Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

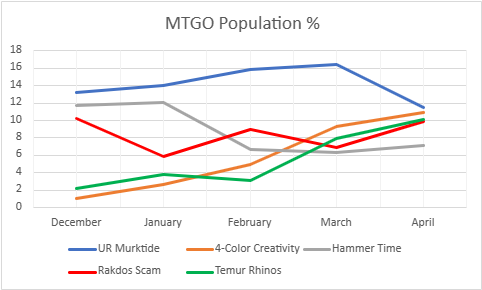

Modern has clearly moved towards stability since Modern Horizons 2 came out. The fact that the data for March and April look pretty similar confirms that conclusion. However, the data doesn't tell the full story. There's a lot more going on than the data conveys. Wednesday was about presenting the data; today's article is about explaining how the data happened and if it means anything.

The Song of Monkey and Archon

The headline data point in April was that 4-Color Creativity was #1 in paper and very nearly caught UR Murktide on Magic Online (MTGO). While Murktide has fallen in paper before, it was never by the extent it did in April and Creativity has never approached this mark online before.

Some might take that to mean that there's change in the air and that Creativity is the new top deck in Modern. The data backs this up, but only if you just look at the numbers. The story of how that happened paints a very different picture. Murktide, and to a lesser extent Rhinos, had a more impressive month than Creativity, which ended up underperforming.

A Marathon, Not a Sprint

At the start of April, I'd have agreed with the above assessment. After the first week of April, Creativity was out ahead of all the other decks by a significant margin. If I recall correctly, it was up in the 20s in both paper and online while its closest competition was Temur Rhinos with around 10 results. Murktide was barely on the board with around five results apiece.

However, over the following weeks, a trend emerged. After a phenomenal opening weekend, Creativity fell away. It had shown up in force for several Challenges, but on MTGO Creativity just wasn't showing up in the Preliminaries. Murktide did, and just kept putting up results during the week and then placing a few into the Challenges. Rhinos was doing the same thing, but not to quite the same degree.

I record data every Friday, and after April 7, Creativity had a big lead on everything else. By April 14, that lead had halved. Rhinos was closing the gap and Murktide had caught Creativity. On April 21, Murktide caught Creativity online, with Rhinos not far behind. By April 28, Murktide was out in front by a good margin, leaving Rhinos behind. The last-minute surge over the weekend wasn't enough for Creativity to come back, even if Murktide hadn't had a compensating good Challenge as well.

Feast And Famine

I've never mentioned this before, but in my experience tracing the data, most results come in feast and famine cycles. A deck will have a really good weekend, disappear for some time, and then return. The length of the disappearance is often determinative for tier status. The power Tier 3 decks that don't show up on the population tier yet are at or near the top of average power ranking are the kings of this. They almost always have one phenomenal weekend and then completely disappear.

The decks that rise to the top of the metagame limit their famines. They often maximize the feast, but that's actually not required. Consistent results over the course of a month do far more to move a deck up the rankings than single events. This is where Murktide and to a lesser extent Rhinos and Hammer Time excel. They can have exceptional weeks, but even if they don't, they'll still put up decent numbers in smaller events over the week. Rhinos and Hammer still have true famine weeks, but Murktide's never been missing a whole week.

Rakdos Scam and Creativity are big feasters but are also prone to famine. Especially online, they show up in large events in force but are often missing entirely during the week. When they feast, they gorge but the relative lack of consistency holds them back. Murktide is so consistent in putting up results that even when it starts behind (which is very rare) it's able to catch up thanks to its rivals having an off week. It just keeps on keeping on.

What About Paper?

This has been a consistent observation for me about MTGO's data. Paper is a different animal. The above-described effects were definitely happening in paper as well this month. However, Murktide and Rhinos didn't actually catch Creativity. In fact, Creativity maintained a fairly commanding lead all month.

This isn't something to read into. The MTGO data comes out in predictable intervals and produces a predictable number of events. Since Daybreak took over running the program, a minimum of three Challenges and seven Preliminaries will be posted every week. Frequently, there are more, but for the past few months never less.

There's no predictability for paper results. Tournament Organizers don't have to schedule any Modern events in a month, nor report them in a timely fashion. I checked today, and there were a number of events from mid-to-late April that are just now being posted. The effect I saw on MTGO was happening in paper, however, the gaps in the data and lower total results yielded a different result. The metagame isn't at fault for the difference, unreliable reporting is, so don't read into the results.

The Implication

It makes sense that Murktide would pull ahead thanks to its consistency more than anything else. The deck is following the Turbo Xerox formula with many cantrips and a low land count. It has more velocity than any other deck which leads to consistent games. This consistency has translated into a very long run as Modern's most-played deck. Even if it's not the best-positioned deck, players know what to expect.

