Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Remember in late 2017 and early 2018, when Bitcoin spiked to a then all-time high and Reserved List cards followed suit? Many members of the Magic community speculated that the two were connected and that those savvy enough to cash out of Bitcoin and turn a hefty profit were reinvesting those proceeds into Magic cards.

Well, if you haven’t noticed, Bitcoin has recently surged a new all-time high. It is approaching $35,000, almost double its 2017/2018 peak. This is likely to generate some ripples in the MTG finance market.

Correlating Bitcoin and Magic

Bitcoin and Magic have an overlapping history, in a roundabout way. In 2013 and 2014, a website known as Mt. Gox was handling over 70% of all Bitcoin transactions worldwide. At the time, this made the site the largest intermediary for Bitcoin exchange. Then the majority of Bitcoin on the site were stolen and Mt. Gox was no more.

But if you go back to 2007, Mt. Gox wasn’t a Bitcoin exchange site. The founder of the website initially created it to track Magic card prices like stocks! In fact, Mt. Gox is short for “Magic: the Gathering Online eXchange.” It was only in 2010 when founder Jed McCaleb converted his website into one for Bitcoin exchange.

Since then, it seems like the demographic that trades in cryptocurrencies appear to overlap with the demographic that participates in the Magic secondary market. Of course, it’s not a direct overlap, but if this were a Venn Diagram, I believe there would be enough overlap to link prices of the two.

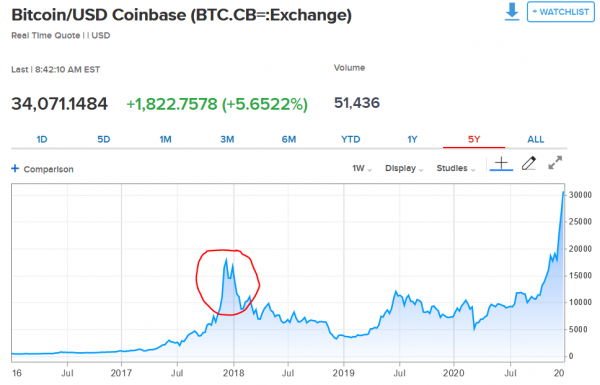

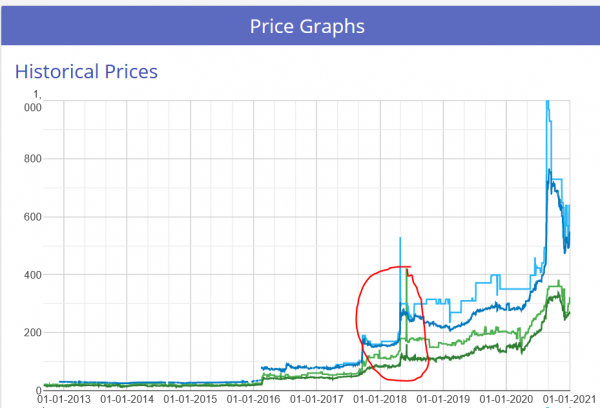

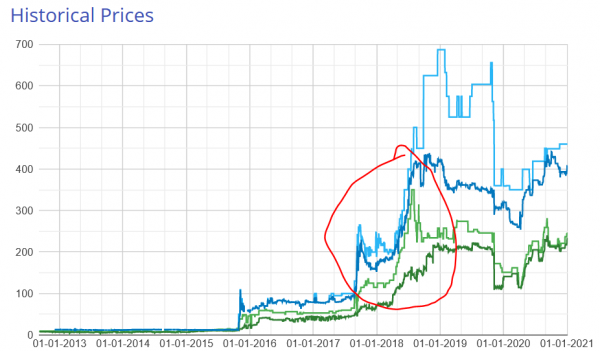

Here are a couple charts as evidence. First, consider the price chart of Bitcoin and a Reserved List staple, Mox Diamond from around that time period.

While this is just a single example, there does appear to be a correlation. Shortly after Bitcoin hit $19,800 or so, Mox Diamond spiked, momentarily hitting $400 on buy lists. How about a Dual Land, like Bayou?

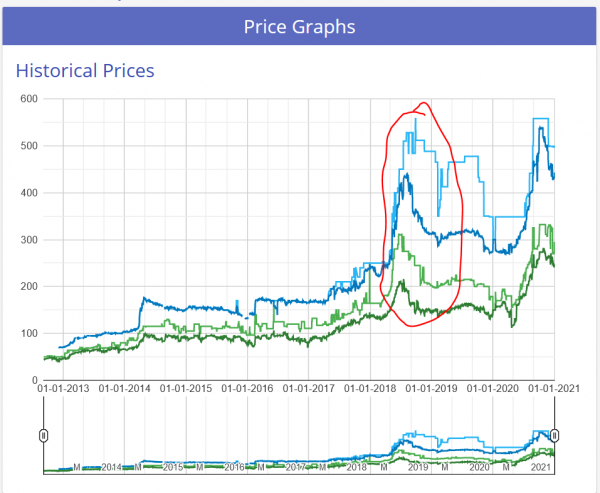

Notice how Bayou follows a similar trend. A couple months after Bitcoin surged in late 2017 / early 2018, Bayou (and other Dual Lands) spiked to record highs. Let’s look at one more: City in a Bottle:

Notice the same trend here. As Bitcoin notched its all-time high, the price of City in a Bottle surged to record highs as well.

