Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Having an appropriate context for short selling on MTGO is one thing, but identifying concrete opportunities is another.

Two weeks ago, I used the example of Khans of Tarkir (KTK) full sets and Anafenza, the Foremost to show how non-linear price variations could be exploited using short sales on MTGO. In the context of KTK full set speculation, Anafenza could have been sold and bought back several times between April and October to generate profit.

Of course, pointing to charts and graphs after the fact isn't that helpful. As with any speculative opportunity, we need to understand how, when and why such events occur so we know when to act ahead of time.

As with Standard speculation, short sales can aim for the long term or short term, or even for quick flip opportunities. Today I'll focus on long-term short sale options, with some examples from the last few years.

One Goal, Different Approaches

Short selling is just like traditional speculation in that it can be executed with different goals and different time frames.

You may short sell a card with the intention of rebuying only a couple hours or days later. Such cases can be seen as quick flips, and may occur during a spike triggered by a major event--PTs, GPs, SCG Opens and the like.

Short-term opportunities may occur when the Standard metagame is about to change. Some cards may lose value as a consequence, which can be taken advantage of with short sales.

Finally, although harder to grasp, extended downward price trends represent short selling opportunities that can be exploited in the long run.

As with any other type of speculation on MTGO, consider your appetite for risk, bankroll size, portfolio strategy and time available before making any moves.

Long-Term Short Sale Opportunities

Long-term short sales are not easy to take advantage of. First of all, determining the optimal entry point (when you are going to sell your position) might not be easy. Your position in question may be on a slow upward trend, a downward trend, or even flat--it's not simple to determine when to pull the trigger.

Then, even after committing to the long run it may not be easy to decide when to rebuy. Since this position will be open for a good chunk of time, you want to avoid having to pay attention to every daily or weekly fluctuation.

Finally, during that period, disruptive events can occur--unexpected metagame changes, new sets, bans--that totally derail your strategy.

With that being said, some contexts may favor long-term short sales more than others.

Standard Rotation

On rotation, the departure of one block can often impact the value of individual cards from the remaining block. Drastic metagame changes aren't always the norm, but usually some cards become better or worse.

Sometimes the impact is large enough to bring a card from format staple to fringe player. In this case its price is sure to drop.

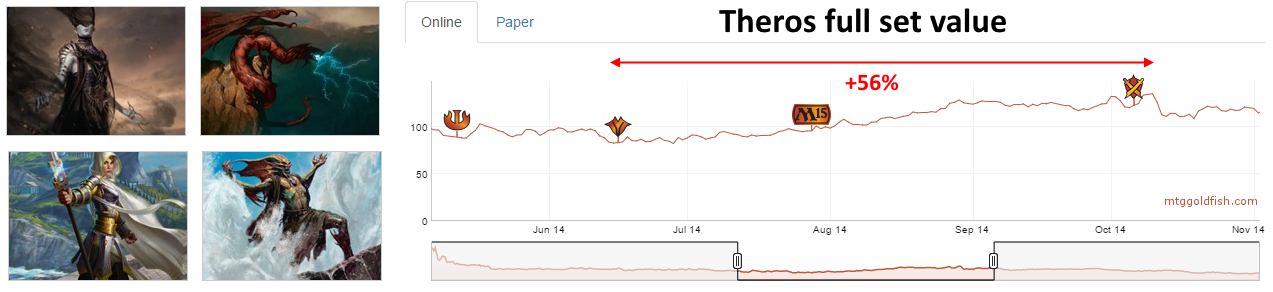

Between mid-June and October 2014, the value of a Theros full set increased pretty constantly, from 83 Tix during Vintage Masters (VMA) release events to over 130 Tix around the release of KTK, a gain of more than 56%.

Master of Waves, however, didn't follow that trend.

The merfolk was clearly strong when Return to Ravnica block hybrid cards like Nightveil Specter were in Standard. While players hoped for a suitable replacement to keep Mono-Blue Devotion alive, it rose slowly from ~5 Tix in June to a little bit over 7 Tix in August.

Then Khans of Tarkir spoilers began and it became apparent that Master of Waves would have a hard time being competitive again. With no major decklists using it at Pro Tour KTK, the two-month price decline ended with a 50% total drop by mid-October.

