Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Last week I began an article series to examine the differences between the stock market and the Magic market. These fundamental deviations make comparing the two markets a dicey proposition at best.

The first article looked at physical data (or lack thereof) to contrast how price and volume tracking takes place between the two markets. The lack of transparent data in the Magic market enables the market manipulation, speculation, and buyouts that are much more difficult to instigate in the stock market.

This week I want to shift focus to how emotions are tracked between the two markets. It turns out there are some major differences in the emotions of stock and Magic investing and how these emotions manifest themselves. Then I’ll shift gears and look at how regulations try to prevent big fish from exploiting these emotions, and then dwell on how such regulations are absent from the Magic market.

Once again, I want to thank Jarrod Ator (@jarrodator) for his ongoing dialogue and inspiration to write on this topic.

The Volatility Index

When I visit CNBC’s landing page, the top banner contains the most popularly tracked indexes in the United States: the Dow Jones Index, the S&P 500, the NASDAQ, and the Russel 2K. But furthest to the right is something that doesn’t quite fit in with the rest.

When market volatility increases or decreases, it is displayed via the Volatility Index, or VIX for short. This index is designed to track S&P 500 volatility via an elaborate calculation; most investors simply refer to the VIX as the “fear gauge” because it has become a proxy for market volatility.

Often (but not always), when there’s a monumental event that triggers a market sell-off, this index will spike double-digit percentage points. Conversely, when the market barely moves or gradually climbs higher over the course of a few days or weeks, you’ll see the VIX drop. Many experienced traders have tried to develop correlations between the Volatility Index and the near-term moves in the stock market.

One can also trade volatility via a number of complex financial instruments. This is beyond the scope of this article, however.

It should come as no surprise that no such “fear index” exists for Magic cards. There is no way to track market volatility in as quantifiable a fashion. The only method I can think of involves reviewing MTG Stocks’ website on a daily basis and tracking how many cards have moved by at least some percentage. The more cards that are moving drastically, the higher the Magic “volatility index” would become.

The lack of a trackable “volatility index” in the Magic market has implications. For stocks, the VIX serves a few key purposes. According to Investopedia:

- Stock market volatility is generally associated with investment risk; however, it may also be used to lock in superior returns.

- Volatility is most traditionally measured using the standard deviation, which indicates how tightly the price of a stock is clustered around the mean or moving average.

- Larger standard deviations point to higher dispersions of returns as well as greater investment risk.

Put simply, the VIX helps investors determine the current risk/reward landscape of the stock market. It also indicates how much stock prices are deviating from their recent prices.

With Magic cards, there is no easy way to examine these factors with a calculation. Unless you’ve been tracking card prices continuously over the course of a few months, you may not realize how much volatility is present in the market. We notice when buyouts occur, but beyond that, it’s hard to determine what risks and rewards are in the market.

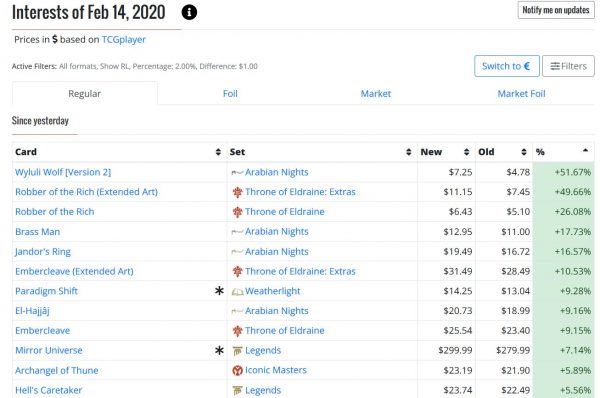

As a tangible example, let’s refer to Wyluli Wolf, which supposedly jumped 51.67% yesterday. Last week I talked about how this pricing method is less robust than pricing methodology in the stock market. But pushing that aside, I would expect such a high spike on this trivial card is uncharacteristic. Therefore, the associated “volatility” would be high—I anticipate this card to drop significantly in the near future so that its price moves closer to its moving average.

If there was an obvious volatility measure, it would indicate the greater risk now associated with this card. But this doesn’t exist. Therefore, prospective investors may see the “spike” and react emotionally without realizing the risk they are taking on.