The cascade decks are similar thanks to effect redundancy, and Hammer Time has tutors. They don't have the smoothing depth that Murktide does, but they do have enough to keep up. Creativity and Scam are lacking in this area. They have some redundancy and smoothing, but it's to a lesser extent and at a higher cost than the other decks. Fable of the Mirror-Breaker // Reflection of Kiki-Jiki and Seasoned Pyromancer are powerful but aren't really smoothing cards like Consider, Mishra's Bauble, and Expressive Iteration. That's probably why Scam has been so volatile.

End Life Care

On the subject of challenging the top decks, what's going on with Living End? That's a genuine question, not remotely rhetorical. It was hot on the heels of the Big Five online, but just barely limped onto Tier 3 in paper. This followed a month where the deck was at the bottom of Tier 1 in both play mediums. Historically, the deck has been quite volatile, but it has never deviated from itself this much.

It's possible that paper's poor reporting is a factor. However, given how far from Tier 1 it is, that seems unlikely. It'd be one thing if there was a positive trend that got interrupted, but it was completely absent from the results. This points to an actual change in pilots and/or metagame positioning for the paper fall-off. However, I don't see enough deviation between paper and online play for positioning to be the reason.

The only distinct difference I can see is that graveyard hate was down slightly online. The various Urza's Saga decks stopped playing Soul Guide Lantern, either maindeck or sideboard, and alternative graveyard hate was also minimal. The paper decks didn't follow this strategy. Endurance was as prevalent as it ever was, so this explanation seems weak but it's all I have.

Doctor's In

On a similar note, Yawgmoth made it back to Tier 1 online after missing in March. However, I wouldn't exactly call it good news for the deck. Its average points were so bad that it fell to Tier 2 on power and was tied for second worst performance for online decks. Not exactly a rousing success, especially when it was lower-mid Tier 3 in paper and underperformed against the baseline there, too.

While I don't know the ins and outs of its matchups, I do know that Yawgmoth has a reputation for beating Murktide. I'd guess that the high amount of play Yawgmoth saw was predicated on there being lots of Murktide to feed on. While there was a lot of Murktide out there, it wasn't to the extent of previous months, and therefore, the strategy didn't work out. There were too many other matchups out there.

Unfit Prime Time?

Something that the data article didn't show is that for the first time, Amulet of Vigor players are branching out. Rather than being all together on Amulet Titan, a few players got experimental. There were a few trying Aspiringspike's Door to Nothingness brew, and others trying other combos with Amulet. There was even one deck that was otherwise an unremarkable Amulet deck, except that it didn't play any Primeval Titans. That'd have positively been blasphemous before now.

You have to be an Amulet player to understand developments in Amulet Titan. However, the fact that the players are willing to experiment with what had been quite an orthodox deck is significant. It might mean that players are getting bored with the typical game plan, or it might also indicate that there are metagame concerns. Maybe Titan is finally getting pushed out? In any case, Amulet willingly changing itself without new cards is always something to watch.

Finance Corner

As always, I end in the Finance Corner. Here is where I gaze into the financial crystal ball to try and foresee the coming month of market trends. This month will leave many disappointed because I don't see much opportunity on the horizon.

There's no reason to think that the Big Five decks are going anywhere. Scam was quite weak in paper in April, but that's probably down to a lack of events. The deck has never shown up that much in local events but shines at the big events. I suspect there are social considerations/pressures at play. With fewer large events, Scam was down. It's still strong online, so it's not in danger of falling out of the metagame.

Consequently, there won't be a wild swing to drive upward price pressures for any deck. In fact, with all the reprints there continues to be gentle downward pressure on staple prices, with particular pressure on Ragavan, Nimble Pilferer. Thus, this is a (weak) buyers' market rather than a seller's market. Plan accordingly.

Aftermarket Aftermath

While there is another set coming out in May, I don't think it will mean anything for the Modern market. March of the Machine: The Aftermath looks extremely underwhelming, particularly for older formats but I have to imagine it's not great for Standard, either. It's less a new set and more like EA-style downloadable content (DLC). It's content that was meant for the main game but got carved out for a microtransaction. I'm not impressed.

There are a few cards I have my eye on that might see niche play in Modern. However, emphasis on the niche, there. They might adjust a few matchups slightly, but there's nothing to completely revamp any deck. Thus, the financial and metagame impact should be muted.

A Modern Stabilized

There's nothing foreseeable that will cause any dramatic change in Modern anytime soon. With prices falling Wizards might choose to make bans in the near future, or they might continue to wait and watch, I can't know. What I do know is that Modern is fine for the moment and will continue to be fine in May. Not great, not bad, just fine.