Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Don't even think about registering a list for Grand Prix Pittsburgh next weekend unless you've checked out all the Regional Pro Tour Qualifier decks. And I mean all of them; you're not going to get away with tabbing through a few Top 8's and just settling on Jund or Affinity.

The RPTQ Top 8's are themselves a winner's metagame, featuring not just players who succeeded earlier this year, but the victors of an already high-performing group. There's a lot we can learn from their finishes, which can mean a big edge at GP Pittsburgh for anyone who's willing to crunch the numbers.

Top Dogs at the RPTQs

Grand Prix aren't the only place this edge can apply. RPTQ stats can also give you a leg up on the Modern market, which is in a down period while the spotlight has remained on Standard, Limited, and even Legacy at Seattle.

In light of Star City Games' announcement about their changed Open and Qualifier structure, the Modern market is on the verge of another explosion like the one we saw back in May 2015. Whether you want to play the format or profit from it, you'll need to act soon to avoid the price spikes, and there won't be a better time than the lead-up to Pittsburgh.

We're going to start today's article with a quick breakdown of the RPTQ Top 8's. Doug Linn broke down the first round of RPTQ numbers last week. Wizards released a second batch on Friday, so I'm revisiting those numbers today.

I already track a huge range of Modern metagame stats on Modern Nexus, and this data is critical for informing financial decisions. We'll look at those numbers both to inform Pittsburgh preparation and highlight some neat speculation targets.

Afterwards, I'm going to focus on a few decks (and their core cards) which you'll want to look at as we get into Pittsburgh on Saturday. If these decks make it big at the Grand Prix, you won't want to get in on them after the fact.

RPTQ Metagame Breakdown

If you've read my articles on Modern Nexus, you know I'm a huge proponent of metagame analysis. I'm already tracking the RPTQ results on the Nexus Top Decks page, and the data below comes straight out of that project.

The RPTQs were split between a series of tournaments on 10/31 and another on 11/7. We have results from 29 of those events, comprising just over 230 decks.

I'm not super interested in the outlying finishes (although I suppose it doesn't hurt to snipe Molten Vortex out of that lone Assault Loam appearance). Outlying decks frequently make Top 8's in Modern, which says more about format diversity and openness than about a specific deck's viability.

RPTQ Top 8's were no exception to this, and a few corner-case performances are worth checking out. Just keep your hype and expectations low.

RPTQ Oddballs

Personally, I'm much more interested in the metagame-shaping performances that are likely to predict Pittsburgh's big winners, and that's what we're going to explore today.

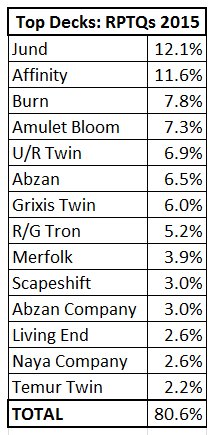

Here are the percentages for all decks representing 2% or more of the metagame. We can think of these as the "tiered" decks within the RPTQ circuit.

The decks above make up about 81% of all those played at the RPTQ. They're the most likely to have the biggest impact at GP Pittsburgh.

The decks above make up about 81% of all those played at the RPTQ. They're the most likely to have the biggest impact at GP Pittsburgh.

Although it's definitely possible for a rogue contender to punch its way into the top tables (see Ad Nauseam, Grishoalbrand, and Elves at GP Charlotte, or Latern Control at GP Oklahoma City), your best bet will be on the major archetypes listed above. That's true for players picking a deck and preparing for matchups, as well as for investors looking for a hot buy.

I'm going to pull out three decks from this list in a moment, but first I want to highlight a few general takeaways from the data.

1) BGx Midrange Was the Most-Played Archetype

Modern's premier police deck is alive and well. Jund was the most-played single deck in the tournament series, with Abzan still putting up respectable numbers at 6.5%. Together, BGx made up 18.5% of the RPTQs, putting it ahead of the next most-played supertype, URx Twin, at 15.1%.

From a metagame perspective, this means you'll want to be ready for the efficient disruption of all the BGx builds, but specifically for Lightning Bolt. Given Affinity's and Burn's prevalence, along with Company decks and random aggro like Merfolk, Bolt is definitely where you want to be right now. Jund's continued dominance proves that.

Financially speaking, I'm on board with Chaz's advice to pick up Thoughtseize and Dark Confidant. These cards have nowhere to go but up, and if Jund's shares stay similar at Pittsburgh (very likely), you'll want to get them sooner rather than later.

2) URx Twin Is Coming Back

Back in August and September, Twin saw some of its lowest metagame shares in months. Grixis Twin and U/R Twin weren't pushing past 7% collectively, a far cry from the days when a single Twin deck was putting up those numbers.

