Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Last week, I wrote an in-depth article exploring the dos and don'ts of investing in uncommons on MTGO. In response to that article, one of my friends on MTGO who is a QS Insider wrote me asking, "So, what about the cheap cards that are rares and mythics?" And being the good friend that I am, I told him to wait until this week's article!

All joking aside, his question is actually a timely one given the recent price spikes of Baral's Expertise and Bomat Courier. When we stumble across a rare or mythic rare that we feel is potentially strong yet insanely cheap, how should we evaluate that card as a speculation target? What strategy or strategies should we have when making speculation decisions about these sorts of cards? And how should these strategies differ from those for investing uncommons? There's lots to unpack here, so let's dig in!

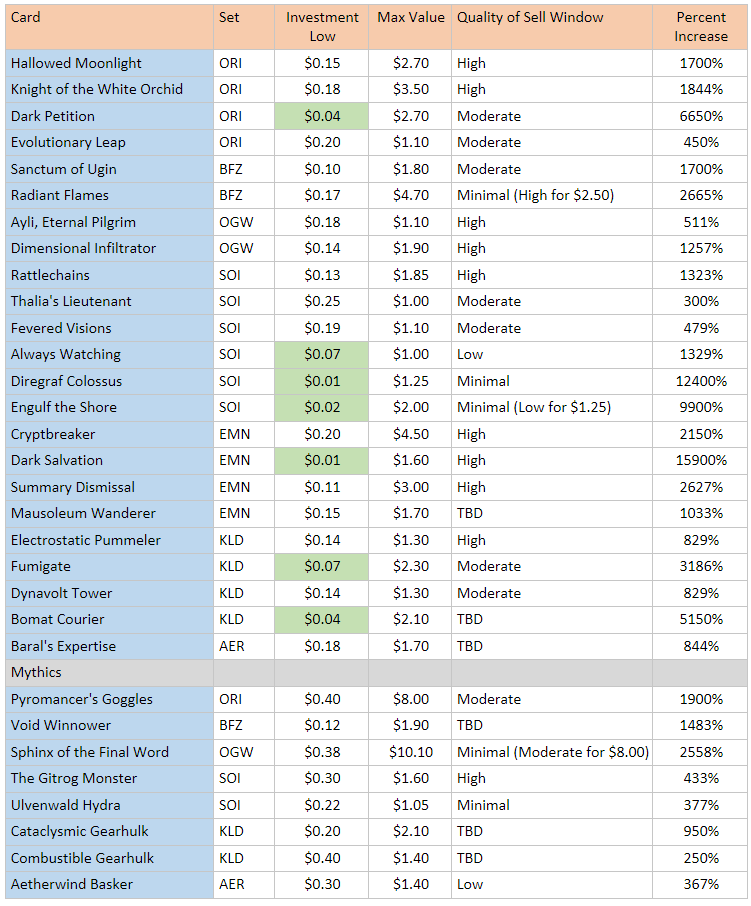

Below is a table of all the tiny-stock rares and mythics (0.20 tix and below) that rose to a sell price above 1.00 tix from the sets Dragons of Tarkir through Aether Revolt. I've arranged this table by set to make it easier to digest.

Like last time, do note that I’ve provided and organized the data most useful to you as an investor. The “Investing Low” listed for each card is the price at which you could buy a significant number of copies of that card (at least 50 copies), with a buy window of at least four weeks. The sell window is a qualitative measurement of how likely you would be to sell your card either at the card’s peak price or near its peak price. Cards with a “low” window indicate that you have to be actively conscious of your investments and utilizing MTGGoldfish price alert updates to have a realistic chance at selling your card for near-peak value. Cards that you could get for below 0.10 tix have been highlighted in green.

One thing that was surprising is that there were a lot more successful tiny-stock rares than I would have guessed. With the exception of Dragons of Tarkir, there were actually at least a few from every set. The returns on all of the ones without a "minimal" sell-window rating would have been very good, and additionally some of these, like Knight of the White Orchid or Radiant Flames, would have been incredible investments.

In general, these cards fall into four camps, and I would avoid investing in a tiny-stock rare or mythic if you can't readily place it into one of these camps. Phrased positively, if you identify a tiny-stock rare that does fit into one of these four camps, you may want to consider investing in it.

I. Archetypal Linchpins

These are cards that you know anchor a potentially powerful strategy, or a strategy that once was competitive but has since fallen out of favor. These cards tend to be cards around which a shell can be built.

Thalia's Lieutenant proved the strength of the White Human shell early on in its Standard life. Cryptbreaker is itself an interesting case and highlights the greater amount of risk involved in these speculations rather than the uncommons we looked at last week. Most would have thought that if Zombies were to become a tier-one strategy, thenCryptbreaker would be a linchpin of the deck. Yet there was no guarantee that the last block to be released before Shadows over Innistrad and Eldritch Moon rotated out of Standard would have provided additional Zombie tribal support to push the archetype to tier-one status for the first time. Sanctum of Ugin is an essential card to any ramp strategy involving Eldrazi and to most Emerge strategies as well. To invest in cards from this archetype, one must acquire a good sense about what specific cards enable certain archetypes to function and feel comfortable taking a risk, investing in the potential for the archetype to come together in the future either once again or for the first time altogether. Having a sense for the relative and absolute strength of an archetype is necessary as well.

