Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Welcome to the MTGO Market Report as compiled by Sylvain Lehoux and Matthew Lewis. The report is loosely broken down into two perspectives. A broader perspective will be written by Matthew and will focus on recent trends in set prices, taking into account how paper prices and MTGO prices interact. Sylvain will take a closer look at particular opportunities based on various factors such as (but not limited to) set releases, flashback drafts and banned/restricted announcements.

There will be some overlap between the two sections. As always, speculators should take into account their own budget, risk tolerance and current portfolio before taking on any recommended positions.

Redemption

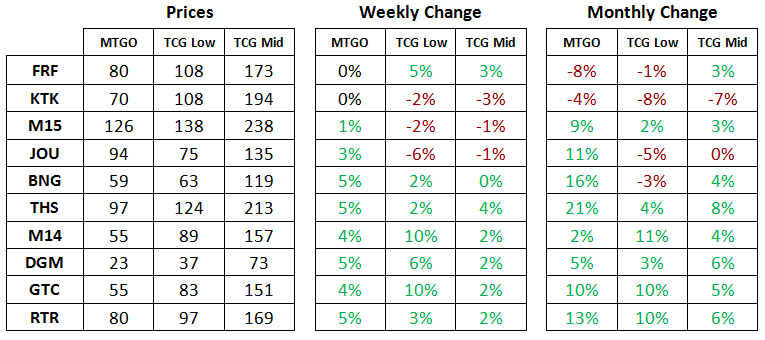

Below are the total set prices for all redeemable sets on MTGO. All prices are current as of March 9th, 2015. The MTGO prices reflect the set sell price scraped from the Supernova Bots website while the TCG Low and TCG Mid prices are the sum of each set’s individual card prices on TCG Player, either the low price or the mid-price respectively.

Broadly speaking, it is the correct time to accumulate tix in advance of DTK release events, when the inevitable liquidity crunch drives up the value of tix relative to everything else. Once demand for tix ramps up during DTK events, prices for singles will fall and there will inevitably be some good buying opportunities.

Be prepared in advance though. Sell now when tix are still valued in a normal way. Short-term positions should be liquidated, and some trimming of longer-term positions is also warranted.

Return to Ravnica Block & M14

The paper set price increases for RTR and GTC are rising at an accelerating rate. It’s not clear how long this trend will last, but the spoiling of Tarmogoyf and Karn Liberated on Friday have helped to build expectations for the release of Modern Masters 2015. Paper retailers appear to be responding with higher prices on these sets due to the staples they contain.

The outlook for RTR and GTC on MTGO remains increasingly positive as a result. In the short-term, flat prices are likely as interest moves to the upcoming DTK release events. But when paper set prices start moving up, redeemable digital set prices are sure to follow.

Jace, Architect of Thought briefly tipped over 7 tix last week, but has now settled back down into the 5 to 6 tix range. This card has so far shown two price spikes since rotation, due to two separate events. If you missed the most recent one, it’s not time to sell these yet. There will probably be a period of price weakness, but if there’s one last price jump in the next three months, don’t hesitate to sell into it.

This applies to other mythic rares from these sets as well. If you can catch the price spike, don’t be afraid to sell. But there is still time for further gains so don’t worry if you miss out on any short-term price swings.

M14 still looks like one of the sets with the most value on MTGO, but the price increases in paper are not accelerating at the same rate as GTC and RTR. Ultimately this means that gains on M14 mythic rares might be smaller in comparison. It will be worth watching over the coming weeks. Regardless, the outlook is still for higher prices but M14 might underperform relative to RTR and GTC.

Theros Block & M15

The first two sets of Theros block have solid price gains in paper over the last month, while M15 and JOU have been flat. On MTGO, each of the sets is off of their mid-winter peaks; as a whole, they are neither under- nor overvalued.

Expect some further price declines leading up to the release of DTK, followed by a rally back to current levels before starting the long price fade to rotation. If DTK shakes up Standard and generates some large price swings in Theros block and M15, don’t hesitate to take advantage and exit from holding cards from these sets.

It’s possible that another price decline occurs for a Standard staple like Goblin Rabblemaster. Buying this in and around FRF release events at about 12 tix would have been a profitable play, as it recently crested in the 17-18 tix range. During DTK release events, look for unexpected price weakness in Standard staples like this in order to profit from the price rebound.

Khans of Tarkir & Fate Reforged

KTK is currently working on putting in a bottom. It’s no surprise that this occurs right near the end of its run as a part of the current draft format. Relative to paper, sets of KTK on MTGO represent ‘good value’. That being said, paper prices are still in decline so it’s possible that there won’t be much support from redemption in the near term.

