Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

We are all well versed in the concept of supply and demand. Items in short supply with high demand are expensive and items in large supply with limited demand are cheap.

Supply

One aspect of MTG finance that I like is that the supply side is relatively steady when it comes to cards. If the print run of a set is over then the supply of any particular card in that set is relatively static. Sadly, this has become less and less true as WoTC continues to pump out additional products full of reprints. Arguably, this is a major reason why speculating on non-Standard legal cards has become far riskier than it used to be. Still, for the sake of our argument today, we will be looking from the macro level and thus we will assume a relatively static supply of any given card. Obviously the supply for in print cards is not static and one can fairly assume grows with each passing day, however, the rate of growth is likely highest for the newest product and much lower for older products.

Demand

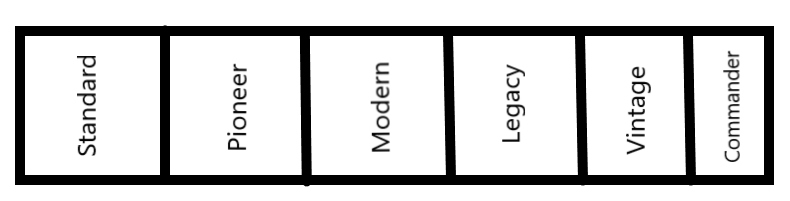

I like to consider the demand of any given Magic card as a sort of segmented bar, with each source of demand making up some amount of the overall demand.

Each segment is some percent of the overall demand, which unfortunately is never going to be known. However, we can substitute price for demand; in a free market system, the price is determined heavily by demand. We already use this same logic when calculating the EV (Estimated Value) of a box of any given set, as the contents of the box are unknown until opening; but averages of the possibilities can be used to get a decent expectation of what one could expect to get from opening said box. While we don't know how much of a percentage each segment accounts for in a given card's price, we can make educated guesses about which segments account for the most value.

For example, let's look at:

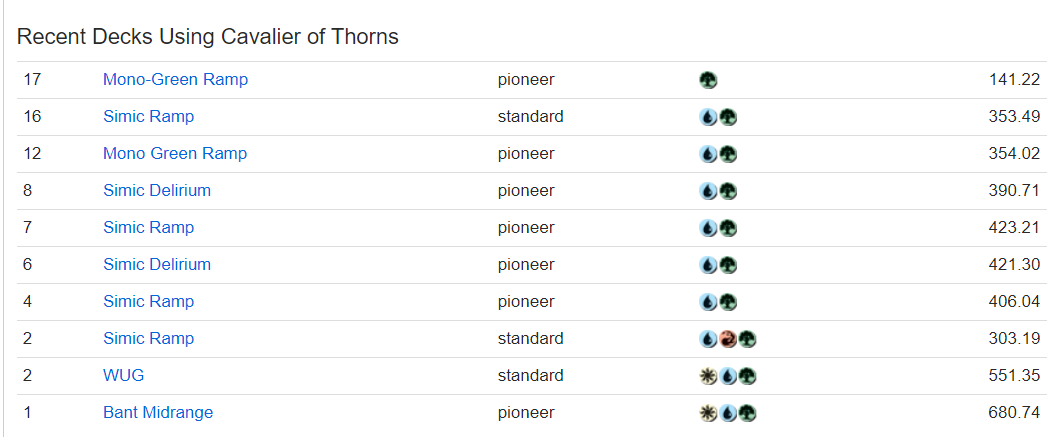

If we check out

mtggoldfish and lookup Cavalier of Thorns, we can see that it's currently finding a home in Standard and Pioneer decks. However, we aren't seeing it much in Modern, Legacy, or Vintage. We can therefore assume those segments are very small or nonexistent. We can then check EDHRec to see how often it shows up in Commander decks.

806 decks is a very small number of the overall green decks listed on

EDHRec, so we can surmise that very little of Cavalier's overall price is Commander driven. Why does this matter? Well, if you are looking to buy copies of this card, then its best possible price would emerge when these conditions are met: it's seeing little play in Standard (or no longer Standard-legal) AND it's down in the Pioneer metagame. That's the "best case" scenario for when to buy, that doesn't mean you shouldn't buy any copies if either of those things happens but the other doesn't; just simply that it's ideal lowest price would be if/when both instances occur. So it's current demand bar would look something like this:

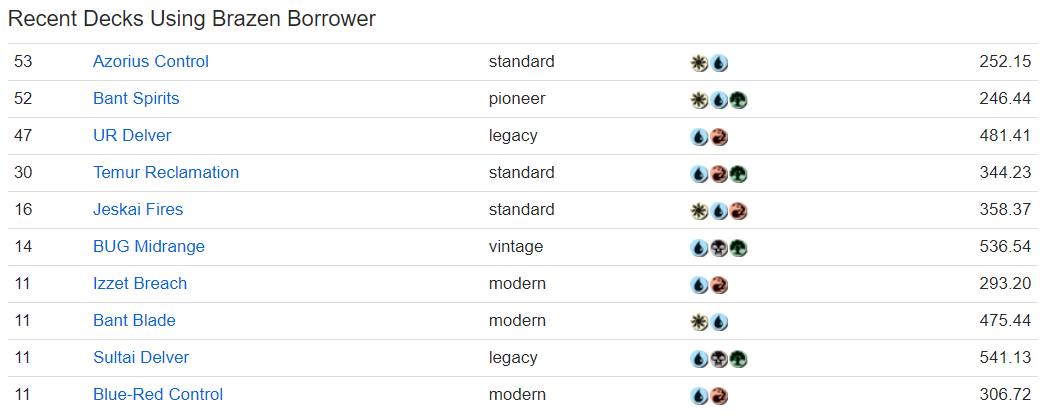

Now let's look at a card that has demand from quite a few more formats.

And here is a snapshot of decks referencing the card on MTGGoldfish.

So here we have a card that sees play in standard and all major eternal formats, but very little Commander play. So it's bar would look more like this;

You can see that this bar would be larger due to the fact that it sees play in multiple formats. While the actual segment size would vary based on how much demand per format it sees, this implies that the price should, in fact, be significantly higher than that of Cavalier of Thorns despite both cards being Standard-legal mythic rares. Unfortunately, we don't have enough information readily available to really define the size of each segment, and the fact that metagames shift all the time would honestly make it a fool's errand to even try.

The big take away is that while we can't tie price perfectly to the demand bar, we can make a fair argument that cards with larger demand bars SHOULD be more valuable than cards with smaller demand bars. This means that when we examine a card that sees a lot of play in multiple formats AND the price is low, it then makes logical sense that the card's price should rise by some amount. If we can compare it to other similar cards with higher prices and lower demand bars, then its price should rise to above the price of those similar cards.

What Effects Demand?

So we know what affects supply, but what affects demand?

- A new card is printed that the old card interacts well with.

- Format and/or metagame shifts to make the card good.

- A card gets banned in a format (or formats).

- A Card gets unbanned in a format (or formats).

- Someone with a lot of followers highlights a card.

- A new format is created.

The first reason for demand increase on our list is often the reason we see some of the biggest price spikes, with item 4 being the other reason. We can see this with a card like Inverter of Truth.

There was no demand for this card prior to someone realizing its ability was broken with Thassa's Oracle, hence its price curve mirrors the demand.

Knowing what factors affect demand allows us to get ahead of price movement caused by an increase in demand or an expected increase in demand. This is the reason that many speculators used to go to major retailer websites, fill up a shopping cart ahead of a B&R announcement, and then adjusting said cart quickly and check out, thus allowing almost instantaneous action based on new demand information.