Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Magic finance has been somewhat boring lately. Sure, there’s a new Commander set to build around, and Modern just saw some major shake-ups. But these past few weeks haven’t offered me much inspiration. Others are likely finding avenues to speculate on some spicy targets, but I haven’t found much.

But I think that’s about to change.

These next couple months will bring with it many changes. Changes to the weather, changes to Standard, and an unfolding of recent Modern changes. Change is good. It fuels transactions, which equates to liquidity. Every time money exchanges hands for Magic cards, it reflects confidence in the market.

This week I’m going to examine three pending changes and identify what pockets of the market could exhibit strength as a result of these changes.

Standard Rotation

The most obvious change ahead is the rotation in Standard with the release of Throne of Eldraine. While Standard speculation doesn’t excite me like it once did, there will be money made on it by others. This happens every fall. A new, exciting set is released, a handful of sets depart Standard, and the drastically new metagame leads to significant price changes.

Of course, the newly developed Tier 1 Standard decks will contain cards that increase in value. This is inevitable. But other than rare, nonbasic lands with utility across multiple strategies, there isn’t much I have to offer here. I guess that means Lotus Field merits closer investigation, but at $8 I’m not sure if it’s worth picking up with cash.

Your best bet is to read what other writers have to offer, engage in the Quiet Speculation Discord, and react to evolution in Standard along with the rest of our Insiders. Often times the group identifies the best pick-ups by working together and talking through ideas.

The other financially relevant outcome of Standard rotation is that prices on cards leaving Standard tend to drop. This means opportunity—cards that have utility in non-rotating formats such as Modern or Commander can pull back in price a bit in the short term, offering attractive entry points for the long term. Whether you’re trying to pick up cards for decks at better prices or you’re looking to make a few bucks over time, it’s important to pay attention to pricing trends as they unfold post-rotation.

Again, picking the right cards isn’t my strength since I pay so little attention to Standard nowadays. But with Dominaria’s departure, I wonder if we’ll see an attractive entry point on Mox Amber again. The artifact bottomed at $6, spiked almost to $20 on speculation while doing very little in Standard, and then pulled all the way back down towards $8. Rotation could bury it’s price even further, making it a worthwhile speculation target for a potential breakout in other formats.

I wonder how cheap Teferi, Hero of Dominaria will become. A pullback on that card could make for an attractive entry point if you’ve been itching for a copy.

Modern Shake-ups

There’s plenty to be excited about in Modern now with the recent B&R shakeup.

What was previously a stale metagame revolving around a couple core cards should become something far more interesting. At least, it will for the first few weeks. Maybe the format will warp around some other card, who knows?

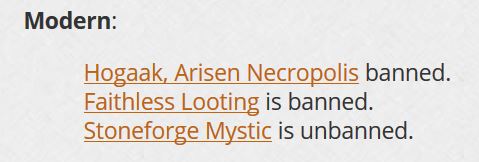

But until that happens, there’s a lot to unpack with these three seemingly simple changes. With Hogaak’s disappearance and the nerfing of Phoenix-based strategies in Faithless Looting’s banning, we should see far less graveyard-centric strategies going forward. And the unbanning of Stoneforge Mystic has opened up an entirely new design space in Modern.

Just like with Standard, I’m no Modern expert. I can’t predict what cards will be best in the new metagame (though again, I like multi-purposed, rare, nonbasic lands). Yet again, the QS Insider Discord will be where I turn when I want the latest and greatest Modern tech coming out of these B&R changes. Following tournament results shortly after this change takes effect will be another worthwhile investment of time.

The only thing that is certain is that cards will be bought and sold in response to the metagame shifts. That means liquidity and confidence in Magic, something that bodes well for anyone who owns cards. Beyond simple liquidity, though, is the influx of demand that stems from such changes. We’ve seen it already with Stoneforge Mystic and associated equipment prices—I’ve even already made some money on Batterskull, and the metagame hasn’t even had a chance to unfold yet!

The excitement of speculation and profit will breathe new life into Magic finance this fall, giving us yet another catalyst for growth.

Premium Set Price Increases

The third catalyst I want to talk about isn’t tied to a specific format. Instead, it’s an overall observation about trends on a subset of cards in the market. I’m talking about premium sets: Eternal Masters, Masters 25, Modern Horizons, etc.