Anticipating this in August and short selling Master of Waves at that moment would have generated a nice profit. The price bounced back by the end of October and actually sustained a 6 Tix price tag most of the following year.

The story is a bit different for Khans of Tarkir. KTK was a strong block with a lot of internal synergies, and it has been the dominant block during its entire tenure in Standard. Pro Tour KTK was won by Abzan, only for a similar Abzan deck a full year later to take down Pro Tour Battle for Zendikar!

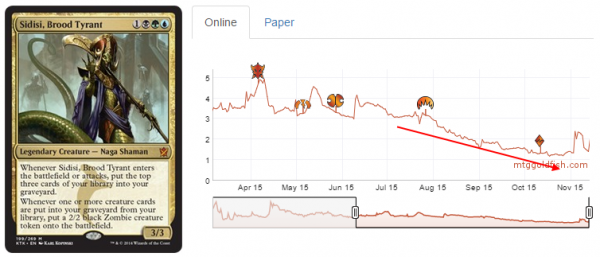

Khans of Tarkir did have a card in Sidisi, Brood Tyrant that mirrored the behavior of Master of Waves. The price of the legendary snake plateaued this summer and plunged soon after the release of Magic Origins (ORI).

While it might seem like self-mill cards are easier to replace than heavy blue mana costs, this didn't happen in ORI nor in Battle for Zendikar (BFZ).

This was probably harder to anticipate than in the case of Master of Waves. Nonetheless, Sidisi's price crashed by about 65% over more than three months, while KTK full sets increased by about 50% over the same period.

Hedging Full Set Specs

When speculating on full sets, we're betting that the average price of cards will go up. But we certainly know that won't hold for every card. At the time of investing in full sets, prices may be at their lowest on average but some cards may actually be close their highest.

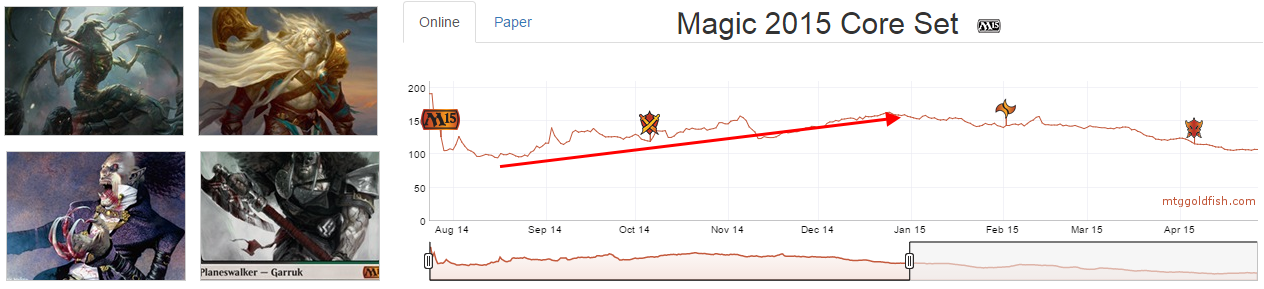

This is especially true for core sets. Due to their position in the calendar, core sets hit a bottom only about a month after release, whereas Fall sets take more than six months. As for any other set, specific cards may be in demand and see their price rise quickly after release, only to fall back to a more reasonable price in the course of several months.