This example is trivial, but the concept can be generalized to the entire Magic market. When the Old School market blew up, the volatility index would have soared. If we had that index, we’d also be able to use it to determine when the sell-off in the overheated Old School market would be nearing its end.

When a big reprint set is announced, card prices tend to drop rapidly. A fear index could have helped indicate when the sell-off became overdone and prices are bottoming.

A lack of volatility index is a lack of information for traders and investors. We are left to evaluate risk and reward on our own accord—this is suboptimal to say the least!

Big Fish and Transparency

Major transactions by big-time stock investors have to be reported on a quarterly basis. When someone like Warren Buffett makes such transactions, people notice. Recently, his company Berkshire Hathaway revealed a new stock position in Kroger. This is an understatement—he revealed a gigantic position in Kroger stock: 18.9 million shares to be exact! At market close on Feb 14, Kroger’s stock was valued at nearly $30. Therefore Berkshire’s stock purchase equates to $567 million.

Knowing Buffett’s investment strategy, we can infer that he perceived there to be value in Kroger stock at its current price. The supermarket chain had been struggling recently—the stock is down about 25% from its 2016 high. Maybe he anticipates a turnaround or a bottoming of the stock. One thing is certain: Kroger’s stock is perceived to be cheap relative to its earnings potential in the coming years.

Before I transition to Magic, I want to note a few things. First, observe that Kroger’s current market cap (stock price times number of shares) is $22.6 billion. Therefore, Berkshire Hathaway now owns 2.5% of Kroger stock! Second, this significant position was acquired over the past quarter without notice—it’s a good thing Berkshire is required to disclose these purchases, because otherwise, we may never know such share concentration was taking place.

Big fish in the stock market have to be transparent with their big transactions. Does the SEC have such rules for Magic cards? Of course not! What would happen if someone bought up 2.5% of the market’s supply of a given Magic card? The price would jump significantly!

For example, when someone bought up all the Pyramids, it triggered a major (still-sustained) price increase. As a U2, there are 20,500 copies of Pyramids in existence. To purchase 2.5%, one would need to buy over 500 copies—I don’t think one could even find 500 copies for sale in the U.S., at least not at any given point in time.

In the case of Pyramids, we’re fortunate that the person doing the buyout was vocal about their actions. This isn’t always the case. Should someone decide to buy 2.5% of the market supply of a given card—especially a Reserved List card—they could do so, influence the price drastically, and do so completely anonymously. There are no rules in place requiring such purchases need to be disclosed.

This lack of oversight further fuels the prone nature of market buyouts and panic-buying. Last week we learned how easy it is to artificially manipulate a card’s price. This week we’re learning that large positions in a stock needs to be disclosed publicly, but no similar oversight exists in the Magic market. Therefore, not only is it easy to manipulate a card’s price, it can also be done anonymously without legal ramifications.

Suddenly we can see how such an opportunity could entice big fish with deep pockets. And with the lack of transparency, we can understand how easily emotions take over, creating a fear of missing out (FOMO) when prices start to climb. If I see that Pyramids are disappearing from the market, I have no way of knowing who is doing the buying and how many copies they’re buying. All I see is that copies are disappearing, I don’t know if they’ll return to the market, and so I may decide to buy copies immediately in case they spike even higher.

Thus, buyouts are easily cascaded due to fear. If only there was a measure for this “fear” to warn buyers of the risk they’re taking!

Wrapping It Up

Emotions are part of the human condition; they will always interfere with investing where common sense and numbers should reign. But there are measures in place in the stock market to try and help make these emotions more transparent and quantified. The Volatility Index, or VIX, is a measure of market “fear”, and it is useful when evaluating the current risk/reward proposition of the stock market.

Without such a measure in the Magic market, we’re left to our own devices when determining how stable the market is at any given time. If there’s a wave of buyouts, or if a reprint set starts hitting card prices, we have to constantly monitor prices to determine when they may stabilize. Without this transparency, fear can run rampant and unchecked, unbeknownst to investors.

This fear cannot easily be preyed upon in the stock market by the big fish—many have to disclose significant transactions. Warren Buffett’s Berkshire Hathaway can’t quietly accumulate a few percent of a given stock. It would be illegal for them not to disclose such a transaction.