I’ve noticed some traction on certain cards from these sets lately, and I’m wondering if it reflects the inevitable drying-up of supply from the market over time. Looking at MTG Stocks’ Interests page from the past week, I see a handful of these cards on the list.

Worldgorger Dragon has spiked for some reason (I’m sure someone reading this article knows why) and has one of the largest percentage gains of the week.

Then you have Necropotence spiking, with Eternal Masters copies jumping from $10 to $14 in a few short days. This is directly tied to the comment made in Ian Duke’s B&R announcement article where he states, “Other cards we’ve discussed unrestricting in the future are Windfall and Necropotence."

I don’t like speculating on Vintage unrestrictions because the impact on actual demand is tiny. But that’s not going to stop speculators, and the market’s supply will dry up quickly as a result.

Ice-Fang Coatl has seen a significant run over the last week, rising from $3 to over $4. A dollar increase may seem inconsequential, but a lot of copies had to move in order for this 33% jump to take place. Modern Horizons supply isn’t likely to increase further, so any increase in the playability of this card in Modern will mean a higher price. Maybe this is a prime time to get some copies.

Other noteworthy increases include Giver of Runes (plays well with Stoneforge Mystic), Ball Lightning from Masters 25, and Sword of Sinew and Steel.

The point here is not that any rare or mythic rare from one of these premium sets is going to increase in price. Rather, my point is that these cards are all like coiled springs and any shift in market dynamic could result in a significant price jump. I don’t recommend buying these cards indiscriminately; rather, I recommend picking up copies of the cards you want most now, rather than waiting for a change in the metagame. I especially like the Horizon Canopy lands from Modern Horizons, which have become far cheaper than I anticipated they would.

Wrapping It Up

There are pockets of movement here and there, but the back half of the summer is typically a slow time for Magic and Magic finance. This year has been no exception.

Thanks to three catalysts, I expect the market will become much more interesting as we enter fall months. Standard rotation is always a chance for price fluctuation. Modern’s recent bannings and unbanning will surely shake up the metagame. (Vintage’s changes may also shake things up a bit). And while not directly tied to a format, I believe these shifts will cause some significant price increases on cards from premium sets.

Each of these factors will create fluctuations in market pricing, leading to the exchange of cash for cards. The continuation of these transactions represents a healthy, liquid market, giving confidence to players, speculators, and investors alike. With that confidence could come another lift of the tide, with values trickling up towards higher-end cards like Dual Lands and Power. While I do expect this will happen at some point, I won’t rush things. For now, I’ll be eagerly embracing any change in the market to make MTG finance a bit more interesting once again.

…

Sigbits

- While a long ways away from its high, it’s interesting to see The Abyss return to Card Kingdom’s hotlist, with a buy price of $420. I don’t know why this card is suddenly showing up on the hotlist, but it’s encouraging to see. Cards like this one have given up much of their gains from last year. In fact now may be a very attractive entry point, while we’re still in the summer doldrums.

- As I predicted last week, Mox Diamond’s buy price has reached a new high on Card Kingdom! They now offer $220 for the Stronghold printing of the card. They offered even more on the foil FtV printing for a day or two, but have since pulled their offer back to $200. If you’ve been sitting on copies, this could be an attractive exit point.

- Pyramids may flaunt a $200+ price tag on TCG Player, but I don’t think Card Kingdom’s a believer. They restocked this card from Arabian Nights multiple times, and each time they sell out quickly. Despite this, they’re still only offering $56 for the card (though it is on their hotlist now). We may see another tick higher, but given the card’s limited utility, I suspect further increases will be a slow, step-wise process.

Worldgorger is due to Commander hype with Anje. With Animate Dead, Dance of the Dead, or Necropotence, you can generate infinite mana and draw through your deck for a kill condition.

The Pyramids were a confirmed buy-out by a single person, so it was artificially inflated. The guy who openly declared he was the buyer would have been better off not saying anything. Now the buylists reflect this information, and he is left with unplayable garbage that imo will drop in price, or stagnate. He even spent the money to get the mediocre quality ones graded, and wants to use the prestige to open a card store.

It’s basically finance 101 how to screw up a spec.

Not if said individual has no intent to ever sell the cards, hypothetically.

Additionally, this “hypothetical” individual could have hypothetically been running a test on the market to see if it sparked additional buyouts, which seemed to have happened.

The individual would likely offer some advice to you: take finance 102. 🙂