That makes you the greatest fool of all.

Test

Article is well-written and tight. I want to add an insightful comment, but you pretty much covered it. Don’t blindly buy into hype without your own thesis. It’s too easy to see big financial names tweet about a hot card, but we should always think about practicality of waiting for the card to be shipped and then fees/shipping costs with re-selling the card. Sometimes it’s just not worth trying to jump on the last car of the hype train.