Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

May's data overall looks fairly similar to April's, continuing the trend from March. There's been no major shakeup in Modern's metagame's composition, though many decks have exchanged places on the list. That is a worrying cherry atop a pile of worrying data. Modern is trending towards concentration, perhaps even stagnation.

The Pattern Repeats

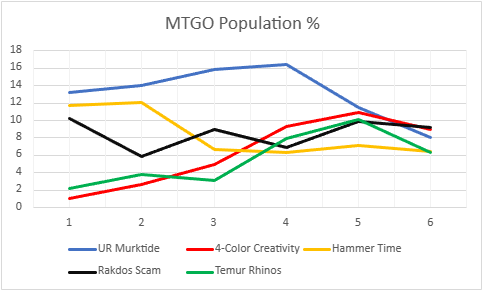

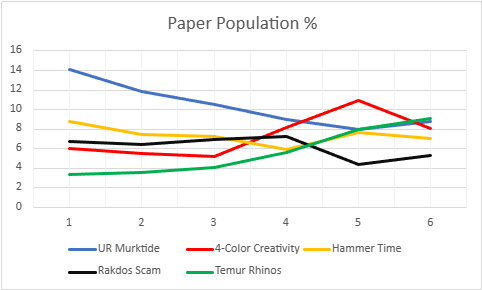

As in April, Murktide has fallen from the top position it occupied for over a year. However, once again, that doesn't tell the full story. Murktide steadily rose up the charts after being down at the end of week one to almost reclaim the top position. I don't know why it fell off, but the past two months have aptly demonstrated the comeback power that propelled Murktide to the top in the first place.

Of course, Murktide didn't actually completely come back in May, though the paper gap is so narrow as to be statistically meaningless. This was entirely thanks to late-month explosions by the top-placed decks. As I mentioned in the data article, Rhinos beat Murktide in paper thanks to a single event. Rakdos Scam winning Magic Online (MTGO) was the result of an entire weekend of Challenge dominance.

This kind of fluctuation is very common, so there's nothing to read into here. What it happened to is interesting. Scam is the most volatile (consistently) Tier 1 deck on MTGO, regularly seeing swings of 3% or more each month. There may be nothing to this latest surge, but it could also point to a change of fortune. Rhinos has been on a strong upward trend since January in paper, so this is just a culmination.

Impressive Result

I'd be remiss at this point not to specifically mention Murktide's position on the average power tiers. For most of its run as Modern's top deck, Murktide placed near Baseline. Not usually right on it, but a bit above or below was typical. It helped feed the narrative that Murktide wasn't that impressive of a deck, but was just really popular.

However, the drop in popularity coupled with improved average stats undermines that narrative. It suggests that the weaker players have finally moved on from Murktide and are no longer dragging down its stats. Popular decks will necessarily have a worse win/loss record than they "should" have due to weak players picking up the "best deck" for easy wins.

Now that they're gone, the stats will be more reflective of the good Murktide players. Murktide is therefore unlikely to be the top deck by the same margins but should instead have a better win/loss record. The next month's data will prove or disprove this hypothesis.

The Wider Picture

On that note, the overall picture of the metagame is changing. As I noted back in March, Modern's metagame has been getting concentrated around a small number of effects. In April, I noted that Modern is concentrating around a small number of decks in a way that it hadn't done since the early days. This continues to be the case, but the waters are muddier.

Thanks (I suspect) to Living End's huge push on MTGO and Amulet Titan always putting up numbers in paper, the 5-Deck Concentration ratios fell in May. MTGO had a concentration of 49.63% in April which fell to 39.08 in May.

Paper's ratio also fell, but not dramatically. In purely statistical terms, it really didn't fall thanks to error margins. April's ratio was 38.85 and May's was 38.37.

On that basis, one might conclude that Modern is moving away from concentration toward a more competitive field. One might be right, but one could also be wrong. There's more to the situation than these numbers indicate.

Uneven Distribution

The way competitive Magic data works, Tier 1 will always represent more of the results percentagewise than the other tiers. The data is always going to be extremely skewed, with most of the results concentrated on the high end. The distribution looks like a smashed raindrop with a long tail. Somewhere between 25%-60% of all the unique decks are singletons every month. The tiers are drawn from only the top quartile of decks.

Thus, when I note how large a percent of the results Tier 1 takes up, that's not really news. It's like that for every format and across time. The concern is whether there's still room for Tiers 2 and 3 to survive, compete and thrive. When the format is less concentrated, results are more evenly distributed and the format is more competitive, which is good and healthy. Highly concentrated formats are solved and stagnated.