Prices cooled off throughout 2019 in all of these price charts, including that of Bitcoin. This strengthens my belief that the two are correlated. Accepting this hypothesis, implications are about to be profound as we head into 2021.

2021: Bitcoin at Record Highs

Now we’re sitting at new all-time highs for Bitcoin, significantly above where it traded during its previous peak. Will the correlation between Magic and Bitcoin continue, leading to new highs for Magic prices? I believe this is likely.

In fact, I’ve already seen some moves higher on Card Kingdom’s buylist. Why is this relevant? Because Card Kingdom is highly agile when it comes to pricing—their buy prices on popular cards can fluctuate multiple times in a week (sometimes in a day!). So when prices move, Card Kingdom’s algorithm responds quickly.

I already mentioned Mox Diamond before, but here’s the Trader Tools chart again:

Notice how, after dropping for a week or two, the top buy price on this card has been rebounding? That’s because Card Kingdom has increased their buy price on the card a couple of times in the past week or so.

Another card on the move is Elephant Graveyard, where Card Kingdom recently upped their buy price from $140 to $185 to reflect the recent move in its price.

Other cards Card Kingdom has recently upped their buy prices for include Gaea's Cradle (up to $510), Lion's Eye Diamond (up to $300), and a smattering of Dual Lands. After pulling back from the recent run, it appears the demand for expensive Reserved List cards has returned with a vengeance. I believe this trend will continue thanks to the recent surge in Bitcoin.

Beyond Bitcoin

Beyond Bitcoin, there are economic dynamics that are conducive to rising asset prices. I discussed this a couple weeks ago, so I won’t go into excess detail here. What I will touch upon here is the newest development from Washington, D.C.: new stimulus checks to Americans.

Starting last weekend, qualifying individuals are receiving $600, plus another $600 per child! A family of four making less than $150,000 annually in total would qualify for a $2400 check. While this is less than the previous stimulus check, it is still a lump of cash in people’s bank accounts. Many Americans are struggling in this pandemic—unfortunately, this money won’t be nearly enough for them to make ends meet.

However, there’s a large portion of people who qualify for this check but hasn’t been as impacted financially by the pandemic. For them, this money is like a little bonus to do with what they please. Some may use the money to pay off debt. Others may use it to fund some house projects. Others, yet, will probably spend the money on Magic cards and other collectibles. It’s inevitable.

Fast forward a couple months, and tax returns will start rolling in. I have no clue what refund checks will look like this year as compared to last year. None at all. But I have to assume at least some folks will receive refund checks, and some portion of that group will use their refunds to fund their hobbies, including Magic. We’ve seen this happen in years past and I don’t see a reason why this wouldn’t happen again in 2021.

Lastly, there’s the hope factor. We made it through a miserable 2020, and 2021 brings a great deal of hope to people across the world. This is the year: the year we can get vaccinated, the year we can go into public again without fear, the year we can feel a little closer to normal, and the year we can [hopefully] start participating in large paper Magic events again.

The stock market is forward-looking; that is, prices trade on anticipated trends and performance. If people maintain hope that 2021 will be better than 2020, then stock prices could react accordingly. In the same, way, Magic prices could trend upwards if people anticipate playing paper Magic at some point in the near future. This is yet another positive catalyst for Magic card prices.

Wrapping It Up

This article may seem overly bullish. It also may appear, on the surface, to be an attempt to drive prices higher in a similar vein as a Rudy (Alpha Investments) video. I assure you, this article is neither. My intention is not to drive buyouts nor to encourage reckless speculation.

Before investing in Magic cards, make sure you have other boxes checked: you don’t have any high-interest rate debt, you have health insurance, you have a 401(k) and/or a Roth IRA, etc. Only once these items are in place do I recommend an alternate investment like Magic.

I also don’t recommend buying out individual cards. This puts huge pressure on the market. If you target a staple, you’re likely going to pay hefty premiums once you finish buying the first dozen or so copies. Paying higher prices is not a productive way to invest. If you target something obscure you can pick up more copies on the cheap, but it is difficult to liquidate 100 copies of a card that only set collectors want to buy.

Instead, I’d make sure you have a list of priority cards in you mind and start checking some off your list little by little. For example, if you’re hoping to acquire a Commander set of Dual Lands (one each), start prioritizing these now rather than waiting for a deal on the Sick Deals Facebook group. I don’t think prices are going to be soft as we work our way through 2021 and if history is any indication, the opposite may be true. Prices may surge to new highs on the backs of stimulus checks, tax refunds, inflation, and newfound profits from Bitcoin.