II. Late Bloomers

These are cards that are intrinsically powerful but needed cards to rotate in and out to find a home in a tier-one Standard strategy. Dimensional Infiltrator needed the release of Shadows over Innistrad, as Shadows over Innistrad brought enough support for a blue-based flying tempo deck. Knight of the White Orchid didn't see much Standard play until Thalia's Lieutenant made it an appealing two-drop in an aggressive strategy. Just this week, Combustible Gearhulk shot up in price due to the emergence of a powerful God-Pharaoh's Gift shell.

Unlike the cards from the first group, speculating on cards in this group need to be made more on the basis of their intrinsic power level. Like the cards from above, however, there is a good amount of risk involved.

III. Counters to Future Tier-One Strategies

Cards in this group are ones that look like sideboard cards and need the right metagame to see play. Sphinx of the Final Word is an excellent way to break a control mirror. Hallowed Moonlight became popular to counter Collected Company and Rally the Ancestors. Summary Dismissal was the only way to cleanly counter Emrakul, the Promised End.

What is annoying about some on the cards that made this particular group is that you couldn't invest in them for free. Investing in Hallowed Moonlight for 0.15 tix does incur significant risk, much more than investing in a card that costs 0.05 tix. If you bought 100 Hallowed Moonlights at 0.15 tix each and only managed to get back 0.03 tix for each of them, you would have lost 12 tix. Nevertheless, it is valuable information for you as an investor to know that even some more niche rare cards can make for solid investments in a way that is impossible for tiny stock uncommons.

IV. Undervalued Utility Cards

Cards in this group are powerful utility cards that managed to become significantly undervalued during their life cycles in Standard. Of recent note is Fumigate, a card that managed to dip below 0.10 tix! Remember that rares need to see less play than an uncommon to reach equivalent price points, and so powerful cards that Wizards puts into sets precisely for their Constructed potential and their ability to establish parameters for the Standard metagame are well-worth investing in if they dip too low into tiny-stock territory.

A Word of Caution

The chart above indicates that there is plenty of potential here to make a lot of money. But what is also undoubtedly true is that these require not only a greater financial acumen, but a greater Standard acumen.

I do not recommend investing in any tiny-stock rares and mythics unless you are a player who plays and keeps up with Standard. Identifying the linchpins to powerful archetypes, judging the intrinsic power level of various archetypes and identifying powerful cards that work well in certain matchups (like Sphinx of the Final Word) requires a greater knowledge of Standard than do the tiny-stock uncommons.

Although I did not discuss this particular benefit to the uncommons we looked at last week, we can definitely appreciate it now: two-mana removal spells like Abrade or Harnessed Lightning will always be important for Standard. Cards like Reckless Bushwacker, automatic includes in Red Deck Wins-style strategies, will always make reasonable speculation targets. It is a truly infrequent occurrence when an uncommon like Blessed Alliance comes around that really catches you off-guard. The cards we looked at today, on average, take a greater amount of savvy, Standard knowledge and intrinsic risk than the uncommons we looked at last week.

And one final word: as with uncommons, small sets continue to produce wider, more forgiving sell windows.

Signing Off

I'll make a post on the forums asking what y'all want to see for next week's column. Heretofore, I've covered a wide array of topics, everything from investing advice by card type to looking at the cost of drafting on MTGO. Let me know what you want to see! And as always, I'll answer any questions you have and will do my best to respond to every comment below.

Last week, I gave y'all a taste of the Amonkhet sun, but what if you prefer the moon instead? Here's a lunar card to rival Cryptic Command.

Great Article. A few things Id like to add, based on your chart you can visually see how “rare” it is for a rare/mythic to go from nothing to above a dollar. There are only a couple for each set, and with 60+ mythics and rares you really need to be on point with your spec game, as you have pointed out. Also, in my experience maxing at 50 copies seems to be a good idea. Ive gone real deep on some of these, and even when they do spike, the price doesn’t hold and I am not able to move all of them. With the uncommons Ive been able to move 100+ copies without too much trouble. I really enjoyed this articles.

Thanks,

Peter

Thanks Peter. I think you’d have to have a really really high level of confidence in a card to go more than 50 copies, and it is hard to have confidence in a card that hasn’t proven itself (hence their penny-stock status). Sometimes it is just sheer luck (e.g. the Gearhulks getting a major bump from God-Pharaoh’s Gift).

I think you’re right when you say that the windows on tiny-stock uncommons tend to be higher. That’s probably because an uncommon has to be a real core part of Standard’s fabric to be worth a dollar. The bar is significantly lower for a rare or mythic, which in turn means you’re going to get more “flashes in the pan” in rares and mythics.

And thank you for the kind words. I’m glad you liked this article. Definitely a lot of data to mine through, but I think the 4-step checklist method will help you and me and others make sound investments in this area in the future.