A Worrying Trend

My April article on Murktide noted that Modern's concentration looks more like pre-2016 Modern than recent years. This was done on the basis of concentration ratios because I don't have a way to compare the tier composition over the years. I wasn't doing the data for most of those years and therefore can't assign tier-rankings. The statistical method I'm using doesn't work for just percentage numbers.

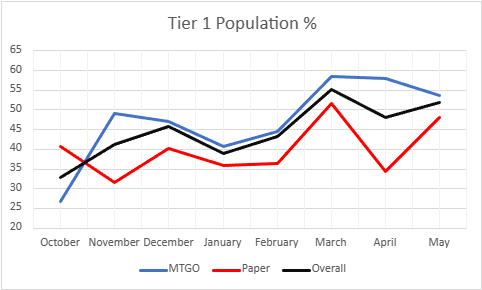

However, when we look at what's happening in the data I have collected about Tier 1's concentration, a worrying trend is emerging.

Since Yorion, Sky Nomad was banned and our current metagame was initialized, there's been a steady and strong upward trend for Tier 1's metagame percentage. I'm focusing on population because it's the important one in this discussion, but power's metagame has the same trend. This overall increase in Tier 1's representation is primarily at the expense of Tier 2.

The metagame is zero-sum; as Tier 1 takes up more space, there's necessarily less room for anything else. This indicates that the ability of other decks to win is decreasing. Decreasing diversity means the metagame is solved, and players generally hate solved metagames and stop playing. Modern isn't there yet, but the trend is worrying.

Confounding Variable

One thing to note about the fall off from March is that the size of the data set is a factor. March was the largest dataset I've ever worked with, and was also when concentration was highest. The fall off in April's population was accompanied by the fall in concentration. The two events may or may not be linked. That May was smaller than April and more concentrated is a point for not, but there's no way to be certain. There's too much that goes into tournament participation and event reporting to be definitive.

Elsewhere in Modern

In other news, after spending most of the past few years in Modern's basement, Tron has made it back to Tier 1 on MTGO and Tier 2 in paper. It's been through some tweaks to help its competitiveness, but overall Tron remains Tron. Arguably the least-changed deck in Modern's history is still alive and kicking. Time to remember this and be prepared.

Tron is back this month largely thanks to 4-Color Creativity. While it has all the trappings of a Tinker-style combo deck, Creativity mostly plays like a midrange deck. Tron has always been the deck for eating midrange, and Creativity is no exception. Creativity doesn't play many counters and fewer still that Tron cares about, and can't reliably disrupt Tron's lands. That's a great way to lose.

Whether this will continue remains to be seen. There's plenty of Tron hate available to all decks these days, so there's no excuse for just losing to Tron anymore. The question is whether or not players will adjust and plan for this problem.

The Classic Foil

This also might explain why Counter-Cat has seen a resurgence in May after falling in April. Big, chunky threats backed up by counters has always been a great strategy against Tinker decks and also Tron. The fact that Territorial Kavu resists the most common removal and can ensure Unholy Heat can't kill it is gravy. Again, this might be a blip or an actual metagame shift. Time will tell.

Financial Corner

As per tradition, it's time to gaze into the crystal ball to see if any of these shifts will impact the card sale market. As the metagame is remaining relatively stable and the competitive focus is on Pioneer, I would expect the Modern market to be in a downward trend. Non-Pioneer staples are in less demand right now and show slight price decreases. Pioneer staples have some upward pressure, but it doesn't seem strong.

Thus, I continue to forecast a buyers' market. Players are looking for the best deals in a colder market and stocking up ahead of the Modern RCQ season later this year. I'd look to Pioneer for making a quick buck and investing in Modern for the longer haul.

New Set Bounce

The Lord of the Rings: Tales of Middle-Earth will be releasing in the next few weeks, which will be the first time a set like this is coming to Modern as well as Legacy. While there is potential for some cards to find homes in Modern, I'm not convinced that there's anything metagame-shaking. I'll be going into this more next week, but the set's power level is more appropriate for Pioneer than Modern.

For those looking to sell sealed product, there should be huge demand initially. If the allure of finding the one The One Ring isn't enough to drive sales, the flavor and art of the set will. Never mind how powerful the pull of The Lord of the Rings is in general. The new cards should sell well initially, but I wouldn't expect them to drive sales of existing cards.

Stability Reigns

There's nothing wrong with a more stable metagame. Modern spent years constantly and violently churning, so it's nice to have a breather. However, the concern I have is that Modern is moving towards high concentration, and that sounds suspiciously like it's been solved. That's a poor omen, and we'll be watching.