October saw a reversal of this trend, and the RPTQ circuit just keeps that Twin momentum going. URx Twin was at 15.1% of the RPTQ metagame, with Temur Twin rejoining the U/R and Grixis regulars as a major deck.

Twin's share has big metagame implications. It's bad news for Affinity and Amulet Bloom (although both those decks still enjoyed considerable success) but great for Abzan and Merfolk. Don't forget those Rending Volleys at Pittsburgh, especially if you're playing a Bolt-based linear deck.

Exarch and Twin are always good purchase targets, but the big winner from Twin's RPTQ rise is Bounding Krasis.

Copies of foil Krasis (Krasis's? Krases?) cost peanuts today and a big Temur Twin performance could push them into much more profitable territory. Every single Temur Twin list ran at least two copies of the 3/3 fish lizard, which suggests its on its way to becoming an archetype mainstay.

Another option here is Hinterland Harbor, although as a singleton in most lists, its ceiling is somewhat low.

Reading the Metagame

There are plenty of other conclusions you can draw from the RPTQ data, especially around all the linear decks like Affinity, R/G Tron, Amulet Bloom, Burn, etc. These fast decks attack from a variety of angles and make up huge metagame percentages, so be ready for them if you want to succeed at Pittsburgh.

Be sure to think of these numbers in the broader metagame context. At the end of the day, the RPTQ's are just one series of tournaments, so paying attention to the October metagame forces overall is important.

With this higher-level Modern view in mind, let's turn to a few big decks you'll want to be ready for, whether at Pittsburgh or on TCGPlayer carts.

Breakout Performer: Scapeshift

Chaz talked about Scapeshift in his article last Friday, and I agreed with him even before I saw the RPTQ numbers. Now that I've seen the stats and compared them to October's metagame numbers, I'm really feeling Scapeshift's chances at Pittsburgh.

As a deck, Scapeshift has been sneaking up the metagame charts since early October, and its RPTQ share of 3% is almost double the paper metagame share back from 10/1 - 10/31.

We're seeing a lot of players brew with Bring to Light to give the deck a more toolbox approach; Jeff Hoogland wrote about this following an exciting Top 8 finish at SCG St. Louis in late October.

We're also seeing more traditional Scapeshift lists at the RPTQ's, which suggests a strong game plan even independent of the Bring to Light tech. The card Scapeshift itself is a great bet here, with low circulation and a big upside if the deck really takes off.

If you want to bank on the 4- to 5-color toolbox build, Damnation stands out as the card that could gain the most.

This is a riskier buy-in because of an already high price tag, but imagine for a second a reality where Damnation is Modern-playable. That $40 pricetag is sustained off casual and Commander alone--a big Modern finish will catapult it even higher.

I don't expect we'll see Scapeshift make up more than 3%-4% of the GP metagame, but it only takes one representative in the Top 8 or 16 to send these prices soaring.

Worst case scenario, you buy a card that will probably go up anyway just due to natural demand. Remember that SCG's tournament structure now favors Modern more than ever before, and Scapeshift is guaranteed to be a player in many events.

Best case scenario? You get in early on a big player with an established record of success in this autumn Modern metagame.

Uncertain Bet: Amulet Bloom

Amulet Bloom has been a Modern presence all year, but never at the same frequency as in the RPTQs. We haven't seen it crack 5% in previous metagames, even zeroing in on event series like SCG States. Cards like Blood Moon and Twin players have mostly kept it in check.

The RPTQs provide an early indication that Amulet Bloom has overcome those threats, either due to tight play or tighter lists.

RPTQs featured great players who undoubtedly knew about Bloom, and if they couldn't stop it from reaching 7.3% of the RPTQ metagame it suggests Amulet Bloom is in a great position heading into Pittsburgh. Pick your deck and pick your purchases accordingly!

Amulet Bloom All-Stars

It's possible RPTQ players weren't as ready for Amulet Bloom as I'm giving them credit for. If that's the case, then Bloom is unlikely to repeat its performance at Pittsburgh (a definite possibility with all the Twin throughout the format).

This is one reason I characterize Amulet Bloom as an "uncertain bet." Authors always talk about how broken the deck is, but metagame numbers have rarely justified it.

The RPTQs were a change in that narrative, and if those statistics hold steady into Pittsburgh, the deck will be huge.

If you want to buy into Bloom, I'd stay away from expensive staples like Azusa, Lost but Seeking. The ship has already sailed on Azusa, as well as Primeval Titan. Amulets are a much safer bet, with a low buy-in point and a ceiling that has only been limited by the mid-level success of Bloom so far.