With Magic cards, there are no such laws. Someone with deep pockets could quietly (or overtly) purchase 3% of the market’s supply of a card, and there are no laws to regulate such transactions. Given how easy it is to manipulate card prices, you can see how this could trigger FOMO and lead to wild oscillations in price.

Actually, we’re fortunate more investors with deep pockets aren’t active in the Magic market. Should a few Wall Street buffs suddenly decide to make Magic an alternate investment in their portfolio, it could devastate a portion of the Magic market. Magic can’t handle multi-million dollar positions like the stock market can. It’s not cut out for that.

Once again, these fundamental differences between stocks and Magic cards have far-reaching implications. That doesn’t mean one shouldn’t consider an investment in Magic. I’m just ensuring prospective buyers are fully aware of the Wild West landscape that is the reality of Magic card investing.

Buyer (and seller) beware!

…

Sigbits

- After tumbling a long ways, Nether Void may finally be bottoming. It’s at the top of Card Kingdom’s hotlist, with a $270 buy price. Lightly played copies had been selling for as low as $350 recently, so that buy/sell spread is tightening, indicating the price may stabilize at last.

- For a while, the FtV foil version of Mox Diamond was trending in step with the Stronghold But recently, Card Kingdom’s hotlist has seen these two prices diverge a bit. The foil printing carries a $235 buy price whereas the original version now buylists for $180. Both are on Card Kingdom’s hotlist, but it’ll be interesting to see how this trend unfolds over the coming year.

- The top Masterpiece card on Card Kingdom’s hotlist remains Misty Rainforest, with a buy price of $190. They probably pay more on other Masterpieces (Sol Ring and Mana Crypt come to mind). But as far as the hotlist goes, Misty Rainforest takes the prize. Perhaps Wizards is seeing more demand for these at their current price point, whereas volume may have slowed down on the most expensive Masterpieces.

I think that comparing Magic with the stock market is the wrong approach. Investing in Magic is closer to investing in gold. Just like in gold, there is a degree of volatility but there is no depreciation in base value. An Alpha mox in played conditions is set between $5,000 to $10,000 depending on the color. Judging by its continuous trend in rising value, it is determined that the value will continue to rise even more, but how much and how fast is a different question. In the end, vintage Magic is just a great place to park your money.

Yamil,

I am inclined to agree that comparing Magic and stocks is difficult. Many people do because they are both options for investing money, so I wanted to address the reasons why the two are drastically different to drive awareness.

I’d be careful stating there’s no depreciation in Magic cards. Over the past 27 years, Magic has been a fantastic investment. But those who purchased some Old School Reserved List cards in 2018 and 2019 are sitting on some hefty losses. It all comes down to timing. I share this to clarify there’s no such thing as a guarantee. Of course in reality, I also feel an Alpha Mox would make for a good long term investment at today’s price point. 🙂

Thanks for sharing!

Sig

Very true what you say about depreciation. However much of that depreciation is due to the fact that online companies like Cardkingdom.com are still sitting on top of a number of vintage packs that haven’t been opened yet, especially from Alpha and Beta. That means that as they sell the newly minted cards, they keep the inventory full by opening new ones.

One recent example of that is Ancestral Recall, which automatically dropped considerably in value as one more rare is thrown into the market pool. Yet the fact that this is a newly minted card fresh out of the pack means that the card can exponentially cost several times its current value due to its condition, making it a winning investment in the long run despite its dropping value. This is likely the closest thing there is to short selling in Magic. Focusing on cards that are dropping in value as their mint condition might raise their value several times from their set market price, ultimately paying big for those willing to take the risk.

I consider most collectables alternative currencies. You can’t capture volatility because no options exist and the market isn’t deep. If i hit market order sell, my shares are gone. I could post up at a 10+% discount to tcg on that site or a fb group (or twitter i guess) and get no takers. In other words there isn’t good price discovery in collectables/mtg. This is why i use buylist pricing to inform my mtg financial number crunching.

You summarize it very nicely! There is no robust, reliable price discovery. Volume is too small, and there’s too much variation from site to site (particularly on older cards). Buylist pricing is a wise approach because it acts as the surrogate “bid” price; it’s an assurance that the card can be sold at that price instantly. Any extrapolations on value above buylist involve risk.