As for FRF, the next big wave of product is going to hit the market in both paper and digital with the release of DTK and the new draft format. This is a negative for the price outlook on this set, but is counteracted by the apparent fact that FRF has some of the more powerful (and Standard-playable) mythic rares from recent sets, as well as a couple of staple uncommons.

Longer term, FRF might be the set to stock up on. Keep that in mind during the run up to the release of Magic Origins later this year.

Modern

The Modern season is coming to an end this week. MOCS preliminaries start today with the season final scheduled this coming Saturday. Speculators should strongly consider selling their Modern staples this weekend.

Selling now is even more important since WotC made two major announcements last week that are going to impact Modern prices. First, two cards from Modern Masters 2015 were spoiled--Tarmogoyf and Karn Liberated, two current Modern high rollers. The reprint of the ‘goyf was clearly expected and is not a surprise; its paper price is over $200 and a reprint is crucial for the future of Modern accessibility.

Now we know that cards in MMA can be reprinted in MM2, and this is another reason to sell Modern staples. Don’t fall into the trap of looking at the price of an online version, and think it is safe from a reprint. The prices of paper and digital Modern staples can be quite different.

For instance, a reprint of Dark Confidant is probably needed in paper since Bob is sitting at around $70 whereas the card is below 20 Tix on MTGO. The digital price more accurately reflects how hostile the Modern metagame is to Bob, but it would be very incorrect to base the likelihood of a reprint in MM2 based on MTGO prices.

Second, the next fall set will be Battle for Zendikar. The simple mention of “Zendikar” was enough for the price of the ZEN fetchlands to tank by 25%. It will take many more months before we know if fetchlands are reprinted. In the meantime speculating on ZEN fetchlands will be a risky business.

However, as the panic lowered the price of these fetchlands by 25% this may as well represent a short- to mid-term opportunity for anyone willing to take a small risk for moderate gains. DTK release events will constitute a great window for taking speculative positions, and this includes being on the lookout for discounted Modern staples.

Vintage, Legacy and Pauper

Many staples in these formats kept climbing this past week and have not shown signs of weakness yet. The Legacy index and the VMA whole set index are flat or slightly rising.

In Pauper, some prices are stabilizing and showing signs of a price correction after a recent spike, such as Mental Note. Others are still on the rise and have some ways to go before reaching their previous heights, such as Innocent Blood.

Overall, the recent DE scheduling change for these three formats seems to have stimulated demand for cards used in these formats. This is good news for speculators, as player demand is always the primary driver in prices.

Targeted Speculative Buying Opportunities

Modern

This card is at a cyclic low and periodically shows up in Modern. It is also not going to be reprinted in MM2 this spring.

Targeted Speculative Selling Opportunities

Modern

Kitchen Finks

Manamorphose

Life from the Loam

Vendilion Clique

Skullcrack

Kitchen Finks, Manamorphose and Life from the Loam are at a local high and this is the opportunity to sell these positions now. Vendilion Clique may not have risen as expected, but with a real threat of being in Modern Masters 2015 it’s time to sell before potential serious losses.

With the new red-green command spoiled in DTK, Skullcrack may not have any future. This spec is clearly a miss but it’s time to let go.

Should Mental Note be a hold? What is the expected ceilling?

I’m still holding on to my copies. This card is rising for the first time so all we have our guesses and judgment. I’m targeting a 1 tix selling price, meaning the actual price of mental note has to be in the 1.2-1.5 tix range. It could also go much higher if delve gets more popular in pauper.

What percent of the MM set can they reprint without this becoming an overpriced 8th edition? I think it can’t be more than 5%

It’s important to note that MM2 (online anyway) is not constrained by a print run or a %, but it is time constrained. I think there will be a three week release period, and then it will go off sale and out of the draft queues. This has generally been enough time to have a large impact on prices as drafting of these sets is very popular, and no redemption means there is no price floor on digital MM2 cards.

Any thought to discussing booster prices in this series?

Yes, it’s something I’ve considered. I’ll talk it over with Sylvain. One of the big benefits of a joint report like this is that we both have to sign off on any buy/sell recommendation. Stay tuned!

what is going to happen to this series now that Sylvain is leaving QS?

I’m only stoping my weekly insider regular article. I’m still up for the MTGO Market Report and I’ll finish the 100 Tix 1 Year project and its reports.

I apologize for my ignorance on MTGO things..but does your table mean that FRF sets on MTGO are only $80?

That’s correct. Supernova sometimes is missing prices though, so It might be a little low. Checking with Goatbots today, they have them for sale at 87 tix.