Foil Sleight of Hands are also looking hot these days, with more Bloom players shifting away from Ancient Stirrings towards cantrip-heavy lists. Add Temple of Mystery to that list, but be aware a large number of Temples are likely in circulation after the Theros rotation.

Before we close on Amulet Bloom, there's another reason I'm calling this an uncertain bet (at least in the long term): the upcoming ban announcement. There has been a lot of needless and ungrounded alarmism about Amulet Bloom all year, and I've been fighting against it since we saw Blood Moon decks rein in Amulet during GP Charlotte in June.

The only way Amulet Bloom sees a banning in Modern is if it can sustain a top-tier status, something the deck hasn't been able to do all year.

The RPTQ numbers are the first indication that Amulet Bloom is finally pulling away from its hate cards and the decks that police it. If this leads to a broader adoption throughout the format, I wouldn't be optimistic about Bloom's chances of dodging a banning.

If it stays at a modest share of the metagame, however, then Bloom actually becomes the safest bet it's been all year. Bloom's inability to convert huge RPTQ wins into a performance at Pittsburgh would all but prove the deck is weaker than many alarmists and hype-train conductors purport.

We'll need to wait and see, but for now be cautious when investing in this deck.

Pumped for Pittsburgh!

I won't be playing in the Modern Grand Prix, but you can be sure I'll be eagerly following results on the Twitch stream and via social media. We'll check back in on the tournament results next week.

If you're playing in the event, good luck and don't forget to read up on your RPTQ results!

If you're buying cards based on the event, remember spoils go to the swift. You aren't going to profit from a rogue Top 8 finish if you try to buy cards Monday morning. You'll need to identify that deck before Day 2 to really make the big bucks, and your window is all but closed by the time the Top 8 gets posted.

What are some other takeaways you saw in the RPTQ data? Any cards or decks I missed? I'll look for you in the comments and hope to see you on the Twitch chat as we enjoy the Modern action this coming weekend!

I think my biggest problem with your bloom argument that it’s “not consistant” enough is that the same arguement could be made for Blazing Shoal….that deck only wins on turn 2 if you have a glistener elf on turn 1 and blazing shoal in your opening hand for first 1-2 draws…but they banned it. If WoTC is going to stick by their “no turn 2 wins” mentality then they need to ban cards to eliminate them…for Titan Bloom it’s as simple as eliminating the summer bloom.

I’m not even speaking to the consistency of the deck. I’m just speaking to its metagame share. Wizards has made it very clear that the turn four rule does NOT mean “no decks can consistently win before turn four”. It means “no TOP-TIER decks can consistently win before turn four”. For a deck to be considered “top-tier”, it needs to occupy some share of the metagame, and Bloom just wasn’t there for most of the year. While all the pros were panicking about it, the deck was at a mere 2%-4% (at most). This suggested to me it was all hype and the data wasn’t there to support the ban talk.

The RPTQ data suggests a new picture, so we’ll have to see where it goes from there. If the deck does sustain this 7% share, I do expect we’ll see a banning.

With regard to Bloom, I was undefeated against the deck until I finally played against a pilot who impressively navigated the deck. It’s a complicated deck even for players that consider themselves, or are considered by others, as being “very good”. Tom Martel has started an article *series* on the deck, and in it he says that there are quite a few stock mistakes to make with the deck.

I was crushing opponents who tried to combo as soon as possible and when I finally lost to the deck it was in the hands of somebody who knew the ins and outs of winning in the face of potential disruption, and exploiting the resiliency of the deck rather than its explosiveness. Piloting it correctly takes some pretty high level play, which I imagine is the biggest factor keeping the deck in check.

Perhaps, but I also think this is much less of an issue in the days of the internet, streamers, and the overall Magic content mill. On top of this information on playing the deck, there are ample opportunities to practice it, whether online, in one of the frequent IQs, or in local stores with growing Modern scenes. All of this suggests the deck should have had a bigger following earlier this year than it did.

Moreover, it would only take a handful of pros and experienced Amulet Bloom pilots to make a big impact at GP and Open T8s. And yet, we consistently saw those players fall short of the top prize, and we saw few of them to begin with. I think this might be taking a turn following the RPTQ, but we’ll need to wait until Sunday to see for sure!

Good article Sheridan, it’s great to see so many of us on the same line of thinking when it comes to Modern.

I agree with a lot of your recent analysis on Modern, and they’re basically in line with my own. It’s good to see that, especially when you personally focus on Modern (considering the site you also closely work with).

Also, greatly appreciate the reference to my article! Thanks Sheridan 🙂

Absolutely! Glad to see we’re on the same wavelength with a lot of this. Keep up the great content!