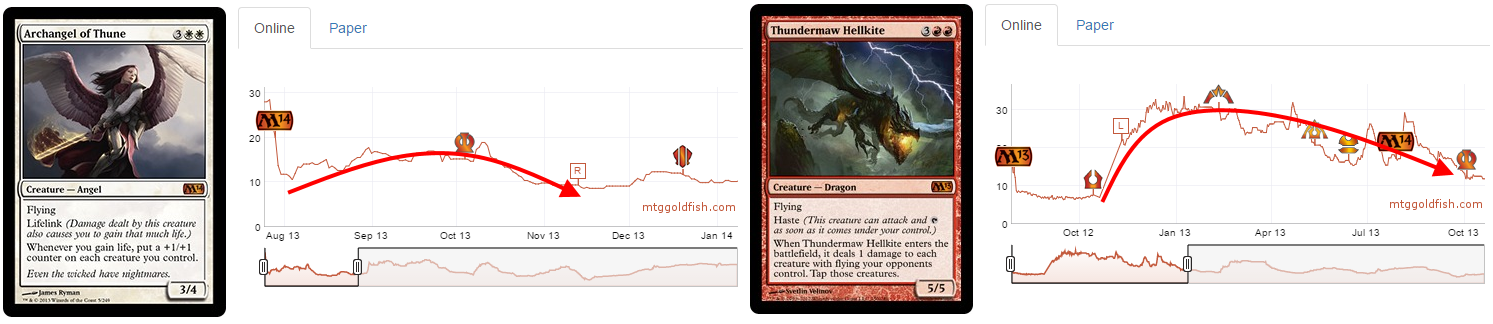

Nissa, Worldwaker from M15 illustrates this principle very well. M15 as a whole rose from its bottom in August to hit its highest price the following Winter.

The green planeswalker did not partake in the rally. She was great in pre-rotation Standard, but not so much once KTK hit.

Selling Nissa for 30 Tix in October and rebuying for about 15 Tix sometime in November or December would have netted you an additional 15 Tix on each M15 full set investment. It would have provided a good hedge in case the M15 full set didn't pan out for some reason.

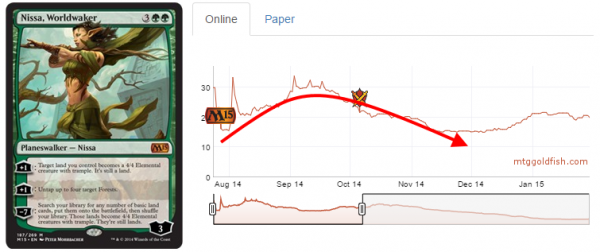

Speculators might have been able to identify Nissa as a good short sale target at the time by looking at price trends from past core set mythics. Both Archangel of Thune and Thundermaw Hellkite followed the same pattern, and the latter evidenced a ceiling of 30 Tix for core set mythics.

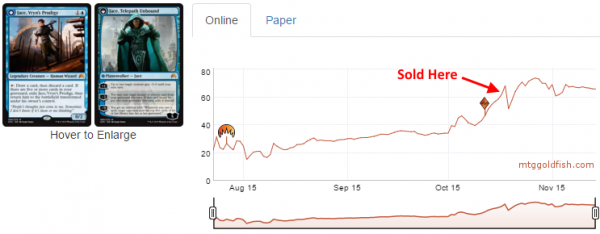

That price point was the maximum observed for any core set mythic, until the arrival of Jace, Vryn's Prodigy.

Mid-October Jace was already above 30 Tix. At this time he exhibited both the price limit shown for Thundermaw Hellkite above, and the beginning of the price patterns observed for Nissa, Worldwaker and Archangel of Thune.

Short selling Jace at that point would have made perfect sense. What could have made speculators hesitant here is the fact that Jace was already seeing heavy cross-format play in Standard, Modern, Legacy and Vintage. That's why, as tempting as it was, I didn't sell my Jaces at that time. Instead, I only did a quick flip short sale after the early October spike.

I wasn't done with Jace, however, and history was about to be made. The iconic blue planeswalker hit the absolute record high for a core set mythic, at 74 Tix about a month ago.

I thought Jace's exorbitant price was belied by a Standard metagame where he wasn't that dominant, so in the wake of PT BFZ I sold Jace slightly above 60 Tix, planning on a long-term short sale.

It seems that Jace has plateaued this October and that the curve of its price trend is about to drop. Whether this actually happens, as well as the degree and speed of any drop, are still up in the air.

With my move, I'm expecting Jace, Vryn's Prodigy to return to the 30-40 Tix price range, which would net me 20 more Tix on each of my ORI full set specs. We'll see how I fared in due time.

The overall short selling/hedging strategy is certainly viable, but as I describe here, you must be ready to hold for the long run. Make sure you've thought things through and know your endgame.

Next Time

In the next article I'll cover short-term short sale opportunities more in depth. As with traditional quick flips, it's possible to achieve a decent profit by selling a position and buying it back just a few days later.

Buyouts, PTs, GPs, and even intra-week price fluctuations are as many opportunities for short-term short sales. I have successfully executed a couple of these short sale moves in the context of my "100 Tix, 1 Year" project.

Join me in the next installment and I'll give you the rundown.

Thank you for reading,

Sylvain